Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accidential and sickness Kelly owns a house construction company. He has a basic group benefits plan, with extended health care and accidental death and dismemberment

Accidential and sickness

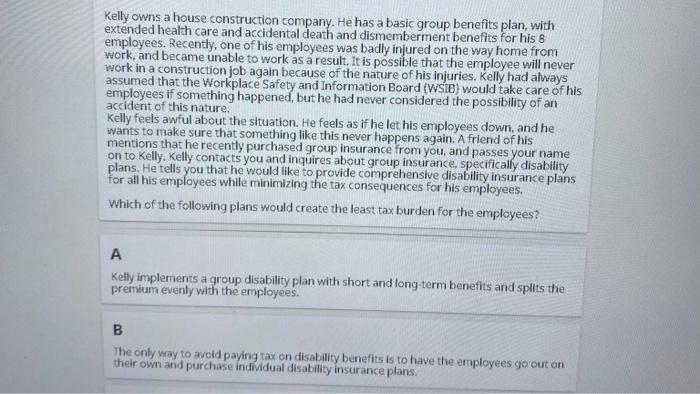

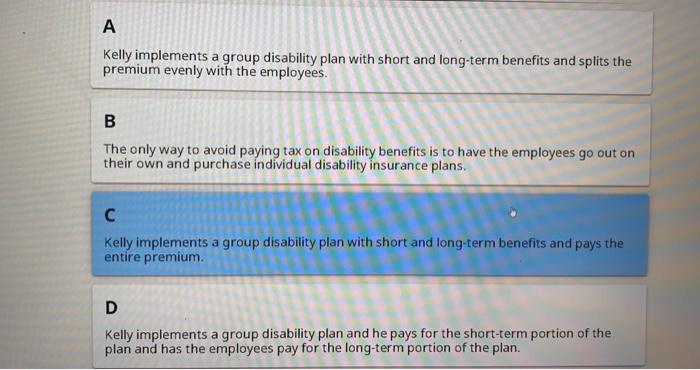

Kelly owns a house construction company. He has a basic group benefits plan, with extended health care and accidental death and dismemberment benefits for his 8 employees. Recently, one of his employees was badly injured on the way home from work, and became unable to work as a result. It is possible that the employee will never work in a construction job again because of the nature of his injuries, Kelly had always assumed that the Workplace Safety and Information Board (WSB) would take care of his employees if something happened, but he had never considered the possibility of an accident of this nature. Kelly feels awful about the situation. He feels as if he let his employees down, and he wants to make sure that something like this never happens again. A friend of his mentions that he recently purchased group insurance from you, and passes your name on to Kelly. Kelly contacts you and inquires about group insurance, specifically disability plans. He tells you that he would like to provide comprehensive disability insurance plans for all his employees while minimizing the tax consequences for his employees. Which of the following plans would create the least tax burden for the employees? Kelly implements a group disability plan with short and long-term benefits and splits the premium evenly with the employees. B The only way to avoid paying tax on disability benefits is to have the employees go out on their own and purchase individual disability insurance plans. Kelly implements a group disability plan with short and long-term benefits and splits the premium evenly with the employees. B The only way to avoid paying tax on disability benefits is to have the employees go out on their own and purchase individual disability insurance plans. Kelly implements a group disability plan with short and long-term benefits and pays the entire premium. D Kelly implements a group disability plan and he pays for the short-term portion of the plan and has the employees pay for the long-term portion of the plan. Kelly owns a house construction company. He has a basic group benefits plan, with extended health care and accidental death and dismemberment benefits for his 8 employees. Recently, one of his employees was badly injured on the way home from work, and became unable to work as a result. It is possible that the employee will never work in a construction job again because of the nature of his injuries, Kelly had always assumed that the Workplace Safety and Information Board (WSB) would take care of his employees if something happened, but he had never considered the possibility of an accident of this nature. Kelly feels awful about the situation. He feels as if he let his employees down, and he wants to make sure that something like this never happens again. A friend of his mentions that he recently purchased group insurance from you, and passes your name on to Kelly. Kelly contacts you and inquires about group insurance, specifically disability plans. He tells you that he would like to provide comprehensive disability insurance plans for all his employees while minimizing the tax consequences for his employees. Which of the following plans would create the least tax burden for the employees? Kelly implements a group disability plan with short and long-term benefits and splits the premium evenly with the employees. B The only way to avoid paying tax on disability benefits is to have the employees go out on their own and purchase individual disability insurance plans. Kelly implements a group disability plan with short and long-term benefits and splits the premium evenly with the employees. B The only way to avoid paying tax on disability benefits is to have the employees go out on their own and purchase individual disability insurance plans. Kelly implements a group disability plan with short and long-term benefits and pays the entire premium. D Kelly implements a group disability plan and he pays for the short-term portion of the plan and has the employees pay for the long-term portion of the plan

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started