According to the Case study provided above answer the following question:

- Identify the opportunities for Go-Jek to expand to other countries in Asia, and to the Western countries. Further, identify the challenges it may face in internationalization and make appropriate recommendations for Go-Jek's internationalization.

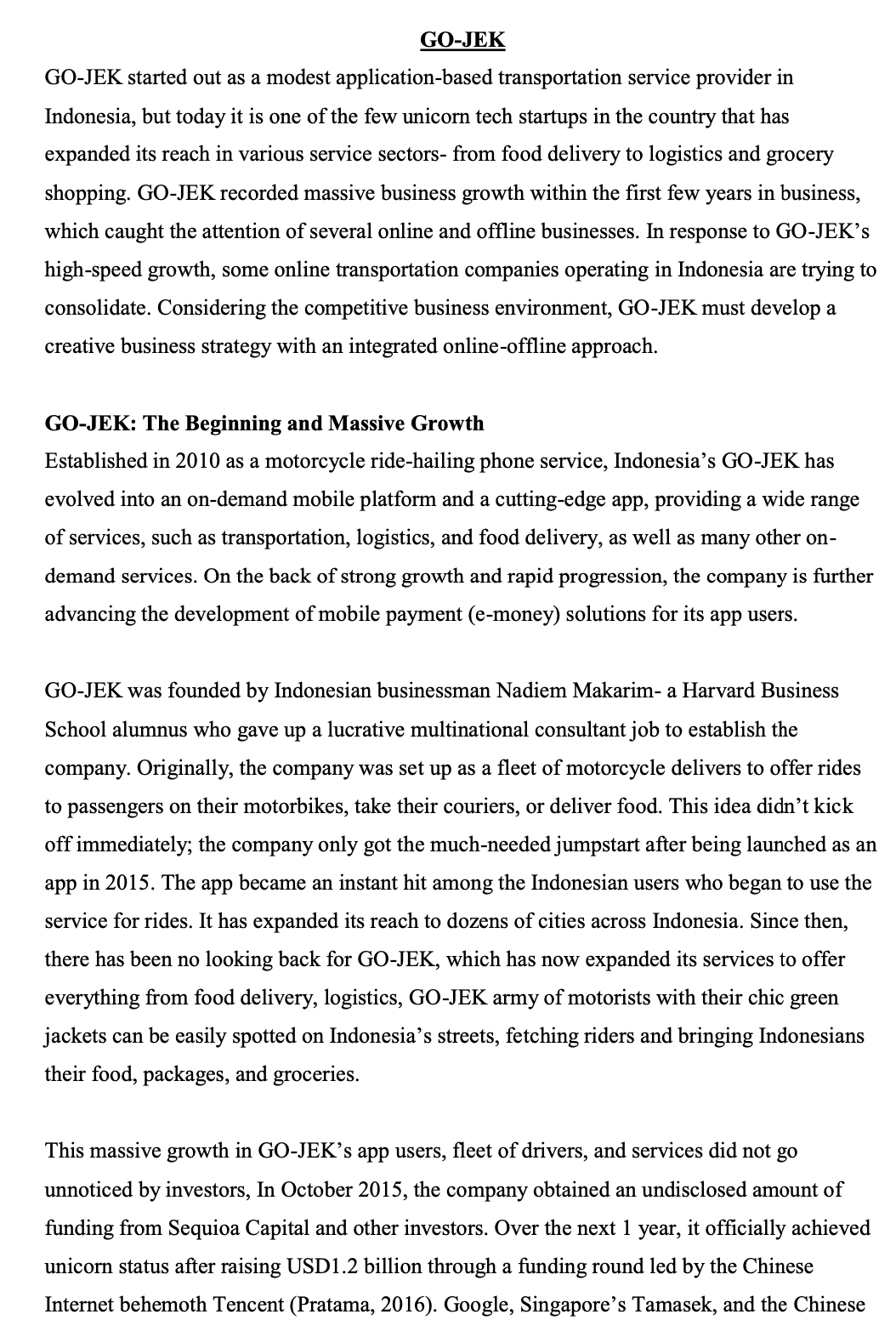

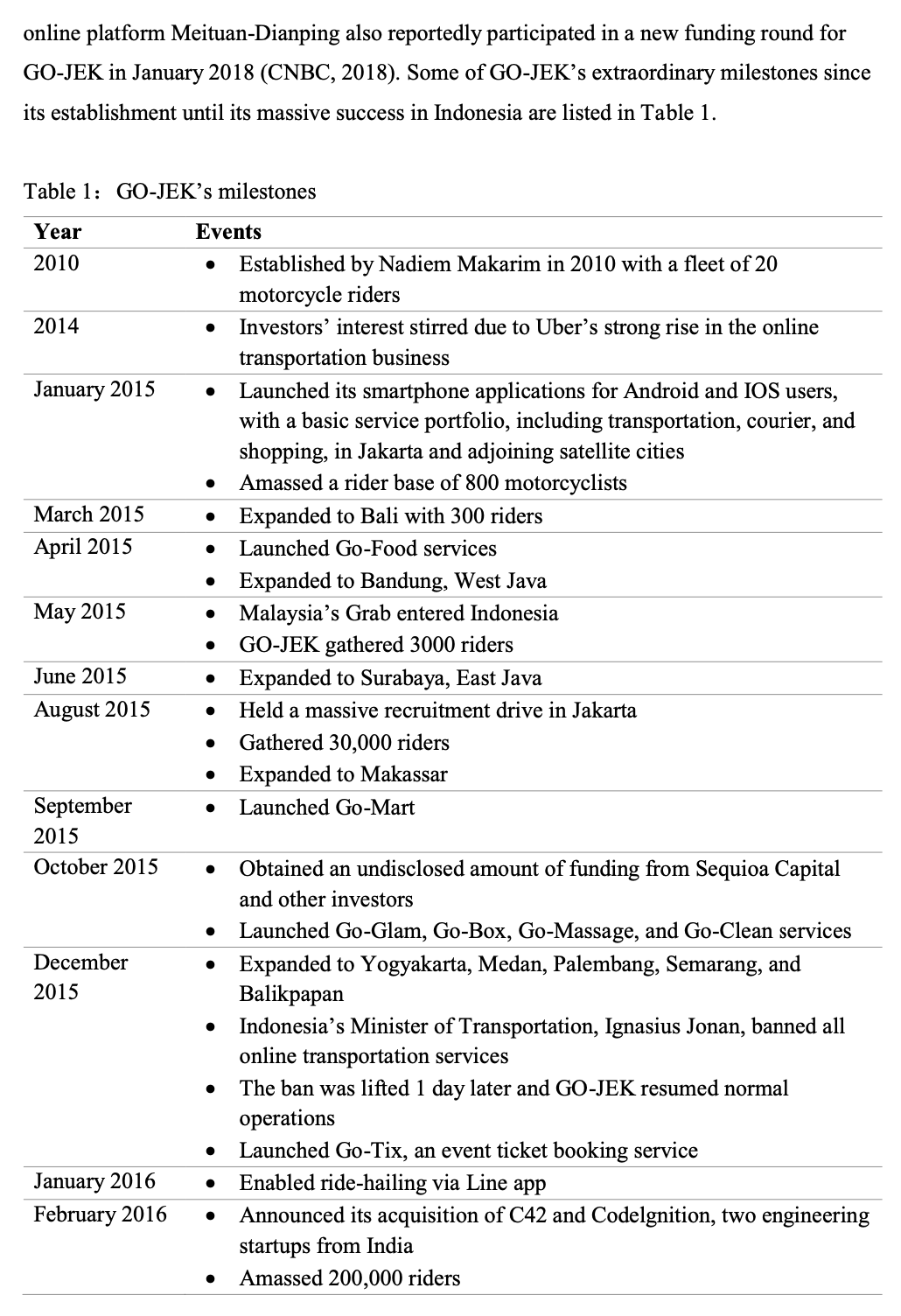

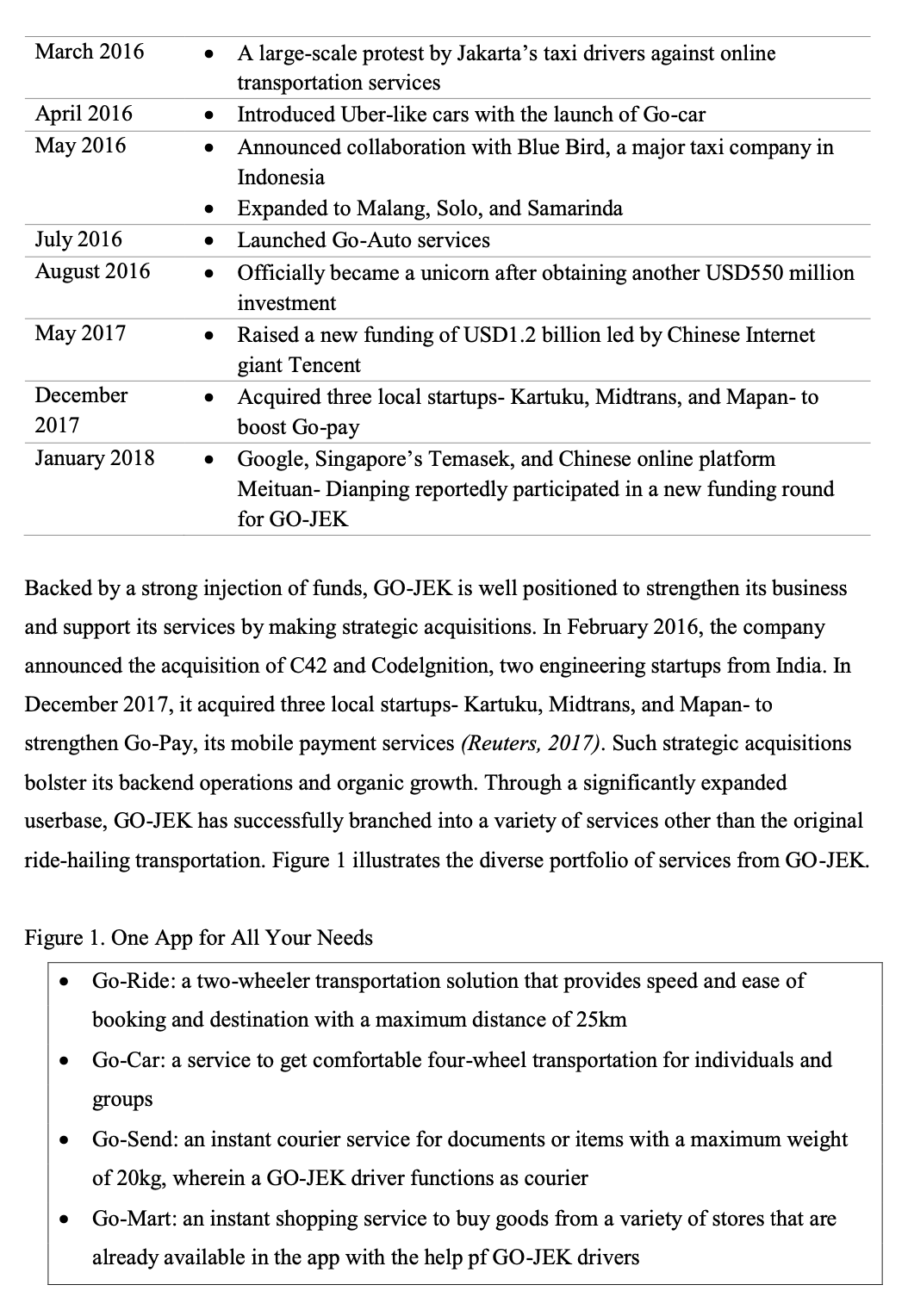

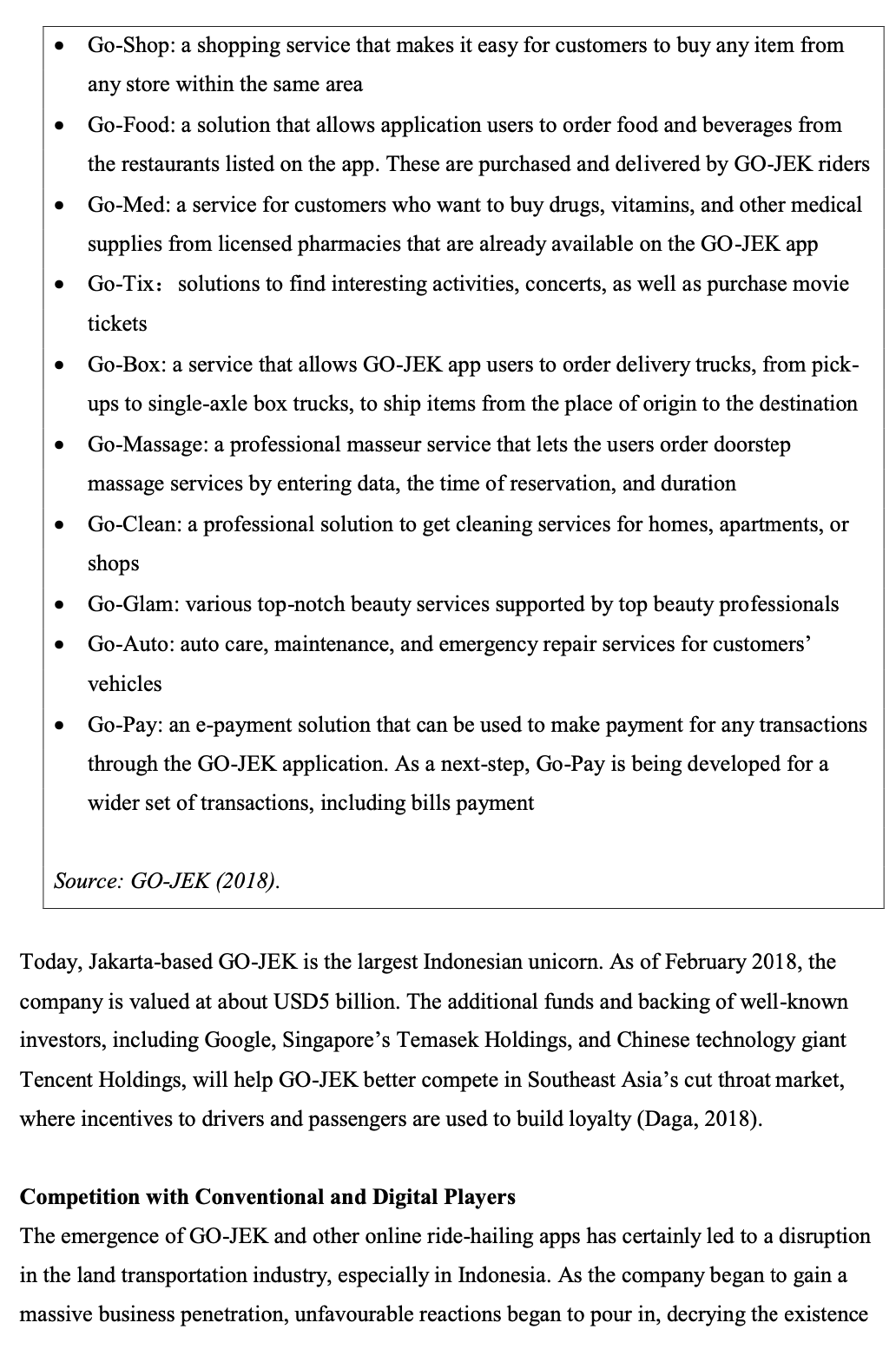

GO-JEK GO-JEK started out as a modest application-based transportation service provider in Indonesia, but today it is one of the few unicorn tech startups in the country that has expanded its reach in various service sectors- from food delivery to logistics and grocery shopping. GO-JEK recorded massive business growth within the first few years in business, which caught the attention of several online and offline businesses. In response to GO-JEK's high-speed growth, some online transportation companies operating in Indonesia are trying to consolidate. Considering the competitive business environment, GO-JEK must develop a creative business strategy with an integrated online-offline approach. GO-JEK: The Beginning and Massive Growth Established in 2010 as a motorcycle ride-hailing phone service, Indonesia's GO-JEK has evolved into an on-demand mobile platform and a cutting-edge app, providing a wide range of services, such as transportation, logistics, and food delivery, as well as many other on- demand services. On the back of strong growth and rapid progression, the company is further advancing the development of mobile payment (e-money) solutions for its app users. GO-JEK was founded by Indonesian businessman Nadiem Makarim- a Harvard Business School alumnus who gave up a lucrative multinational consultant job to establish the company. Originally, the company was set up as a fleet of motorcycle delivers to offer rides to passengers on their motorbikes, take their couriers, or deliver food. This idea didn't kick off immediately; the company only got the much-needed jumpstart after being launched as an app in 2015. The app became an instant hit among the Indonesian users who began to use the service for rides. It has expanded its reach to dozens of cities across Indonesia. Since then, there has been no looking back for GO-JEK, which has now expanded its services to offer everything from food delivery, logistics, GO-JEK army of motorists with their chic green jackets can be easily spotted on Indonesia's streets, fetching riders and bringing Indonesians their food, packages, and groceries. This massive growth in GO-JEK's app users, fleet of drivers, and services did not go unnoticed by investors, In October 2015, the company obtained an undisclosed amount of funding from Sequioa Capital and other investors. Over the next 1 year, it officially achieved unicorn status after raising USD1.2 billion through a funding round led by the Chinese Internet behemoth Tencent (Pratama, 2016). Google, Singapore's Tamasek, and the Chineseonline platform Meituan-Dianping also reportedly participated in a new funding round for GO-JEK in January 2018 (CNBC, 2018). Some of GO-JEK's extraordinary milestones since its establishment until its massive success in Indonesia are listed in Table 1. Table 1: GO-JEK's milestones Year Events 2010 . Established by Nadiem Makarim in 2010 with a fleet of 20 motorcycle riders 2014 . Investors' interest stirred due to Uber's strong rise in the online transportation business January 2015 . Launched its smartphone applications for Android and IOS users, with a basic service portfolio, including transportation, courier, and shopping, in Jakarta and adjoining satellite cities Amassed a rider base of 800 motorcyclists March 2015 . Expanded to Bali with 300 riders April 2015 . Launched Go-Food services . Expanded to Bandung, West Java May 2015 . Malaysia's Grab entered Indonesia . GO-JEK gathered 3000 riders June 2015 . Expanded to Surabaya, East Java August 2015 . Held a massive recruitment drive in Jakarta . Gathered 30,000 riders . Expanded to Makassar September Launched Go-Mart 2015 October 2015 Obtained an undisclosed amount of funding from Sequioa Capital and other investors . Launched Go-Glam, Go-Box, Go-Massage, and Go-Clean services December . Expanded to Yogyakarta, Medan, Palembang, Semarang, and 2015 Balikpapan Indonesia's Minister of Transportation, Ignasius Jonan, banned all online transportation services . The ban was lifted 1 day later and GO-JEK resumed normal operations . Launched Go-Tix, an event ticket booking service January 2016 Enabled ride-hailing via Line app February 2016 . Announced its acquisition of C42 and Codelgnition, two engineering startups from India Amassed 200,000 ridersMarch 2016 . A large-scale protest by Jakarta's taxi drivers against online transportation services April 2016 . Introduced Uber-like cars with the launch of Go-car May 2016 . Announced collaboration with Blue Bird, a major taxi company in Indonesia . Expanded to Malang, Solo, and Samarinda July 2016 . Launched Go-Auto services August 2016 . Officially became a unicorn after obtaining another USD550 million investment May 2017 . Raised a new funding of USD1.2 billion led by Chinese Internet giant Tencent December Acquired three local startups- Kartuku, Midtrans, and Mapan- to 2017 boost Go-pay January 2018 . Google, Singapore's Temasek, and Chinese online platform Meituan- Dianping reportedly participated in a new funding round for GO-JEK Backed by a strong injection of funds, GO-JEK is well positioned to strengthen its business and support its services by making strategic acquisitions. In February 2016, the company announced the acquisition of C42 and Codelgnition, two engineering startups from India. In December 2017, it acquired three local startups- Kartuku, Midtrans, and Mapan- to strengthen Go-Pay, its mobile payment services (Reuters, 2017). Such strategic acquisitions bolster its backend operations and organic growth. Through a significantly expanded userbase, GO-JEK has successfully branched into a variety of services other than the original ride-hailing transportation. Figure 1 illustrates the diverse portfolio of services from GO-JEK. Figure 1. One App for All Your Needs . Go-Ride: a two-wheeler transportation solution that provides speed and ease of booking and destination with a maximum distance of 25km . Go-Car: a service to get comfortable four-wheel transportation for individuals and groups . Go-Send: an instant courier service for documents or items with a maximum weight of 20kg, wherein a GO-JEK driver functions as courier . Go-Mart: an instant shopping service to buy goods from a variety of stores that are already available in the app with the help pf GO-JEK driversGo-Shop: a shopping service that makes it easy for customers to buy any item from any store within the same area . Go-Food: a solution that allows application users to order food and beverages from the restaurants listed on the app. These are purchased and delivered by GO-JEK riders . Go-Med: a service for customers who want to buy drugs, vitamins, and other medical supplies from licensed pharmacies that are already available on the GO-JEK app . Go-Tix: solutions to find interesting activities, concerts, as well as purchase movie tickets Go-Box: a service that allows GO-JEK app users to order delivery trucks, from pick- ups to single-axle box trucks, to ship items from the place of origin to the destination . Go-Massage: a professional masseur service that lets the users order doorstep massage services by entering data, the time of reservation, and duration . Go-Clean: a professional solution to get cleaning services for homes, apartments, or shops Go-Glam: various top-notch beauty services supported by top beauty professionals Go-Auto: auto care, maintenance, and emergency repair services for customers' vehicles Go-Pay: an e-payment solution that can be used to make payment for any transactions through the GO-JEK application. As a next-step, Go-Pay is being developed for a wider set of transactions, including bills payment Source: GO-JEK (2018). Today, Jakarta-based GO-JEK is the largest Indonesian unicorn. As of February 2018, the company is valued at about USD5 billion. The additional funds and backing of well-known investors, including Google, Singapore's Temasek Holdings, and Chinese technology giant Tencent Holdings, will help GO-JEK better compete in Southeast Asia's cut throat market, where incentives to drivers and passengers are used to build loyalty (Daga, 2018). Competition with Conventional and Digital Players The emergence of GO-JEK and other online ride-hailing apps has certainly led to a disruption in the land transportation industry, especially in Indonesia. As the company began to gain a massive business penetration, unfavourable reactions began to pour in, decrying the existenceof online transportation apps. Somewhat surprisingly, a kneejerk reaction was also demonstrated by some in the "ojek" driver community, who failed to view GO-JEK as a lucrative opportunity to boost their income and efficiency. For conventional taxi drivers, GO- JEK understandably posed a mounting threat with the rise of Go-Car. To counter the rise of such online ride-hailing apps, and particularly GO-JEK, detractors staged large-scale protests not only in Jakarta but also in other big cities. In order to defuse the looming tension, the Indonesian government made several attempts to mediate and issue revised regulations to provide a win-win solution for both parties. One of the new regulations that can allow transportation companies to lower tariff is expected to stir healthier competition among conventional and online transportation companies. GO-JEK, on its part, has attempted to join hands with conventional taxi operators in Indonesia by launching a new service called Go-Blue Bird- named after the largest taxi operator in Indonesia, Blue Bird. Under the collaboration, users can book a Blue Bird taxi through the GO-JEK app and Blue Bird taxi drivers can also obtain orders from passengers looking for a ride. This partnership represents a long-term commitment by Blue Bird and GO-JEK to jointly innovate and provide the best services to their community, as well as improve the well-being of drivers (Marzuki, 2017). As a mutual benefit, Blue Bird taxi drivers have the opportunity to acquire new passengers, while GO-JEK can also offer an additional fleet of transport to its users. Such a win-win collaboration could defuse the tensions previously occurring on the part of taxi drivers. GO-JEK's close competitors would certainly be fellow app-based online transport businesses. Malaysia's Grab and Uber are its main rivals who are stirring competition in Indonesia's online ride-hailing transportation industry. Grab is a Malaysia-based technology company that offers ride-hailing and logistics services through its app in the home country and neighbouring Southeast Asian nations such as Singapore, Indonesia, Phillippines, Vietnam, Thailand, Myanmar, and Cambodia. As a regional player, Grab enjoys deeper pockets to fund its expansion in the region. Uber is a peer-to-peer ridesharing, food delivery, and transportation network company headquartered in San Francissco, California, with operations in 633 cities worldwide.In March 2018, Grab announced the acquisition of Uber's Southeast Asia operations. This game-changing deal represented the biggest-ever acquisition in this space in Southeast Asia. Under the terms of the acquisition, Uber's ridesharing and food-delivery businesses will be integrated into Grab's existing transportation and payment platform. This combined entity aims to be the number one online-too'line (020) mobile platform and one of the major companies handling food delivery in Southeast Asia (Grab, 2018). Integrating Online and Ofine Campaign To counter the increasingly erce competition, GO-JEK focused its attention on the very diverse range of services it offers to its customers and the ways to meet their everyday needs. All GO-JEK services (e.g., Go-Ride, Go-Car, GoBox, GoSend, Go-Mart, GoFood, Go- Auto, Go-Med, and Go-Busway) provide solutions to problems faced by people in all major Indonesian cities, be it the ease of nding an Ojek (the motorcycle taxi) to wade through the infamous trafc snarls or a cab at the doorstep, delivering items easily and securely or buying groceries sitting at home. Unfortunately, not many users are aware of all these features. In fact, customers need to be \"aware\" of a service, show interest (appeal) in the benets it offers, know more information (ask) about the service or product, and then take an \"action\" (download the app, opt to use a service). If they are \"wowed\" by the experience, they would often voluntarily share their stories with those around them (advocate). This is the 5A model (aware-appealaskactadvocate) that represents a new customer path in the digital age (Kotler, Kartajaya and Hooi, 2016). This is why, GOJEK continues to intensively work on introducing new services or enhancing the existing ones with new features that appeal to the current and new customers. To target those who have not yet downloaded the GO-JEK app and build awareness, the company carries out massive publicity drives through various media- online and ofine. It uses various attractive offers, especially discounted rates, to stir the interest of potential customers and customer education to make the existing users of the GOJEK app try out the diverse range of services on offer. As a technology company, GOJEK takes full advantage of the digital media to introduce its services and benets. However, as its competitors- especially Grab- are also proactive in campaigning on the digital and social media, it is re-emphasizing the importance of the word ofmouth strategy (WOM) in order to attract the attention of its target audience. The main keys are story and placement. GOJEK uses two types of story-based contents in its creative campaigns to stimulate WOM response from the audience: authentic stories told by drivers and stories that contain the elements of fun and emotion. In the \"For My Country\" campaign, for example, the company presents an inspiring and emotional story from seven GO-JEK drivers. The company also encourages customers to create and share their personal stories (user-generated content) through social media. Funny experiences and inspirational and touching anecdotes from customer interactions with GOJEK drivers are widely shared on various social media platforms. Many of these stories become viral that keeps the interest of people in GO-JEK alive while also educating potential customers about the app and its services. In addition to stories, placement is also a key determinant of the success of campaigns in the digital and social media because each social media has different characters and audiences (Wulandari, 2016). Despite a strong online presence through various campaigns on digital media, GOJEK continues to utilize traditional media. The company invests heavily in outdoor advertising through billboards and print media, mostly advertorials, to boost its ofine campaign. Below the-line advertising is also conducted to engage target customers, especially in fairs, festivals, and music events. Along with its digital media campaigns, GO-JEK pays special attention to the importance of creativity in campaigning. For example, some billboards installed by the company do not apply the rule of thumb commonly used by other advertisers. Instead of using attractive pictures and ashy words, it actually uses texts like those in classied print ads. Such creative execution of traditional campaigns then creates word of mouth on social media, triggered by audiences documenting such unique billboards and sharing the messages. Such integration of online and ofine campaigning helps the company acquire new customers and stand its ground against competitors, who are also aggressively expanding their reach in Indonesia's lucrative techsavvy user market