Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Access Macy's, Inc 10-K filing for the year ended February 1, 2020. Search or scroll to find the financial statements and related notes. 1. What

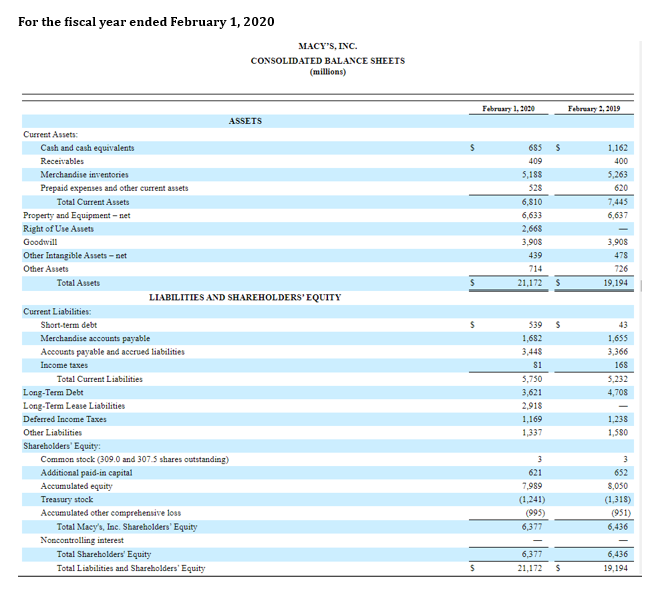

Access Macy's, Inc 10-K filing for the year ended February 1, 2020. Search or scroll to find the financial statements and related notes. 1. What is the total debt (including current liabilities and deferred taxes) reported in the balance sheet in the most recent two years?

I apologize if some of the disclosure notes are needed. There were so many notes that I did not know which ones to include. If you are not able to help without the disclosure notes, I understand. Any direction you are able to provide is appreciated. Thank you.

For the fiscal year ended February 1, 2020 Current Assets: Cash and cash equivalents Receivables Merchandise inventories Prepaid expenses and other current assets Total Current Assets Property and Equipment-net Right of Use Assets Goodwill Other Intangible Assets-net Other Assets Total Assets Current Liabilities: MACY'S, INC. CONSOLIDATED BALANCE SHEETS ASSETS (millions) February 1, 2020 February 2, 2019 685 $ 1,162 409 400 5,188 5,263 528 620 6,810 7,445 6,633 6,637 2,668 3,908 3,908 439 478 714 726 21,172 $ 19,194 LIABILITIES AND SHAREHOLDERS' EQUITY Short-term debt Merchandise accounts payable Accounts payable and accrued liabilities Income taxes Total Current Liabilities Long-Term Debt Long-Term Lease Liabilities Deferred Income Taxes Other Liabilities Shareholders' Equity: Common stock (309.0 and 307.5 shares outstanding) Additional paid-in capital Accumulated equity Treasury stock Accumulated other comprehensive loss Total Macy's, Inc. Shareholders' Equity Noncontrolling interest 539 43 1,682 1,655 3,448 3,366 81 168 5,750 5,232 3,621 4,708 2,918 1,169 1,238 1,337 1,580 3 3 621 652 7,989 8,050 (1,241) (1,318) (995) (951) 6,377 6,436 Total Shareholders' Equity 6,377 6,436 Total Liabilities and Shareholders' Equity 21,172 $ 19,194

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started