Answered step by step

Verified Expert Solution

Question

1 Approved Answer

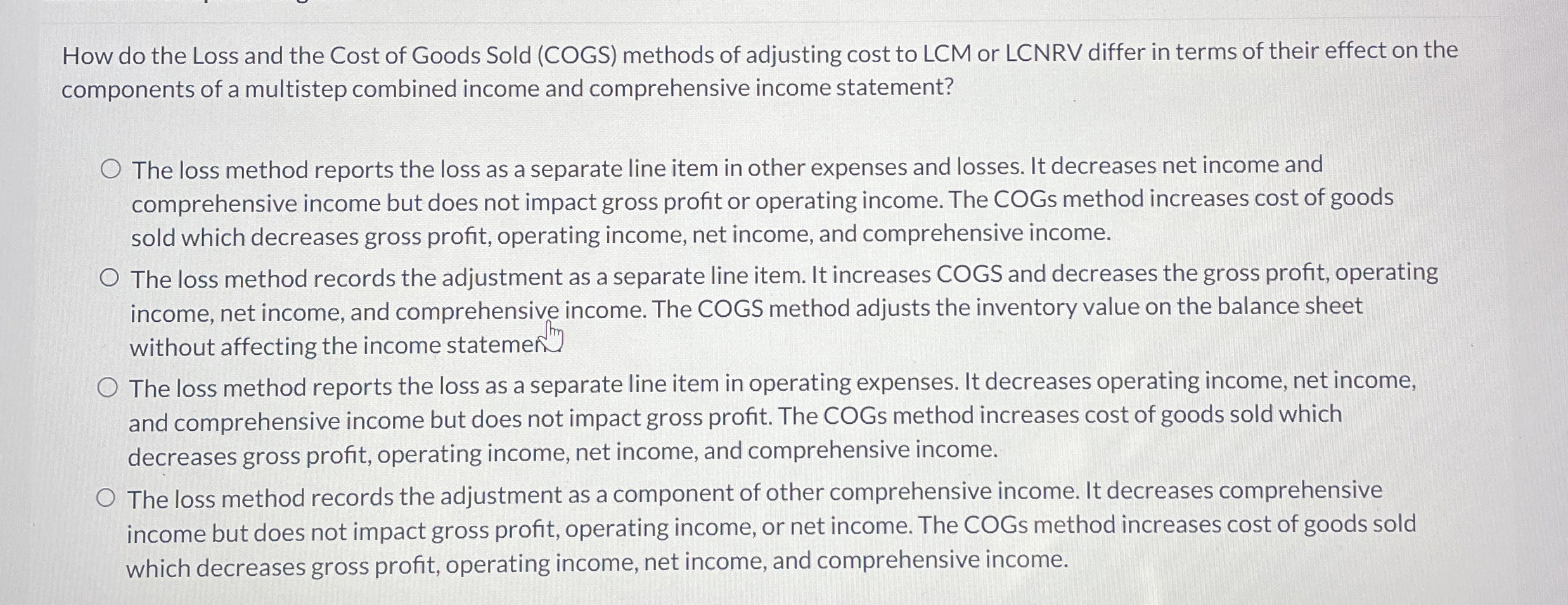

How do the Loss and the Cost of Goods Sold ( COGS ) methods of adjusting cost to LCM or LCNRV differ in terms of

How do the Loss and the Cost of Goods Sold COGS methods of adjusting cost to LCM or LCNRV differ in terms of their effect on the

components of a multistep combined income and comprehensive income statement?

The loss method reports the loss as a separate line item in other expenses and losses. It decreases net income and

comprehensive income but does not impact gross profit or operating income. The COGs method increases cost of goods

sold which decreases gross profit, operating income, net income, and comprehensive income.

The loss method records the adjustment as a separate line item. It increases COGS and decreases the gross profit, operating

income, net income, and comprehensive income. The COGS method adjusts the inventory value on the balance sheet

without affecting the income statemen

The loss method reports the loss as a separate line item in operating expenses. It decreases operating income, net income,

and comprehensive income but does not impact gross profit. The COGs method increases cost of goods sold which

decreases gross profit, operating income, net income, and comprehensive income.

The loss method records the adjustment as a component of other comprehensive income. It decreases comprehensive

income but does not impact gross profit, operating income, or net income. The COGs method increases cost of goods sold

which decreases gross profit, operating income, net income, and comprehensive income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started