Question

According to Mr. Jones on July 01, 2019, he and his wife exchanged their two-family house in Westchester County (400 Pinebrook Blvd, New Rochelle, NY),

According to Mr. Jones on July 01, 2019, he and his wife exchanged their two-family house in Westchester County (400 Pinebrook Blvd, New Rochelle, NY), which they rented entirely from January 01, 2010 to July 01, 2019, for a four-family rental property located at 685 Atlantic Avenue, Brooklyn, NY. At the time of the exchange, the FMV of the two-family house was $1,025,000, and the adjusted basis was $??????? (Calculate based on information provided below). The six-family house had an adjusted basis of $600,000 and an FMV of $900,000. The two-family home was subject to a $125,000 mortgage, which the buyer assumed.

Question:

Can you please show me how you get the adjusted basis for the Jones exchange of property? I know this is a 1031 exchange & I know there has to be depreciation to get the adjusted basis, but I'm not sure how to do it.

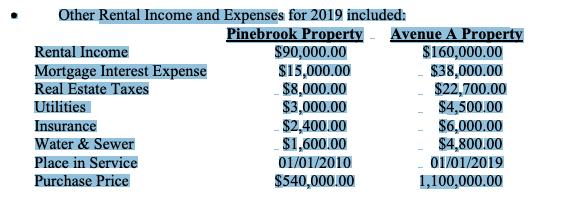

Other Rental Income and Expenses for 2019 included: Pinebrook Property $90,000.00 S15,000.00 $8,000.00 $3,000.00 $2,400.00 S1,600.00 01/01/2010 Avenue A Property $160,000.00 $38,000.00 $22,700.00 $4,500.00 $6,000.00 $4,800.00 01/01/2019 Rental Income Mortgage Interest Expense Real Estate Taxes Utilities Insurance Water & Sewer Place in Service Purchase Price $540,000.00 1,100,000.00

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The adjusted basis for twofamily house is 1025000 with assumption that MARCS depreciation under stra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started