In your final project, you will assume the role of an accountant and complete the year-end adjustment process for your company using a provided workbook.

In your final project, you will assume the role of an accountant and complete the year-end adjustment process for your company using a provided workbook. This workbook is the first deliverable (Part I) of your final project. In Part II, you will analyze the provided financials of the same company and create a report documenting your findings. For your third milestone, you will complete a draft of your ratio analysis report so that you can gain feedback and improve your work prior to the final submission in Module Eight. Note that you do not need feedback from Milestone Two to successfully complete this assignment. You should use the provided Final Project Part II template to structure your submission. Prompt: Specifically, the following critical elements must be addressed:

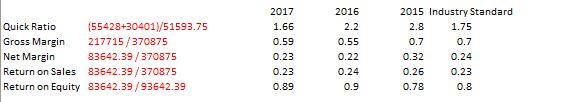

I. Abstract: Summarize the story of profitability and liquidity for your company. In other words, highlight the most important aspects of your report, including your major conclusions.

II. Computations: Identify and describe your computations from the Financial Analysis tab of your workbook. Be sure to format your key results in a table or graphical format, as appropriate. Explain why each cited figure was included in your report in terms of its importance for the organization.

III. Comparison: Evaluate the financials of the company by comparing current ratios to both historical and industry-average ratios. Clearly identify all unexpected or aberrant figures.

IV. Conclusion: Draw informed conclusions based on your computations and comparisons in the previous paragraphs. Be sure to justify your claims with specific evidence and examples.

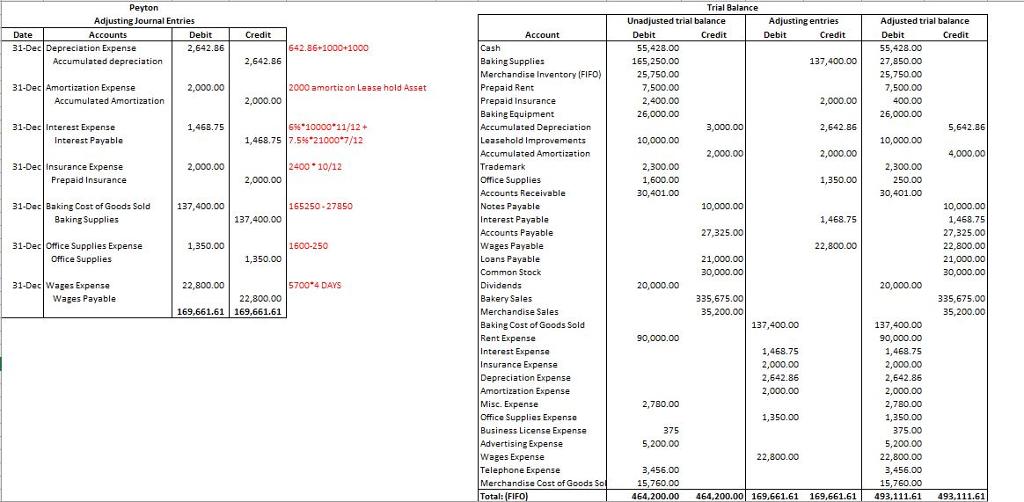

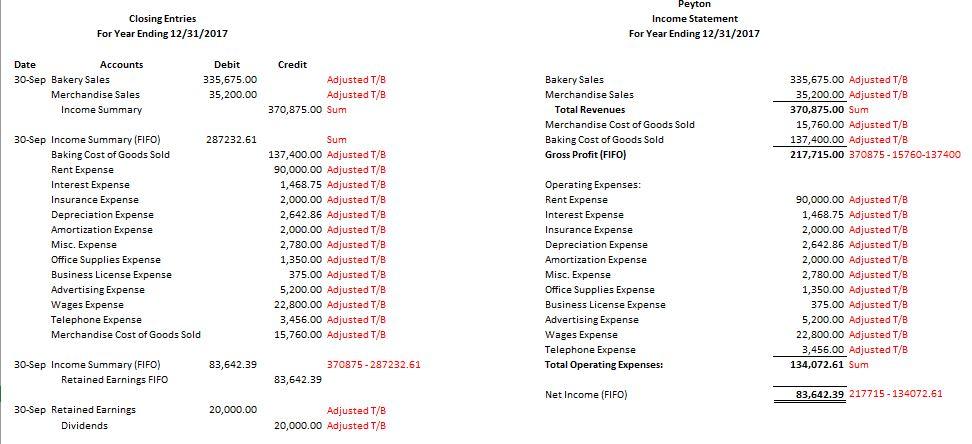

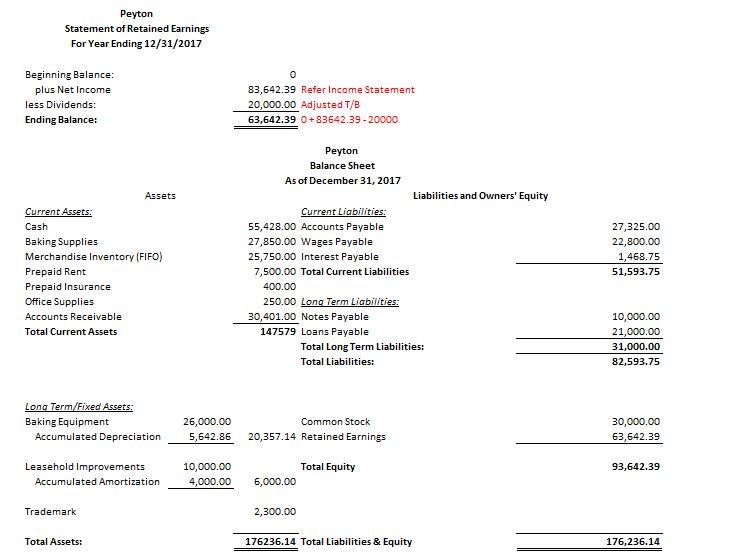

Trial Balance Peyton Adjusting Journal Entries Unadjusted trial balance Adjusting entries Debit Adjusted trial balance Debit Credit Credit Debit Credit Accounts 31-Dec Depreciation Expense Date Debit 2,642.86 Credit Account 642.86+1000+1000 Cash Baking Supplies 55,428.00 55,428.00 Accumulated depreciation 2,642.86 165,250.00 137,400.00 27,850.00 Merchandise Inventory (FIFO) Prepaid Rent: Prepaid Insurance 25,750.00 25,750.00 31-Dec Amortization Expense 2,000.00 2000 amortiz on Lease hold Asset 7,500.00 7,500.00 Accumulated Amortization 2,000.00 2,400.00 2,000.00 400.00 26,000.00 26,000.00 Baking Equipment Accumulated Depreciation Leasehold Improvements Accumulated Amortization Trademark Office Supplies Accounts Receivable Notes Payable 31-Dec Interest Expense 1,468.75 6%*10000*11/12+ 3,000.00 2,642.86 5,642.86 Interest Payabla 1,468.75 7.5% 21000*7/12 10,000.00 10,000.00 2,000.00 2,000.00 4,000.00 31-Dec Insurance Expense 2,000.00 2400 * 10/12 2,300.00 2,300.00 Prepaid Insurance 2,000.00 1,600.00 1,350.00 250.00 30,401.00 30,401.00 31-Dec Baking Cost of Goods Sold 137,400.00 165250 -2785o 10,000.00 10,000.00 Baking Supplies 137,400.00 Interest Payable Accounts Payable Wages Payable 1,468.75 1,468.75 27,325.00 27,325.00 31-Dec Office Supplies Expense 1,350.00 1600-250 22,800.00 22,800.00 Office Supplies 1,350.00 Loans Payable 21,000.00 21,000.00 Common Stock 30,000.00 30,000.00 31-Dec Wages Expanse Wages Payable 5700*4 DAYS Dividends Bakery Sales Merchandise Sales 22,800.00 20,000.00 20,000.00 335,675.00 335,675.00 35,200.00 22,800.00 169,661.61 169,661.61 35,200.00 Baking Cost of Goods Sold Rent Expense Interest Expense Insurance Expense Depreciation Expense Amortization Expense Misc. Expense 137,400.00 137,400.00 90,000.00 90,000.00 1,468.75 2,000.00 1,468.75 2,000.00 2,642.86 2,000.00 2,642.86 2,000.00 2,780.00 2,780.00 Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense Merchandise Cost of Goods So Total: (FIFO) 1,350.00 1,350.00 375 375.00 5,200.00 5,200.00 22,800.00 22,800.00 3,456.00 3,456.00 15,760.00 15,760.00 464,200.00 464,200.00 169,661.61 169,661.61 493,111.61 493,111.61

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Summarize the story of profitability and liquidity for your company In other words highlight the most important aspects of your report including your major conclusions Profitability The company has ea...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started