Question

ACC 301/501 Homework #2 The unadjusted pre-closing 12/31/24 account balances for the Mahoney Company are listed below: Net Sales $12,540 Net Purchases 9,418 Selling Expenses

ACC 301/501

Homework #2

The unadjusted pre-closing 12/31/24 account balances for the Mahoney Company are listed below:

| Net Sales | $12,540 |

| Net Purchases | 9,418 |

| Selling Expenses | 460 |

| Cash | 897 |

| Machines | 6,429 |

| Accumulated Depreciation, Machines | 2,564 |

| Accounts Payable | 1,445 |

| Retained Earnings | 7,382 |

| Allowance for Doubtful Accounts | 86 |

| Building | 8,000 |

| Accumulated Depreciation, Building | 780 |

| Common Stock | 4,460 |

| Accounts Receivable | 2,054 |

| Depreciation Expense, Machines | 1,074 |

| Inventory @ 1/1/24 (periodic method used) | 925 |

During your audit, you discover the following five items that have yet to be recorded:

No depreciation on the building has been recorded in 2024. Depreciation on the building is based on Double-Declining Balance. It was purchased on 1/1/22 and has an estimated useful life of 40 years. The estimated salvage value is $670.

Mahoney exchanged a machine for a similar machine on 12/31/24. The original machine cost $3,429 and had a book value of $2,134. The new machine had a fair value of $1,823; Mahoney also received $270 in cash. The exchange did not have commercial substance.

Mahoney also exchanged its only other machine for a different machine on 12/31/24. The original machine cost $3,000 and had a book value of $1,731. The fair value was $1,987. Mahoney paid cash of $396 as well. The exchange had commercial substance.

Mahoney uses the Balance Sheet approach to adjust Accounts Receivable to Net Realizable Value. At 12/31/24, uncollectible receivables are estimated to be 5% of Accounts Receivable.

Ending Inventory is to be estimated using the Gross Profit Method. The historic Gross Profit percentage is 20%.

(See additional information on next page.)

Required

Record journal entries for items #1-#4 above; show supporting computations. In addition, compute ending inventory per #5 above; show supporting computations. Assume closing entries were made properly.

Draft the 2024 Condensed Income Statement and the 12/31/24 Balance Sheet. Use the Cabrera and the Uptown Cabinet format examples in the text. Assume no taxes. Do not include EPS.

Submission Instructions

Discussions with fellow students encouraged.

You must use Excel to complete your assignment.

Present all answers on one worksheet within your file. Show supporting computations.

Follow text examples for proper formatting

Show only whole dollars, i.e., do not show cents.

Dollar signs should be used only on the first and last line in a column of numbers.

Use proper underlining, as follows:

Single underline prior to a subtotal or total.

Double underline for final totals.

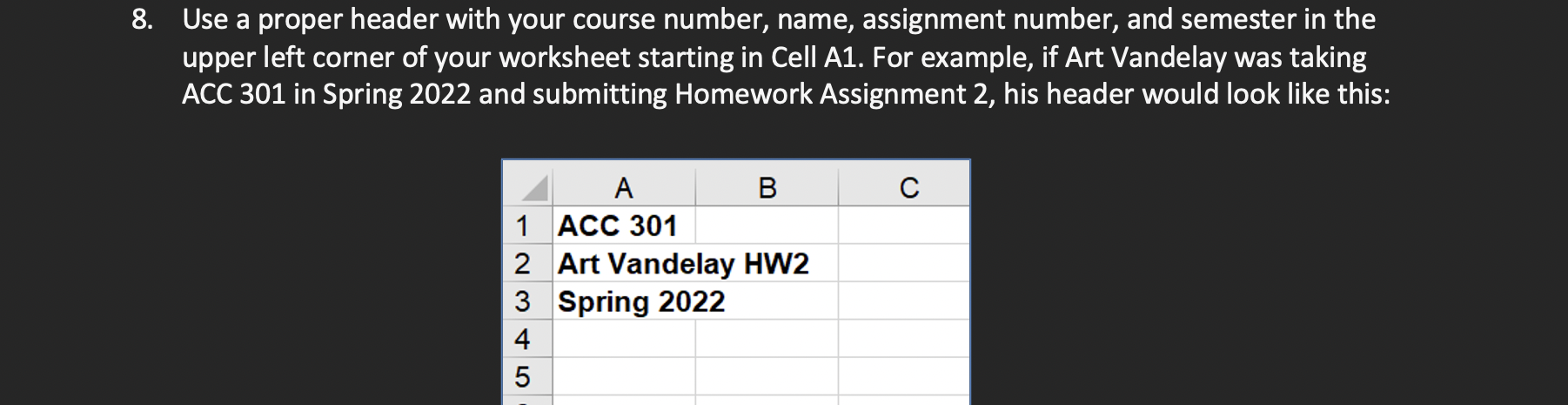

Use a proper header with your course number, name, assignment number, and semester in the upper left corner of your worksheet starting in Cell A1. For example, if Art Vandelay was taking ACC 301 in Spring 2022 and submitting Homework Assignment 2, his header would look like this:

Submit the assignment through the upload feature within Moodle. Do not email any assignment files to your instructor.

Be sure to fully submit the assignment, i.e., do not leave your submitted assignment in draft status. You will be required to acknowledge the submitted work is your own.

Organization and presentation will be a factor in determining your grade.

Use a proper header with your course number, name, assignment number, and semester in the upper left corner of your worksheet starting in Cell A1. For example, if Art Vandelay was taking ACC 301 in Spring 2022 and submitting Homework Assignment 2, his header would look like this: Use a proper header with your course number, name, assignment number, and semester in the upper left corner of your worksheet starting in Cell A1. For example, if Art Vandelay was taking ACC 301 in Spring 2022 and submitting Homework Assignment 2, his header would look like thisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started