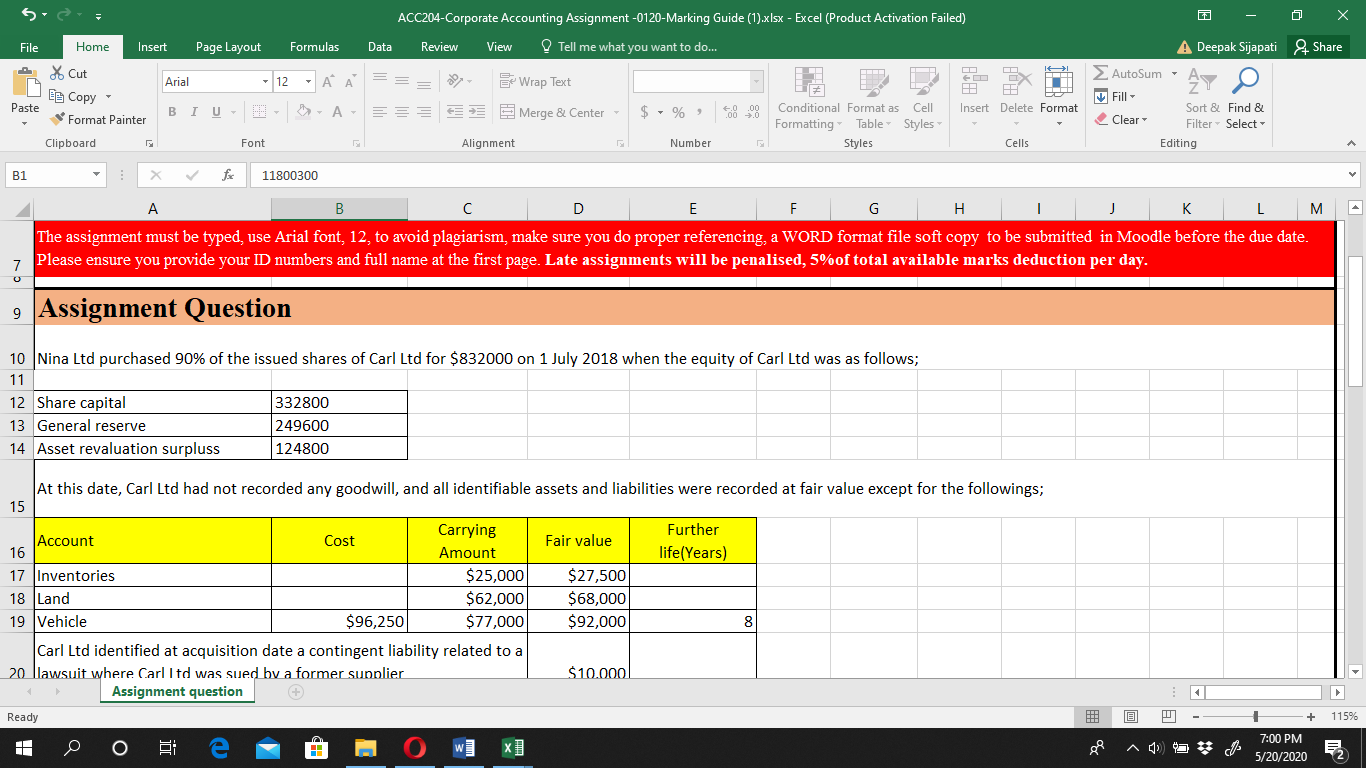

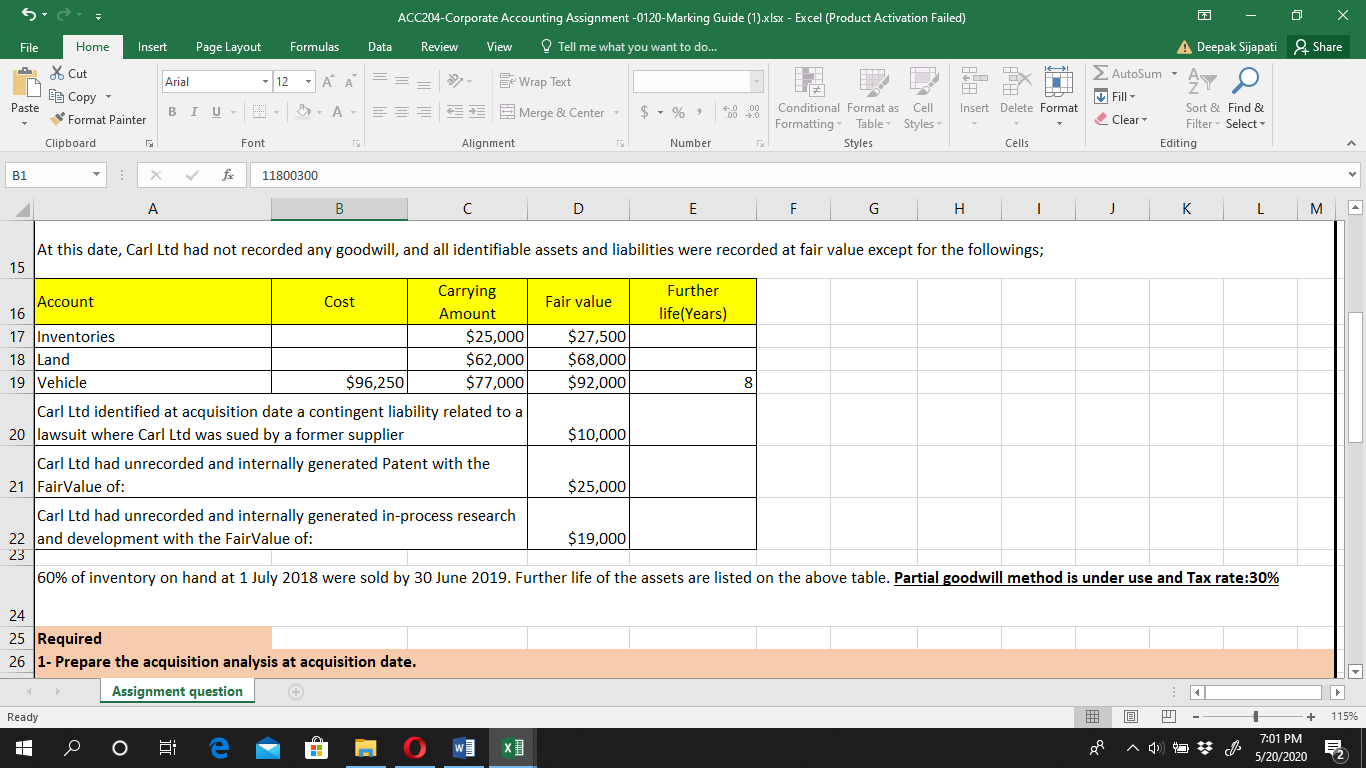

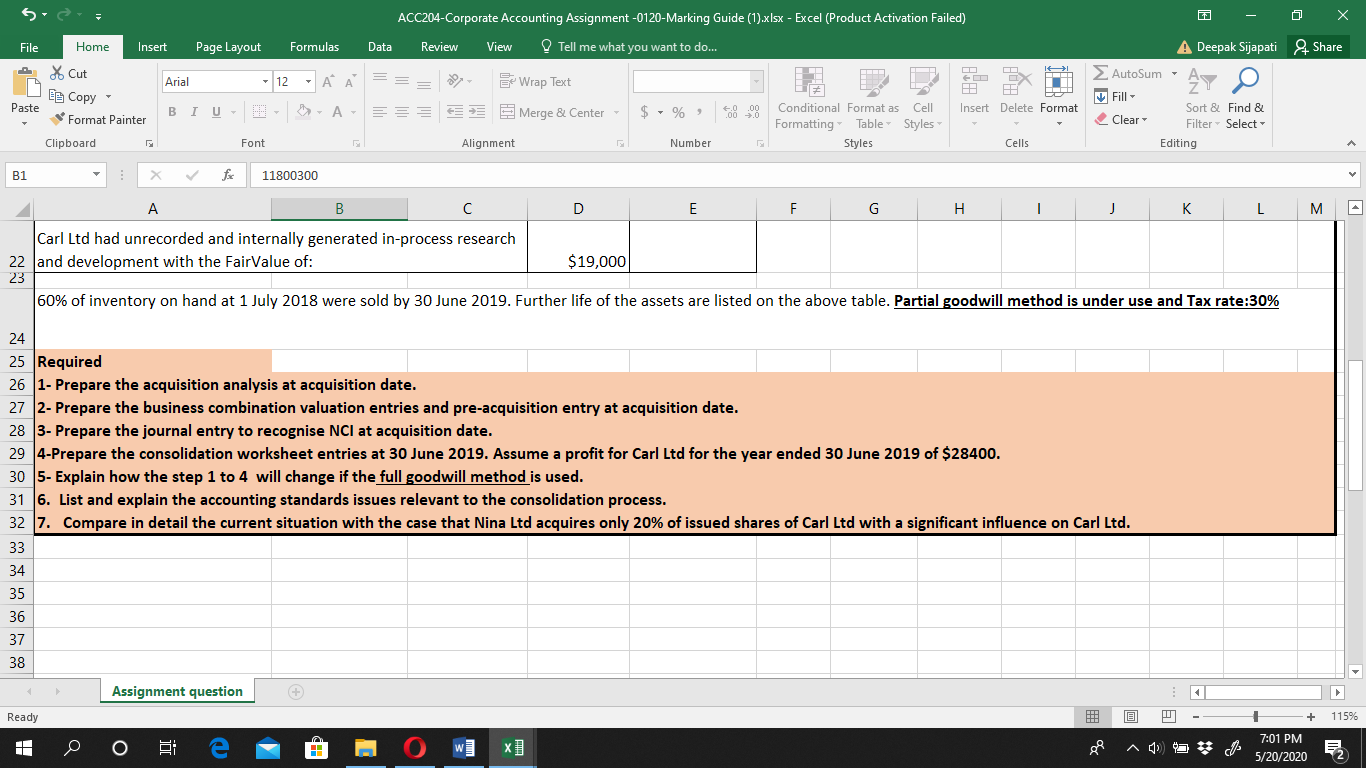

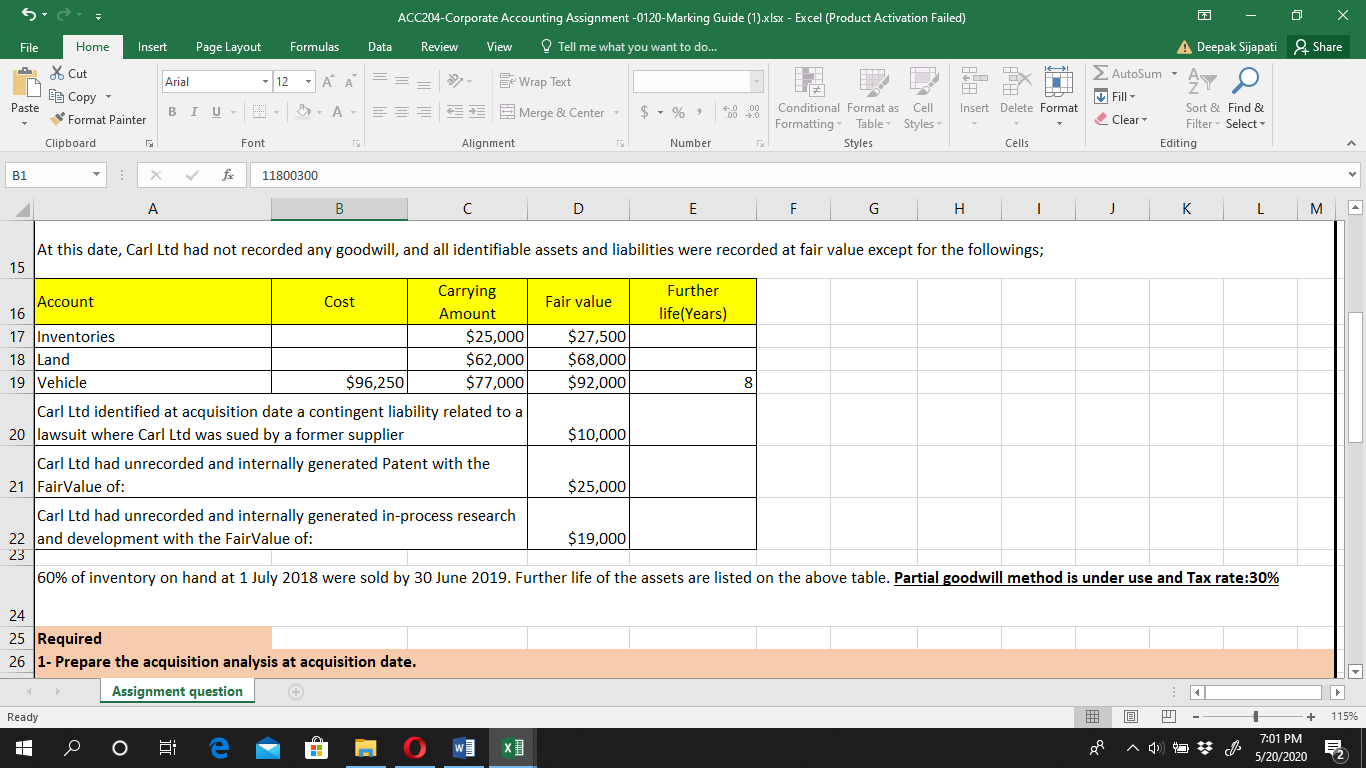

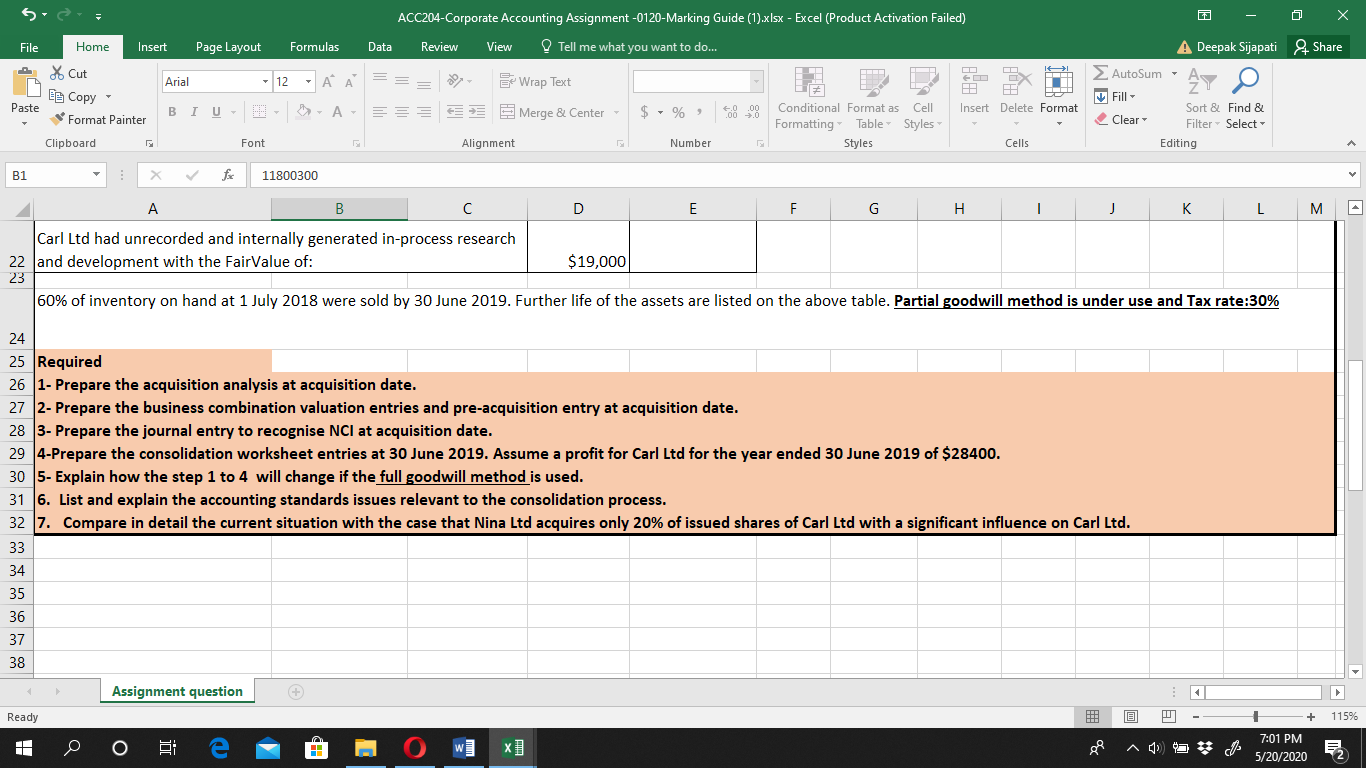

ACC204-Corporate Accounting Assignment -0120-Marking Guide (1).xlsx - Excel (Product Activation Failed) o X File Home Insert Page Layout Formulas Data Review View Tell me what you want to do... A Deepak Sijapati Share AutoSum - II Arial - A Wrap Text of Cut e Copy Format Painter Fill Paste L Insert Delete Format B I U A Merge & Center - % El 98 Conditional Format as Cell Formatting Table Styles Styles Clear Sort & Find & Filter Select- Editing Clipboard Font Alignment Number Cells B1 f 11800300 B D H . The assignment must be typed, use Arial font, 12, to avoid plagiarism, make sure you do proper referencing, a WORD format file soft copy to be submitted in Moodle before the due date. Please ensure you provide your ID numbers and full name at the first page. Late assignments will be penalised, 5% of total available marks deduction per day. 9 Assignment Question 10 Nina Ltd purchased 90% of the issued shares of Carl Ltd for $832000 on 1 July 2018 when the equity of Carl Ltd was as follows; 11 12 Share capital 332800 13 General reserve 249600 14 Asset revaluation surpluss 124800 At this date, Carl Ltd had not recorded any goodwill, and all identifiable assets and liabilities were recorded at fair value except for the followings; 15 Carrying Further Account Cost Fair value 16 Amount life(Years) 17 Inventories $25,000 $27,500 18 Land $62,000 $68,000 19 Vehicle $96,250 $77,000 $92,000 Carl Ltd identified at acquisition date a contingent liability related to a 20 llawsuit where Carlitd was sued by a former supplier $10.0001 Assignment question Ready @ 115% + 7:00 PM 5/20/2020 Q o i A4 ACC204-Corporate Accounting Assignment -0120-Marking Guide (1).xlsx - Excel (Product Activation Failed) o X File Home Insert Page Layout Formulas Data Review View Tell me what you want to do... A Deepak Sijapati Share AutoSum - II Arial - A Wrap Text of Cut BE Copy Format Painter Fill - Paste L Insert Delete Format B I U A Merge & Center - % El 98 Conditional Format as Cell Formatting Table Styles Styles Clear Sort & Find & Filter Select Editing Clipboard Font Alignment Number Cells B1 X 11800300 B D E F - K L M At this date, Carl Ltd had not recorded any goodwill, and all identifiable assets and liabilities were recorded at fair value except for the followings; 15 Carrying Further Account Cost Fair value 16 Amount life(Years) 17 Inventories $25,000 $27,500 18 Land $62,000 $68,000 19 Vehicle $96,250 $77,000 $92,000 Carl Ltd identified at acquisition date a contingent liability related to a 20 lawsuit where Carl Ltd was sued by a former supplier $10,000 Carl Ltd had unrecorded and internally generated Patent with the 21 FairValue of: $25,000 Carl Ltd had unrecorded and internally generated in-process research 22 and development with the FairValue of: $19,000 23 60% of inventory on hand at 1 July 2018 were sold by 30 June 2019. Further life of the assets are listed on the above table. Partial goodwill method is under use and Tax rate:30% 24 25 Required 26 1- Prepare the acquisition analysis at acquisition date. Assignment question + Ready @ + 115% Q 7:01 PM 5/20/2020 o X ACC204-Corporate Accounting Assignment -0120-Marking Guide (1).xlsx - Excel (Product Activation Failed) Review View Tell me what you want to do... File Home Insert Page Layout Formulas Data A Deepak Sijapati & Share AutoSum - II Arial 12 - A Wrap Text Fill Paste * Cut Copy Format Painter Clipboard L Insert Delete Format I U D-A Merge & Center $ 6.000 .000 - % Clear - Conditional Format as Cell Formatting Table Styles Styles Sort & Find & Filter Select Editing Font Alignment Number Cells B1 : X fi 11800300 - . A B D E F . K L Carl Ltd had unrecorded and internally generated in-process research 22 and development with the FairValue of: $19,000 23 60% of inventory on hand at 1 July 2018 were sold by 30 June 2019. Further life of the assets are listed on the above table. Partial goodwill method is under use and Tax rate:30% 24 25 Required 26 1- Prepare the acquisition analysis at acquisition date. 27 2- Prepare the business combination valuation entries and pre-acquisition entry at acquisition date. 28 3- Prepare the journal entry to recognise NCI at acquisition date. 29 4-Prepare the consolidation worksheet entries at 30 June 2019. Assume a profit for Carl Ltd for the year ended 30 June 2019 of $28400. 30 5- Explain how the step 1 to 4 will change if the full goodwill method is used. 31 6. List and explain the accounting standards issues relevant to the consolidation process. 32 7. Compare in detail the current situation with the case that Nina Ltd acquires only 20% of issued shares of Carl Ltd with a significant influence on Carl Ltd. 33 34 35 36 37 38 Assignment question + Ready @ + 115% o Q e WL 7:01 PM 5/20/2020