Answered step by step

Verified Expert Solution

Question

1 Approved Answer

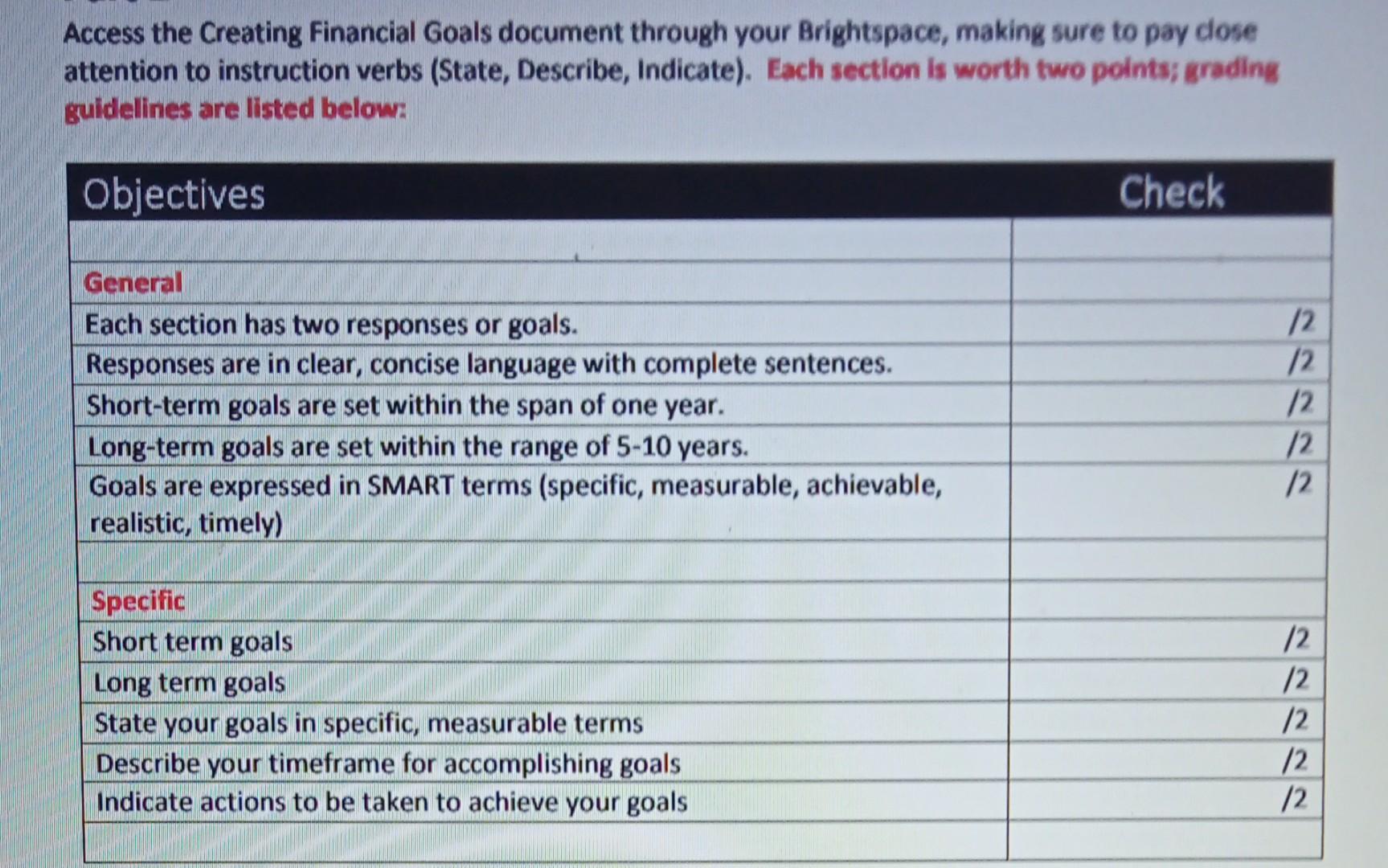

Access the Creating Financial Goals document through your Brightspace, making sure to pay ciose attention to instruction verbs (State, Describe, Indicate). Each section is worth

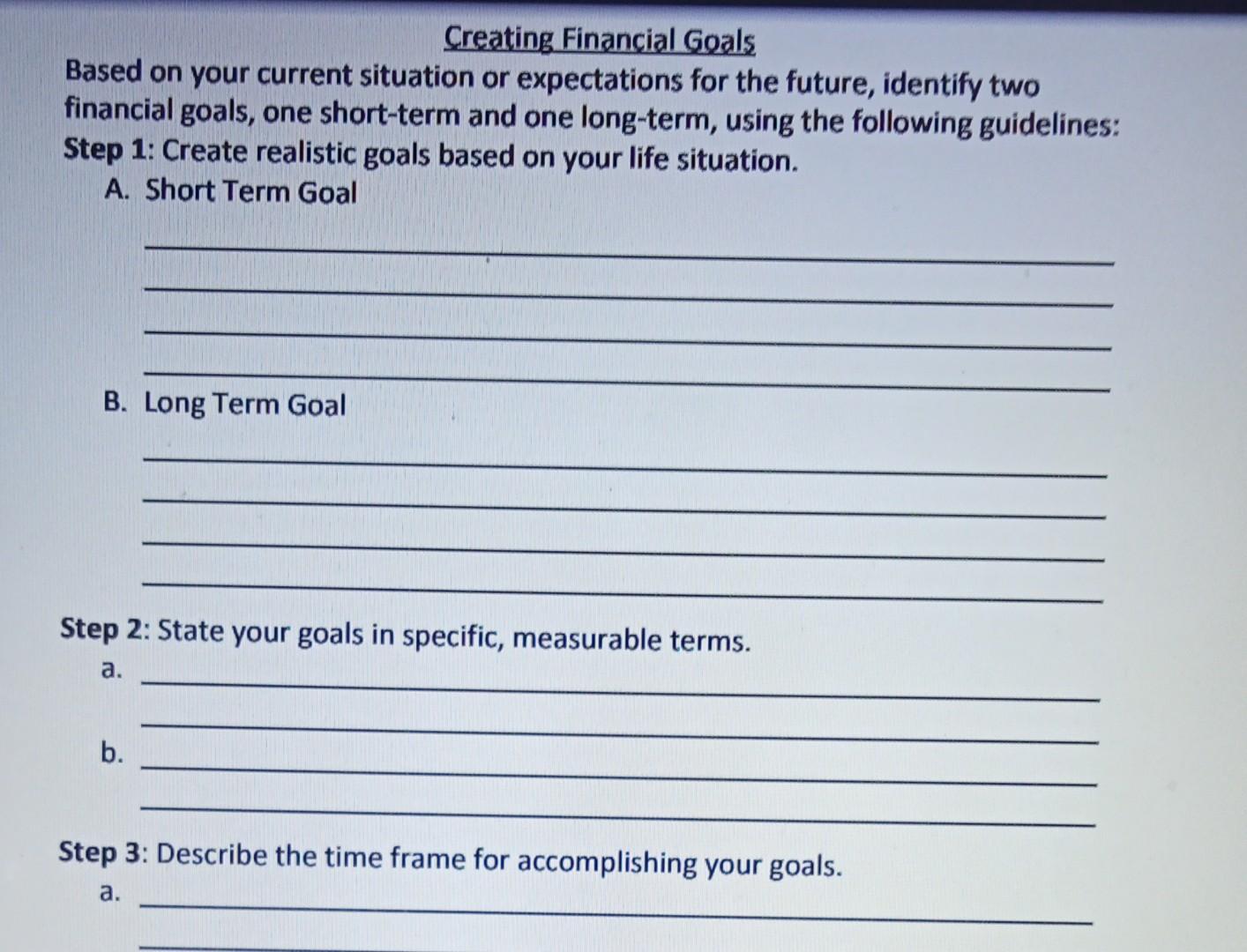

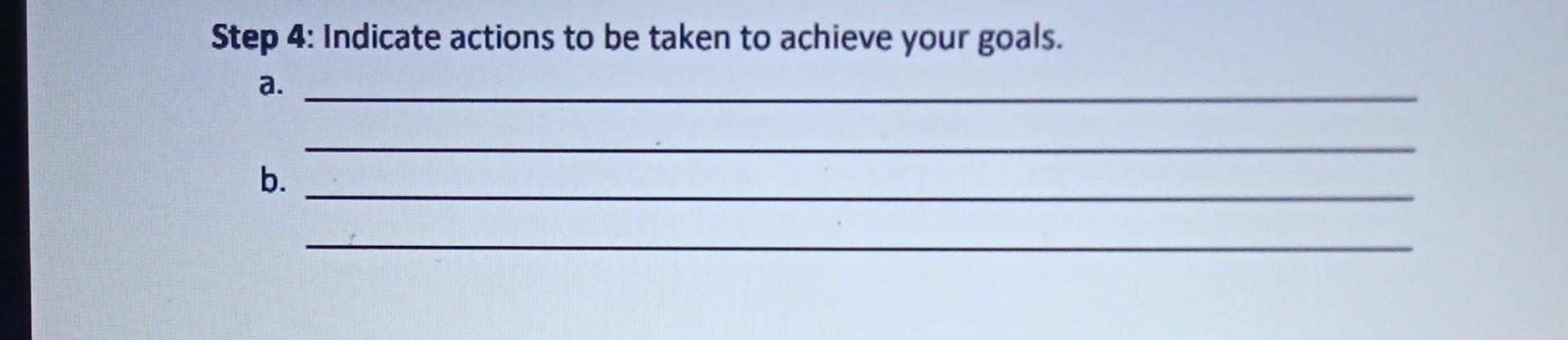

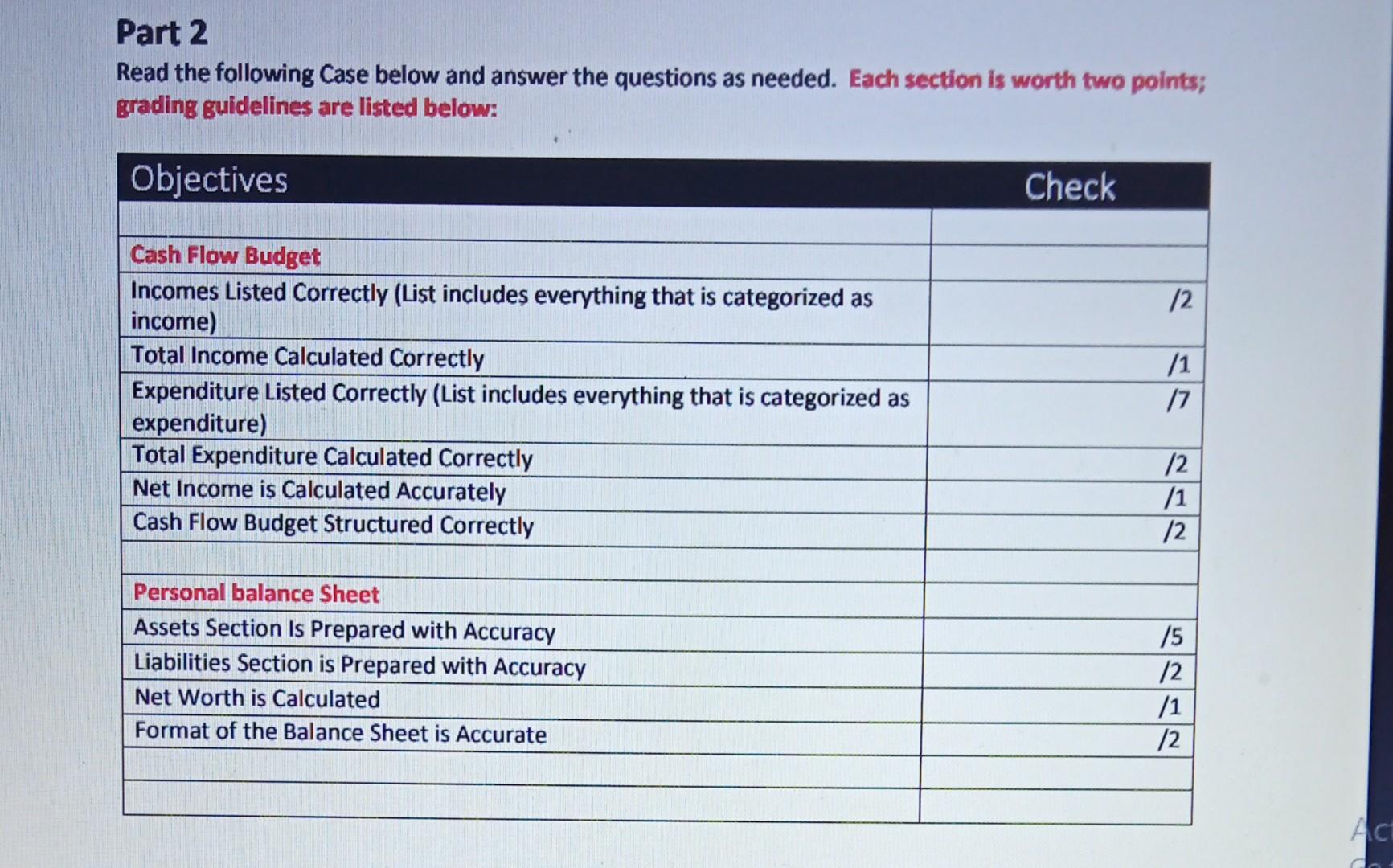

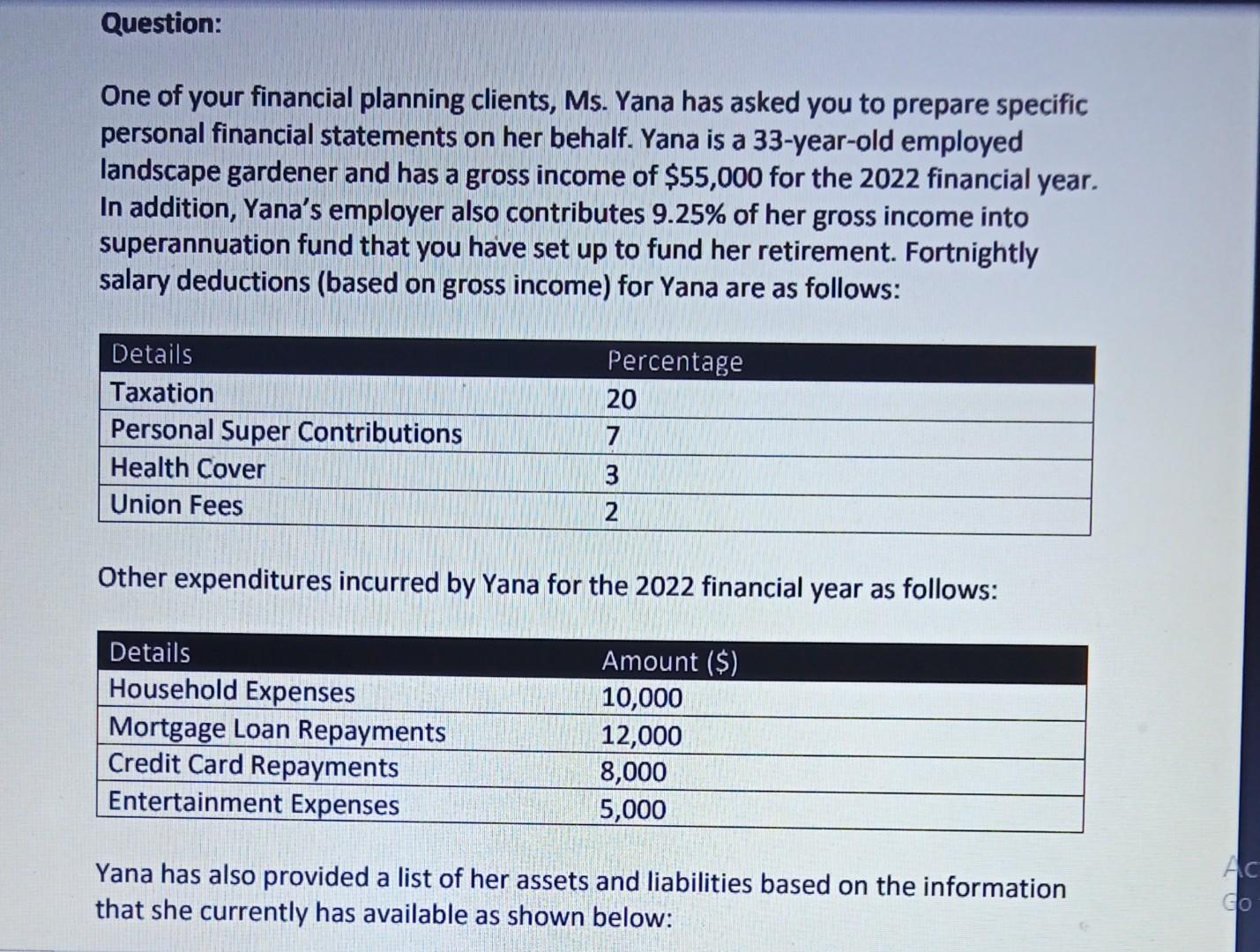

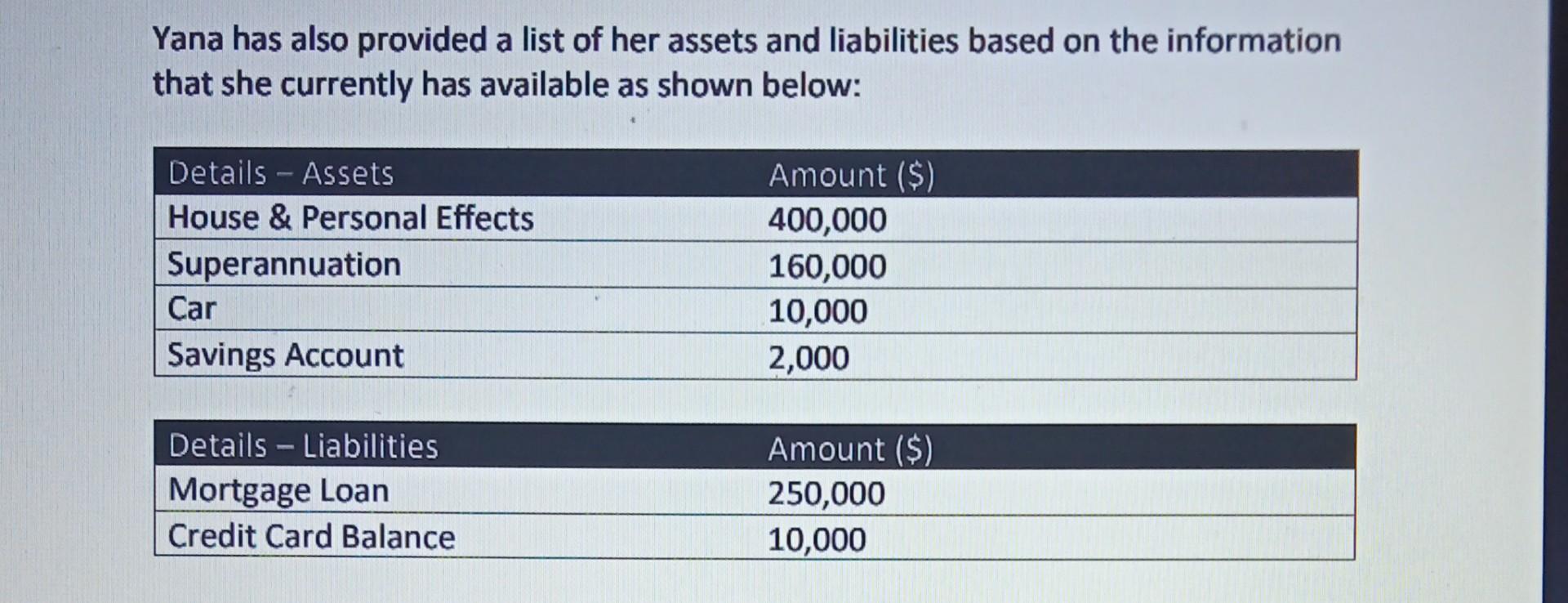

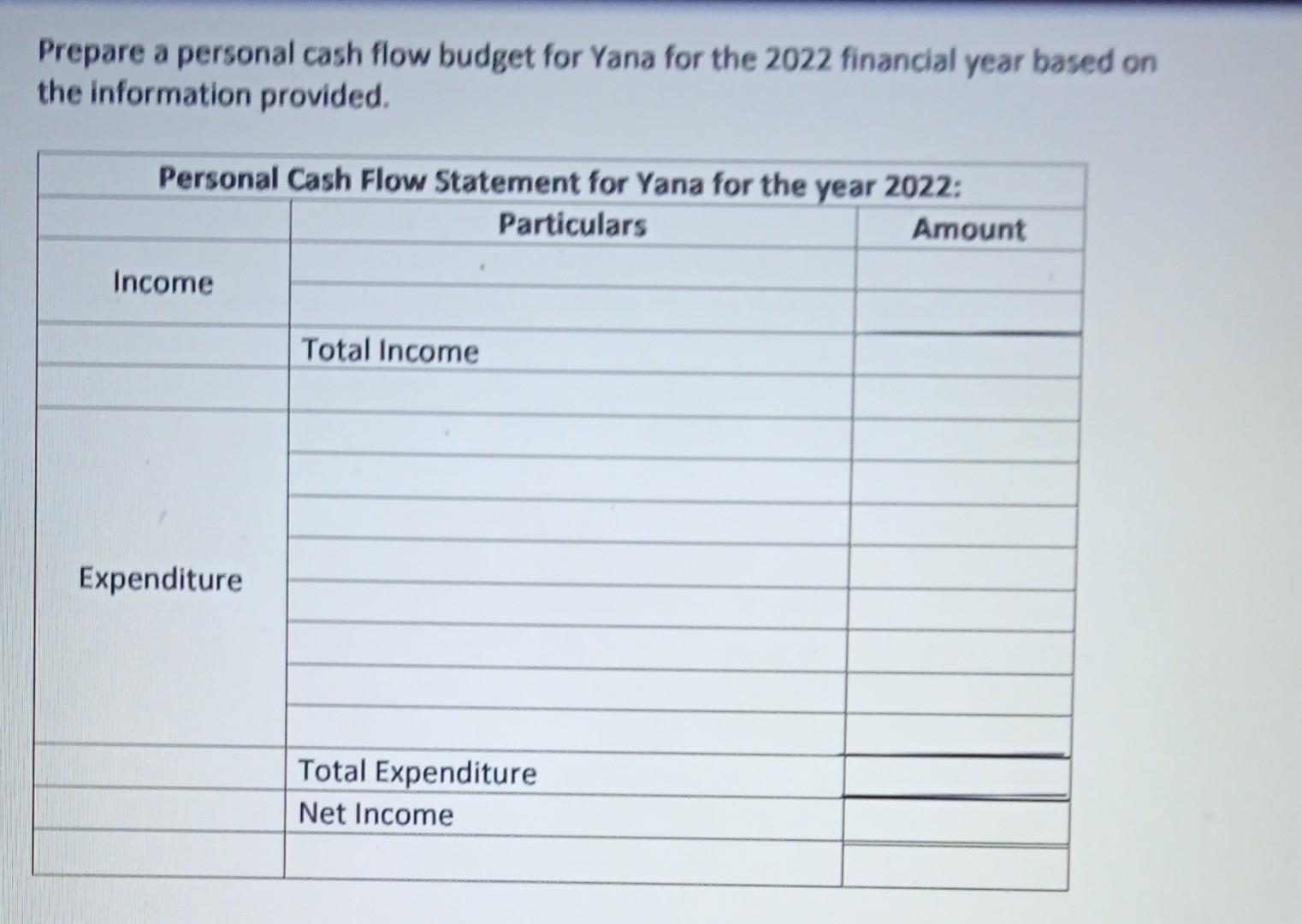

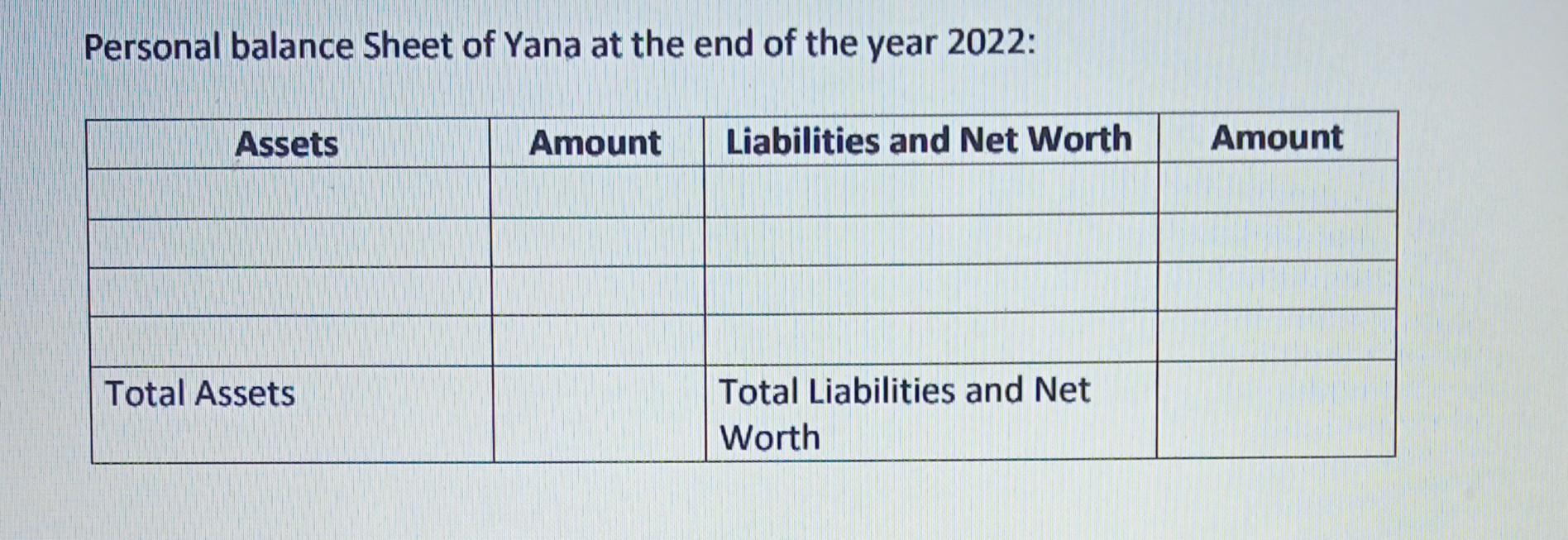

Access the Creating Financial Goals document through your Brightspace, making sure to pay ciose attention to instruction verbs (State, Describe, Indicate). Each section is worth two points; grading guidelines are listed below: Creating Financial Goals Based on your current situation or expectations for the future, identify two financial goals, one short-term and one long-term, using the following guidelines: Step 1: Create realistic goals based on your life situation. A. Short Term Goal B. Long Term Goal Step 2: State your goals in specific, measurable terms. a. b. Step 3: Describe the time frame for accomplishing your goals. a. Step 4: Indicate actions to be taken to achieve your goals. a. b. Read the following Case below and answer the questions as needed. Each section is worth two points; grading guidelines are listed below: One of your financial planning clients, Ms. Yana has asked you to prepare specific personal financial statements on her behalf. Yana is a 33-year-old employed landscape gardener and has a gross income of $55,000 for the 2022 financial year. In addition, Yana's employer also contributes 9.25% of her gross income into superannuation fund that you have set up to fund her retirement. Fortnightly salary deductions (based on gross income) for Yana are as follows: Other expenditures incurred by Yana for the 2022 financial year as follows: Yana has also provided a list of her assets and liabilities based on the information that she currently has available as shown below: Yana has also provided a list of her assets and liabilities based on the information that she currently has available as shown below: Prepare a personal cash flow budget for Yana for the 2022 financial year based on the information provided. Personal balance Sheet of Yana at the end of the year 2022: Access the Creating Financial Goals document through your Brightspace, making sure to pay ciose attention to instruction verbs (State, Describe, Indicate). Each section is worth two points; grading guidelines are listed below: Creating Financial Goals Based on your current situation or expectations for the future, identify two financial goals, one short-term and one long-term, using the following guidelines: Step 1: Create realistic goals based on your life situation. A. Short Term Goal B. Long Term Goal Step 2: State your goals in specific, measurable terms. a. b. Step 3: Describe the time frame for accomplishing your goals. a. Step 4: Indicate actions to be taken to achieve your goals. a. b. Read the following Case below and answer the questions as needed. Each section is worth two points; grading guidelines are listed below: One of your financial planning clients, Ms. Yana has asked you to prepare specific personal financial statements on her behalf. Yana is a 33-year-old employed landscape gardener and has a gross income of $55,000 for the 2022 financial year. In addition, Yana's employer also contributes 9.25% of her gross income into superannuation fund that you have set up to fund her retirement. Fortnightly salary deductions (based on gross income) for Yana are as follows: Other expenditures incurred by Yana for the 2022 financial year as follows: Yana has also provided a list of her assets and liabilities based on the information that she currently has available as shown below: Yana has also provided a list of her assets and liabilities based on the information that she currently has available as shown below: Prepare a personal cash flow budget for Yana for the 2022 financial year based on the information provided. Personal balance Sheet of Yana at the end of the year 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started