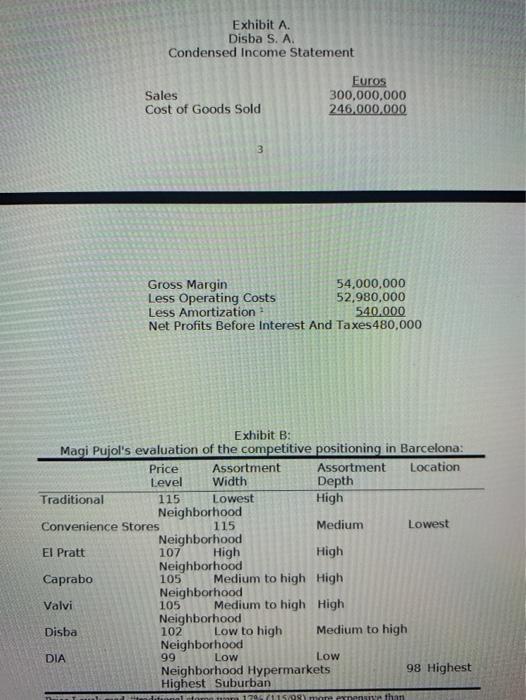

acceptable answer as all clients are women. Men are not feasible. 3. Given this target, with whom will Disba compete? 4. Can Disba lower prices? (see tables). Disba Disba S. A. was a leading Spanish supermarket chain. They had 130 stores that sold 300.000.000 Euros per year. Sales had grown 30% in the previous year as they added 21 new stores. Over the last few years, Disba had made important acquisitions in Cartegena (22 stores) and Albacete (17 stores) (see map) as well as opening stores in the Balearic islands and Castelln (see map). Some of these stores were more than 500 kilometers to the south of Disba's Barcelonan headquarters where Disba had 35 stores. As Magi put it, "We would have preferred to find acquisition candidates closer to our warehouse in Barcelona to keep our logistics costs down, but Cartegena is in keeping with our goal of covering Spain's Mediterranean coast." Disba began as a wholesaler and distributor, buying in bulk and distributing in case lots to its client stores. Management still felt proud of its warehousing and transportation functions. Disba, however, finally decided to enter retailing because their function of warehouse/distributor was becoming outdated by the rise of supermarket chains and hypermarkets that do not need such services. While Magi wanted stores of at least 500 square meters so as to maintain a uniform product assortment of about 4.000 SKU, such stores were very difficult to find in Barcelona. As a result, Disba's stores ranged in size from 150 to 1000 square meters. As Spanish law required, Disba was open from Monday to Saturday from 9:00 in the morning to 8:00 in the evening with a break from about 2:00 to 5:00 in the afternoon for siesta. Disba's stores outside Barcelona ranged from 500 to 600 square meters, had parking and a uniform 4.000 SKU. Originally, Disba had taken advantage of the relative efficiency of their logistic system to offer the lowest prices available. Reflecting this original emphasis on low price, Disba's stores carry the name "Bonpreu" which means "good price" in Catalan, the regional language. In recent years, however, Disba's strategy had been to go 1 "upmarket" through the addition of an extensive line of high quality perishable products (fruit, produce and meat) that Disba processed and distributed themselves. Disba had also added new lines of non- food products such as health and beauty aids, kitchen ware and clothes. Magi viewed this shift upmarket as a competitive reaction to the hypermarkets that had grown up around Barcelona. As he put it, "We can't compete with hypermarkets on price or assortment, but with high quality perishable products we can attract the customers who buy fresh products more than once a week. People who won't wait until the weekend to drive to the hypermarket Customers Shopping was highly localized in Barcelona because, due to the cities ancient design, only a few of Barcelona's thousands of grocery stores had parking places. As a result, 96% of Disba's Barcelonan clients arrived on foot, most pulling shopping trolleys into which they loaded their groceries. Disba's customers were an evolving mix of women. Older shoppers were generally traditional housewives who took great pride in going from store to store to find the lowest prices and the highest quality. Younger clients often worked during the day and made their purchases after work. Working women valued a wide variety of goods because their shopping time was limited and they did not wisth to visit several stores. Male shoppers were very rare. Competition The other large chains were also growing rapidly. Caprabo had 50 supermarkets, all in Barcelona, and sales almost equal to Disba's. Valvi, another chain, had grown fast after its arrival from Gerona. Valvi and Caprabo's prices were about three percent higher than Disba's but they offered a somewhat wider (more categories) and deeper (more products per category) selection of merchandise. New competition could come from the many small Catalonian supermarket chains (between five and ten stores) or even from other regions. As the president of Caprabo said, "We all know the situation. It's grow or die." Outside of Barcelona, in areas such as Cartagena, Castelln or Albacete, competition was somewhat different. Parking was commonly available, zoning restrictions less stringent and rents lower. In these areas, Disba competed largely with independent grocers, traditional stores (green grocers, butchers bakers etc) and few Outside of Barcelona, in areas such as Cartagena, Castelln or Albacete, competition was somewhat different. Parking was commonly available, zoning restrictions less stringent and rents lower. In these areas, Disba competed largely with independent grocers, traditional stores (green grocers, butchers, bakers, etc.) and few hypermarkets. a Dia S.A. 2 Into Barcelona's already competitive environment entered Dia, a highly standardized chain modeled on Germany's "Aldi". Dia only offered of 800 stock keeping units versus Disba's 2-4,000 and Caprabo and Valvi's 3 - 5,000. Dia's prices and were well below those of its in-town competitors. Indeed some of its prices were below those of the surrounding hypermarkets. Magi noted, obviously alarmed, that Dia sold milk for less than the price that Disba paid wholesale. As Dia's stores were small (200 square meters), it had no problem finding storefronts in urban areas. Indeed, Dia favored locations in large cities with high population densities and avoided towns in which it could not open at least 100 stores. Dia was growing very quickly: it opened 200 stores in Madrid in its first five years of existence then opened 120 stores in Barcelona. Dia had recently entered Seville where it had opened an aditional 100 stores. Dia's stores each sold an estimated average of 1.000.000 Euros per year. It was rumored that Da, Caprabo and Valvi all made before-tax profits of around 4% on sales. Exhibit A. Disba S.A. Condensed Income Statement Sales Cost of Goods Sold Euros 300,000,000 246,000,000 3 Gross Margin 54,000,000 Less Operating Costs 52,980,000 Less Amortization 540.000 Net Profits Before Interest And Taxes 480,000 Exhibit B: Magi Pujol's evaluation of the competitive positioning in Barcelona: Price Assortment Assortment Location Level Width Depth Traditional 115 Lowest High Neighborhood Convenience Stores 115 Medium Lowest Neighborhood El Pratt 107 High High Neighborhood Caprabo 105 Medium to high High Neighborhood Valvi 105 Medium to high High Neighborhood Disba 102 Low to high Medium to high Neighborhood DIA 99 Low Low Neighborhood Hypermarkets 98 Highest Highest Suburban moment than 17015 acceptable answer as all clients are women. Men are not feasible. 3. Given this target, with whom will Disba compete? 4. Can Disba lower prices? (see tables). Disba Disba S. A. was a leading Spanish supermarket chain. They had 130 stores that sold 300.000.000 Euros per year. Sales had grown 30% in the previous year as they added 21 new stores. Over the last few years, Disba had made important acquisitions in Cartegena (22 stores) and Albacete (17 stores) (see map) as well as opening stores in the Balearic islands and Castelln (see map). Some of these stores were more than 500 kilometers to the south of Disba's Barcelonan headquarters where Disba had 35 stores. As Magi put it, "We would have preferred to find acquisition candidates closer to our warehouse in Barcelona to keep our logistics costs down, but Cartegena is in keeping with our goal of covering Spain's Mediterranean coast." Disba began as a wholesaler and distributor, buying in bulk and distributing in case lots to its client stores. Management still felt proud of its warehousing and transportation functions. Disba, however, finally decided to enter retailing because their function of warehouse/distributor was becoming outdated by the rise of supermarket chains and hypermarkets that do not need such services. While Magi wanted stores of at least 500 square meters so as to maintain a uniform product assortment of about 4.000 SKU, such stores were very difficult to find in Barcelona. As a result, Disba's stores ranged in size from 150 to 1000 square meters. As Spanish law required, Disba was open from Monday to Saturday from 9:00 in the morning to 8:00 in the evening with a break from about 2:00 to 5:00 in the afternoon for siesta. Disba's stores outside Barcelona ranged from 500 to 600 square meters, had parking and a uniform 4.000 SKU. Originally, Disba had taken advantage of the relative efficiency of their logistic system to offer the lowest prices available. Reflecting this original emphasis on low price, Disba's stores carry the name "Bonpreu" which means "good price" in Catalan, the regional language. In recent years, however, Disba's strategy had been to go 1 "upmarket" through the addition of an extensive line of high quality perishable products (fruit, produce and meat) that Disba processed and distributed themselves. Disba had also added new lines of non- food products such as health and beauty aids, kitchen ware and clothes. Magi viewed this shift upmarket as a competitive reaction to the hypermarkets that had grown up around Barcelona. As he put it, "We can't compete with hypermarkets on price or assortment, but with high quality perishable products we can attract the customers who buy fresh products more than once a week. People who won't wait until the weekend to drive to the hypermarket Customers Shopping was highly localized in Barcelona because, due to the cities ancient design, only a few of Barcelona's thousands of grocery stores had parking places. As a result, 96% of Disba's Barcelonan clients arrived on foot, most pulling shopping trolleys into which they loaded their groceries. Disba's customers were an evolving mix of women. Older shoppers were generally traditional housewives who took great pride in going from store to store to find the lowest prices and the highest quality. Younger clients often worked during the day and made their purchases after work. Working women valued a wide variety of goods because their shopping time was limited and they did not wisth to visit several stores. Male shoppers were very rare. Competition The other large chains were also growing rapidly. Caprabo had 50 supermarkets, all in Barcelona, and sales almost equal to Disba's. Valvi, another chain, had grown fast after its arrival from Gerona. Valvi and Caprabo's prices were about three percent higher than Disba's but they offered a somewhat wider (more categories) and deeper (more products per category) selection of merchandise. New competition could come from the many small Catalonian supermarket chains (between five and ten stores) or even from other regions. As the president of Caprabo said, "We all know the situation. It's grow or die." Outside of Barcelona, in areas such as Cartagena, Castelln or Albacete, competition was somewhat different. Parking was commonly available, zoning restrictions less stringent and rents lower. In these areas, Disba competed largely with independent grocers, traditional stores (green grocers, butchers bakers etc) and few Outside of Barcelona, in areas such as Cartagena, Castelln or Albacete, competition was somewhat different. Parking was commonly available, zoning restrictions less stringent and rents lower. In these areas, Disba competed largely with independent grocers, traditional stores (green grocers, butchers, bakers, etc.) and few hypermarkets. a Dia S.A. 2 Into Barcelona's already competitive environment entered Dia, a highly standardized chain modeled on Germany's "Aldi". Dia only offered of 800 stock keeping units versus Disba's 2-4,000 and Caprabo and Valvi's 3 - 5,000. Dia's prices and were well below those of its in-town competitors. Indeed some of its prices were below those of the surrounding hypermarkets. Magi noted, obviously alarmed, that Dia sold milk for less than the price that Disba paid wholesale. As Dia's stores were small (200 square meters), it had no problem finding storefronts in urban areas. Indeed, Dia favored locations in large cities with high population densities and avoided towns in which it could not open at least 100 stores. Dia was growing very quickly: it opened 200 stores in Madrid in its first five years of existence then opened 120 stores in Barcelona. Dia had recently entered Seville where it had opened an aditional 100 stores. Dia's stores each sold an estimated average of 1.000.000 Euros per year. It was rumored that Da, Caprabo and Valvi all made before-tax profits of around 4% on sales. Exhibit A. Disba S.A. Condensed Income Statement Sales Cost of Goods Sold Euros 300,000,000 246,000,000 3 Gross Margin 54,000,000 Less Operating Costs 52,980,000 Less Amortization 540.000 Net Profits Before Interest And Taxes 480,000 Exhibit B: Magi Pujol's evaluation of the competitive positioning in Barcelona: Price Assortment Assortment Location Level Width Depth Traditional 115 Lowest High Neighborhood Convenience Stores 115 Medium Lowest Neighborhood El Pratt 107 High High Neighborhood Caprabo 105 Medium to high High Neighborhood Valvi 105 Medium to high High Neighborhood Disba 102 Low to high Medium to high Neighborhood DIA 99 Low Low Neighborhood Hypermarkets 98 Highest Highest Suburban moment than 17015