Question

Common shares of lectrofunk inc. traded on the secondary market at a price of 405 at the end of 2022. The company had just distributed

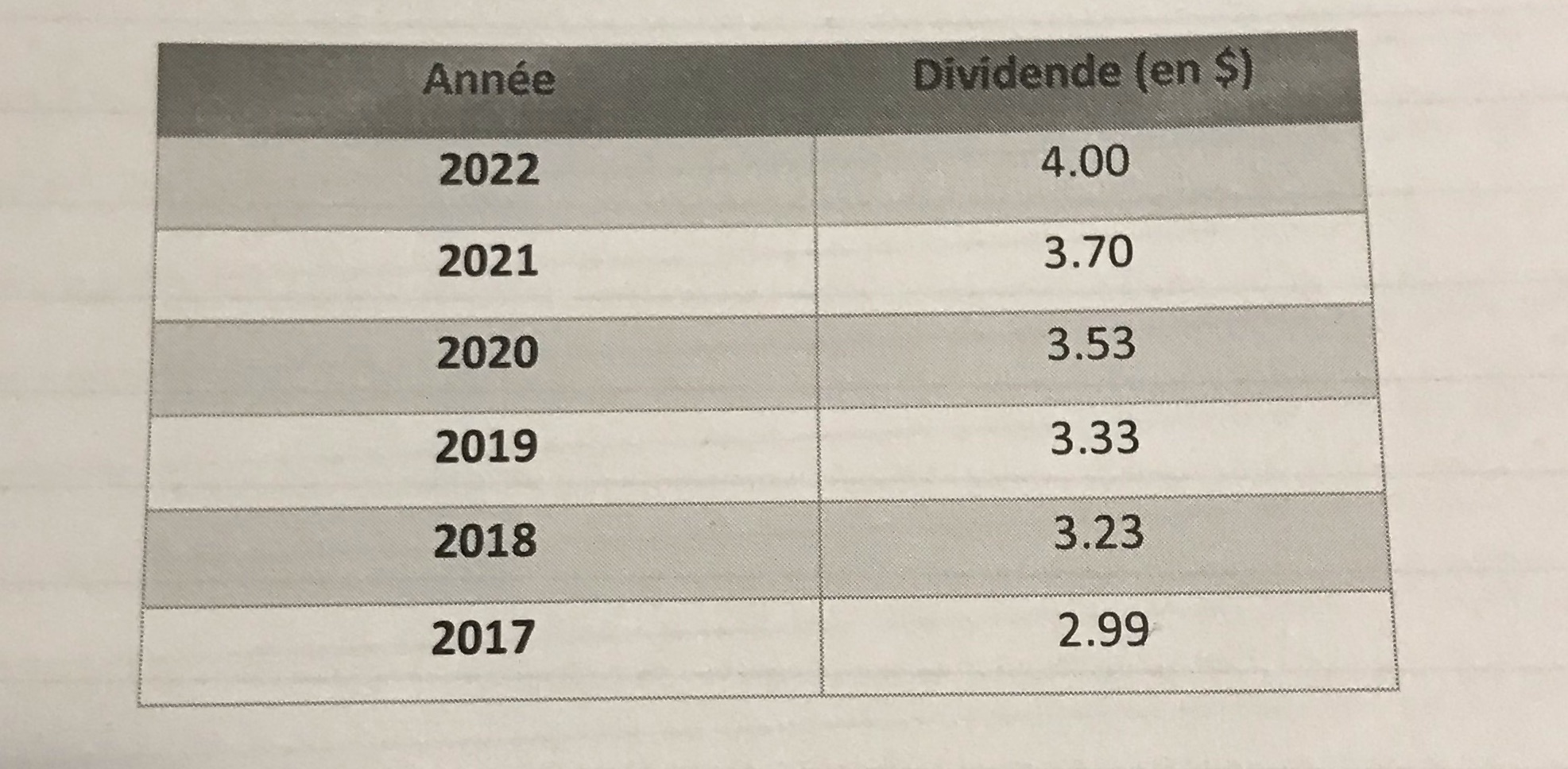

Common shares of lectrofunk inc. traded on the secondary market at a price of 405 at the end of 2022. The company had just distributed a dividend of 4.00S per share. You are provided with the following information on the distributions of dividends from previous years, paid to shareholders on December 31 of each year.Knowing that the rate of return required by investors is 17%:A) Calculate the share price based on the data provided and indicate whether this ordinary share is undervalued or overvalued by the market. (4 points)Analysts predict that this company will pay a dividend of $4.00 per share in 1 year. After this year, the dividend will increase by 5% per year per share for 4 years, then increase to 7% in perpetuity.B) Knowing that the rate of return required by investors is 17%, if the share price is $40 today (assuppose it is January 1, 2023), would you think of buying it?

Anne Dividende (en $) 2022 4.00 2021 3.70 2020 3.53 2019 3.33 2018 3.23 2017 2.99

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started