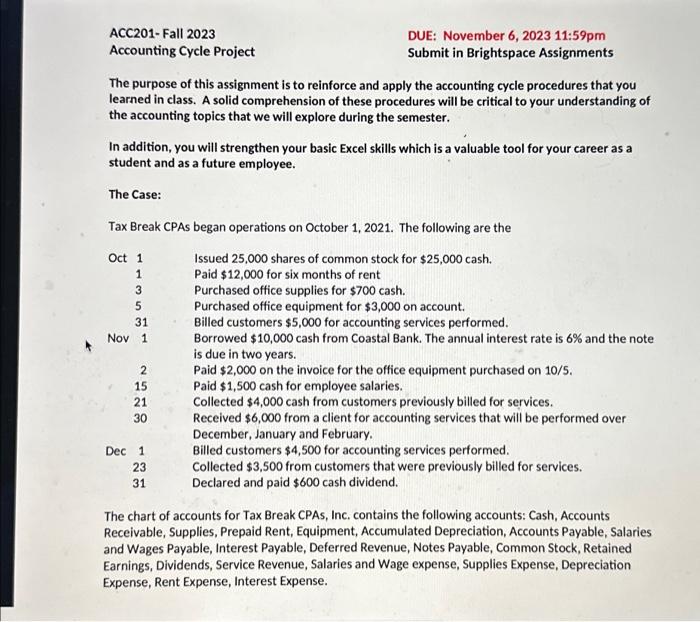

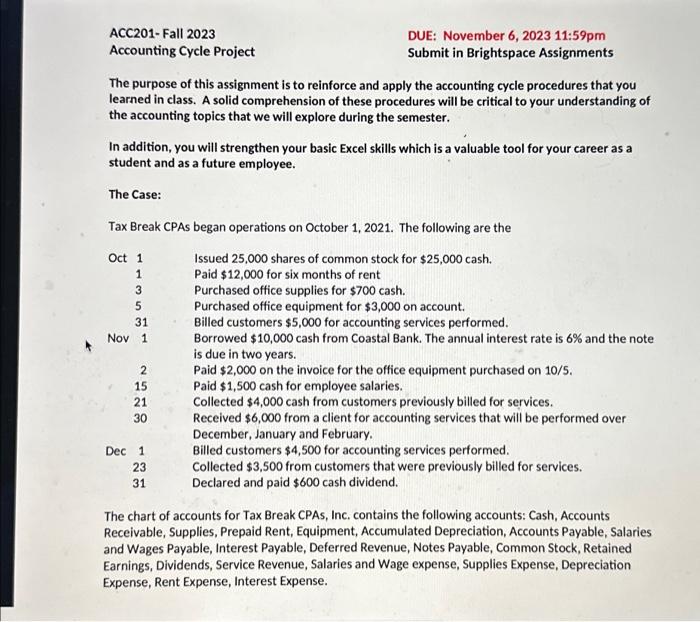

ACC201-Fall 2023 Accounting Cycle Project The purpose of this assignment is to reinforce and apply the accounting cycle procedures that you learned in class. A solid comprehension of these procedures will be critical to your understanding of the accounting topics that we will explore during the semester. In addition, you will strengthen your basic Excel skills which is a valuable tool for your career as a student and as a future employee. The Case: DUE: November 6, 2023 11:59pm Submit in Brightspace Assignments Tax Break CPAS began operations on October 1, 2021. The following are the Issued 25,000 shares of common stock for $25,000 cash. Paid $12,000 for six months of rent Purchased office supplies for $700 cash. Purchased office equipment for $3,000 on account. Oct 1 1 3 5 31 Nov 1 2 15 21 30 Dec 1 23 31 Billed customers $5,000 for accounting services performed. Borrowed $10,000 cash from Coastal Bank. The annual interest rate is 6% and the note is due in two years. Paid $2,000 on the invoice for the office equipment purchased on 10/5. Paid $1,500 cash for employee salaries. Collected $4,000 cash from customers previously billed for services. Received $6,000 from a client for accounting services that will be performed over December, January and February. Billed customers $4,500 for accounting services performed. Collected $3,500 from customers that were previously billed for services. Declared and paid $600 cash dividend. The chart of accounts for Tax Break CPAS, Inc. contains the following accounts: Cash, Accounts Receivable, Supplies, Prepaid Rent, Equipment, Accumulated Depreciation, Accounts Payable, Salaries and Wages Payable, Interest Payable, Deferred Revenue, Notes Payable, Common Stock, Retained Earnings, Dividends, Service Revenue, Salaries and Wage expense, Supplies Expense, Depreciation Expense, Rent Expense, Interest Expense.

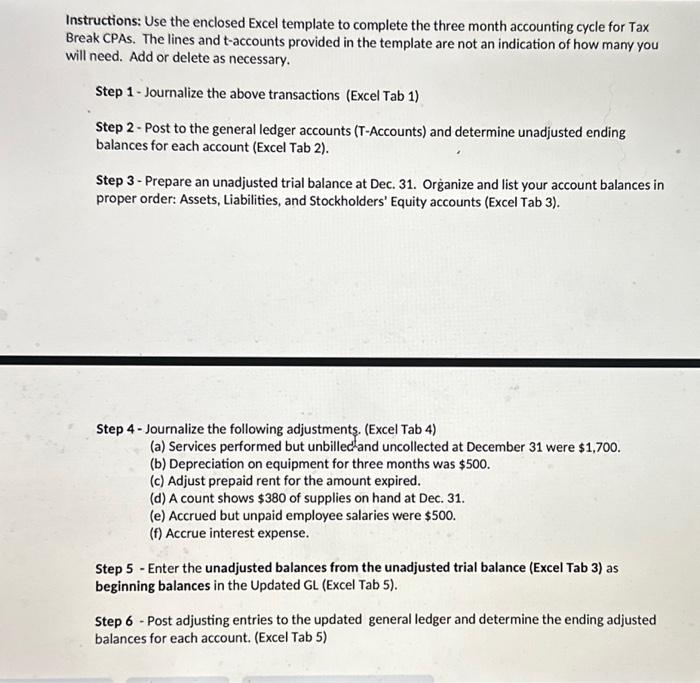

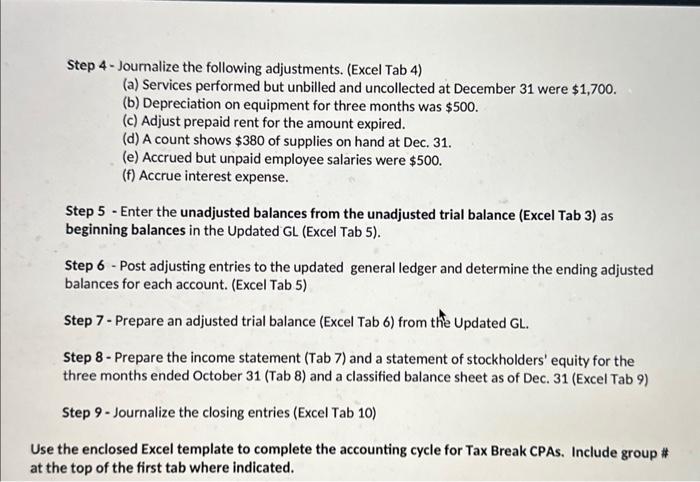

Instructions: Use the enclosed Excel template to complete the three month accounting cycle for Tax Break CPAs. The lines and t-accounts provided in the template are not an indication of how many you will need. Add or delete as necessary. Step 1- Journalize the above transactions (Excel Tab 1) Step 2 - Post to the general ledger accounts (T-Accounts) and determine unadjusted ending balances for each account (Excel Tab 2). Step 3- Prepare an unadjusted trial balance at Dec. 31. Organize and list your account balances in proper order: Assets, Liabilities, and Stockholders' Equity accounts (Excel Tab 3). Step 4 - Journalize the following adjustments. (Excel Tab 4) (a) Services performed but unbilled-and uncollected at December 31 were $1,700. (b) Depreciation on equipment for three months was $500. (c) Adjust prepaid rent for the amount expired. (d) A count shows $380 of supplies on hand at Dec. 31. (e) Accrued but unpaid employee salaries were $500. (f) Accrue interest expense. Step 5 - Enter the unadjusted balances from the unadjusted trial balance (Excel Tab 3) as beginning balances in the Updated GL (Excel Tab 5). Step 6 - Post adjusting entries to the updated general ledger and determine the ending adjusted balances for each account. (Excel Tab 5) ACC201- Fall 2023 Accounting Cycle Project DUE: November 6, 2023 11:59pm Submit in Brightspace Assignments The purpose of this assignment is to reinforce and apply the accounting cycle procedures that you learned in class. A solid comprehension of these procedures will be critical to your understanding of the accounting topics that we will explore during the semester. In addition, you will strengthen your basic Excel skills which is a valuable tool for your career as a student and as a future employee. The Case: Tax Break CPAs began operations on October 1, 2021. The following are the \begin{tabular}{cl} Oct 1 & Issued 25,000 shares of common stock for $25,000 cash. \\ 1 & Paid $12,000 for six months of rent \\ 3 & Purchased office supplies for $700 cash. \\ 5 & Purchased office equipment for $3,000 on account. \\ 31 & Billed customers $5,000 for accounting services performed. \\ Nov 1 & Borrowed $10,000 cash from Coastal Bank. The annual interest rate is 6% and the note \\ & is due in two years. \\ 2 & Paid $2,000 on the invoice for the office equipment purchased on 10/5. \\ 15 & Paid $1,500 cash for employee salaries. \\ 21 & Collected $4,000 cash from customers previously billed for services. \\ 30 & Received $6,000 from a client for accounting services that will be performed over \\ Dec 1 & December, January and February. \\ 23 & Billed customers $4,500 for accounting services performed. \\ 31 & Collected $3,500 from customers that were previously billed for services. \end{tabular} The chart of accounts for Tax Break CPAs, Inc. contains the following accounts: Cash, Accounts Receivable, Supplies, Prepaid Rent, Equipment, Accumulated Depreciation, Accounts Payable, Salaries and Wages Payable, Interest Payable, Deferred Revenue, Notes Payable, Common Stock, Retained Earnings, Dividends, Service Revenue, Salaries and Wage expense, Supplies Expense, Depreciation Expense, Rent Expense, Interest Expense. Step 4- Journalize the following adjustments. (Excel Tab 4) (a) Services performed but unbilled and uncollected at December 31 were $1,700. (b) Depreciation on equipment for three months was $500. (c) Adjust prepaid rent for the amount expired. (d) A count shows $380 of supplies on hand at Dec. 31 . (e) Accrued but unpaid employee salaries were $500. (f) Accrue interest expense. Step 5 - Enter the unadjusted balances from the unadjusted trial balance (Excel Tab 3) as beginning balances in the Updated GL (Excel Tab 5). Step 6 - Post adjusting entries to the updated general ledger and determine the ending adjusted balances for each account. (Excel Tab 5) Step 7 - Prepare an adjusted trial balance (Excel Tab 6) from the Updated GL. Step 8 - Prepare the income statement (Tab 7) and a statement of stockholders' equity for the three months ended October 31 (Tab 8) and a classified balance sheet as of Dec. 31 (Excel Tab 9) Step 9- Journalize the closing entries (Excel Tab 10) Use the enclosed Excel template to complete the accounting cycle for Tax Break CPAs. Include group \# at the top of the first tab where indicated. Instructions: Use the enclosed Excel template to complete the three month accounting cycle for Tax Break CPAs. The lines and t-accounts provided in the template are not an indication of how many you will need. Add or delete as necessary. Step 1- Journalize the above transactions (Excel Tab 1) Step 2 - Post to the general ledger accounts (T-Accounts) and determine unadjusted ending balances for each account (Excel Tab 2). Step 3- Prepare an unadjusted trial balance at Dec. 31. Organize and list your account balances in proper order: Assets, Liabilities, and Stockholders' Equity accounts (Excel Tab 3). Step 4 - Journalize the following adjustments. (Excel Tab 4) (a) Services performed but unbilled-and uncollected at December 31 were $1,700. (b) Depreciation on equipment for three months was $500. (c) Adjust prepaid rent for the amount expired. (d) A count shows $380 of supplies on hand at Dec. 31. (e) Accrued but unpaid employee salaries were $500. (f) Accrue interest expense. Step 5 - Enter the unadjusted balances from the unadjusted trial balance (Excel Tab 3) as beginning balances in the Updated GL (Excel Tab 5). Step 6 - Post adjusting entries to the updated general ledger and determine the ending adjusted balances for each account. (Excel Tab 5) ACC201- Fall 2023 Accounting Cycle Project DUE: November 6, 2023 11:59pm Submit in Brightspace Assignments The purpose of this assignment is to reinforce and apply the accounting cycle procedures that you learned in class. A solid comprehension of these procedures will be critical to your understanding of the accounting topics that we will explore during the semester. In addition, you will strengthen your basic Excel skills which is a valuable tool for your career as a student and as a future employee. The Case: Tax Break CPAs began operations on October 1, 2021. The following are the \begin{tabular}{cl} Oct 1 & Issued 25,000 shares of common stock for $25,000 cash. \\ 1 & Paid $12,000 for six months of rent \\ 3 & Purchased office supplies for $700 cash. \\ 5 & Purchased office equipment for $3,000 on account. \\ 31 & Billed customers $5,000 for accounting services performed. \\ Nov 1 & Borrowed $10,000 cash from Coastal Bank. The annual interest rate is 6% and the note \\ & is due in two years. \\ 2 & Paid $2,000 on the invoice for the office equipment purchased on 10/5. \\ 15 & Paid $1,500 cash for employee salaries. \\ 21 & Collected $4,000 cash from customers previously billed for services. \\ 30 & Received $6,000 from a client for accounting services that will be performed over \\ Dec 1 & December, January and February. \\ 23 & Billed customers $4,500 for accounting services performed. \\ 31 & Collected $3,500 from customers that were previously billed for services. \end{tabular} The chart of accounts for Tax Break CPAs, Inc. contains the following accounts: Cash, Accounts Receivable, Supplies, Prepaid Rent, Equipment, Accumulated Depreciation, Accounts Payable, Salaries and Wages Payable, Interest Payable, Deferred Revenue, Notes Payable, Common Stock, Retained Earnings, Dividends, Service Revenue, Salaries and Wage expense, Supplies Expense, Depreciation Expense, Rent Expense, Interest Expense. Step 4- Journalize the following adjustments. (Excel Tab 4) (a) Services performed but unbilled and uncollected at December 31 were $1,700. (b) Depreciation on equipment for three months was $500. (c) Adjust prepaid rent for the amount expired. (d) A count shows $380 of supplies on hand at Dec. 31 . (e) Accrued but unpaid employee salaries were $500. (f) Accrue interest expense. Step 5 - Enter the unadjusted balances from the unadjusted trial balance (Excel Tab 3) as beginning balances in the Updated GL (Excel Tab 5). Step 6 - Post adjusting entries to the updated general ledger and determine the ending adjusted balances for each account. (Excel Tab 5) Step 7 - Prepare an adjusted trial balance (Excel Tab 6) from the Updated GL. Step 8 - Prepare the income statement (Tab 7) and a statement of stockholders' equity for the three months ended October 31 (Tab 8) and a classified balance sheet as of Dec. 31 (Excel Tab 9) Step 9- Journalize the closing entries (Excel Tab 10) Use the enclosed Excel template to complete the accounting cycle for Tax Break CPAs. Include group \# at the top of the first tab where indicated