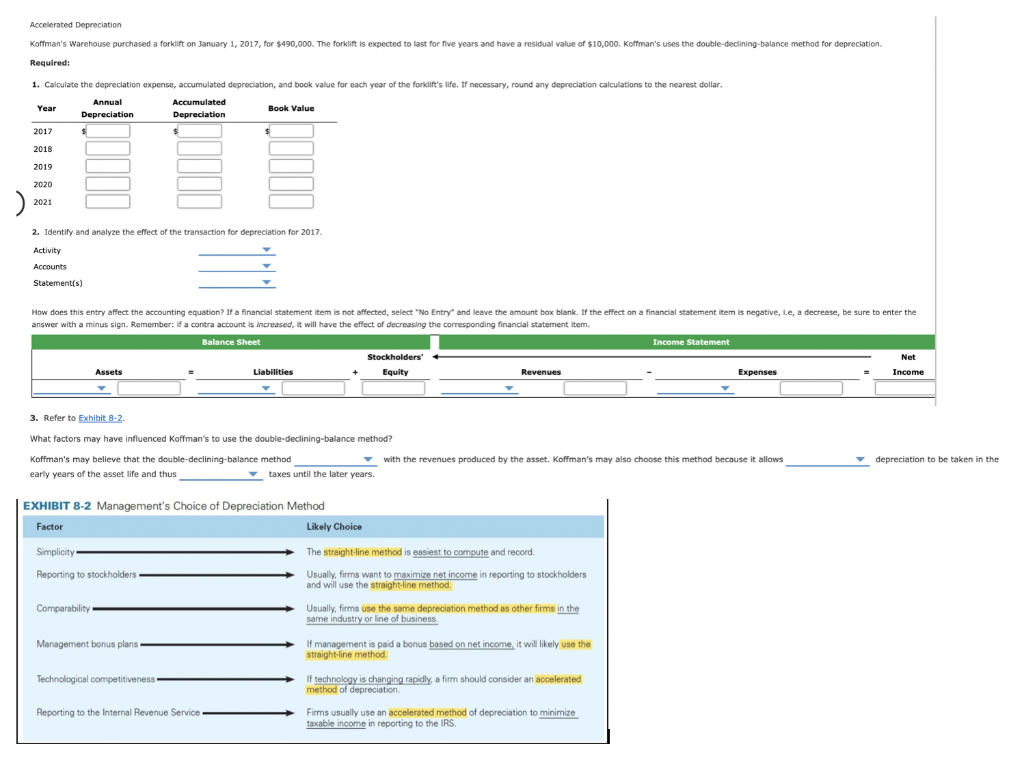

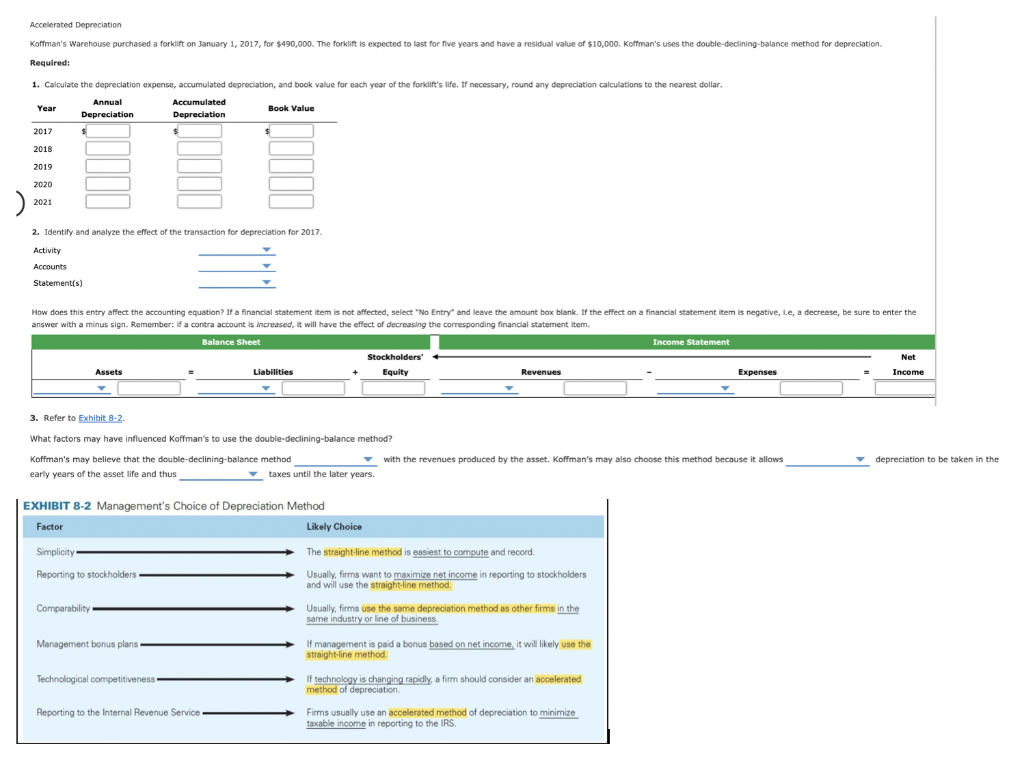

Accelerated Depreciation Koffman's Warehouse purchased a forklift on January 1, 2017, for $490,000. The forklift is expected to last for five years and have a residual value of $10,000. Koffman's uses the double-declining-balance method for depreciation. Required: 1. Calculate the depreciation expense, accumulated depreciation, and book value for each year of the forklift's life. If necessary, round any depreciation calculations to the nearest dollar. Annual Accumulated Year Depreciation Depreciation Book Value 2017 $ 2018 2019 2020 2021 2. Identify and analyze the effect of the transaction for depreciation for 2017 Activity Accounts Statement(s) How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. Remember: If a contra account is increased, it will have the effect of decreasing the corresponding financial statement item. Balance Sheet Income Statement Stockholders' + Net Assets Liabilities Equity Revenues Expenses Income 3. Refer to Exhibit 8-2. What factors may have influenced Koffman's to use the double-declining-balance method? Koffman's may believe that the double-declining-balance method with the revenues produced by the asset. Koffman's may also choose this method because it allows early years of the asset life and thus taxes until the later years. depreciation to be taken in the EXHIBIT 8-2 Management's Choice of Depreciation Method Factor Likely Choice Simplicity Reporting to stockholders The straight-line method is easiest to compute and record Usually, firms want to maximize net income in reporting to stockholders and will use the straight-line method Comparability Usually, firms use the same depreciation method as other firms in the same industry or line of business. Management bonus plans If management is paid a bonus based on net income, it will likely use the straight line method Technological competitiveness If technology is changing rapidly, a firm should consider an accelerated method of depreciation Reporting to the Internal Revenue Service Firms usually use an accelerated method of depreciation to minimize taxable income in reporting to the IRS