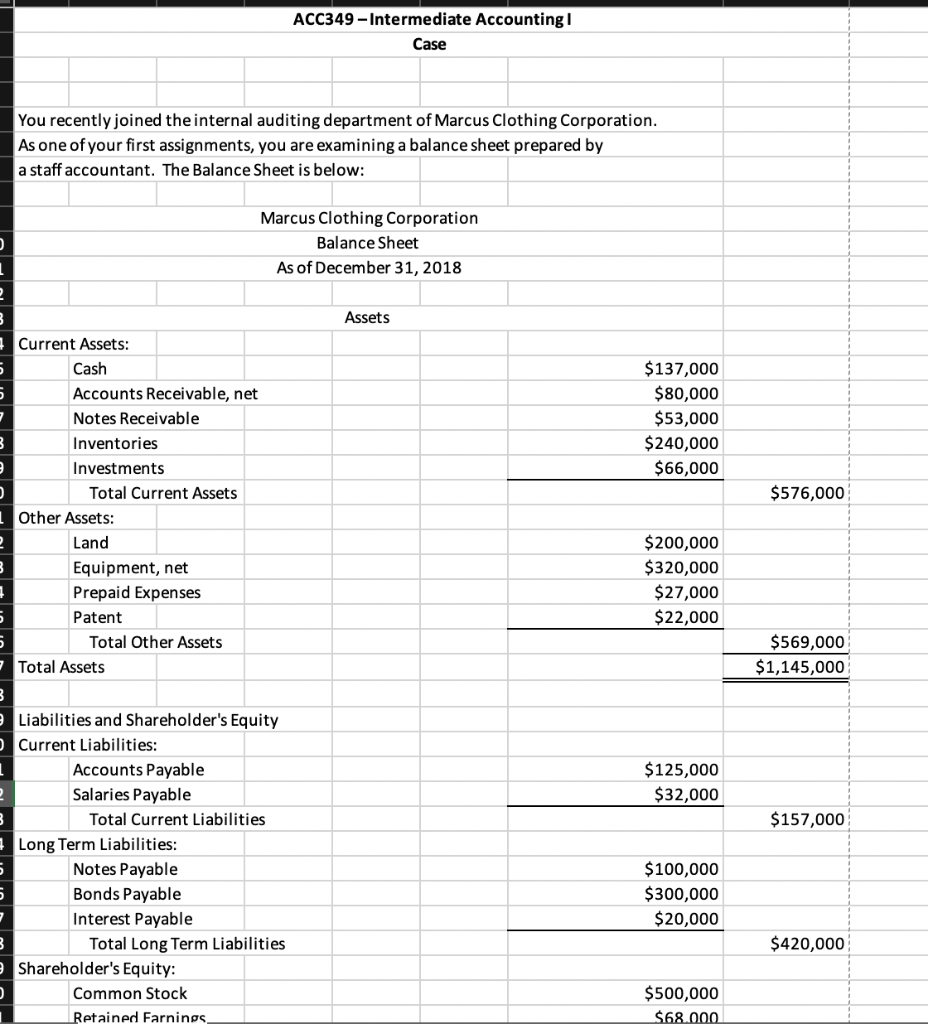

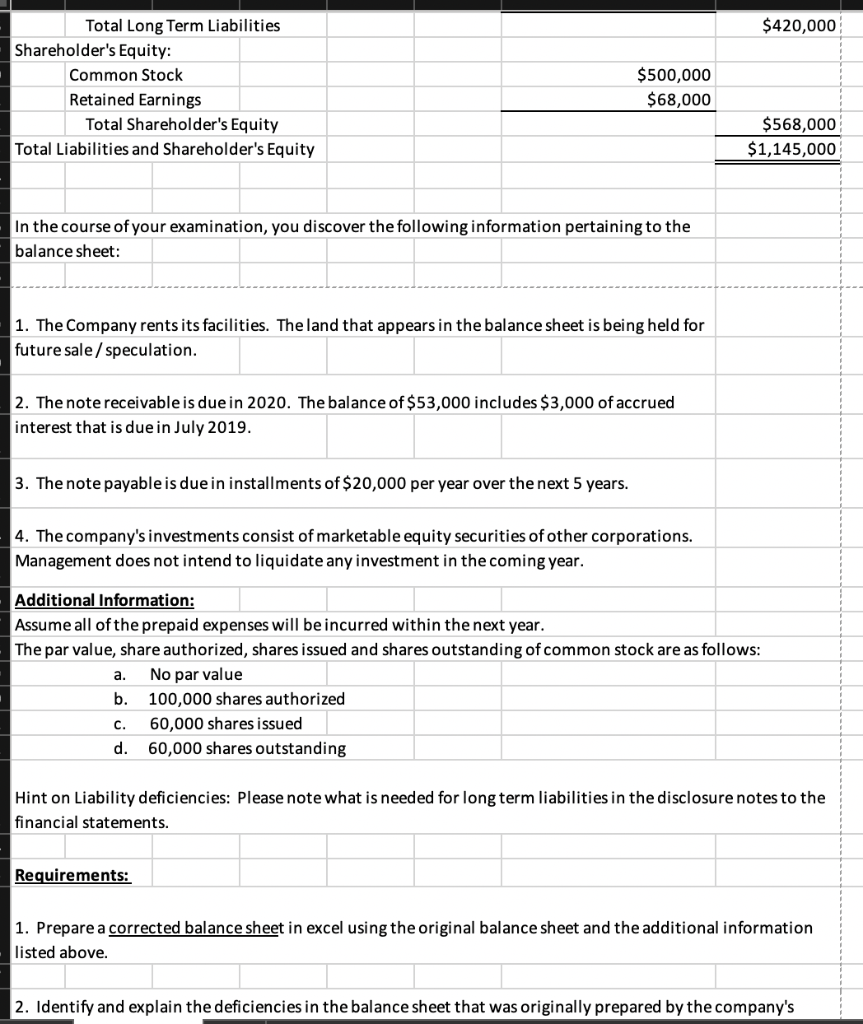

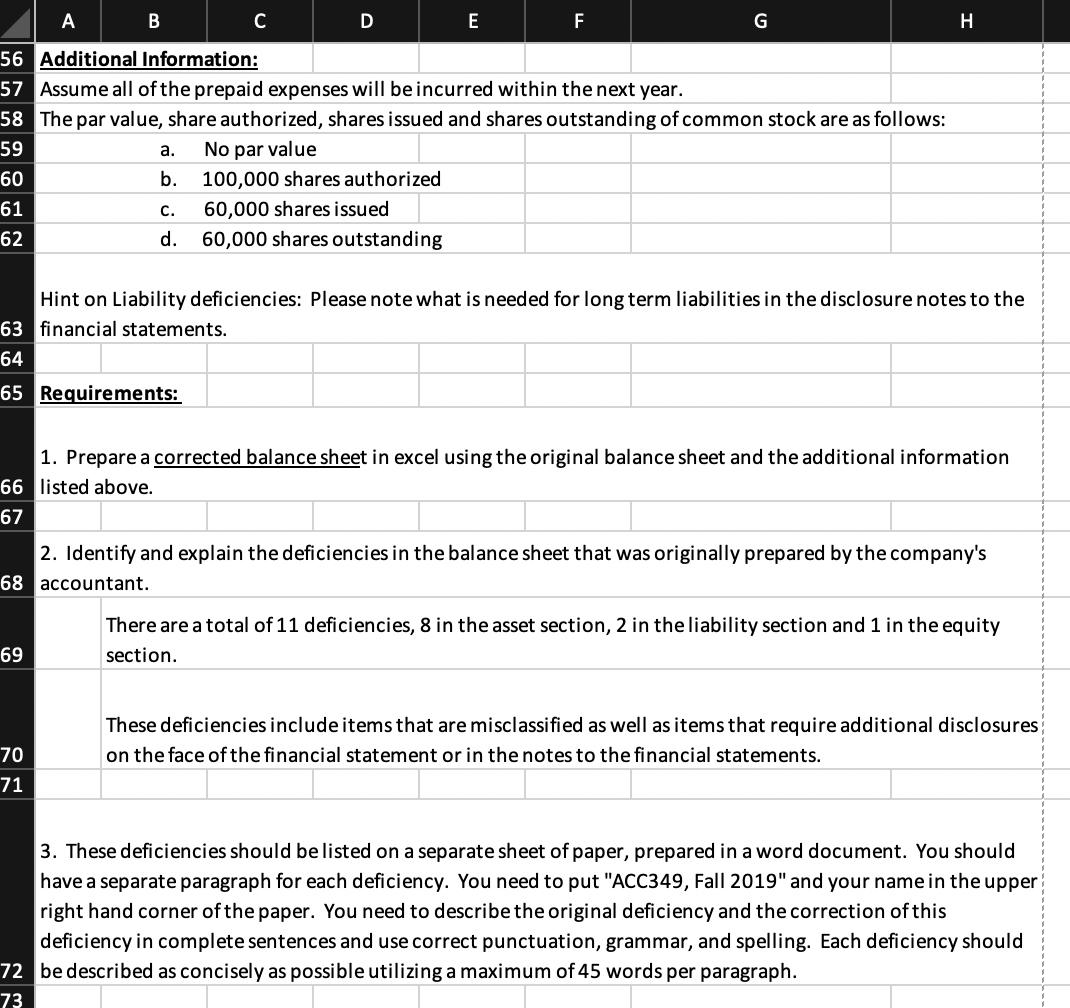

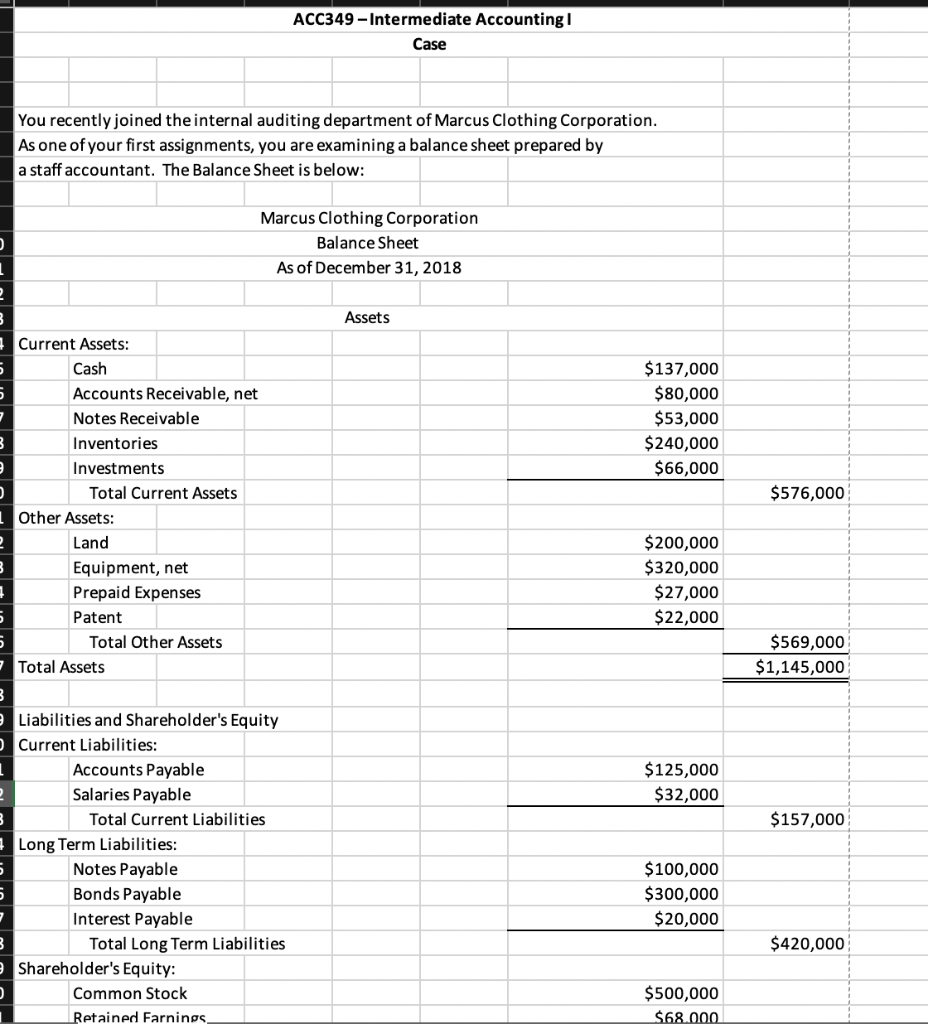

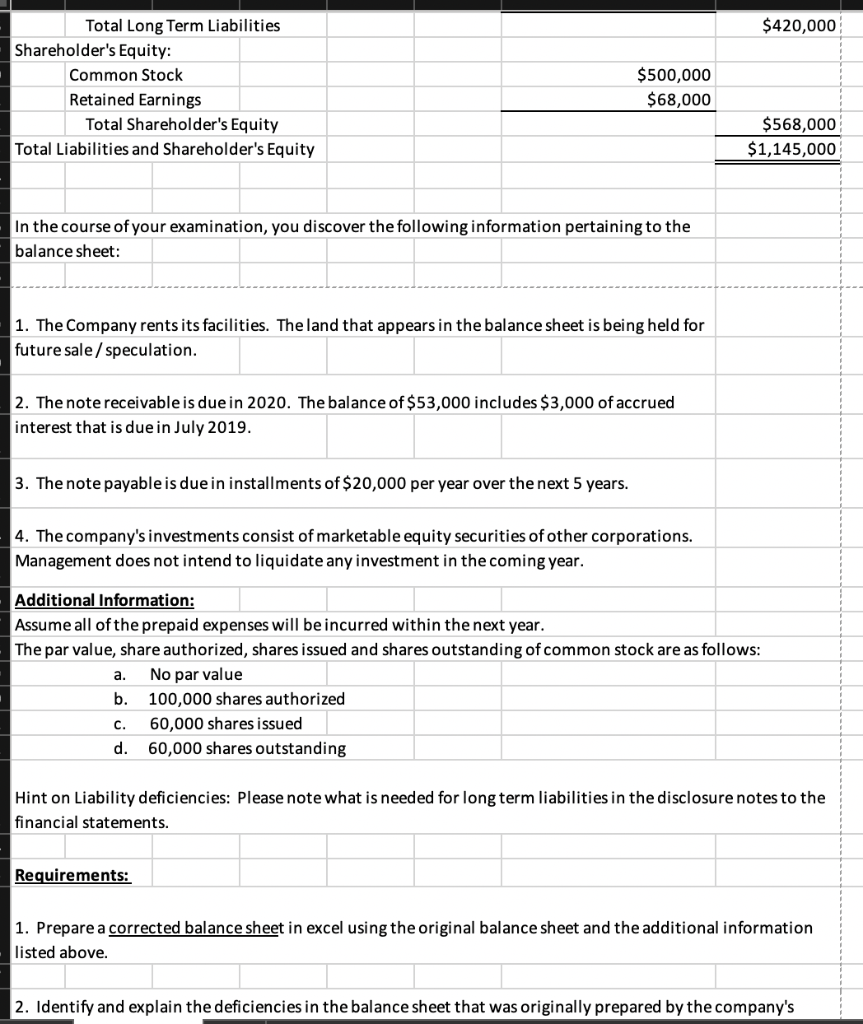

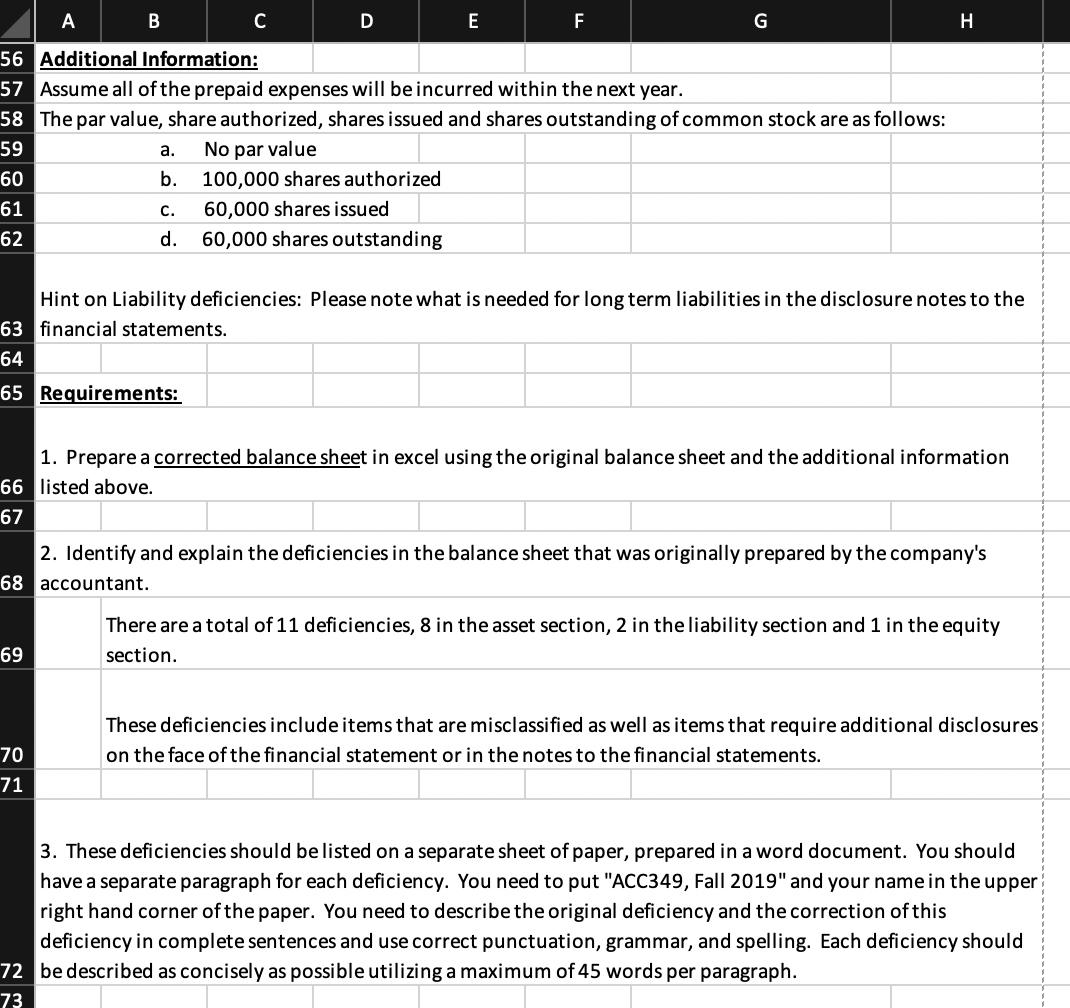

ACC349 - Intermediate Accounting Case You recently joined the internal auditing department of Marcus Clothing Corporation. As one of your first assignments, you are examining a balance sheet prepared by a staff accountant. The Balance Sheet is below: Marcus Clothing Corporation Balance Sheet As of December 31, 2018 Assets $137,000 $80,000 $53,000 $240,000 $66,000 $ 576,000 Current Assets: Cash Accounts Receivable, net Notes Receivable Inventories Investments Total Current Assets 1 Other Assets: Land Equipment, net Prepaid Expenses Patent Total Other Assets - Total Assets $200,000 $320,000 $27,000 $22,000 $569,000 $1,145,000 $125,000 $32,000 $157,000 e Liabilities and Shareholder's Equity Current Liabilities: Accounts Payable Salaries Payable Total Current Liabilities Long Term Liabilities: Notes Payable Bonds Payable Interest Payable Total Long Term Liabilities Shareholder's Equity: Common Stock Retained Farnings $100,000 $300,000 $20,000 $420,000 $500,000 $68.000 $420,000 Total Long Term Liabilities Shareholder's Equity: Common Stock Retained Earnings Total Shareholder's Equity Total Liabilities and Shareholder's Equity $500,000 $68,000 $568,000 $1,145,000 - In the course of your examination, you discover the following information pertaining to the - balance sheet: 1. The Company rents its facilities. The land that appears in the balance sheet is being held for future sale / speculation. 2. The note receivable is due in 2020. The balance of $53,000 includes $3,000 of accrued interest that is due in July 2019. 3. The note payable is due in installments of $20,000 per year over the next 5 years. - 4. The company's investments consist of marketable equity securities of other corporations. Management does not intend to liquidate any investment in the coming year. Additional Information: Assume all of the prepaid expenses will be incurred within the next year. The par value, share authorized, shares issued and shares outstanding of common stock are as follows: a. No par value b. 100,000 shares authorized C. 60,000 shares issued d. 60,000 shares outstanding Hint on Liability deficiencies: Please note what is needed for long term liabilities in the disclosure notes to the financial statements. Requirements: 1. Prepare a corrected balance sheet in excel using the original balance sheet and the additional information - listed above. 2. Identify and explain the deficiencies in the balance sheet that was originally prepared by the company's 56 Additional Information: 57 Assume all of the prepaid expenses will be incurred within the next year. 58 The par value, share authorized, shares issued and shares outstanding of common stock are as follows: 59 a. No par value 60 b. 100,000 shares authorized 61 C. 60,000 shares issued d. 60,000 shares outstanding 62 Hint on Liability deficiencies: Please note what is needed for long term liabilities in the disclosure notes to the 63 financial statements. 64 65 Requirements: 1. Prepare a corrected balance sheet in excel using the original balance sheet and the additional information 66 listed above. 67 2. Identify and explain the deficiencies in the balance sheet that was originally prepared by the company's 68 accountant. There are a total of 11 deficiencies, 8 in the asset section, 2 in the liability section and 1 in the equity section. 69 These deficiencies include items that are misclassified as well as items that require additional disclosures on the face of the financial statement or in the notes to the financial statements. 70 71 3. These deficiencies should be listed on a separate sheet of paper, prepared in a word document. You should have a separate paragraph for each deficiency. You need to put "ACC349, Fall 2019" and your name in the upper right hand corner of the paper. You need to describe the original deficiency and the correction of this deficiency in complete sentences and use correct punctuation, grammar, and spelling. Each deficiency should 72 be described as concisely as possible utilizing a maximum of 45 words per paragraph. 73 ACC349 - Intermediate Accounting Case You recently joined the internal auditing department of Marcus Clothing Corporation. As one of your first assignments, you are examining a balance sheet prepared by a staff accountant. The Balance Sheet is below: Marcus Clothing Corporation Balance Sheet As of December 31, 2018 Assets $137,000 $80,000 $53,000 $240,000 $66,000 $ 576,000 Current Assets: Cash Accounts Receivable, net Notes Receivable Inventories Investments Total Current Assets 1 Other Assets: Land Equipment, net Prepaid Expenses Patent Total Other Assets - Total Assets $200,000 $320,000 $27,000 $22,000 $569,000 $1,145,000 $125,000 $32,000 $157,000 e Liabilities and Shareholder's Equity Current Liabilities: Accounts Payable Salaries Payable Total Current Liabilities Long Term Liabilities: Notes Payable Bonds Payable Interest Payable Total Long Term Liabilities Shareholder's Equity: Common Stock Retained Farnings $100,000 $300,000 $20,000 $420,000 $500,000 $68.000 $420,000 Total Long Term Liabilities Shareholder's Equity: Common Stock Retained Earnings Total Shareholder's Equity Total Liabilities and Shareholder's Equity $500,000 $68,000 $568,000 $1,145,000 - In the course of your examination, you discover the following information pertaining to the - balance sheet: 1. The Company rents its facilities. The land that appears in the balance sheet is being held for future sale / speculation. 2. The note receivable is due in 2020. The balance of $53,000 includes $3,000 of accrued interest that is due in July 2019. 3. The note payable is due in installments of $20,000 per year over the next 5 years. - 4. The company's investments consist of marketable equity securities of other corporations. Management does not intend to liquidate any investment in the coming year. Additional Information: Assume all of the prepaid expenses will be incurred within the next year. The par value, share authorized, shares issued and shares outstanding of common stock are as follows: a. No par value b. 100,000 shares authorized C. 60,000 shares issued d. 60,000 shares outstanding Hint on Liability deficiencies: Please note what is needed for long term liabilities in the disclosure notes to the financial statements. Requirements: 1. Prepare a corrected balance sheet in excel using the original balance sheet and the additional information - listed above. 2. Identify and explain the deficiencies in the balance sheet that was originally prepared by the company's 56 Additional Information: 57 Assume all of the prepaid expenses will be incurred within the next year. 58 The par value, share authorized, shares issued and shares outstanding of common stock are as follows: 59 a. No par value 60 b. 100,000 shares authorized 61 C. 60,000 shares issued d. 60,000 shares outstanding 62 Hint on Liability deficiencies: Please note what is needed for long term liabilities in the disclosure notes to the 63 financial statements. 64 65 Requirements: 1. Prepare a corrected balance sheet in excel using the original balance sheet and the additional information 66 listed above. 67 2. Identify and explain the deficiencies in the balance sheet that was originally prepared by the company's 68 accountant. There are a total of 11 deficiencies, 8 in the asset section, 2 in the liability section and 1 in the equity section. 69 These deficiencies include items that are misclassified as well as items that require additional disclosures on the face of the financial statement or in the notes to the financial statements. 70 71 3. These deficiencies should be listed on a separate sheet of paper, prepared in a word document. You should have a separate paragraph for each deficiency. You need to put "ACC349, Fall 2019" and your name in the upper right hand corner of the paper. You need to describe the original deficiency and the correction of this deficiency in complete sentences and use correct punctuation, grammar, and spelling. Each deficiency should 72 be described as concisely as possible utilizing a maximum of 45 words per paragraph. 73