Answered step by step

Verified Expert Solution

Question

1 Approved Answer

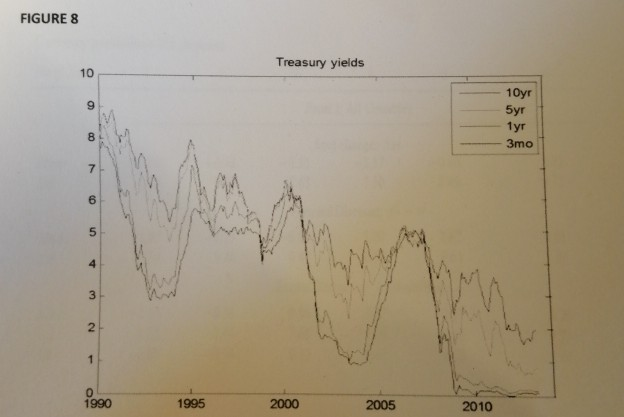

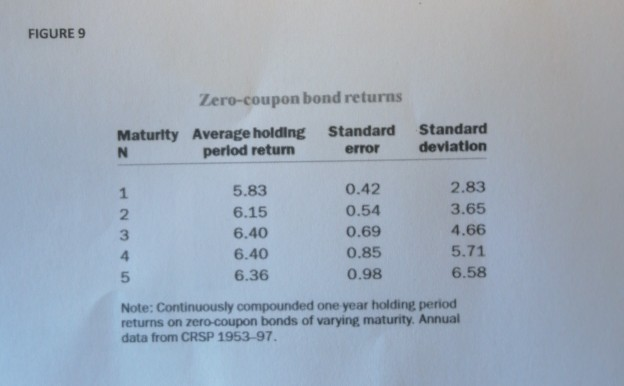

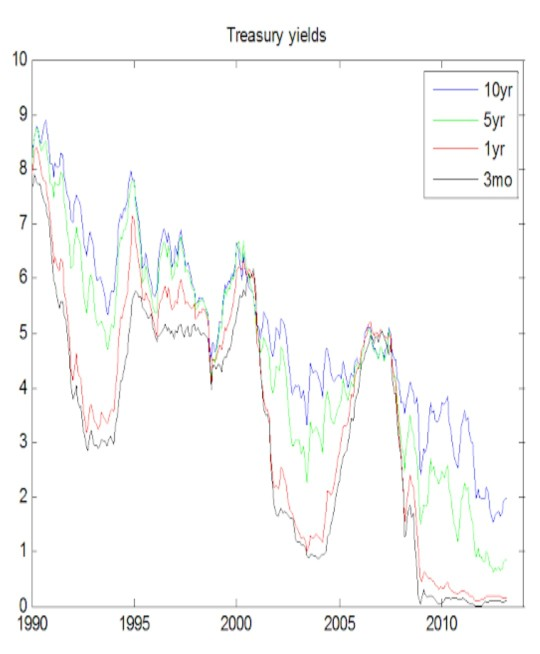

According to Figure 8, what happened to your holding period returns if you purchased long-run bonds in i) 1994 and ii) 2010? Explain why this

According to Figure 8, what happened to your holding period returns if you purchased long-run bonds in i) 1994 and ii) 2010? Explain why this might be so. Is Figure 9 consistent with the pure expectations theory? Explain. FIGURE 8 Treasury yields 10yr 5yr 1yr 3mo 1990 1995 2000 2005 2010 FIGURE 9 Zero-coupon bond returns Maturity Average holding period return Standard error Standard deviation 2.83 3.65 U AWN 5.83 6.15 6.40 6.40 6.36 0.42 0.54 0.69 0.85 0.98 4.66 5.71 6.58 Note: Continuously compounded one year holding period returns on zero-coupon bonds of varying maturity, Annual data from CRSP 1953-97. Treasury yields 1990 1995 2000 2005 2010 According to Figure 8, what happened to your holding period returns if you purchased long-run bonds in i) 1994 and ii) 2010? Explain why this might be so. Is Figure 9 consistent with the pure expectations theory? Explain. FIGURE 8 Treasury yields 10yr 5yr 1yr 3mo 1990 1995 2000 2005 2010 FIGURE 9 Zero-coupon bond returns Maturity Average holding period return Standard error Standard deviation 2.83 3.65 U AWN 5.83 6.15 6.40 6.40 6.36 0.42 0.54 0.69 0.85 0.98 4.66 5.71 6.58 Note: Continuously compounded one year holding period returns on zero-coupon bonds of varying maturity, Annual data from CRSP 1953-97. Treasury yields 1990 1995 2000 2005 2010

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started