Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Access and solve problem P3-24 from the textbook, Principles of Managerial Finance. Describe Zach Industries' overall financial condition? Research and describe a company currently in

Access and solve problem P3-24 from the textbook, Principles of Managerial Finance. Describe Zach Industries' overall financial condition? Research and describe a company currently in the news in similar financial condition, and compose a comparative analysis on what can be/should be done to improve the circumstances of both the fictional and real-world company. Support your answers with financial ratios and provide explanations.

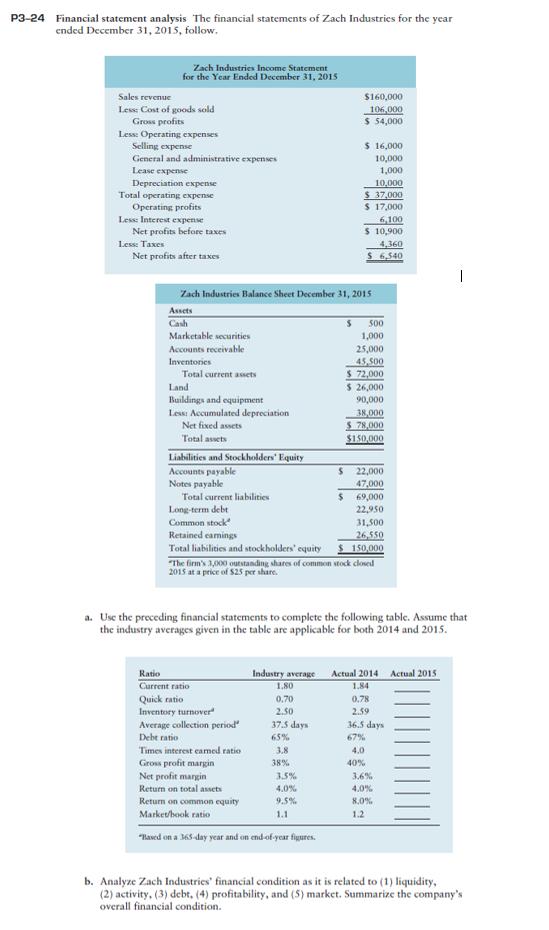

P3-24 Financial statement analysis The financial statements of Zach Industries for the ycar ended December 31, 2015, follow. Zach Industries Income Statement for the Year Ended December 31, 2015 Sales revenue $160,000 Less: Cost of goods sold Gross profits Lesse Operating expenses Selling expense General and administrative expenses 106,000 $ 4,000 $ 16,000 10,000 1,000 Lease expense Depreciation expense Total operating expense Operating profits Less: Interest expense Net profits before taxes 10,000 $ 37,000 S 17,000 6,100 S 10,900 4,360 $ 6,540 Less: Taxes Net profits after taxes Zach Industries Balance Sheet December 31, 2015 Assets Cash 500 Marketable securities 1,000 Accounts receivable 25,000 45,500 $ 72,000 $ 26,000 Inventories Total current asets Land Buildings and equipment Less: Accumulated depreciation Net fixed assets 90,000 38,000 S 78,000 Total assets $150,000 Liabilities and Stockholders' Equity $ 22,000 47,000 $ 69,000 22,950 Accounts payable Notes payable Total current liabilities Long-term debt Common stock 31,500 26,550 150,000 "The firm's 3,000 outstanding shares of common stock closed Retained camings Total liabilities and stockholders' equity 2015 at a price of S25 per share. a. Use the preceding financial statements to complete the following table. Assume that the industry averages given in the table are applicable for both 2014 and 2015. Industry average 1.80 Ratio Actual 2014 Actual 2015 Current ratio Quick ratio Inventory turnover Average collection period Debt ratio 1.84 0.70 2.50 0,78 2.59 37.5 days 36.5 days 65% 67% Times interest earmed ratio 3.8 4.0 Gross profit margin Net profit margin Return on total assets 38% 40% 3.5% 3.6% 4.0% 4.0% Return on common equity 9.5% 8.0% Market/book ratio 1.1 1.2 "laved on a 365-day year and on end of year figures. b. Analyze Zach Industries' financial condition as it is related to (1) liquidity, (2) activity, (3) debt, (4) profitability, and (5) market. Summarize the company's overall financial condition.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Zach Industries Ratio Analysis Industry Average Actual 2014 Actual 2015 Current ratio 18 184 104 Qui...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started