Answered step by step

Verified Expert Solution

Question

1 Approved Answer

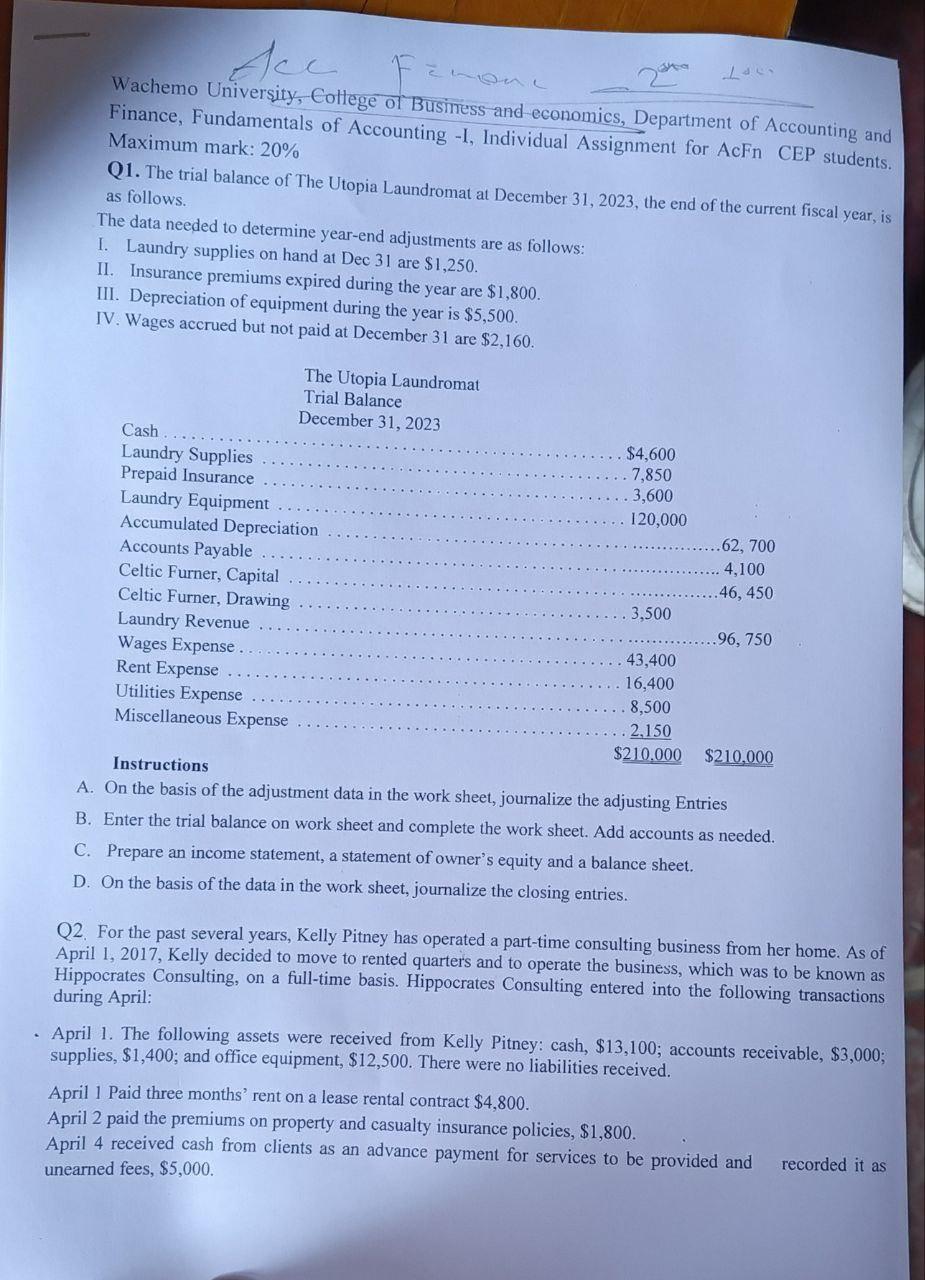

Acc Wachemo University, College of Business and economics, Department of Accounting and Finance, Fundamentals of Accounting -I. Individual Assignment for AcFn CEP students. Maximum

Acc Wachemo University, College of Business and economics, Department of Accounting and Finance, Fundamentals of Accounting -I. Individual Assignment for AcFn CEP students. Maximum mark: 20% Q1. The trial balance of The Utopia Laundromat at December 31, 2023, the end of the current fiscal year, is as follows. The data needed to determine year-end adjustments are as follows: I. Laundry supplies on hand at Dec 31 are $1,250. II. Insurance premiums expired during the year are $1,800. III. Depreciation of equipment during the year is $5,500. IV. Wages accrued but not paid at December 31 are $2,160. Cash. Laundry Supplies. Prepaid Insurance The Utopia Laundromat Trial Balance December 31, 2023 ..$4,600 .. 7,850 3,600 120,000 ......62, 700 Laundry Equipment Accumulated Depreciation Accounts Payable Celtic Furner, Capital .. . 4,100 .....46, 450 Celtic Furner, Drawing. 3,500 Laundry Revenue ........96, 750 Wages Expense. 43,400 Rent Expense 16,400 Utilities Expense Miscellaneous Expense 8,500 .2.150 Instructions $210,000 $210,000 A. On the basis of the adjustment data in the work sheet, journalize the adjusting Entries B. Enter the trial balance on work sheet and complete the work sheet. Add accounts as needed. C. Prepare an income statement, a statement of owner's equity and a balance sheet. D. On the basis of the data in the work sheet, journalize the closing entries. Q2. For the past several years, Kelly Pitney has operated a part-time consulting business from her home. As of April 1, 2017, Kelly decided to move to rented quarters and to operate the business, which was to be known as Hippocrates Consulting, on a full-time basis. Hippocrates Consulting entered into the following transactions during April: April 1. The following assets were received from Kelly Pitney: cash, $13,100; accounts receivable, $3,000; supplies, $1,400; and office equipment, $12,500. There were no liabilities received. April 1 Paid three months' rent on a lease rental contract $4,800. April 2 paid the premiums on property and casualty insurance policies, $1,800. April 4 received cash from clients as an advance payment for services to be provided and unearned fees, $5,000. recorded it as

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Introduction Understanding the fundamentals of accounting involves the preparation and adjustment of financial statements which are crucial for reflecting a companys true financial position This proce...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started