Answered step by step

Verified Expert Solution

Question

1 Approved Answer

accelerated depreciation method (444) amortization (453) book value (443) boot (449) capital expenditures (438) capital lease (439) copyright (454) depletion (452) depreciation (440) double-declining balance

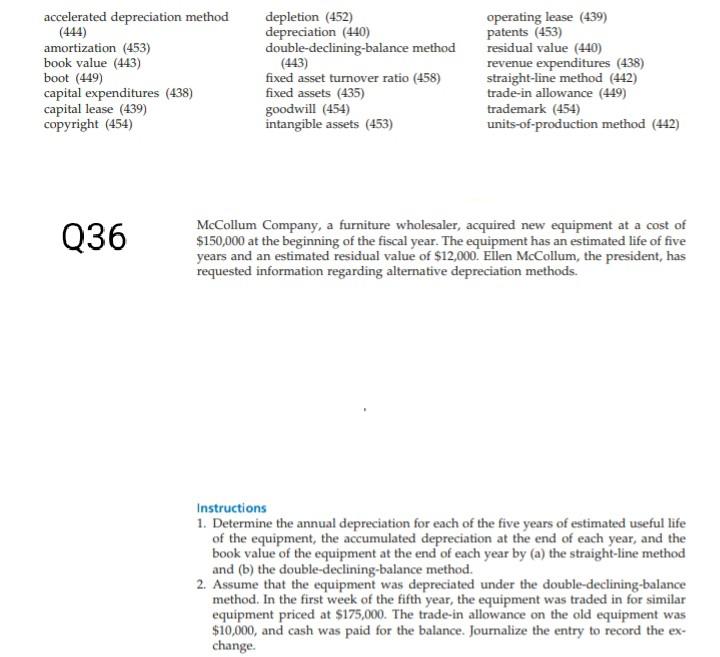

accelerated depreciation method (444) amortization (453) book value (443) boot (449) capital expenditures (438) capital lease (439) copyright (454) depletion (452) depreciation (440) double-declining balance method (443) fixed asset turnover ratio (458) fixed assets (435) goodwill (454) intangible assets (453) operating lease (439) patents (453) residual value (440) revenue expenditures (438) straight-line method (442) trade-in allowance (449) trademark (454) units-of-production method (442) Q36 McCollum Company, a furniture wholesaler, acquired new equipment at a cost of $150,000 at the beginning of the fiscal year. The equipment has an estimated life of five years and an estimated residual value of $12,000. Ellen McCollum, the president, has requested information regarding alternative depreciation methods. Instructions 1. Determine the annual depreciation for each of the five years of estimated useful life of the equipment, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year by (a) the straight-line method and (b) the double-declining-balance method. 2. Assume that the equipment was depreciated under the double-declining balance method. In the first week of the fifth year, the equipment was traded in for similar equipment priced at $175,000. The trade-in allowance on the old equipment was $10,000, and cash was paid for the balance. Journalize the entry to record the ex- change

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started