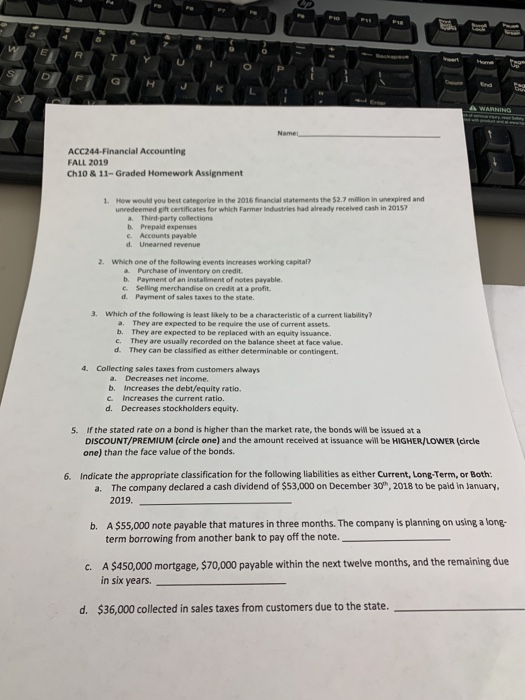

ACC244-Financial Accounting FALL 2019 Ch10 & 11-Graded Homework Assignment 1. How would you best categorize in the 2016 financial statements the $2.7 million in unexpired and unredeemed gift certificates for which Farmer Industries had already received cash in 2015? Third-party collections b. Prepaid expenses c. Accounts payable d. Unearned revenue 2. Which one of the following events increases working capital? a. Purchase of inventory on credit. b. Payment of an installment of notes payable. Selling merchandise on credit at a profit. d. Payment of sales taxes to the state. 3. Which of the following is least likely to be a characteristic of a current liability? a. They are expected to be require the use of current assets. b. They are expected to be replaced with an equity issuance. c. They are usually recorded on the balance sheet at face value. d. They can be classified as either determinable or contingent. 4. Collecting sales taxes from customers always a. Decreases net income. b. Increases the debt/equity ratio. C increases the current ratio. d. Decreases stockholders equity. 5. If the stated rate on a bond is higher than the market rate, the bonds will be issued at a DISCOUNT/PREMIUM (circle one) and the amount received at issuance will be HIGHER/LOWER (circle one) than the face value of the bonds. 6. Indicate the appropriate classification for the following liabilities as either Current, Long-Term, or Both: a. The company declared a cash dividend of $53,000 on December 30, 2018 to be paid in January, 2019. b. A $55,000 note payable that matures in three months. The company is planning on using a long term borrowing from another bank to pay off the note. C. A $450,000 mortgage, $70,000 payable within the next twelve months, and the remaining due in six years. d. $36,000 collected in sales taxes from customers due to the state. ACC244-Financial Accounting FALL 2019 Ch10 & 11-Graded Homework Assignment 1. How would you best categorize in the 2016 financial statements the $2.7 million in unexpired and unredeemed gift certificates for which Farmer Industries had already received cash in 2015? Third-party collections b. Prepaid expenses c. Accounts payable d. Unearned revenue 2. Which one of the following events increases working capital? a. Purchase of inventory on credit. b. Payment of an installment of notes payable. Selling merchandise on credit at a profit. d. Payment of sales taxes to the state. 3. Which of the following is least likely to be a characteristic of a current liability? a. They are expected to be require the use of current assets. b. They are expected to be replaced with an equity issuance. c. They are usually recorded on the balance sheet at face value. d. They can be classified as either determinable or contingent. 4. Collecting sales taxes from customers always a. Decreases net income. b. Increases the debt/equity ratio. C increases the current ratio. d. Decreases stockholders equity. 5. If the stated rate on a bond is higher than the market rate, the bonds will be issued at a DISCOUNT/PREMIUM (circle one) and the amount received at issuance will be HIGHER/LOWER (circle one) than the face value of the bonds. 6. Indicate the appropriate classification for the following liabilities as either Current, Long-Term, or Both: a. The company declared a cash dividend of $53,000 on December 30, 2018 to be paid in January, 2019. b. A $55,000 note payable that matures in three months. The company is planning on using a long term borrowing from another bank to pay off the note. C. A $450,000 mortgage, $70,000 payable within the next twelve months, and the remaining due in six years. d. $36,000 collected in sales taxes from customers due to the state