Answered step by step

Verified Expert Solution

Question

1 Approved Answer

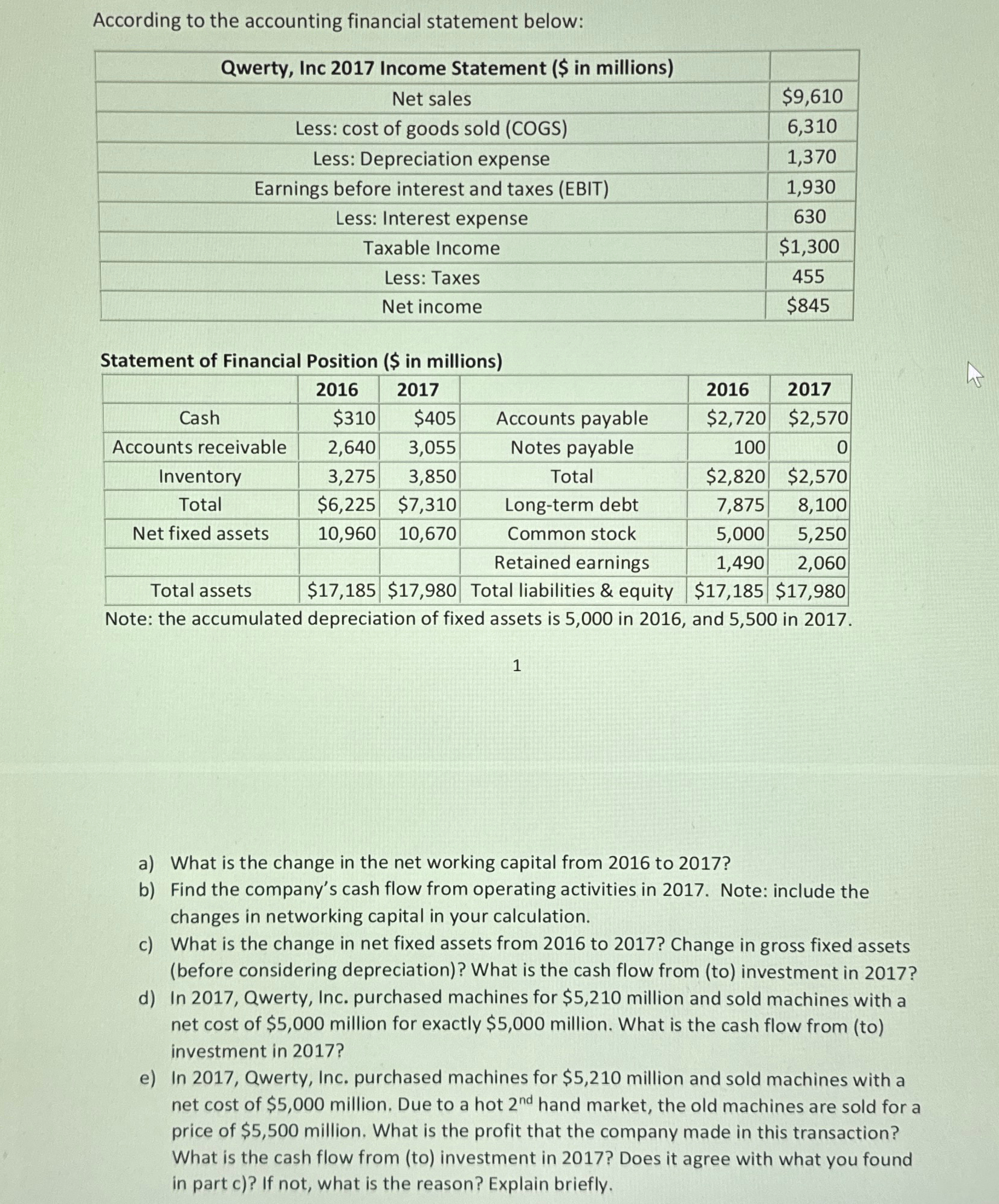

According to the accounting financial statement below: Qwerty, Inc 2017 Income Statement ($ in millions) Net sales Less: cost of goods sold (COGS) Less:

According to the accounting financial statement below: Qwerty, Inc 2017 Income Statement ($ in millions) Net sales Less: cost of goods sold (COGS) Less: Depreciation expense Earnings before interest and taxes (EBIT) Less: Interest expense Taxable Income Less: Taxes Net income $9,610 6,310 1,370 1,930 630 $1,300 455 $845 Statement of Financial Position ($ in millions) 2016 2017 2016 2017 Cash $310 $405 Accounts payable $2,720 $2,570 Accounts receivable 2,640 3,055 Inventory Total 3,275 3,850 $6,225 $7,310 Notes payable Total Long-term debt 100 0 $2,820 $2,570 7,875 8,100 Net fixed assets 10,960 10,670 Common stock Retained earnings 5,000 5,250 1,490 2,060 Total assets $17,185 $17,980 Total liabilities & equity $17,185 $17,980 Note: the accumulated depreciation of fixed assets is 5,000 in 2016, and 5,500 in 2017. 1 a) What is the change in the net working capital from 2016 to 2017? b) Find the company's cash flow from operating activities in 2017. Note: include the changes in networking capital in your calculation. c) What is the change in net fixed assets from 2016 to 2017? Change in gross fixed assets (before considering depreciation)? What is the cash flow from (to) investment in 2017? d) In 2017, Qwerty, Inc. purchased machines for $5,210 million and sold machines with a net cost of $5,000 million for exactly $5,000 million. What is the cash flow from (to) investment in 2017? e) In 2017, Qwerty, Inc. purchased machines for $5,210 million and sold machines with a net cost of $5,000 million. Due to a hot 2nd hand market, the old machines are sold for a price of $5,500 million. What is the profit that the company made in this transaction? What is the cash flow from (to) investment in 2017? Does it agree with what you found in part c)? If not, what is the reason? Explain briefly.

Step by Step Solution

★★★★★

3.60 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer a To calculate the change in net working capital from 2016 to 2017 we use the formula Change in Net Working Capital Current Assets Current Liab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started