Answered step by step

Verified Expert Solution

Question

1 Approved Answer

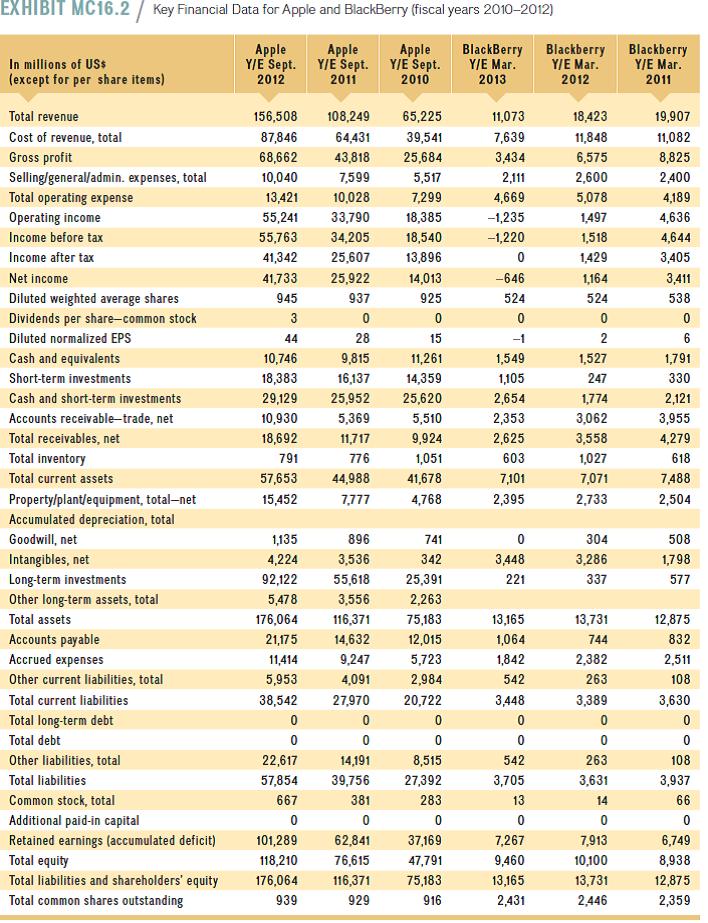

Exhibit MC16.2 shows key financial data for Apple and BlackBerry for the three fiscal years 20102012. A strategic financial analysis (SFA) for this MiniCase is

Exhibit MC16.2 shows key financial data for Apple and BlackBerry for the three fiscal years 2010–2012. A strategic financial analysis (SFA) for this MiniCase is available on Connect.

Reference Exhibit-MC 16.2

Conduct a dynamic firm profitability analysis over time (fiscal years 2008–2012) as shown in Exhibit MC16.2. Can you find signs of performance differentials between these two firms that may have indicated problems at BlackBerry? When did Black- Berry’s performance problems become apparent?

EXHIBIT MC16.2 / Key Financial Data for Apple and BlackBerry (fiscal years 2010-2012) pple Y/E Sept. Y/E Sept. Y/E Sept. 2011 Blackberry Y/E Mar. Apple Apple In millions of US$ (except for per share items) BlackBerry Y/E Mar. 2013 Blackberry Y/E Mar. 2012 2010 2012 2011 Total revenue 156,508 108,249 65,225 11,073 18,423 19,907 Cost of revenue, total 87,846 64,431 39,541 7,639 11,848 11,082 Gross profit 68,662 43,818 25,684 3,434 6,575 8,825 Selling/general/admin. expenses, total 10,040 7,599 5,517 2,111 2,600 2,400 13,421 4,669 Total operating expense Operating income 10,028 7,299 5,078 4,189 55,241 33,790 18,385 -1,235 1,497 4,636 Income before tax 55,763 34,205 18,540 -1,220 1,518 4,644 Income after tax 41,342 25,607 13,896 1,429 3,405 Net income 41,733 25,922 14,013 -646 1,164 3,411 Diluted weighted average shares 945 937 925 524 524 538 Dividends per share-common stock 3 Diluted normalized EPS 44 28 15 -1 Cash and equivalents 10,746 9,815 11,261 1,549 1,527 1,791 Short-term investments 18,383 16,137 14,359 1,105 247 330 Cash and short-term investments 29,129 25,952 25,620 2,654 1,774 2,121 Accounts receivable-trade, net 10,930 5,369 5,510 2,353 3,062 3,955 Total receivables, net 18,692 11,717 9,924 2,625 3,558 4,279 Total inventory 791 776 1,051 603 1,027 618 Total current assets 57,653 44,988 41,678 7,101 7,071 7488 Property/plant/equipment, total-net 15,452 7,777 4,768 2,395 2,733 2,504 Accumulated depreciation, total Goodwill, net 1,135 896 741 304 508 Intangibles, net 4,224 3,536 342 3,448 3,286 1,798 Long-term investments 92,122 55,618 25,391 221 337 577 Other long-term assets, total 5,478 3,556 2,263 Total assets 176,064 116,371 75,183 13,165 13,731 12,875 12,015 Accounts payable Accrued expenses 21,175 14,632 1,064 744 832 11,414 9,247 5,723 1,842 2,382 2,511 Other current liabilities, total 5,953 4,091 2,984 542 263 108 Total current liabilities 38,542 27,970 20,722 3,448 3,389 3,630 Total long-term debt Total debt Other liabilities, total 22,617 14,191 8,515 542 263 108 Total liabilities 57,854 39,756 27,392 3,705 3,631 3,937 Common stock, total 667 381 283 13 14 66 Additional paid-in capital Retained earnings (accumulated deficit) Total equity 101,289 62,841 37,169 7,267 7,913 6,749 118,210 76,615 47,791 9,460 10,100 8,938 Total liabilities and shareholders' equity Total common shares outstanding 176,064 116,371 75,183 13,165 13,731 12,875 939 929 916 2,431 2,446 2,359 EXHIBIT MC16.2 / Key Financial Data for Apple and BlackBerry (fiscal years 2010-2012) pple Y/E Sept. Y/E Sept. Y/E Sept. 2011 Blackberry Y/E Mar. Apple Apple In millions of US$ (except for per share items) BlackBerry Y/E Mar. 2013 Blackberry Y/E Mar. 2012 2010 2012 2011 Total revenue 156,508 108,249 65,225 11,073 18,423 19,907 Cost of revenue, total 87,846 64,431 39,541 7,639 11,848 11,082 Gross profit 68,662 43,818 25,684 3,434 6,575 8,825 Selling/general/admin. expenses, total 10,040 7,599 5,517 2,111 2,600 2,400 13,421 4,669 Total operating expense Operating income 10,028 7,299 5,078 4,189 55,241 33,790 18,385 -1,235 1,497 4,636 Income before tax 55,763 34,205 18,540 -1,220 1,518 4,644 Income after tax 41,342 25,607 13,896 1,429 3,405 Net income 41,733 25,922 14,013 -646 1,164 3,411 Diluted weighted average shares 945 937 925 524 524 538 Dividends per share-common stock 3 Diluted normalized EPS 44 28 15 -1 Cash and equivalents 10,746 9,815 11,261 1,549 1,527 1,791 Short-term investments 18,383 16,137 14,359 1,105 247 330 Cash and short-term investments 29,129 25,952 25,620 2,654 1,774 2,121 Accounts receivable-trade, net 10,930 5,369 5,510 2,353 3,062 3,955 Total receivables, net 18,692 11,717 9,924 2,625 3,558 4,279 Total inventory 791 776 1,051 603 1,027 618 Total current assets 57,653 44,988 41,678 7,101 7,071 7488 Property/plant/equipment, total-net 15,452 7,777 4,768 2,395 2,733 2,504 Accumulated depreciation, total Goodwill, net 1,135 896 741 304 508 Intangibles, net 4,224 3,536 342 3,448 3,286 1,798 Long-term investments 92,122 55,618 25,391 221 337 577 Other long-term assets, total 5,478 3,556 2,263 Total assets 176,064 116,371 75,183 13,165 13,731 12,875 12,015 Accounts payable Accrued expenses 21,175 14,632 1,064 744 832 11,414 9,247 5,723 1,842 2,382 2,511 Other current liabilities, total 5,953 4,091 2,984 542 263 108 Total current liabilities 38,542 27,970 20,722 3,448 3,389 3,630 Total long-term debt Total debt Other liabilities, total 22,617 14,191 8,515 542 263 108 Total liabilities 57,854 39,756 27,392 3,705 3,631 3,937 Common stock, total 667 381 283 13 14 66 Additional paid-in capital Retained earnings (accumulated deficit) Total equity 101,289 62,841 37,169 7,267 7,913 6,749 118,210 76,615 47,791 9,460 10,100 8,938 Total liabilities and shareholders' equity Total common shares outstanding 176,064 116,371 75,183 13,165 13,731 12,875 939 929 916 2,431 2,446 2,359 EXHIBIT MC16.2 / Key Financial Data for Apple and BlackBerry (fiscal years 2010-2012) pple Y/E Sept. Y/E Sept. Y/E Sept. 2011 Blackberry Y/E Mar. Apple Apple In millions of US$ (except for per share items) BlackBerry Y/E Mar. 2013 Blackberry Y/E Mar. 2012 2010 2012 2011 Total revenue 156,508 108,249 65,225 11,073 18,423 19,907 Cost of revenue, total 87,846 64,431 39,541 7,639 11,848 11,082 Gross profit 68,662 43,818 25,684 3,434 6,575 8,825 Selling/general/admin. expenses, total 10,040 7,599 5,517 2,111 2,600 2,400 13,421 4,669 Total operating expense Operating income 10,028 7,299 5,078 4,189 55,241 33,790 18,385 -1,235 1,497 4,636 Income before tax 55,763 34,205 18,540 -1,220 1,518 4,644 Income after tax 41,342 25,607 13,896 1,429 3,405 Net income 41,733 25,922 14,013 -646 1,164 3,411 Diluted weighted average shares 945 937 925 524 524 538 Dividends per share-common stock 3 Diluted normalized EPS 44 28 15 -1 Cash and equivalents 10,746 9,815 11,261 1,549 1,527 1,791 Short-term investments 18,383 16,137 14,359 1,105 247 330 Cash and short-term investments 29,129 25,952 25,620 2,654 1,774 2,121 Accounts receivable-trade, net 10,930 5,369 5,510 2,353 3,062 3,955 Total receivables, net 18,692 11,717 9,924 2,625 3,558 4,279 Total inventory 791 776 1,051 603 1,027 618 Total current assets 57,653 44,988 41,678 7,101 7,071 7488 Property/plant/equipment, total-net 15,452 7,777 4,768 2,395 2,733 2,504 Accumulated depreciation, total Goodwill, net 1,135 896 741 304 508 Intangibles, net 4,224 3,536 342 3,448 3,286 1,798 Long-term investments 92,122 55,618 25,391 221 337 577 Other long-term assets, total 5,478 3,556 2,263 Total assets 176,064 116,371 75,183 13,165 13,731 12,875 12,015 Accounts payable Accrued expenses 21,175 14,632 1,064 744 832 11,414 9,247 5,723 1,842 2,382 2,511 Other current liabilities, total 5,953 4,091 2,984 542 263 108 Total current liabilities 38,542 27,970 20,722 3,448 3,389 3,630 Total long-term debt Total debt Other liabilities, total 22,617 14,191 8,515 542 263 108 Total liabilities 57,854 39,756 27,392 3,705 3,631 3,937 Common stock, total 667 381 283 13 14 66 Additional paid-in capital Retained earnings (accumulated deficit) Total equity 101,289 62,841 37,169 7,267 7,913 6,749 118,210 76,615 47,791 9,460 10,100 8,938 Total liabilities and shareholders' equity Total common shares outstanding 176,064 116,371 75,183 13,165 13,731 12,875 939 929 916 2,431 2,446 2,359

Step by Step Solution

★★★★★

3.44 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

From the figures above its clear that Apple was already seeing consistent gro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started