Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACC160 This week you will finish working on the course project. For your project, you are required to prepare and submit the following financial statements

ACC160

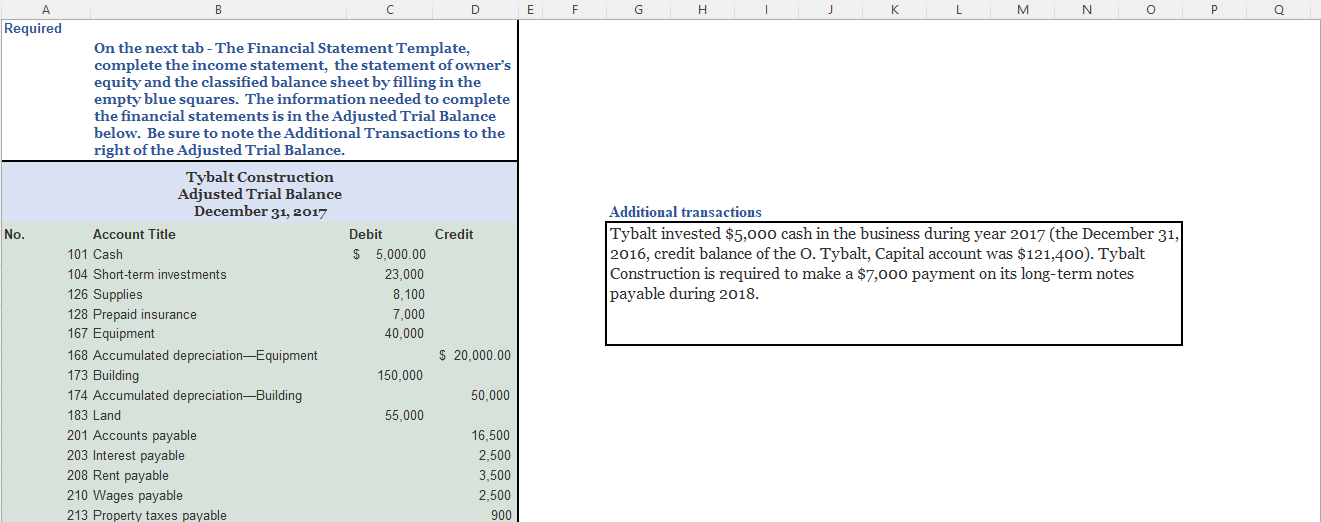

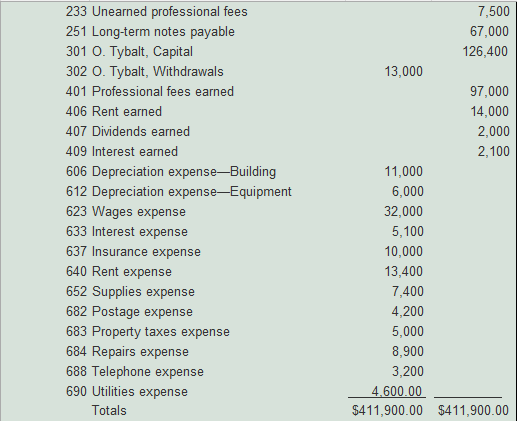

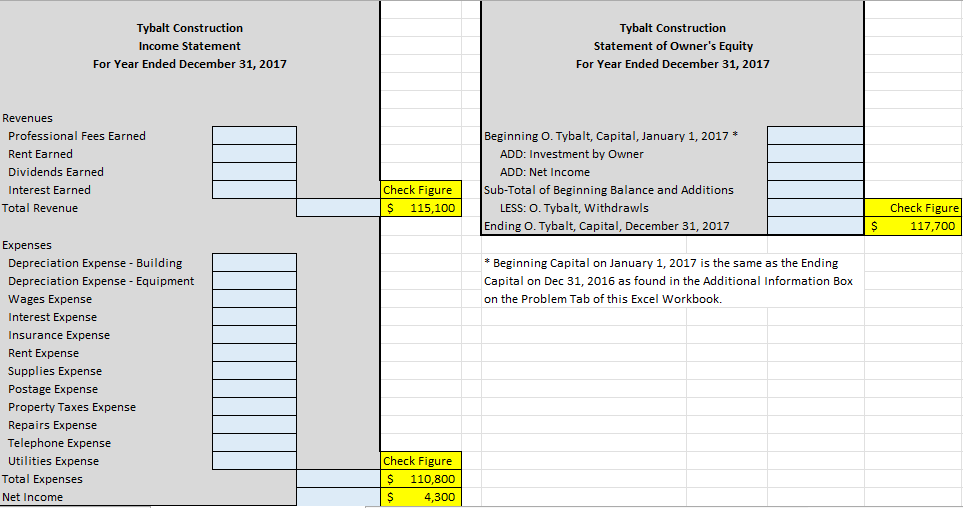

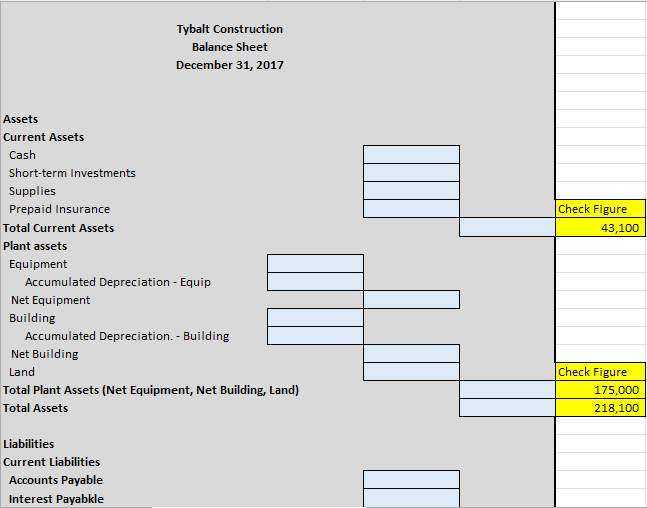

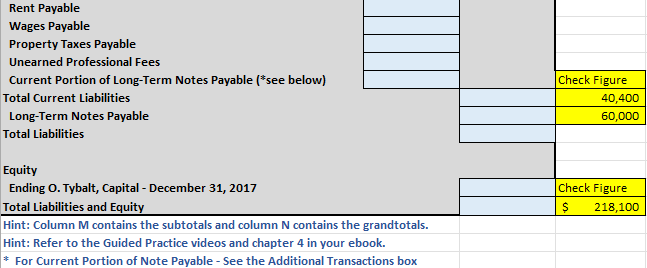

This week you will finish working on the course project. For your project, you are required to prepare and submit the following financial statements for the Tybalt Company: The income statement The statement of owner's equity The balance sheet (using the given Adjusted Trial Balance) Instructions Use the Microsoft Excel Project template, provided for you. Be sure to review the Project Overview page for complete project requirements. Please note that your weekly concept check assignments are designed to help you successfully complete your project. Save and name your file using the following file naming convention: YourFirst LastName_Project. Submit your file using the upload instructions below. Your project is due at the end of week 4. In this course, you will have the opportunity to apply the concepts you learn to create financial statements for the Tybalt Corporation as part of your course project. For this project, you will be using Microsoft Excel to create their financial statements. Project Milestones and Schedule of Delivery Your project is due in Week 4. Below is an outline of project deliverables and the weeks in which they are due to help you manage your time effectively. Create Financial Statements - Due Week 4 a. Create an Income Statement b. Create a Statement of Owner's Equity c. Create a Balance Sheet General Instructions You will begin working on your project in Week 3 and will submit your project in Week 4. In this project, you will follow the instructions to create first the Income Statement, then the Statement of Owner's Equity, and finally the Balance Sheet. Be sure to prepare the financial statements in the order given above. Download the Excel Project template. You will use this template to complete your project. 1. Thoroughly read the problem, and address the requirements for your project. The problem is found on the first tab of the Excel template. 2 Submit the project in the required week C A Required No. B D E On the next tab - The Financial Statement Template, complete the income statement, the statement of owner's equity and the classified balance sheet by filling in the empty blue squares. The information needed to complete the financial statements is in the Adjusted Trial Balance below. Be sure to note the Additional Transactions to the right of the Adjusted Trial Balance. Tybalt Construction Adjusted Trial Balance December 31, 2017 Account Title Credit 101 Cash 104 Short-term investments 126 Supplies 128 Prepaid insurance 167 Equipment 168 Accumulated depreciation Equipment 173 Building 174 Accumulated depreciation-Building 183 Land 201 Accounts payable 203 Interest payable 208 Rent payable 210 Wages payable 213 Property taxes payable Debit $ 5,000.00 23,000 8,100 7,000 40,000 150,000 55,000 $ 20,000.00 50,000 16,500 2,500 3,500 2,500 900 F G H J K L M N O P Additional transactions Tybalt invested $5,000 cash in the business during year 2017 (the December 31, 2016, credit balance of the O. Tybalt, Capital account was $121,400). Tybalt Construction is required to make a $7,000 payment on its long-term notes payable during 2018. Q 233 Unearned professional fees 251 Long-term notes payable 301 O. Tybalt, Capital 302 O. Tybalt, Withdrawals 401 Professional fees earned 406 Rent earned 407 Dividends earned 409 Interest earned 606 Depreciation expense-Building 612 Depreciation expense-Equipment 623 Wages expense 633 Interest expense 637 Insurance expense 640 Rent expense 652 Supplies expense 682 Postage expense 683 Property taxes expense 684 Repairs expense 688 Telephone expense 690 Utilities expense Totals 7,500 67,000 126,400 97,000 14,000 2,000 2,100 13,000 11,000 6,000 32,000 5,100 10,000 13,400 7,400 4,200 5,000 8,900 3,200 4.600.00 $411,900.00 $411,900.00 Tybalt Construction Income Statement For Year Ended December 31, 2017 Revenues Professional Fees Earned Rent Earned Dividends Earned Interest Earned Total Revenue Expenses Depreciation Expense - Building Depreciation Expense - Equipment Wages Expense Interest Expense Insurance Expense Rent Expense Supplies Expense Postage Expense Property Taxes Expense Repairs Expense Telephone Expense Utilities Expense Total Expenses Net Income Check Figure $ 115,100 Check Figure $ 110,800 $ 4,300 Tybalt Construction Statement of Owner's Equity For Year Ended December 31, 2017 Beginning O. Tybalt, Capital, January 1, 2017 * ADD: Investment by Owner ADD: Net Income Sub-Total of Beginning Balance and Additions LESS: O. Tybalt, Withdrawls Ending O. Tybalt, Capital, December 31, 2017 $ * Beginning Capital on January 1, 2017 is the same as the Ending Capital on Dec 31, 2016 as found in the Additional Information Box on the Problem Tab of this Excel Workbook. Check Figure 117,700 Tybalt Construction Balance Sheet December 31, 2017 Assets Current Assets Cash Short-term Investments Supplies Prepaid Insurance Total Current Assets Plant assets Equipment Accumulated Depreciation - Equip Net Equipment Building Accumulated Depreciation. - Building Net Building Land Total Plant Assets (Net Equipment, Net Building, Land) Total Assets Liabilities Current Liabilities Accounts Payable Interest Payabkle Check Figure 43,100 Check Figure 175,000 218,100 Rent Payable Wages Payable Property Taxes Payable Unearned Professional Fees Current Portion of Long-Term Notes Payable (*see below) Total Current Liabilities Long-Term Notes Payable Total Liabilities Equity Ending O. Tybalt, Capital - December 31, 2017 Total Liabilities and Equity Hint: Column M contains the subtotals and column N contains the grandtotals. Hint: Refer to the Guided Practice videos and chapter 4 in your ebook. * For Current Portion of Note Payable - See the Additional Transactions box Check Figure 40,400 60,000 Check Figure $ 218,100Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started