Question

ACC202 Financial Statement Report ( Information has to be taken from the website provided with the current year, My company is Apple (AAPL) I have

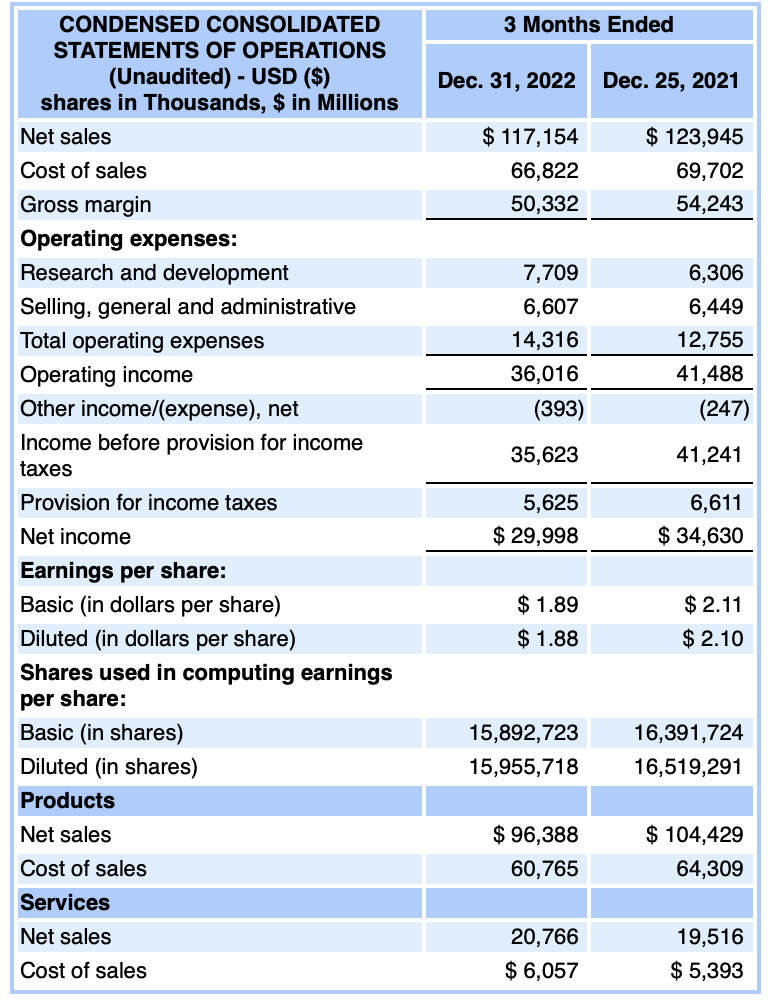

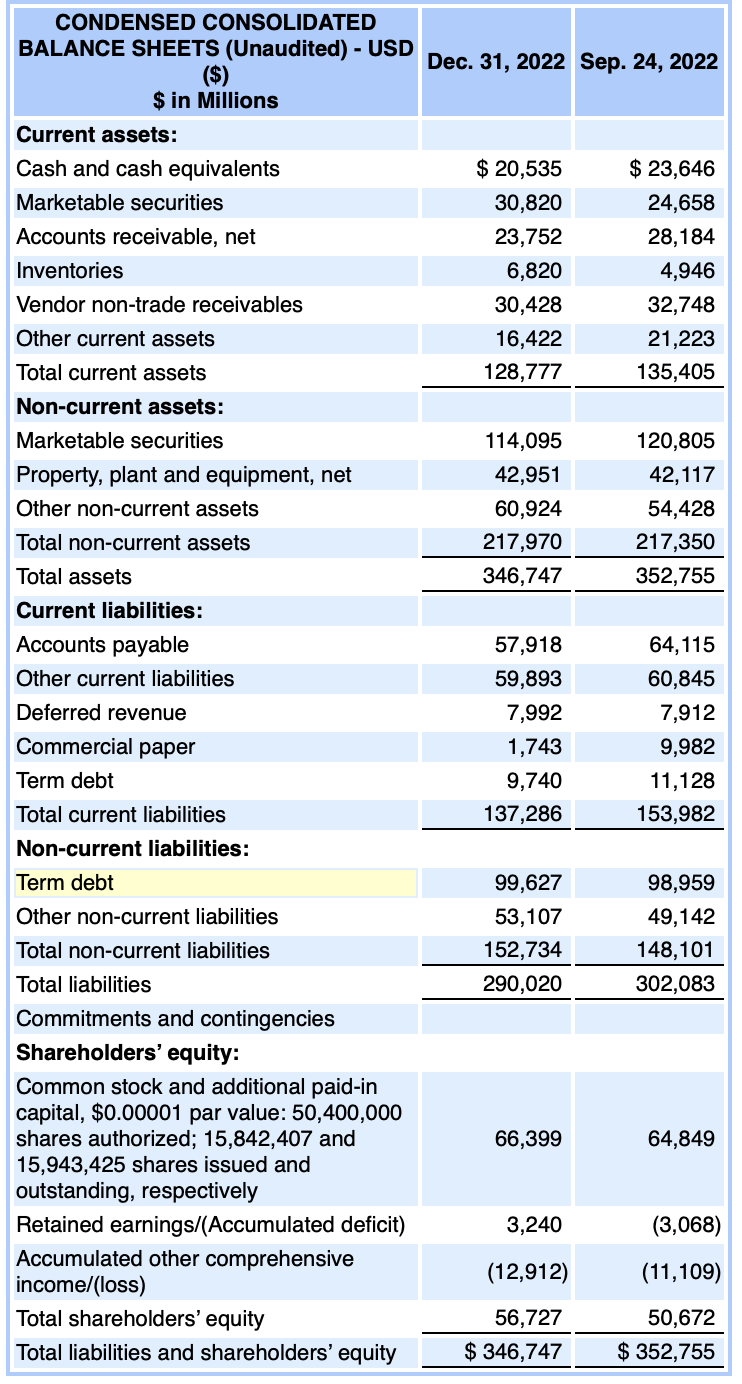

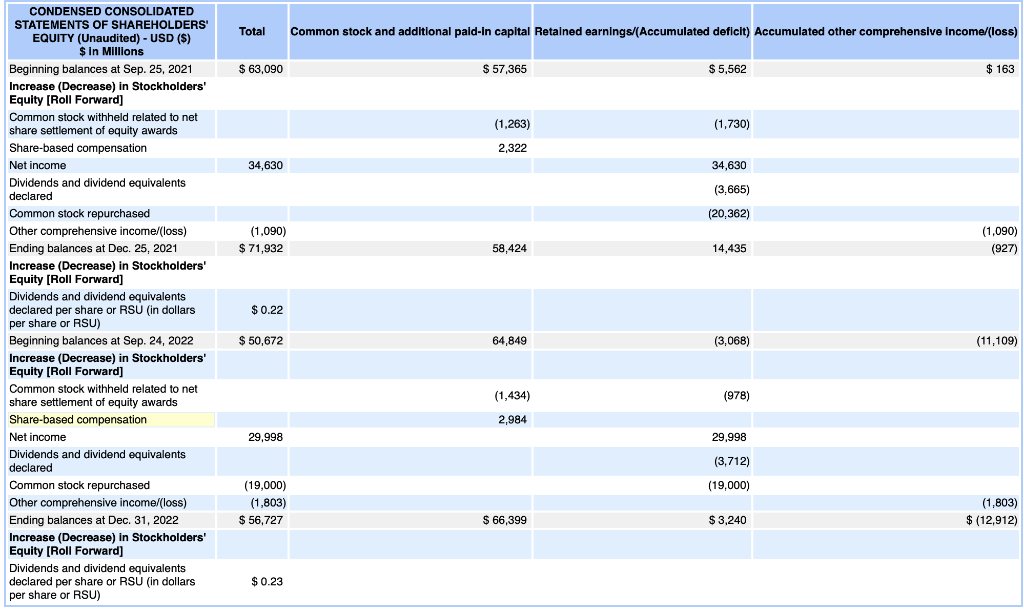

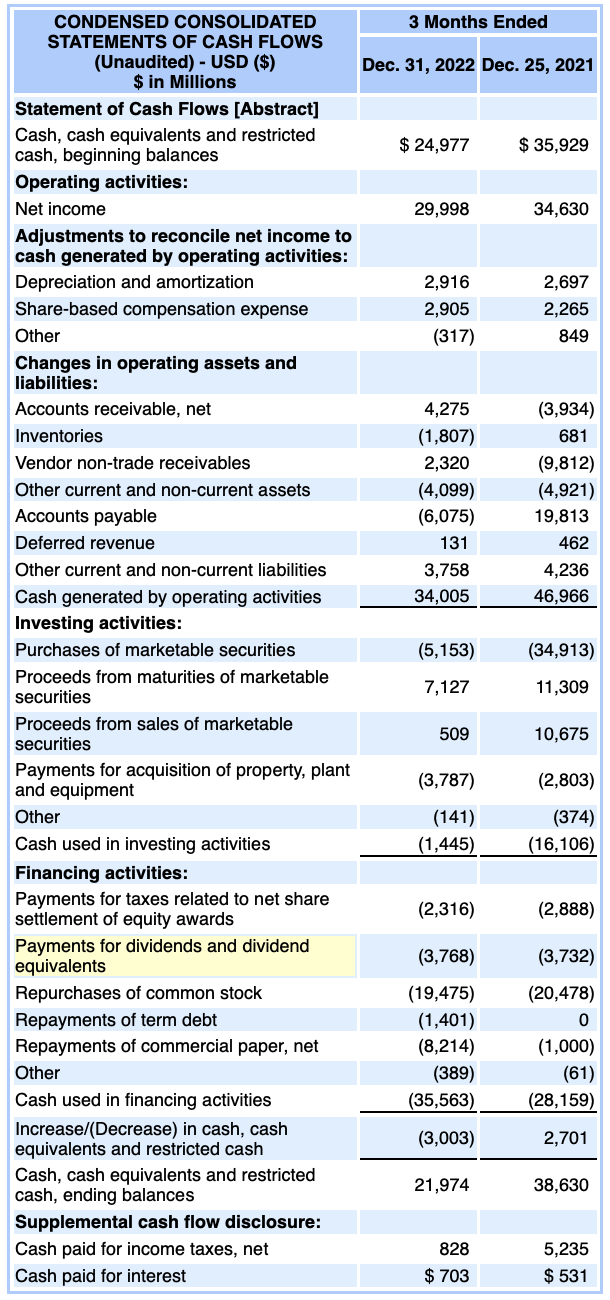

ACC202 Financial Statement Report ( Information has to be taken from the website provided with the current year, My company is Apple (AAPL) I have attached screen shot of the balance sheet, income statement, statement of cash flows, and statement of stockholders equity so no need to follow Step 1

1 Go to www.sec.gov . Under the heading Filings and Forms choose search for company filings. Enter your companys ticker symbol. Find the companys form 10-K Annual Report. Print the balance sheet, income statement, statement of cash flows, and statement of stockholders equity (Only print these 4 pages. Do not print the entire 10-K)

2. Using Excel calculate 12 of the following for the current year: a. Earnings Per Share b. Working Capital c. Current Ratio d. Quick Ratio e. Receivables Turnover f. Days in Receivable g. Inventory Turnover h. Days in Inventory i. Profit Margin Ratio j. Gross Profit Ratio k. Return on assets l. Return on common stockholders equity m. Price-earnings Ratio n. Payout Ratio o. Debt to total assets p. Times interest earned q. Free Cash Flow

3. Choose 3 from the above list and calculate for the prior year. Compare the change from current year to prior year and discuss. (Three paragraphs)

4. Locate the Notes to the Financial Statements and choose 5 of them. Describe them in your own words. I strongly recommend you choose topics you are familiar with (Depreciation, Revenue Recognition, Accounts Receivable, PP&E, etc) (Five paragraphs)

5. Which accounting firm performed the audit?

6. Prepare a vertical analysis of the balance sheet using Excel expressing each item on the CURRENT YEAR'S balance sheet as a percentage of total assets

7. Prepare a horizontal analysis of the income statement using Excel comparing both dollar changes and percentage changes. Compare the current year to one year prior.

CONDENSED CONSOLIDATED Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 50,400,000 shares authorized; 15,842,407 and 15,943,425 shares issued and outstanding, respectively \begin{tabular}{lrr|} \hline Retained earnings/(Accumulated deficit) & 3,240 & (3,068) \\ \hline Accumulatedothercomprehensiveincome/(loss) & (12,912) & (11,109) \\ \hline Total shareholders' equity & 56,727 & 50,672 \\ \hline Total liabilities and shareholders' equity & $346,747 & $352,755 \\ \hline \end{tabular} CONDENSED CONSOLIDATED Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 50,400,000 shares authorized; 15,842,407 and 15,943,425 shares issued and outstanding, respectively \begin{tabular}{lrr|} \hline Retained earnings/(Accumulated deficit) & 3,240 & (3,068) \\ \hline Accumulatedothercomprehensiveincome/(loss) & (12,912) & (11,109) \\ \hline Total shareholders' equity & 56,727 & 50,672 \\ \hline Total liabilities and shareholders' equity & $346,747 & $352,755 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started