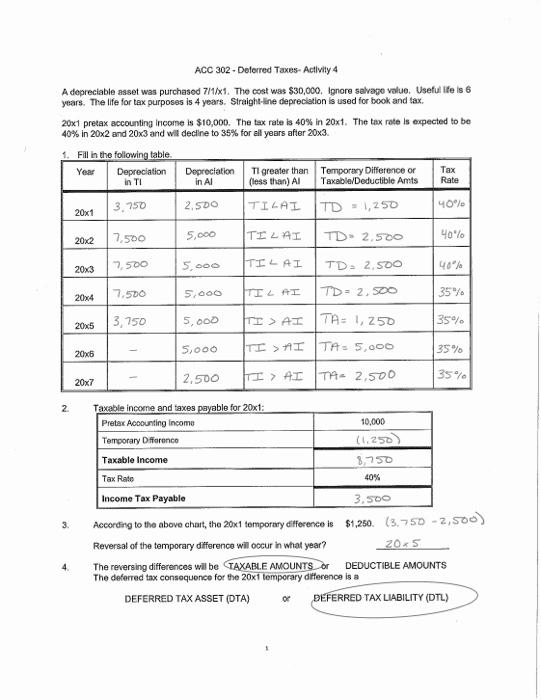

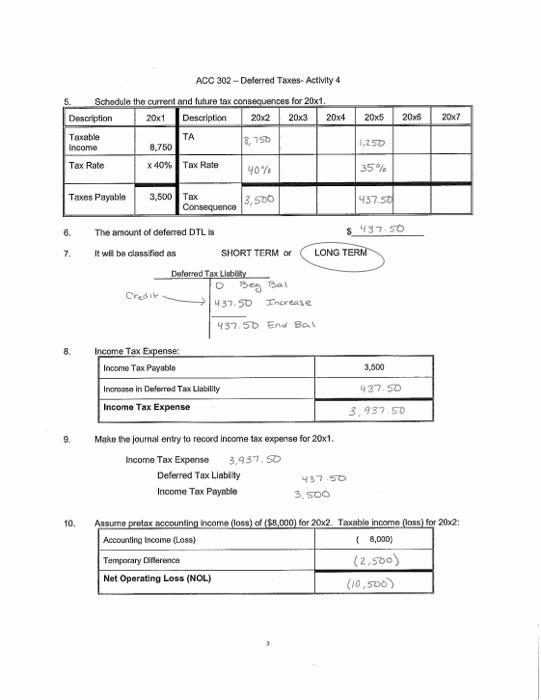

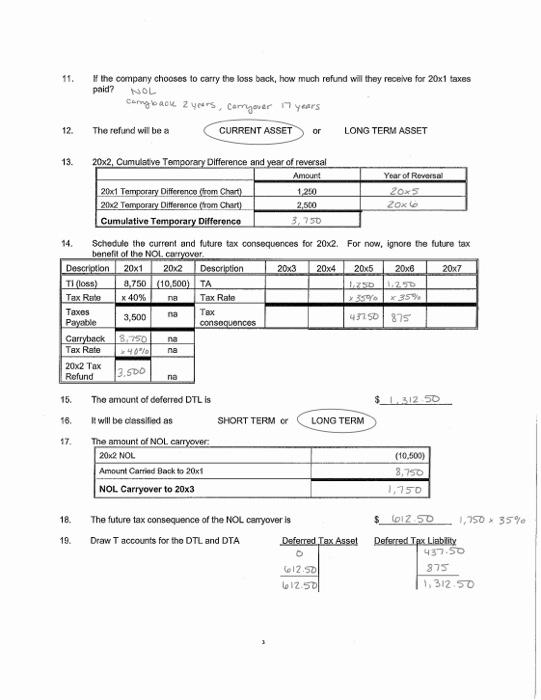

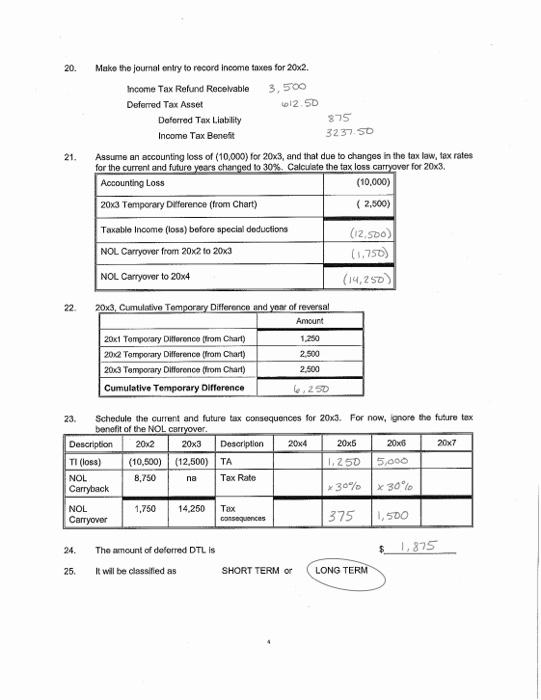

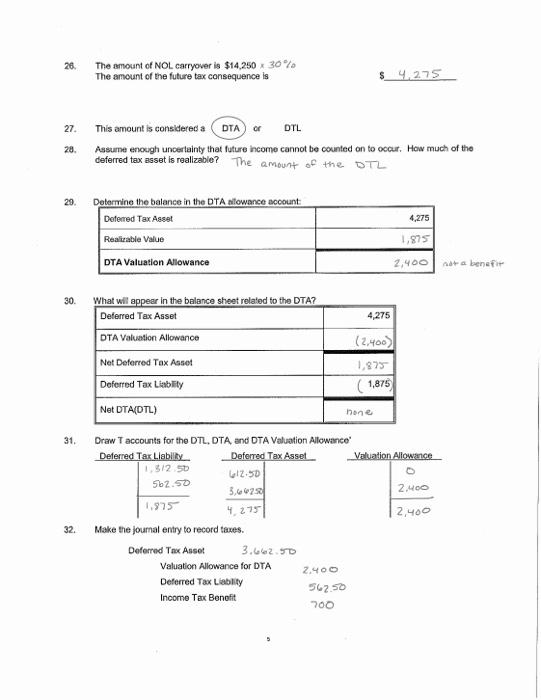

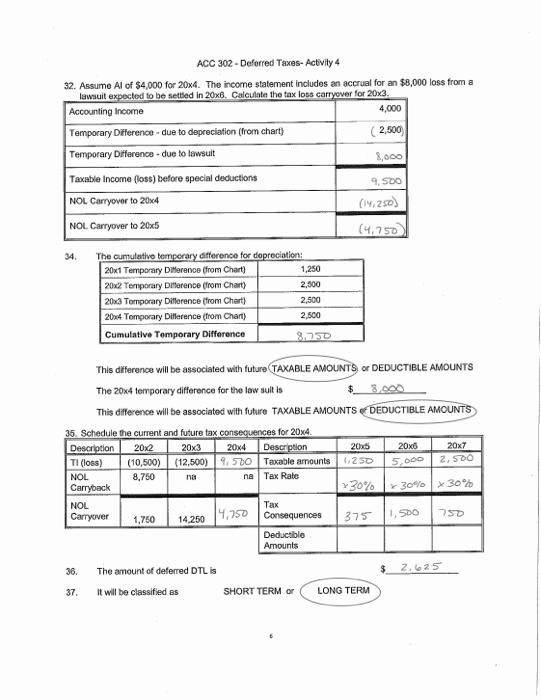

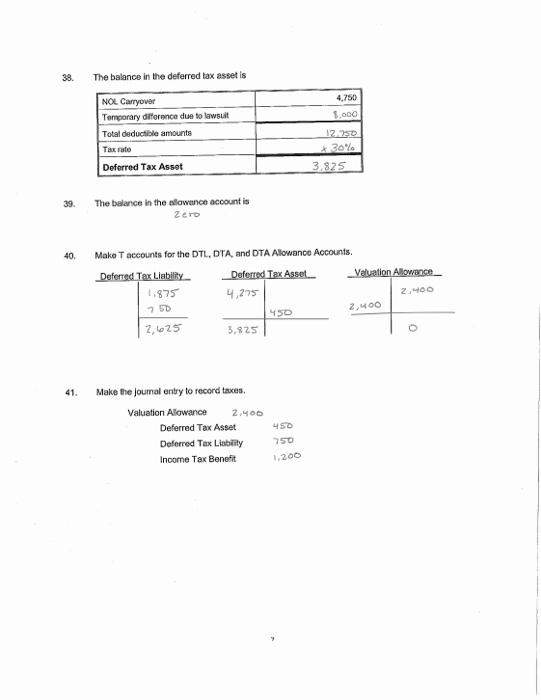

ACC 302 - Deferred Taxes-Activily 4 A depreciable asset was purchasod 7/1/x1. The cost was $30,000, Ignore selvapo value. Useful ife is 6 years. The life for tax purposes is 4 years. Straight-ine depreclation is used for book and tax. 201 pretax accounting income is $10,000. The tax rate is 40% in 201. The tax rate is expected to be 40% in 202 and 203 and will dectine to 35% for all years after 203. 3. According to the above chart, the 201 temporary difference is $1,250.(3,7502,500) Reversal of the temporary difference will occur in what year? 205 4. The reversing differences will be TAXABLE AMOUNTS or DEDUCTIBLE AMOUNTS The deferred tax consequence for the 201 temperary difference is a ACC 302 - Deferred Taxes- Activity 4 5 Sirtharlule the current and future tax consecuences for 201. 6. The ansount of defecred DTL is 7. It will be classifiod as SHORT TERM or LONG TERMT 8. 9. Make the joumal entry to recond income tax expense for 201. IncomeTaxExpenseDeferredTaxLlabilyIncomeTaxPayable3,937.50437.503,500 3,500 10. Assume pretax accounting income (loss) of ($8,00) for 202. Taxable income (loss) for 202 : 11. If the company chooses to carry the loss back, how much refund will they recelve for 201 taxes paid? NoL carngback 2 yeurs, carngover 17 years 12. The refund will be a CURRENT ASSET or LONG TERM ASSET 13. 2hx3 Cimulative Tamnoraru nifferpence and veear af rewersal 14. Schedule the current and future tax consequences for 202. For now, ignore the future tax benefit of the NOL. carvower. 15. The amount of deferred DTL is $1.31250 16. It will be classilled as SHORT TERM or LONG TERM 17. 20. Make the joumal entry to record income taxes for 202. 21. Assume an eccounting loss of (10,000) for 203, and that due to changes in the tax law, tax rates for the current and future years changed to 30%. Calculate the tax loss carryover for 203. 22. 20x3. Cumulative Temaorarv Difference and vear of reversal 23. Schedule the current and future tax consequences for 20x3. For now, ignore the future tex hanafit at the NOI sarrumer 24. The amount of delorred DTL is 8. 1,875 25. It will be classified as SHORT TERM or LONG TERM 28. Assume enough uncertainty that future income cannot be counted on to ocour. How much of the deferred tax asset is realizable? The ambunt of the STL 29. sat a bene 30. What will annear in the halpnra shent ralated to the DTA? 31. Oraw T accounts for the DTL, DTA, and DTA Valuation Allowance' 32. Make the joumal entry to record taxes. 32. Assume Al of $4,000 for 204. The income statement includes an accrual for an $8,000 loss from a tawatit exnected to be settled in 206. Calculate the tax loss carryover for 203. This difference will be associated with future (TAXABLE AMOUNT'S or DEDUCTIBLE AMOUNTS The 20x4 temporary difference for the law sult is $8,000 This difference will be associated with future TAXABLE AMOUNTS \&DEDUCTIBLE AMOUNTS 36. The amount of deferred DTL is $2.625 37. It will be classified as SHORT TERM or 38. The balance in the deferred tax asset is 39. The belance in the ellowence account is zero 40. Make T accounts for the DTL, DTA and DTA Alowance Accounts. 41. Make the joumal entry to record taxes. ACC 302 - Doferred Taxes-Activity 4 Complete this activity at home and turn it in next class period. 42. Assume no sdditional temporary differences occur and that each year following 20x4 pretax accourling income is $12,000. Schedule the tax consequences and record them for 205207. ACC 302 - Deferred Taxes-Activily 4 A depreciable asset was purchasod 7/1/x1. The cost was $30,000, Ignore selvapo value. Useful ife is 6 years. The life for tax purposes is 4 years. Straight-ine depreclation is used for book and tax. 201 pretax accounting income is $10,000. The tax rate is 40% in 201. The tax rate is expected to be 40% in 202 and 203 and will dectine to 35% for all years after 203. 3. According to the above chart, the 201 temporary difference is $1,250.(3,7502,500) Reversal of the temporary difference will occur in what year? 205 4. The reversing differences will be TAXABLE AMOUNTS or DEDUCTIBLE AMOUNTS The deferred tax consequence for the 201 temperary difference is a ACC 302 - Deferred Taxes- Activity 4 5 Sirtharlule the current and future tax consecuences for 201. 6. The ansount of defecred DTL is 7. It will be classifiod as SHORT TERM or LONG TERMT 8. 9. Make the joumal entry to recond income tax expense for 201. IncomeTaxExpenseDeferredTaxLlabilyIncomeTaxPayable3,937.50437.503,500 3,500 10. Assume pretax accounting income (loss) of ($8,00) for 202. Taxable income (loss) for 202 : 11. If the company chooses to carry the loss back, how much refund will they recelve for 201 taxes paid? NoL carngback 2 yeurs, carngover 17 years 12. The refund will be a CURRENT ASSET or LONG TERM ASSET 13. 2hx3 Cimulative Tamnoraru nifferpence and veear af rewersal 14. Schedule the current and future tax consequences for 202. For now, ignore the future tax benefit of the NOL. carvower. 15. The amount of deferred DTL is $1.31250 16. It will be classilled as SHORT TERM or LONG TERM 17. 20. Make the joumal entry to record income taxes for 202. 21. Assume an eccounting loss of (10,000) for 203, and that due to changes in the tax law, tax rates for the current and future years changed to 30%. Calculate the tax loss carryover for 203. 22. 20x3. Cumulative Temaorarv Difference and vear of reversal 23. Schedule the current and future tax consequences for 20x3. For now, ignore the future tex hanafit at the NOI sarrumer 24. The amount of delorred DTL is 8. 1,875 25. It will be classified as SHORT TERM or LONG TERM 28. Assume enough uncertainty that future income cannot be counted on to ocour. How much of the deferred tax asset is realizable? The ambunt of the STL 29. sat a bene 30. What will annear in the halpnra shent ralated to the DTA? 31. Oraw T accounts for the DTL, DTA, and DTA Valuation Allowance' 32. Make the joumal entry to record taxes. 32. Assume Al of $4,000 for 204. The income statement includes an accrual for an $8,000 loss from a tawatit exnected to be settled in 206. Calculate the tax loss carryover for 203. This difference will be associated with future (TAXABLE AMOUNT'S or DEDUCTIBLE AMOUNTS The 20x4 temporary difference for the law sult is $8,000 This difference will be associated with future TAXABLE AMOUNTS \&DEDUCTIBLE AMOUNTS 36. The amount of deferred DTL is $2.625 37. It will be classified as SHORT TERM or 38. The balance in the deferred tax asset is 39. The belance in the ellowence account is zero 40. Make T accounts for the DTL, DTA and DTA Alowance Accounts. 41. Make the joumal entry to record taxes. ACC 302 - Doferred Taxes-Activity 4 Complete this activity at home and turn it in next class period. 42. Assume no sdditional temporary differences occur and that each year following 20x4 pretax accourling income is $12,000. Schedule the tax consequences and record them for 205207