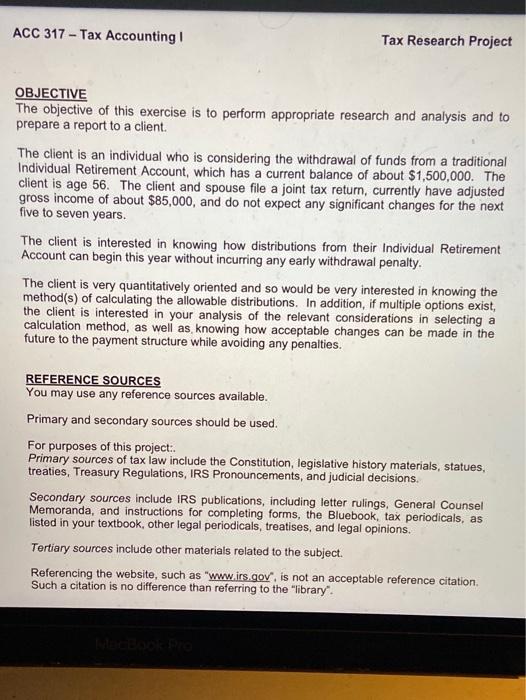

ACC 317 - Tax Accounting! Tax Research Project OBJECTIVE The objective of this exercise is to perform appropriate research and analysis and to prepare a report to a client. The client is an individual who is considering the withdrawal of funds from a traditional Individual Retirement Account, which has a current balance of about $1,500,000. The client is age 56. The client and spouse file a joint tax return, currently have adjusted gross income of about $85,000, and do not expect any significant changes for the next five to seven years. The client is interested in knowing how distributions from their Individual Retirement Account can begin this year without incurring any early withdrawal penalty. The client is very quantitatively oriented and so would be very interested in knowing the method(s) of calculating the allowable distributions. In addition, if multiple options exist, the client is interested in your analysis of the relevant considerations in selecting a calculation method, as well as knowing how acceptable changes can be made in the future to the payment structure while avoiding any penalties. REFERENCE SOURCES You may use any reference sources available. Primary and secondary sources should be used. For purposes of this project: Primary sources of tax law include the Constitution, legislative history materials, statues, treaties, Treasury Regulations, IRS Pronouncements, and judicial decisions. Secondary sources include IRS publications, including letter rulings, General Counsel Memoranda, and instructions for completing forms, the Bluebook, tax periodicals, as listed in your textbook, other legal periodicals, treatises, and legal opinions. Tertiary sources include other materials related to the subject. Referencing the website, such as "www.irs gov". is not an acceptable reference citation, Such a citation is no difference than referring to the library ACC 317 - Tax Accounting! Tax Research Project OBJECTIVE The objective of this exercise is to perform appropriate research and analysis and to prepare a report to a client. The client is an individual who is considering the withdrawal of funds from a traditional Individual Retirement Account, which has a current balance of about $1,500,000. The client is age 56. The client and spouse file a joint tax return, currently have adjusted gross income of about $85,000, and do not expect any significant changes for the next five to seven years. The client is interested in knowing how distributions from their Individual Retirement Account can begin this year without incurring any early withdrawal penalty. The client is very quantitatively oriented and so would be very interested in knowing the method(s) of calculating the allowable distributions. In addition, if multiple options exist, the client is interested in your analysis of the relevant considerations in selecting a calculation method, as well as knowing how acceptable changes can be made in the future to the payment structure while avoiding any penalties. REFERENCE SOURCES You may use any reference sources available. Primary and secondary sources should be used. For purposes of this project: Primary sources of tax law include the Constitution, legislative history materials, statues, treaties, Treasury Regulations, IRS Pronouncements, and judicial decisions. Secondary sources include IRS publications, including letter rulings, General Counsel Memoranda, and instructions for completing forms, the Bluebook, tax periodicals, as listed in your textbook, other legal periodicals, treatises, and legal opinions. Tertiary sources include other materials related to the subject. Referencing the website, such as "www.irs gov". is not an acceptable reference citation, Such a citation is no difference than referring to the library