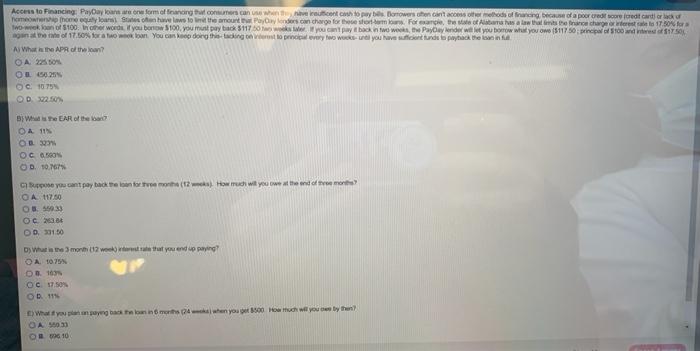

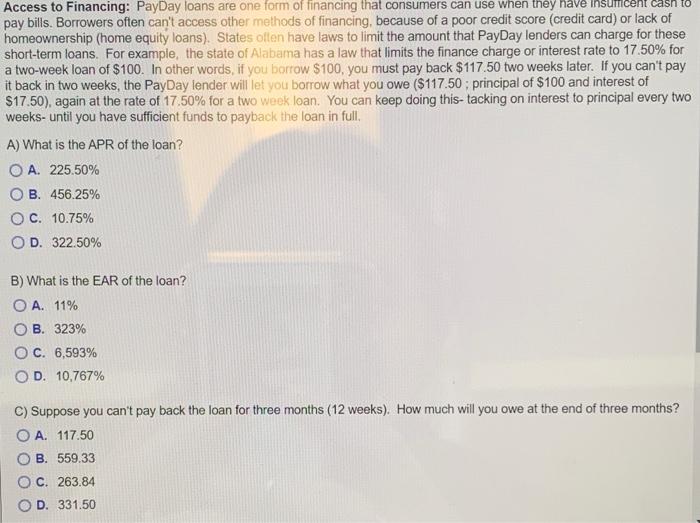

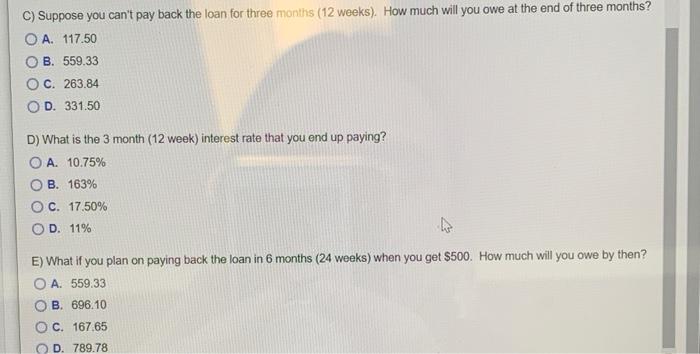

Access to Financing Payayaran format anong consumers can see reconcit pays Borrowers then contacter mod offer because of poor credit score credit card or woon 100 Wonier wordt you bono 100. you must pay back 3117 6 we you can pay back to work, the Payoy de wet you borrow what you owo (511750 100 15 ganat of 17.60% for two weekban. You can doing this acting on to a very lower your aventure pack the As What the APR of the on? OA 250 OL528 1075 OD 250 By WEAR of the O 11% OD 3 Ocasos OD. 1076 you can pay back the form (12 How will you owe the end of OA 117.50 36030 OC 2304 OD 301.00 by Wam w Watyou end up paying O A 1075 0107 OC 17.50% OD 114 E) What you may alam when you 500 How much you by the OA 503) OB 96 10 OD. 11% E) What if you plan on paying back the loan in 6 months (24 weeks) when you get $500. How much will you owe by then? OA. 559.33 B. 696.10 c. 167.65 D. 789.78 Access to Financing: PayDay loans are one form of financing that consumers can use when they have insumcent ca pay bills. Borrowers often can't access other methods of financing, because of a poor credit score (credit card) or lack of homeownership (home equity loans). States often have laws to limit the amount that PayDay lenders can charge for these short-term loans. For example, the state of Alabama has a law that limits the finance charge or interest rate to 17.50% for a two-week loan of $100. In other words, if you borrow $100, you must pay back $117.50 two weeks later. If you can't pay it back in two weeks, the PayDay lender will let you borrow what you owe ($117.50 : principal of $100 and interest of $17.50), again at the rate of 17.50% for a two week loan. You can keep doing this- tacking on interest to principal every two weeks- until you have sufficient funds to payback the loan in full, A) What is the APR of the loan? O A. 225.50% OB. 456.25% O C. 10.75% OD. 322.50% B) What is the EAR of the loan? O A. 11% B. 323% OC. 6,593% OD. 10,767% C) Suppose you can't pay back the loan for three months (12 weeks). How much will you owe at the end of three months? O A. 117.50 OB. 559.33 OC. 263.84 OD. 331.50 C) Suppose you can't pay back the loan for three months (12 weeks). How much will you owe at the end of three months? O A. 117.50 B. 559.33 C. 263.84 D. 331.50 D) What is the 3 month (12 week) interest rate that you end up paying? A. 10.75% B. 163% O C. 17.50% OD. 11% E) What if you plan on paying back the loan in 6 months (24 weeks) when you get $500. How much will you owe by then? A. 559.33 B. 696.10 O C. 167,65 OD. 789.78