Answered step by step

Verified Expert Solution

Question

1 Approved Answer

According to aibitrage pricing theory, assume the following model is appropriate to estimate returns in the market: Assume we beleive a 1 factor APT model

According to aibitrage pricing theory, assume the following model is appropriate to estimate returns in the market:

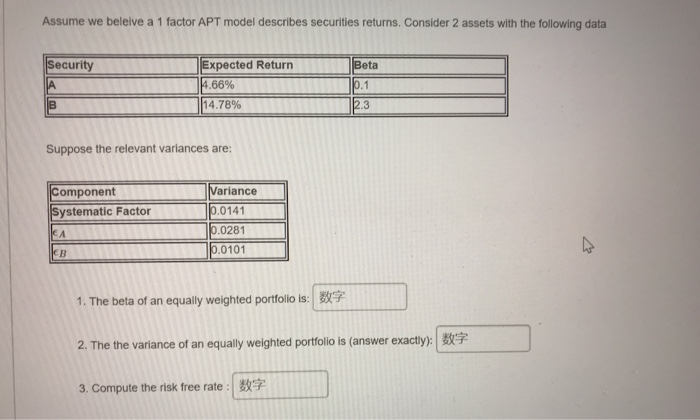

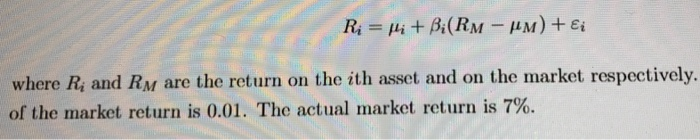

Assume we beleive a 1 factor APT model describes securities returns. Consider 2 assets with the following data Security Expected Return 4.66% 14.78% Beta 10.1 2.3 Suppose the relevant variances are: Component Systematic Factor Variance 0.0141 0.0281 0.0101 1. The beta of an equally weighted portfolio is: 2. The the variance of an equally weighted portfolio is (answer exactly): EU 3. Compute the risk free rate : R; = Hi + Bi(Rm pm) + Ei where Ri and RM are the return on the ith asset and on the market respectively. of the market return is 0.01. The actual market return is 7%. Assume we beleive a 1 factor APT model describes securities returns. Consider 2 assets with the following data Security Expected Return 4.66% 14.78% Beta 10.1 2.3 Suppose the relevant variances are: Component Systematic Factor Variance 0.0141 0.0281 0.0101 1. The beta of an equally weighted portfolio is: 2. The the variance of an equally weighted portfolio is (answer exactly): EU 3. Compute the risk free rate : R; = Hi + Bi(Rm pm) + Ei where Ri and RM are the return on the ith asset and on the market respectively. of the market return is 0.01. The actual market return is 7%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started