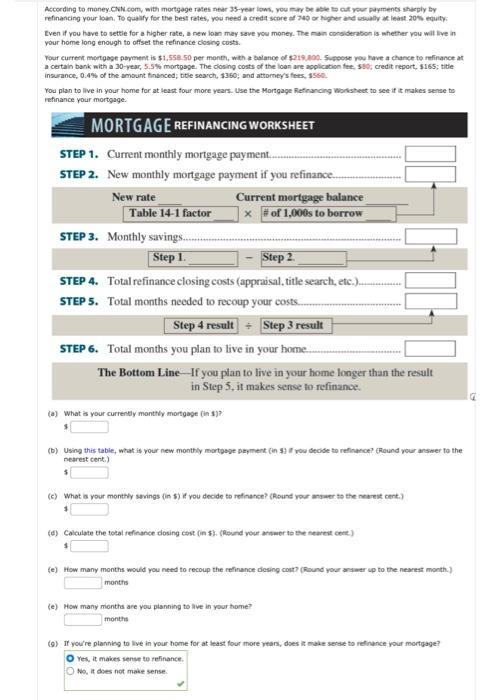

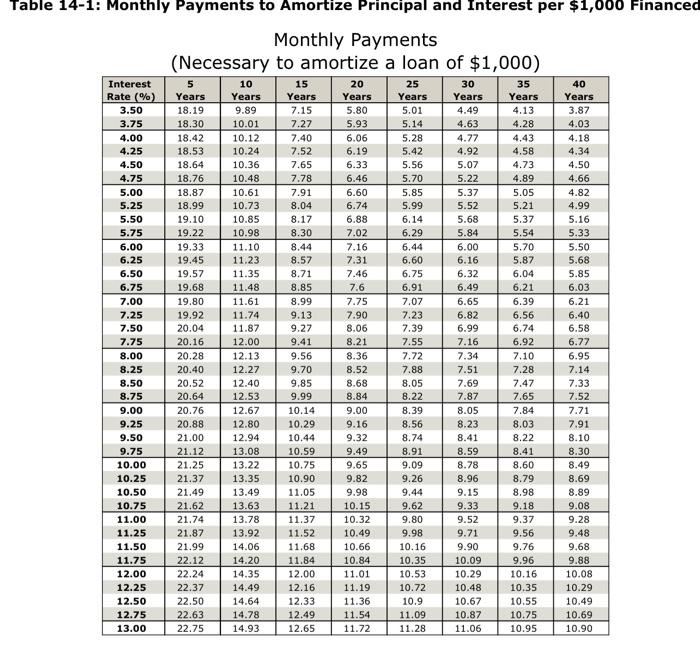

According to money.CNN.comy, with mortgage rates near 35-year lowi, you m.y be aste ta cul your payments sharply by refinancing your loan. To dagafy for the best rates, you need a cred4 score of 749 or higher and ubually ac lease 20% equity. Even if vou have to settie for a higher rate, a new loan may save you money. The man considerabon is whether you will twe in your home long enough to offset the refinance closing costs. a certain bank with a 30 -year, 5.5% mortpage. The closing costs of the foan are aoplication fee, 3s2; credit report, 3165 ; title insurance, 0.4% of the amount tinanced; bile search, 3350 ; and attorney's fees, 1552 . You plan to live in your home for at least four more years. Use the Mortgage Refenancing Worlsheet to see if it makes sense to refinance your mortgage. MORTGAGE REFINANCING WORKSHEET STEP 1. Current monthly mortgage payment. STEP 2. New monthly mortgage payment if you refinance. STEP 3. Monthly savings. - Step 2. STEP 4. Total refinance closing costs (appraisal, title search, etc.). STEP 5. Total months needed to recoup your costs. STEP 6. Total months you plan to live in your home. The Bottom Line-If you plan to live in your home longer than the result in Step 5, it makes sense to refinance. (a) What is your currently monthly mortgage ( in 1)? 17 (b) Using this table, weat is your new monthly mortgspe peyment (in 9 ) it rou decide to refinance? (Round yeur answer to the nearest cent.) 4 (c) What a your monthly savings (in 1 ) if you decide to refinance? (Aound your answer is the nesrest cent.) 1 (d) Colculate the total refinance dosing cost (in 5). (found vour actwer to the nearest cere.) 1 (e) How many months would you need to recoup the refinance diesing cont) (Round your ansater up to the nearest month.) months (e) How many minths are you pianning to llve in your home? months (9) If you're plarinkg to live in your home for at least four more years, dses it make serde to refinance your mortgage? Yes, it makes sense to refinance. No. it does not make sense. Monthly Payments According to money.CNN.comy, with mortgage rates near 35-year lowi, you m.y be aste ta cul your payments sharply by refinancing your loan. To dagafy for the best rates, you need a cred4 score of 749 or higher and ubually ac lease 20% equity. Even if vou have to settie for a higher rate, a new loan may save you money. The man considerabon is whether you will twe in your home long enough to offset the refinance closing costs. a certain bank with a 30 -year, 5.5% mortpage. The closing costs of the foan are aoplication fee, 3s2; credit report, 3165 ; title insurance, 0.4% of the amount tinanced; bile search, 3350 ; and attorney's fees, 1552 . You plan to live in your home for at least four more years. Use the Mortgage Refenancing Worlsheet to see if it makes sense to refinance your mortgage. MORTGAGE REFINANCING WORKSHEET STEP 1. Current monthly mortgage payment. STEP 2. New monthly mortgage payment if you refinance. STEP 3. Monthly savings. - Step 2. STEP 4. Total refinance closing costs (appraisal, title search, etc.). STEP 5. Total months needed to recoup your costs. STEP 6. Total months you plan to live in your home. The Bottom Line-If you plan to live in your home longer than the result in Step 5, it makes sense to refinance. (a) What is your currently monthly mortgage ( in 1)? 17 (b) Using this table, weat is your new monthly mortgspe peyment (in 9 ) it rou decide to refinance? (Round yeur answer to the nearest cent.) 4 (c) What a your monthly savings (in 1 ) if you decide to refinance? (Aound your answer is the nesrest cent.) 1 (d) Colculate the total refinance dosing cost (in 5). (found vour actwer to the nearest cere.) 1 (e) How many months would you need to recoup the refinance diesing cont) (Round your ansater up to the nearest month.) months (e) How many minths are you pianning to llve in your home? months (9) If you're plarinkg to live in your home for at least four more years, dses it make serde to refinance your mortgage? Yes, it makes sense to refinance. No. it does not make sense. Monthly Payments