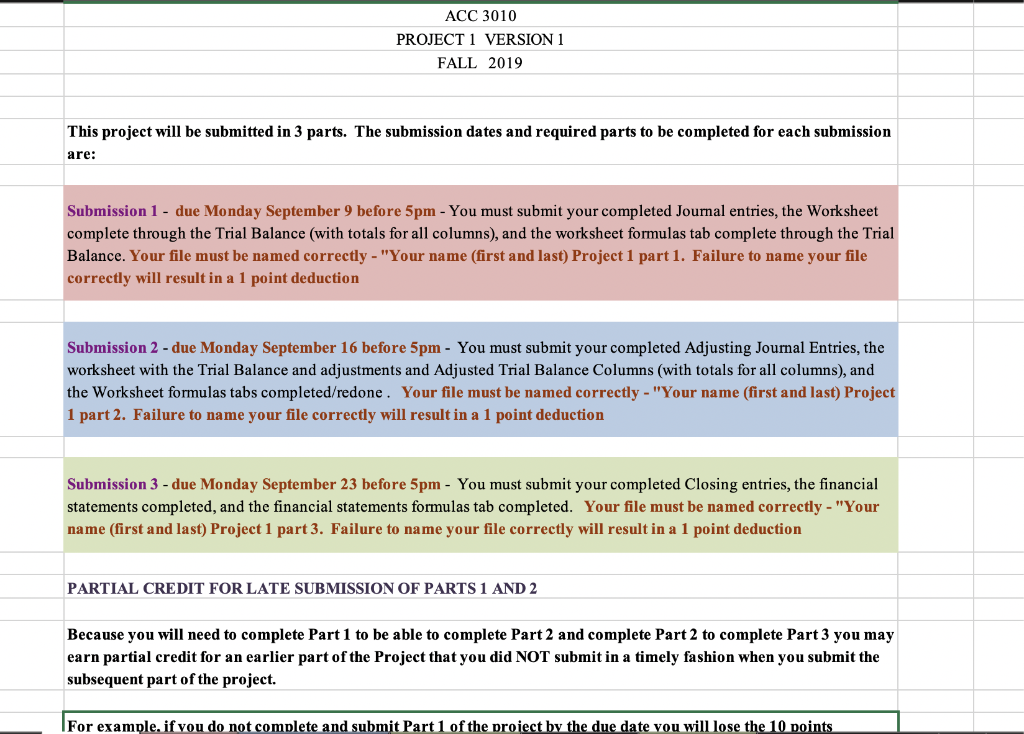

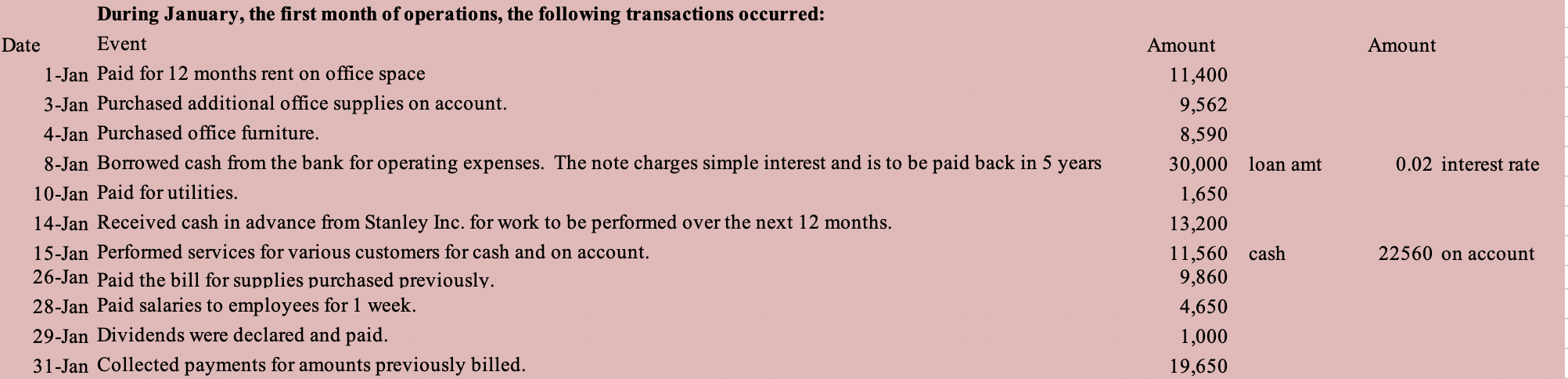

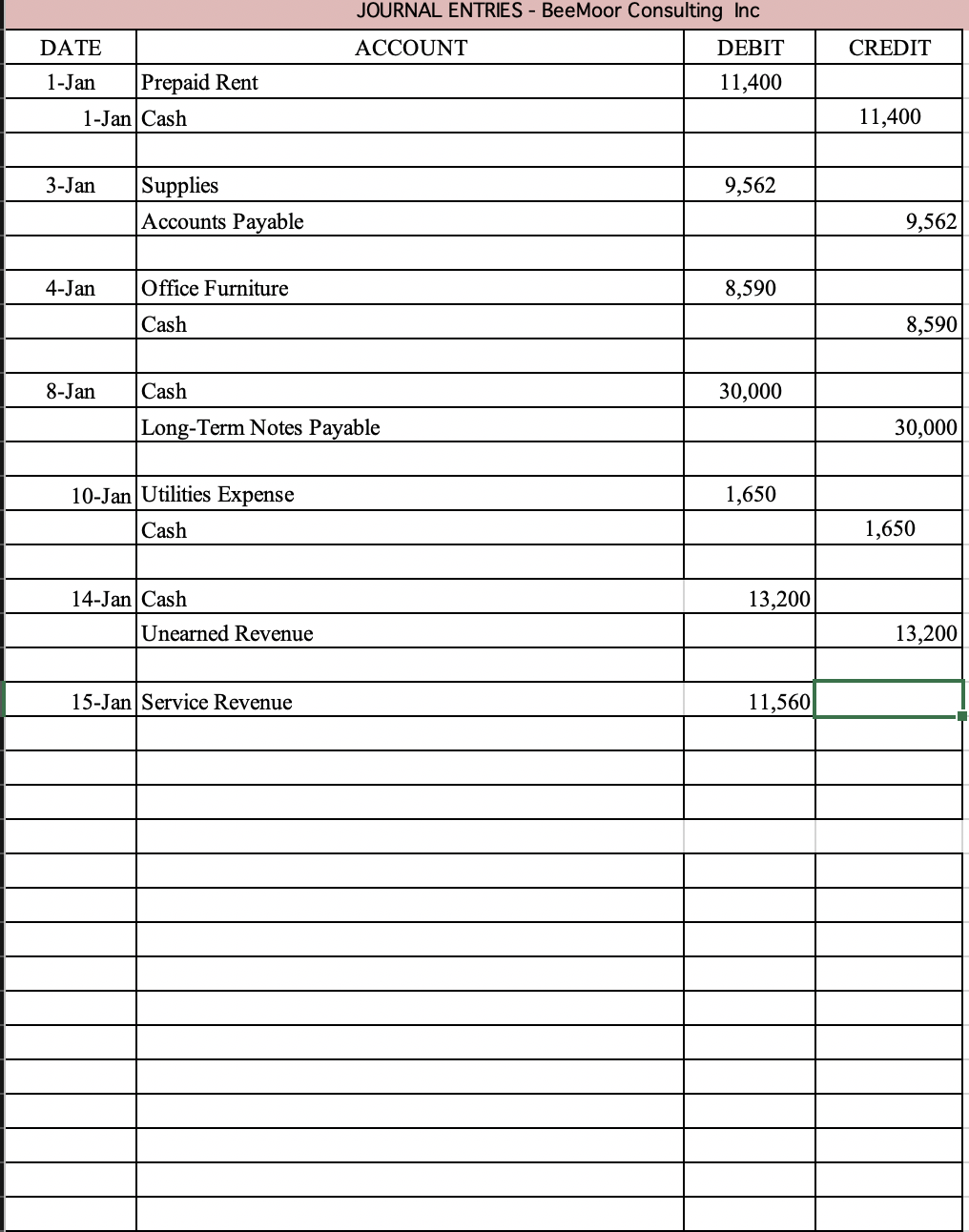

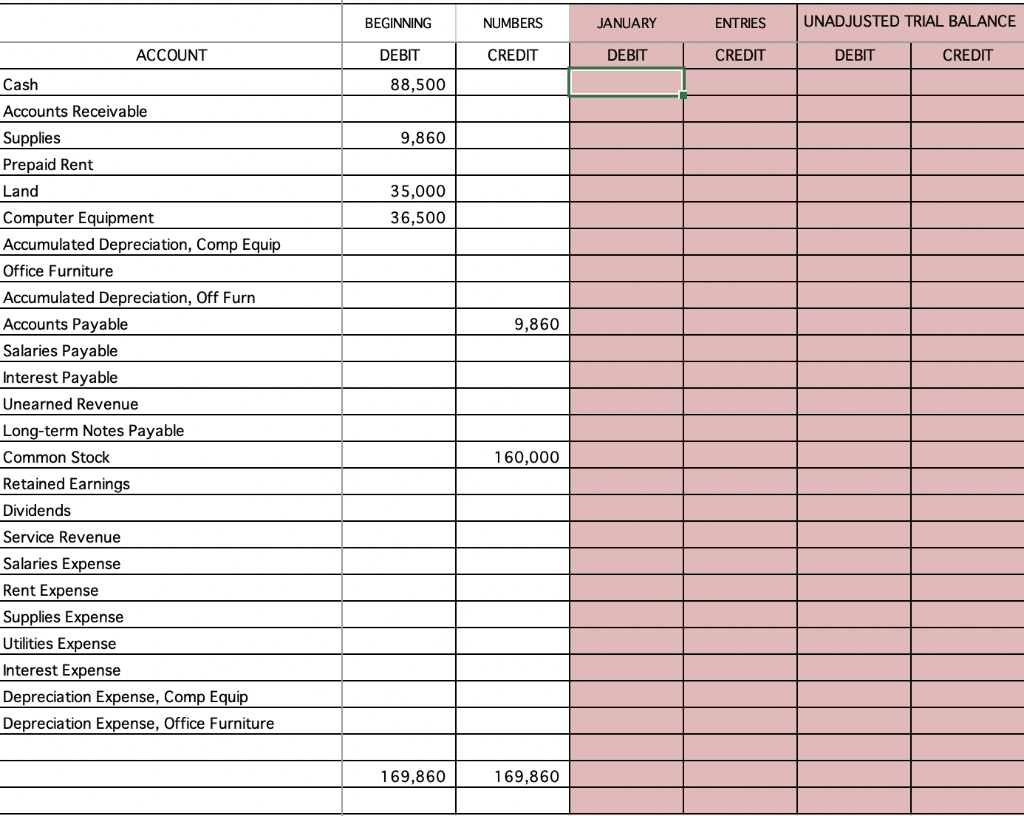

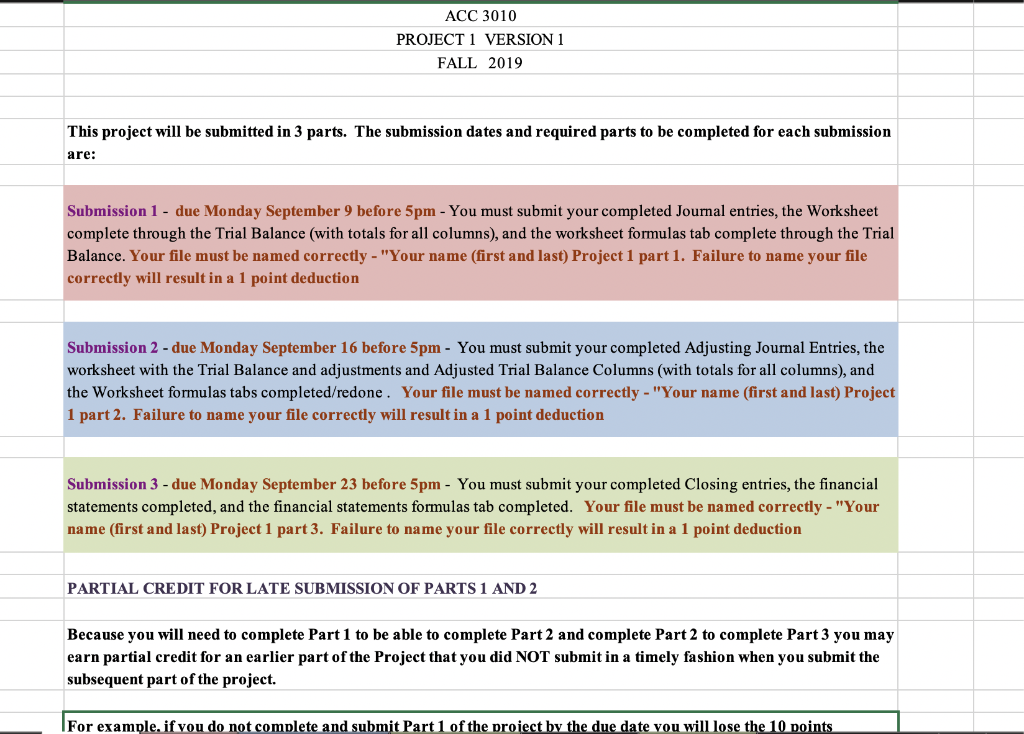

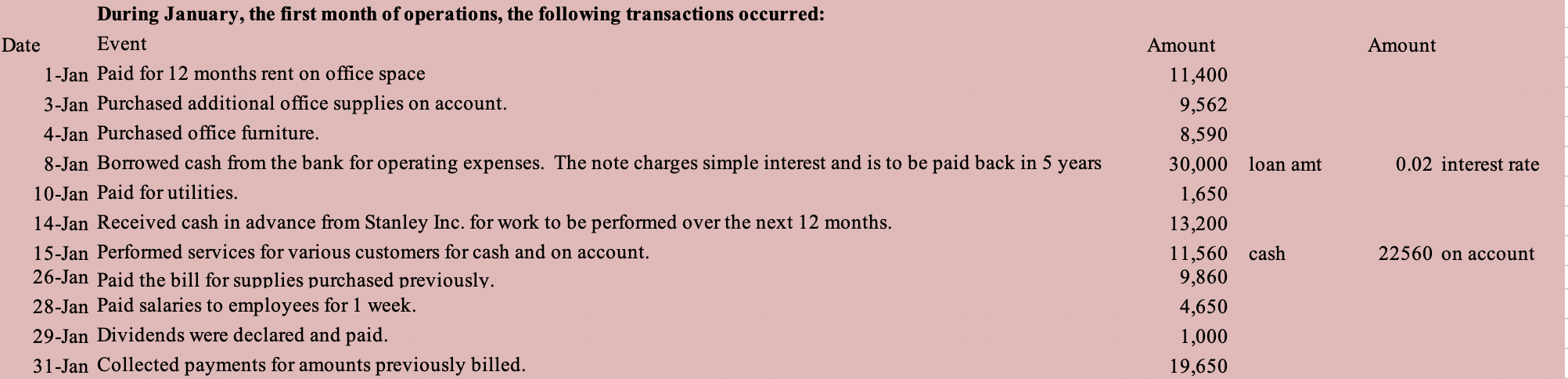

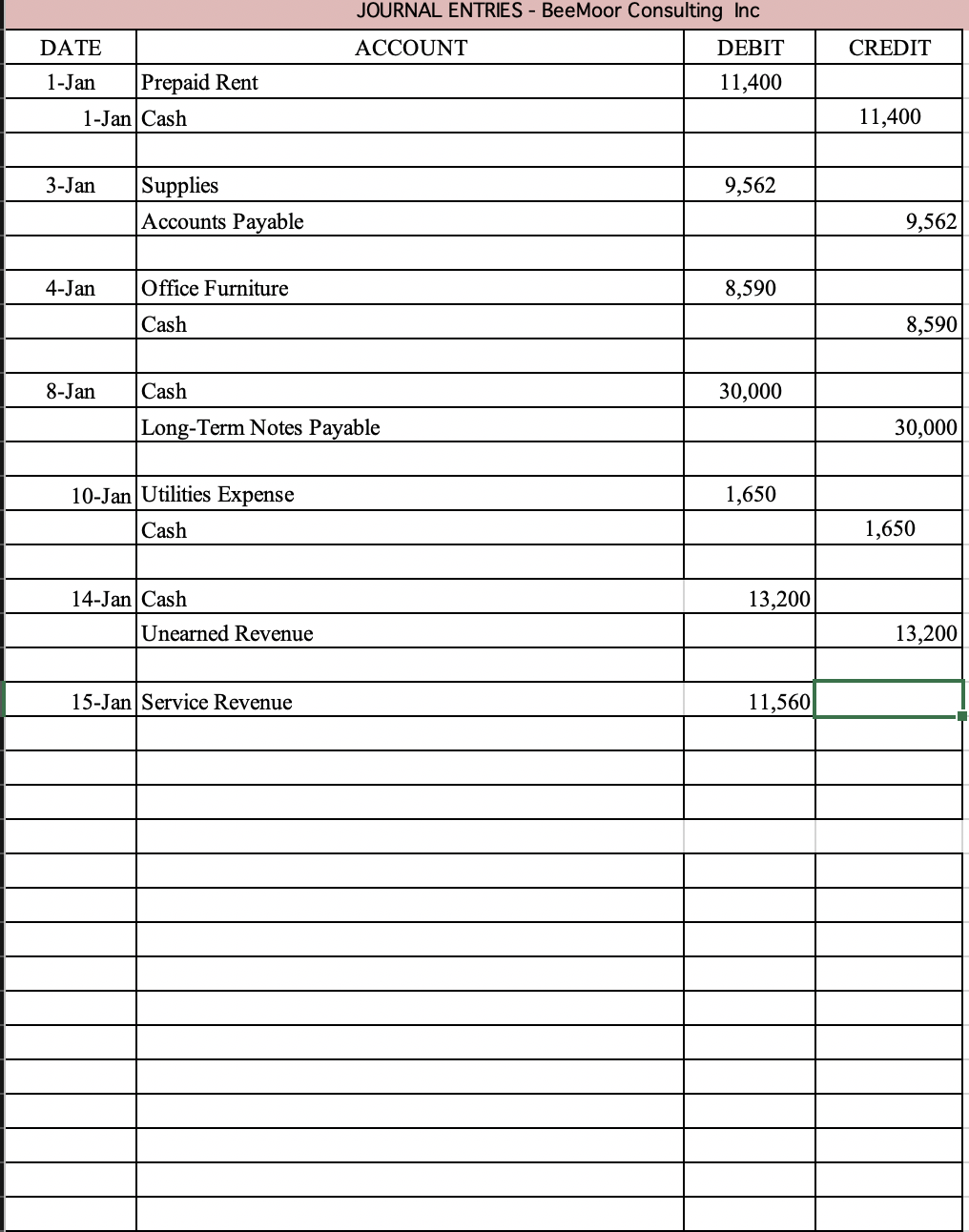

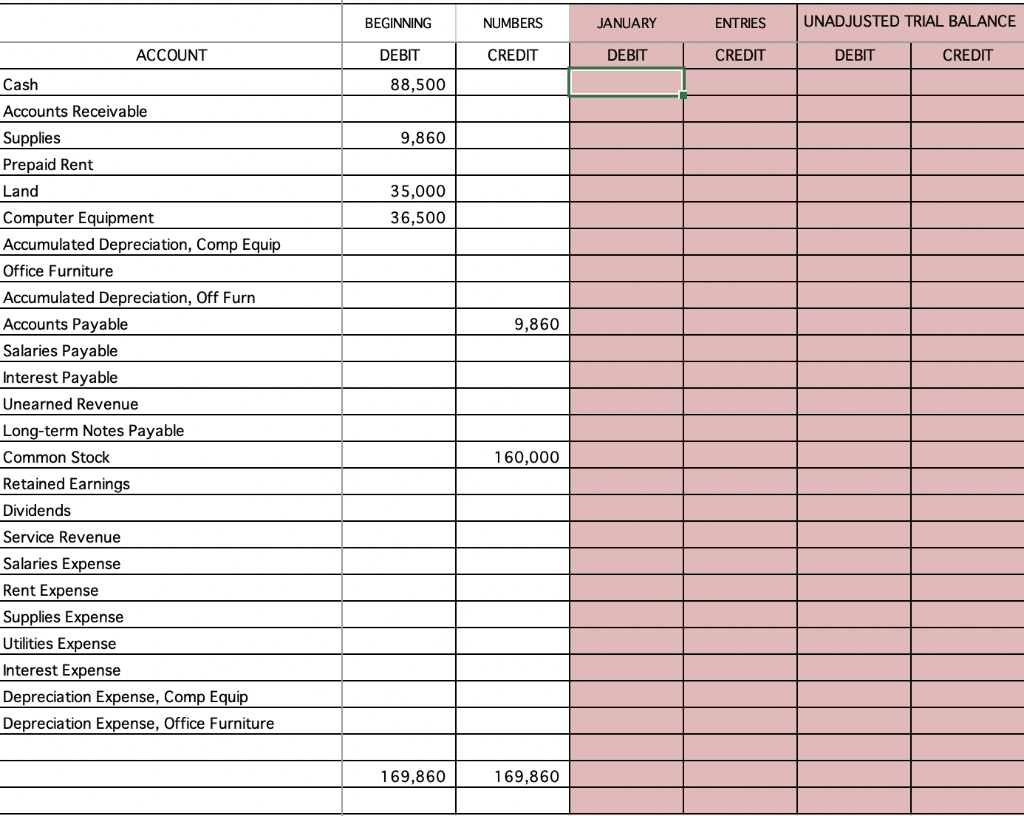

ACC 3010 PROJECT 1 VERSION 1 FALL 2019 This project will be submitted in 3 parts. The submission dates and required parts to be completed for each submission are: Submission 1 - due Monday September 9 before 5pm - You must submit your completed Journal entries, the Worksheet complete through the Trial Balance (with totals for all columns), and the worksheet formulas tab complete through the Trial Balance. Your file must be named correctly - "Your name (first and last) Project 1 part 1. Failure to name your file correctly will result in a 1 point deduction Submission 2 - due Monday September 16 before 5pm - You must submit your completed Adjusting Journal Entries, the worksheet with the Trial Balance and adjustments and Adjusted Trial Balance Columns (with totals for all columns), and the Worksheet formulas tabs completed/redone. Your file must be named correctly - "Your name (first and last) Project 1 part 2. Failure to name your file correctly will result in a 1 point deduction Submission 3 - due Monday September 23 before 5pm - You must submit your completed Closing entries, the financial statements completed, and the financial statements formulas tab completed. Your file must be named correctly - "Your name (first and last) Project 1 part 3. Failure to name your file correctly will result in a 1 point deduction PARTIAL CREDIT FOR LATE SUBMISSION OF PARTS 1 AND 2 Because you will need to complete Part 1 to be able to complete Part 2 and complete Part 2 to complete Part 3 you may earn partial credit for an earlier part of the Project that you did NOT submit in a timely fashion when you submit the subsequent part of the project. For example, if you do not complete and submit Part 1 of the project by the due date vou will lose the 10 points Amount 0.02 interest rate During January, the first month of operations, the following transactions occurred: Date Event 1-Jan Paid for 12 months rent on office space 3-Jan Purchased additional office supplies on account. 4-Jan Purchased office furniture. 8-Jan Borrowed cash from the bank for operating expenses. The note charges simple interest and is to be paid back in 5 years 10-Jan Paid for utilities. 14-Jan Received cash in advance from Stanley Inc. for work to be performed over the next 12 months. 15-Jan Performed services for various customers for cash and on account. 26-Jan Paid the bill for supplies purchased previously. 28-Jan Paid salaries to employees for 1 week. 29-Jan Dividends were declared and paid. 31-Jan Collected payments for amounts previously billed. Amount 11,400 9,562 8,590 30,000 loan amt 1,650 13,200 11,560 cash 9,860 4,650 1,000 19,650 22560 on account JOURNAL ENTRIES - BeeMoor Consulting Inc ACCOUNT DEBIT 11,400 CREDIT DATE 1-Jan Prepaid Rent 1-Jan Cash 11,400 3-Jan 9.562 Supplies Accounts Payable 9,562 4-Jan 8,590 Office Furniture Cash 8,590 8-Jan Cash 30,000 Long-Term Notes Payable 30,000 1,650 10-Jan Utilities Expense Cash 1,650 13.2001 14-Jan Cash Unearned Revenue 13,200 15-Jan Service Revenue 11,5601 BEGINNING NUMBERS JANUARY ENTRIES UNADJUSTED TRIAL BALANCE CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT 88,500 9,860 35,000 36,500 9,860 TTT ACCOUNT Cash Accounts Receivable Supplies Prepaid Rent Land Computer Equipment Accumulated Depreciation, Comp Equip Office Furniture Accumulated Depreciation, Off Furn Accounts Payable Salaries Payable Interest Payable Unearned Revenue Long-term Notes Payable Common Stock Retained Earnings Dividends Service Revenue Salaries Expense Rent Expense Supplies Expense Utilities Expense Interest Expense Depreciation Expense, Comp Equip Depreciation Expense, Office Furniture 160,000 | | I T 169,860 169.860