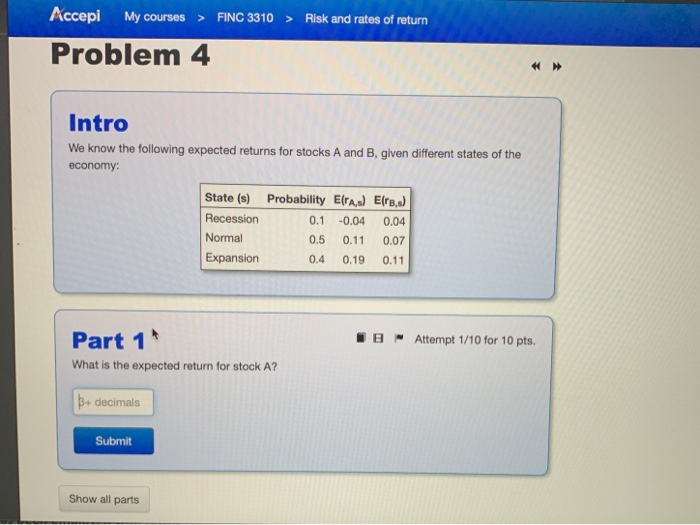

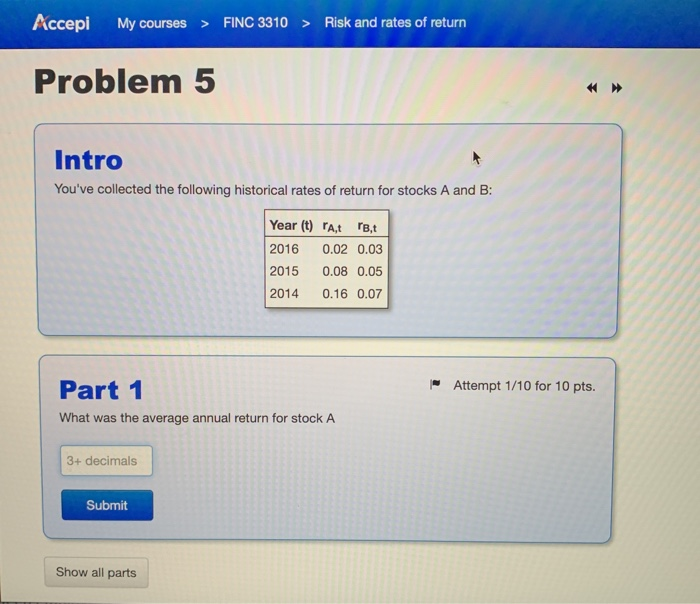

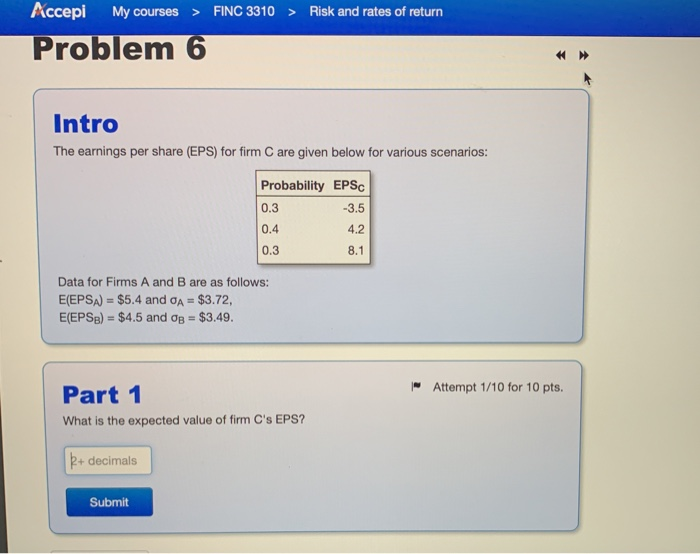

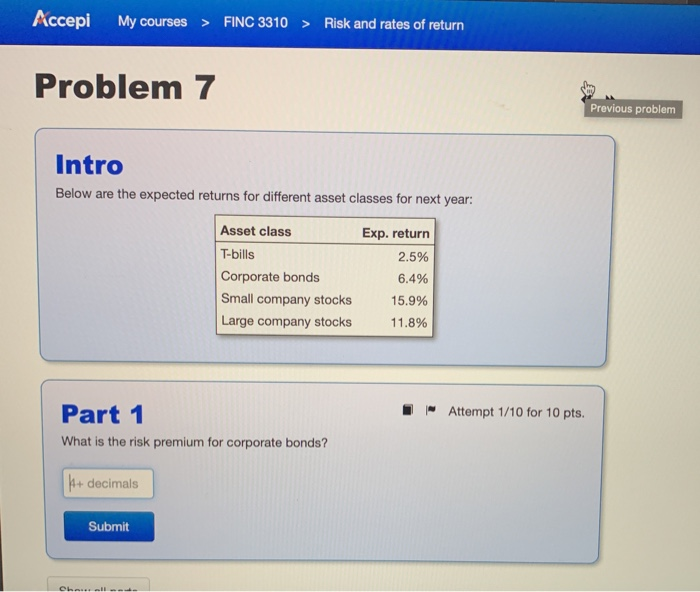

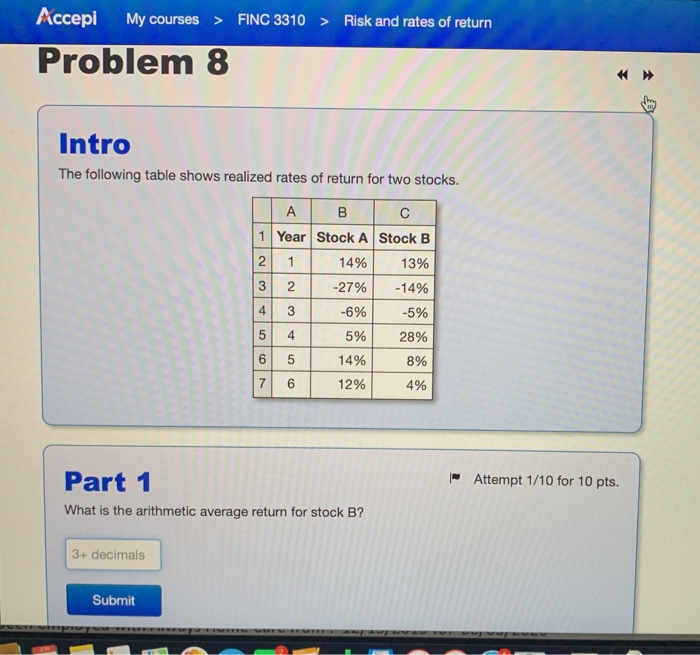

Accepi My courses > FINC 3310 > Risk and rates of return Problem 4 >> Intro We know the following expected returns for stocks A and B, given different states of the economy: State (s) Probability E(As) E[rs,s) Recession 0.1 -0.04 0.04 Normal 0.5 0.11 0.07 Expansion 0.4 0.19 0.11 B Attempt 1/10 for 10 pts. Part 1 What is the expected return for stock A? B+ decimals Submit Show all parts Accepi My courses > FINC 3310 > Risk and rates of return Problem 5 Intro You've collected the following historical rates of return for stocks A and B: Year (t) rat B,t 2016 0.02 0.03 2015 0.08 0.05 2014 0.16 0.07 - Attempt 1/10 for 10 pts. Part 1 What was the average annual return for stock A 3+ decimals Submit Show all parts Accepi My courses > FINC 3310 > Risk and rates of return Problem 6 Intro The earnings per share (EPS) for firm C are given below for various scenarios: Probability EPSC 0.3 -3.5 0.4 4.2 0.3 8.1 Data for Firms A and B are as follows: E(EPSA) = $5.4 and 0A = $3.72, E(EPS) = $4.5 and 0B = $3.49. Attempt 1/10 for 10 pts. Part 1 What is the expected value of firm C's EPS? + decimals Submit Accepi My courses > FINC 3310 > Risk and rates of return Problem 7 Previous problem Intro Below are the expected returns for different asset classes for next year: Asset class T-bills Corporate bonds Small company stocks Large company stocks Exp. return 2.5% 6.4% 15.9% 11.8% Attempt 1/10 for 10 pts. Part 1 What is the risk premium for corporate bonds? A+ decimals Submit Ohl. Accepi My courses > FINC 3310 > Risk and rates of return Problem 8 Intro The following table shows realized rates of return for two stocks. A B 1 Year Stock A Stock B 2 14% 13% 3 2 -27% -14% 3 -6% -5% 1 4 5 4 5% 28% 6 ch 14% 8% 7 6 12% 4% - Attempt 1/10 for 10 pts. Part 1 What is the arithmetic average return for stock B? 3+ decimals Submit Accepi My courses > FINC 3310 > Risk and rates of return Problem 4 >> Intro We know the following expected returns for stocks A and B, given different states of the economy: State (s) Probability E(As) E[rs,s) Recession 0.1 -0.04 0.04 Normal 0.5 0.11 0.07 Expansion 0.4 0.19 0.11 B Attempt 1/10 for 10 pts. Part 1 What is the expected return for stock A? B+ decimals Submit Show all parts Accepi My courses > FINC 3310 > Risk and rates of return Problem 5 Intro You've collected the following historical rates of return for stocks A and B: Year (t) rat B,t 2016 0.02 0.03 2015 0.08 0.05 2014 0.16 0.07 - Attempt 1/10 for 10 pts. Part 1 What was the average annual return for stock A 3+ decimals Submit Show all parts Accepi My courses > FINC 3310 > Risk and rates of return Problem 6 Intro The earnings per share (EPS) for firm C are given below for various scenarios: Probability EPSC 0.3 -3.5 0.4 4.2 0.3 8.1 Data for Firms A and B are as follows: E(EPSA) = $5.4 and 0A = $3.72, E(EPS) = $4.5 and 0B = $3.49. Attempt 1/10 for 10 pts. Part 1 What is the expected value of firm C's EPS? + decimals Submit Accepi My courses > FINC 3310 > Risk and rates of return Problem 7 Previous problem Intro Below are the expected returns for different asset classes for next year: Asset class T-bills Corporate bonds Small company stocks Large company stocks Exp. return 2.5% 6.4% 15.9% 11.8% Attempt 1/10 for 10 pts. Part 1 What is the risk premium for corporate bonds? A+ decimals Submit Ohl. Accepi My courses > FINC 3310 > Risk and rates of return Problem 8 Intro The following table shows realized rates of return for two stocks. A B 1 Year Stock A Stock B 2 14% 13% 3 2 -27% -14% 3 -6% -5% 1 4 5 4 5% 28% 6 ch 14% 8% 7 6 12% 4% - Attempt 1/10 for 10 pts. Part 1 What is the arithmetic average return for stock B? 3+ decimals Submit