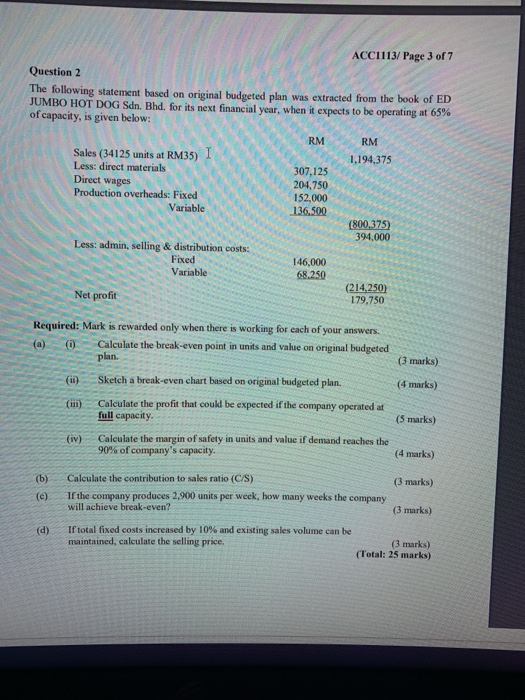

ACC1113/ Page 3 of 7 Question 2 The following statement based on original budgeted plan was extracted from the book of ED JUMBO HOT DOG Sdn. Bhd. for its next financial year, when it expects to be operating at 65% of capacity, is given below: RM RM Sales (34125 units at RM35) I 1,194,375 Less: direct materials 307,125 204,750 Production overheads: Fixed 152,000 Variable 136.500 (800,375) 394,000 Less: admin, selling & distribution costs: Fixed 146,000 Variable 68.250 (214,250) Net profit 179.750 Direct wages (3 marks) Required: Mark is rewarded only when there is working for each of your answers. (a) 0 Calculate the break-even point in units and value on original budgeted plan. (1) Sketch a break-even chart based on original budgeted plan. Calculate the profit that could be expected if the company operated at full capacity. (4 marks) (5 marks) (iv) Calculate the margin of safety in units and value if demand reaches the 90% of company's capacity. (4 marks) (b) (e) (3 marks) Calculate the contribution to sales ratio (C/S) If the company produces 2.900 units per week, how many weeks the company will achieve break-even? (3 marks) (d) If total fixed costs increased by 10% and existing sales volume can be maintained, calculate the selling price. (3 marks) (Total: 25 marks) ACC1113/ Page 3 of 7 Question 2 The following statement based on original budgeted plan was extracted from the book of ED JUMBO HOT DOG Sdn. Bhd. for its next financial year, when it expects to be operating at 65% of capacity, is given below: RM RM Sales (34125 units at RM35) I 1,194,375 Less: direct materials 307,125 204,750 Production overheads: Fixed 152,000 Variable 136.500 (800,375) 394,000 Less: admin, selling & distribution costs: Fixed 146,000 Variable 68.250 (214,250) Net profit 179.750 Direct wages (3 marks) Required: Mark is rewarded only when there is working for each of your answers. (a) 0 Calculate the break-even point in units and value on original budgeted plan. (1) Sketch a break-even chart based on original budgeted plan. Calculate the profit that could be expected if the company operated at full capacity. (4 marks) (5 marks) (iv) Calculate the margin of safety in units and value if demand reaches the 90% of company's capacity. (4 marks) (b) (e) (3 marks) Calculate the contribution to sales ratio (C/S) If the company produces 2.900 units per week, how many weeks the company will achieve break-even? (3 marks) (d) If total fixed costs increased by 10% and existing sales volume can be maintained, calculate the selling price. (3 marks) (Total: 25 marks)