Answered step by step

Verified Expert Solution

Question

1 Approved Answer

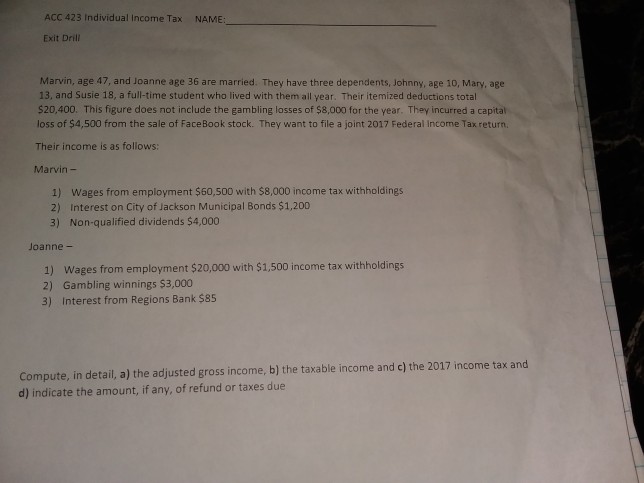

ACC 423 Individual Income Tax NAME: Exit Drill Marvin, age 47, and Joanne age 36 are married. They have three dependents, Johnny, age 10, Mary,

ACC 423 Individual Income Tax NAME: Exit Drill Marvin, age 47, and Joanne age 36 are married. They have three dependents, Johnny, age 10, Mary, age 13, and Susie 18, a full-time student who lived with them all year. Their itemized deductions total 20,400. This figure does not include the gambling losses of $8,000 for the year. They incurred a capital . loss of $4,500 from the sale of FaceBook stock. They want to file a joint 2017 Federal Income Tax return Their income is as follows: Marvin- 1) Wages from employment $60,500 with $8,000 income tax withholdings 2) Interest on City of Jackson Municipal Bonds $1,200 3) Non-qualified dividends $4,000 Joanne - 1) Wages from employment $20,000 with $1,500 income tax withholdings 2) Gambling winnings $3,000 3) Interest from Regions Bank $85 Compute, in detail, a) the adjusted gross income, b) the taxable income and c) the 2017 income tax and d) indicate the amount, if any, of refund or taxes due

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started