Answered step by step

Verified Expert Solution

Question

1 Approved Answer

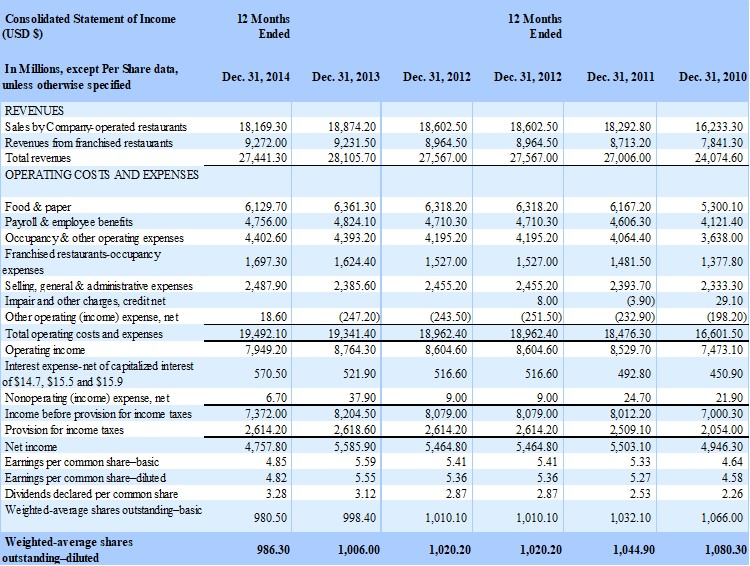

According to Mcdonalds income statement from years 2010-2014, what can you comment on the situation of the company, based on this information. Information of income

According to Mcdonalds income statement from years 2010-2014, what can you comment on the situation of the company, based on this information.

Information of income statement provided below:

Cons olidated Statement of Income 12 Months Ended 12 Months Ended In Millions, except Per Share data, unless otherwise spec ified Dec. 31,2014 Dec. 31, 2013 Dec. 31,2012 Dec. 31, 2012 Dec. 31,2011 Dec. 31, 2010 REVENUES Sales byCompam-operated resta urants Revenues fom franchised resta urants Total revemes OPERATING COSTS AND EXPENSES 16,233.30 7,841.30 24.074.60 18,169.30 9,272.00 27,441.30 18,874.20 18,602.50 18,602.50 8,964.50 27,567.00 9,231.50 28,105.70 8,713.20 27,006.00 27,567.00 6,129.70 4,756.00 4,402.60 6,361.30 4,824.10 6,318.20 4,710.30 4,195.20 1,527.00 6,167.20 4,606.30 4,064.40 5,300.10 4,121.40 3,638.00 Food & paper Payroll & employee benefits Occupancy& other operating expenses Franchised restaurants-occupancy 6,318.20 4,710.30 4,195.20 4,393.20 1,697.30 2,487.90 1,527.00 1,377.80 2,333.30 1,481.50 2,385.60 Selling, general & administrative expenses Impair and other charges, creditnet Other operating (come) expense, ne t Total operating costs and expenses 2,455.20 2,455.20 2,393.70 (247.20 19.492.10 7,949.20 6.601.50 8,604.60 8,764.30 8,604.60 8,529.70 Interest expense-net of capitaized interest of S14.7, S15.5 and $15.9 Nonope rating (income) expense, net Income before provision for income taxes Provision for income taxes Net income 521.90 570.50 516.60 450.90 8314 7.000.30 7,372.00 8,204.50 8,079.00 8,079.00 8,012.20 5,464.80 5,503.10 4,757.80 5,585.90 4,946.30 5,464.80 Earnings per common share dihuted Dividends declared per common share Weighted-average shares outstanding-basic 2.53 998.40 1,010.10 1,010.10 980.50 1,032.10 1,066.00 Weighted-average shares outstanding-diluted 1,020.20 1,080.30 986.30 1,006.00 1,020.20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started