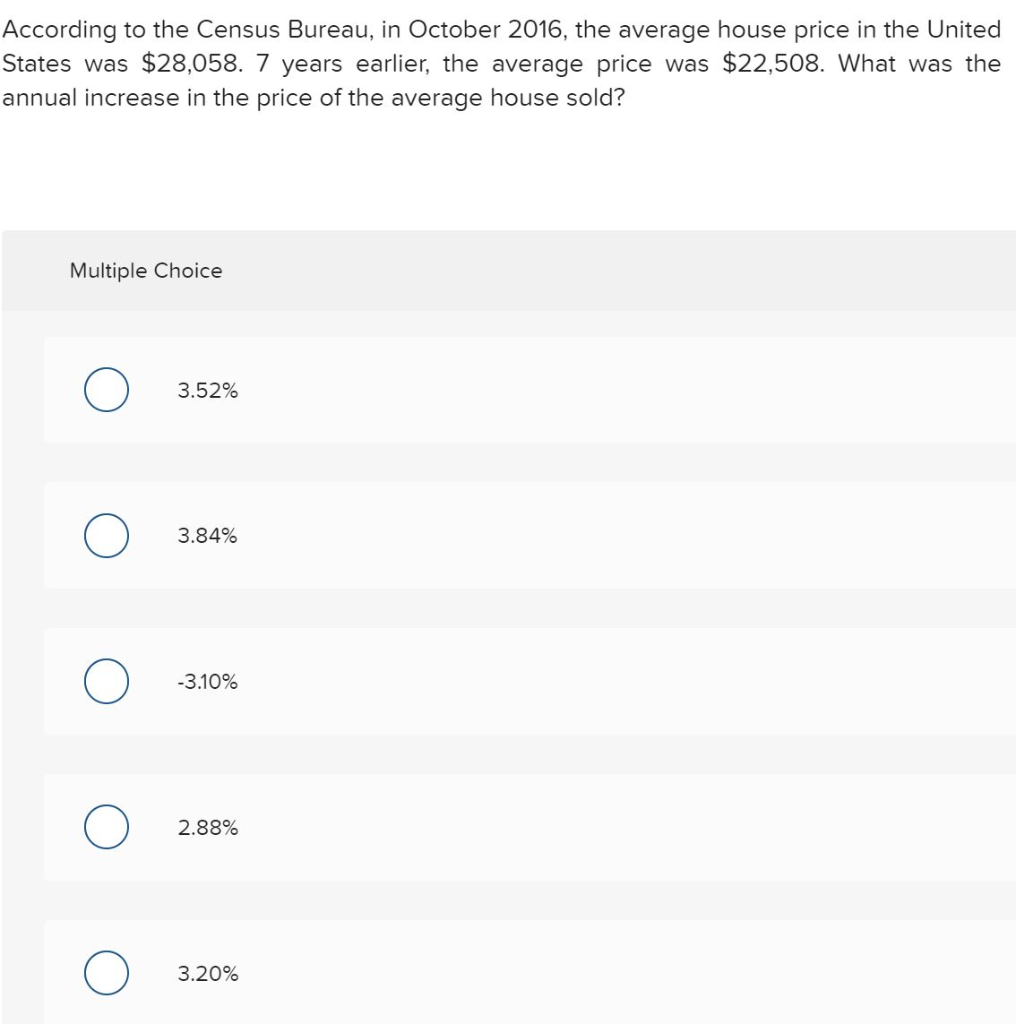

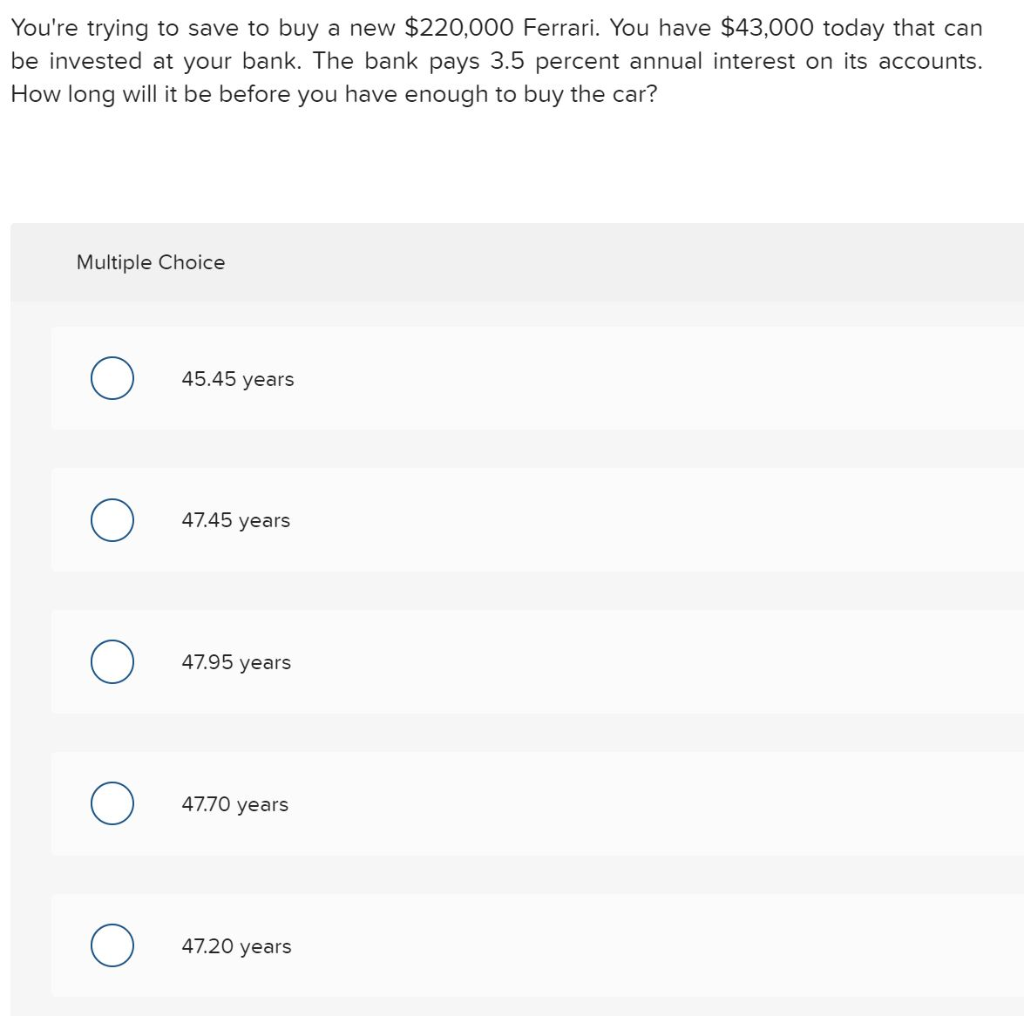

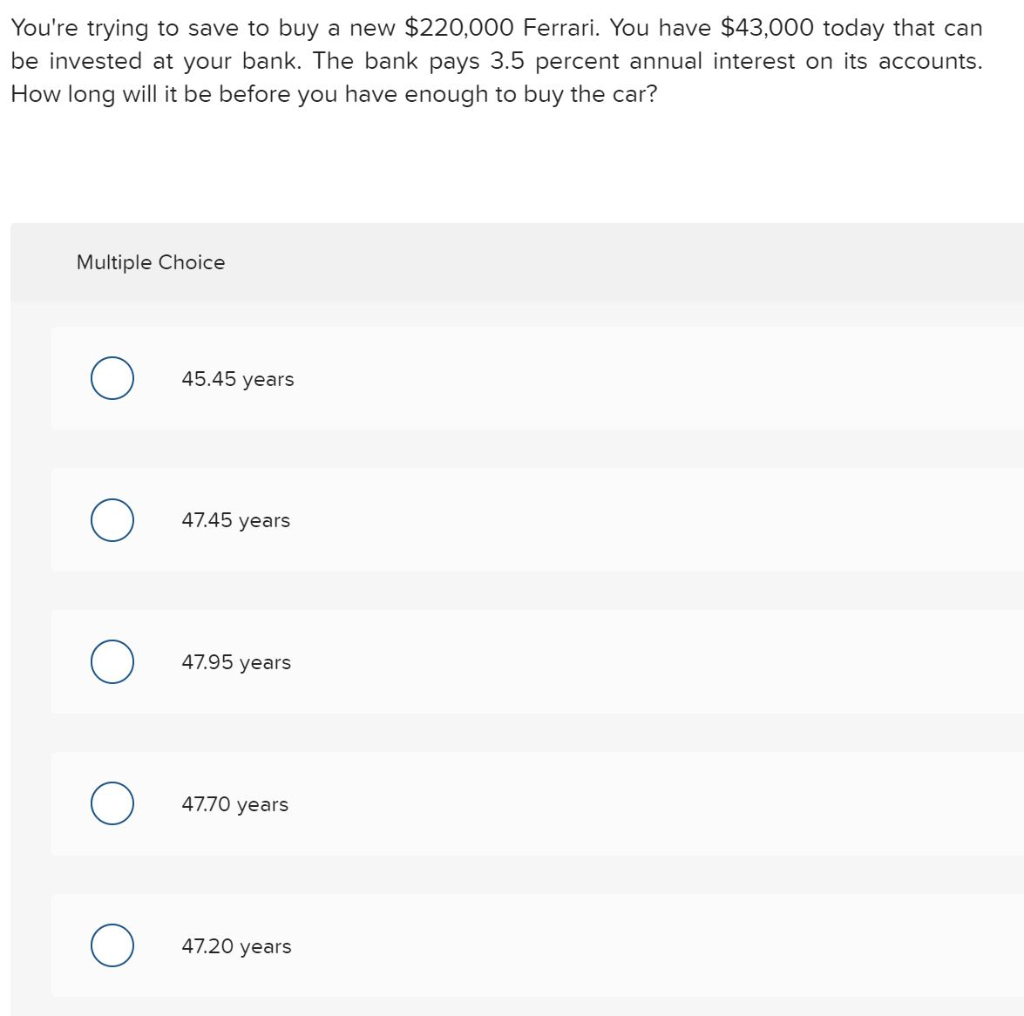

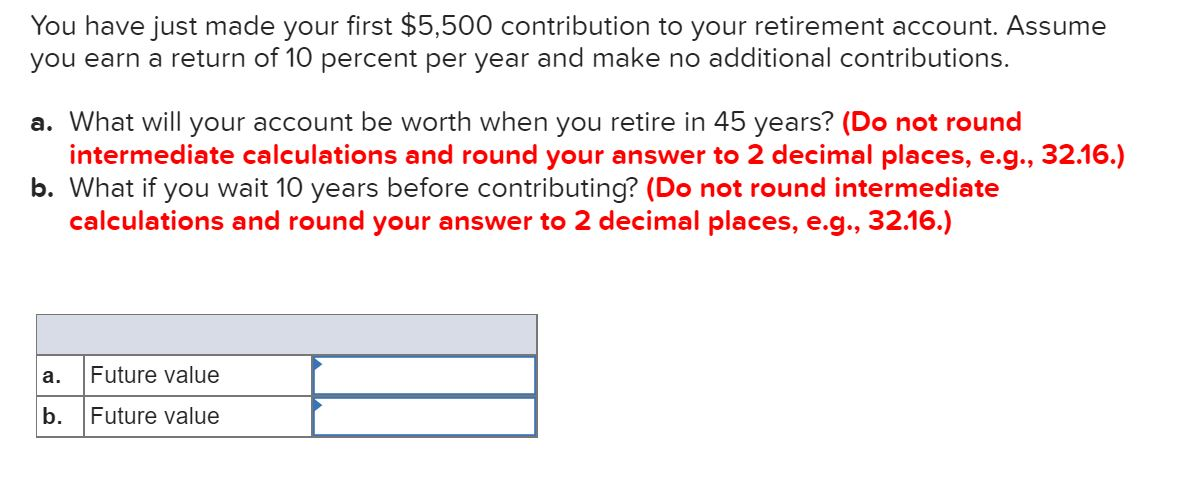

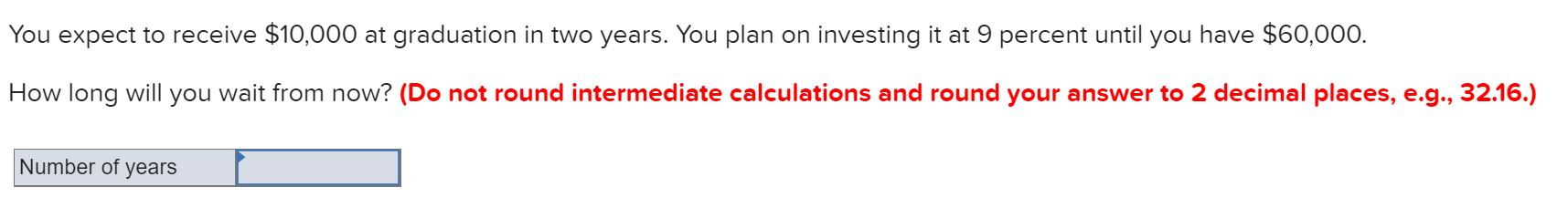

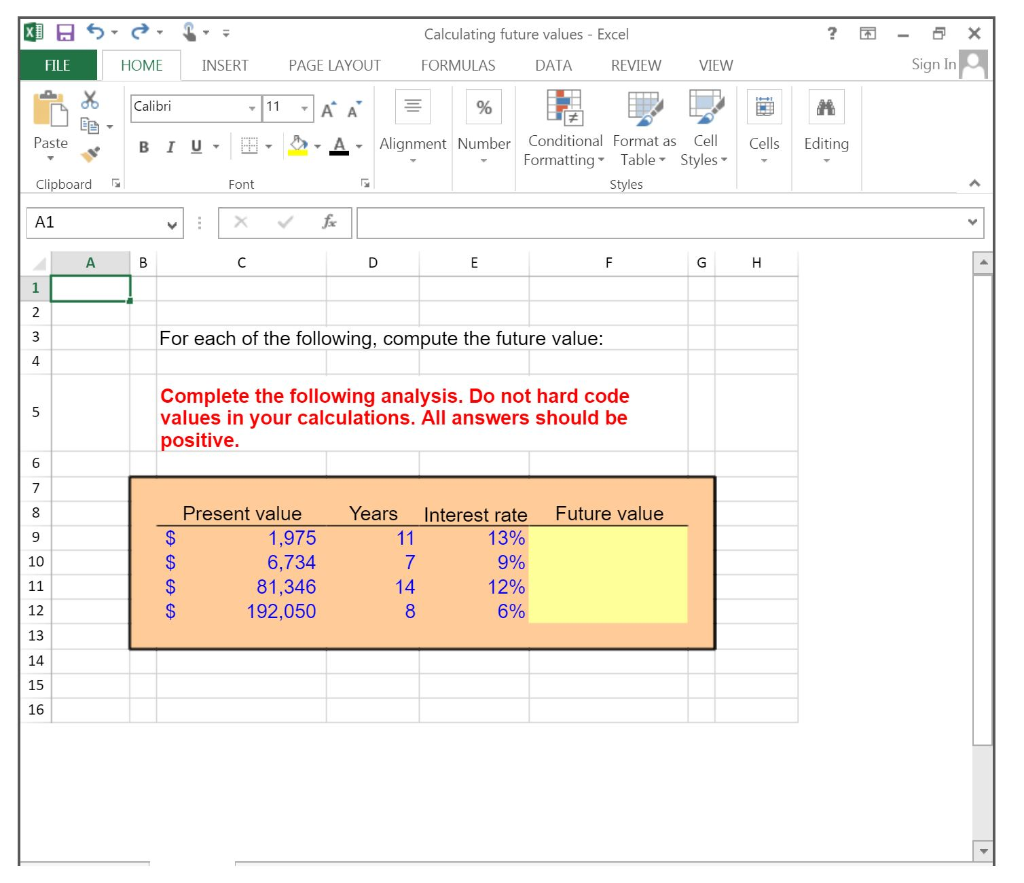

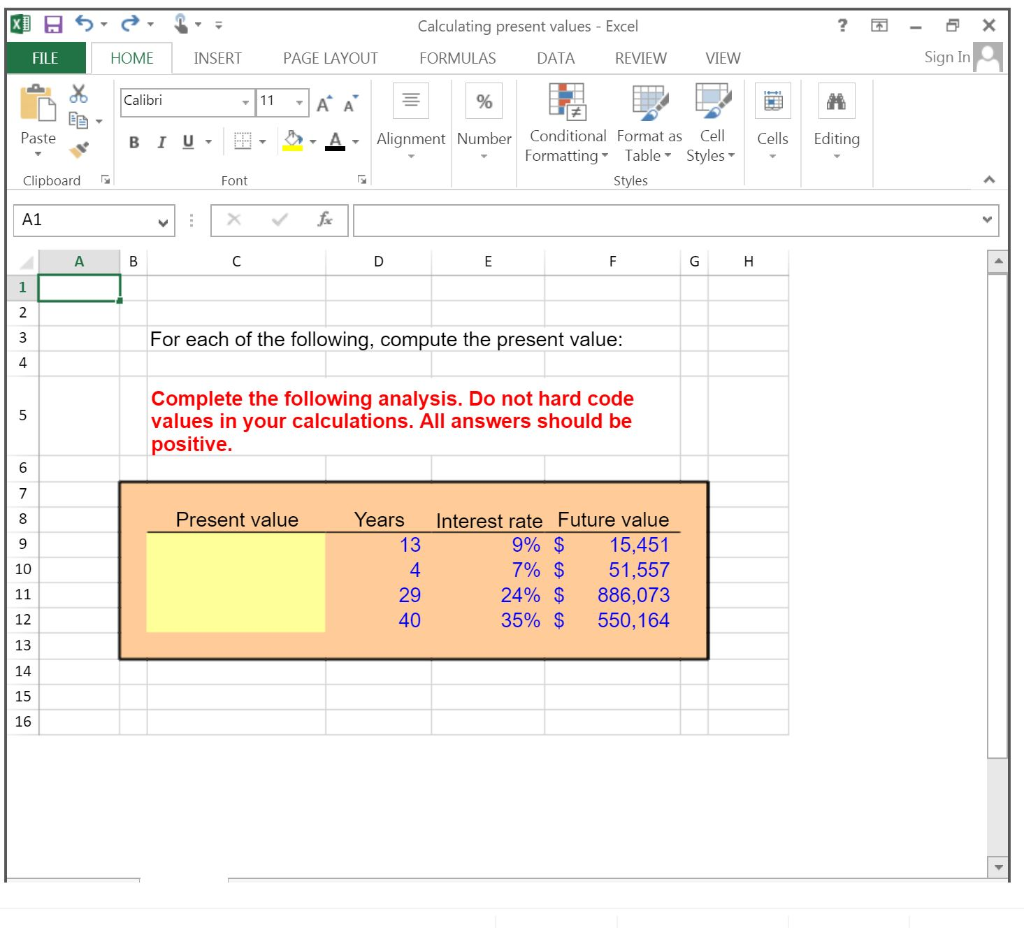

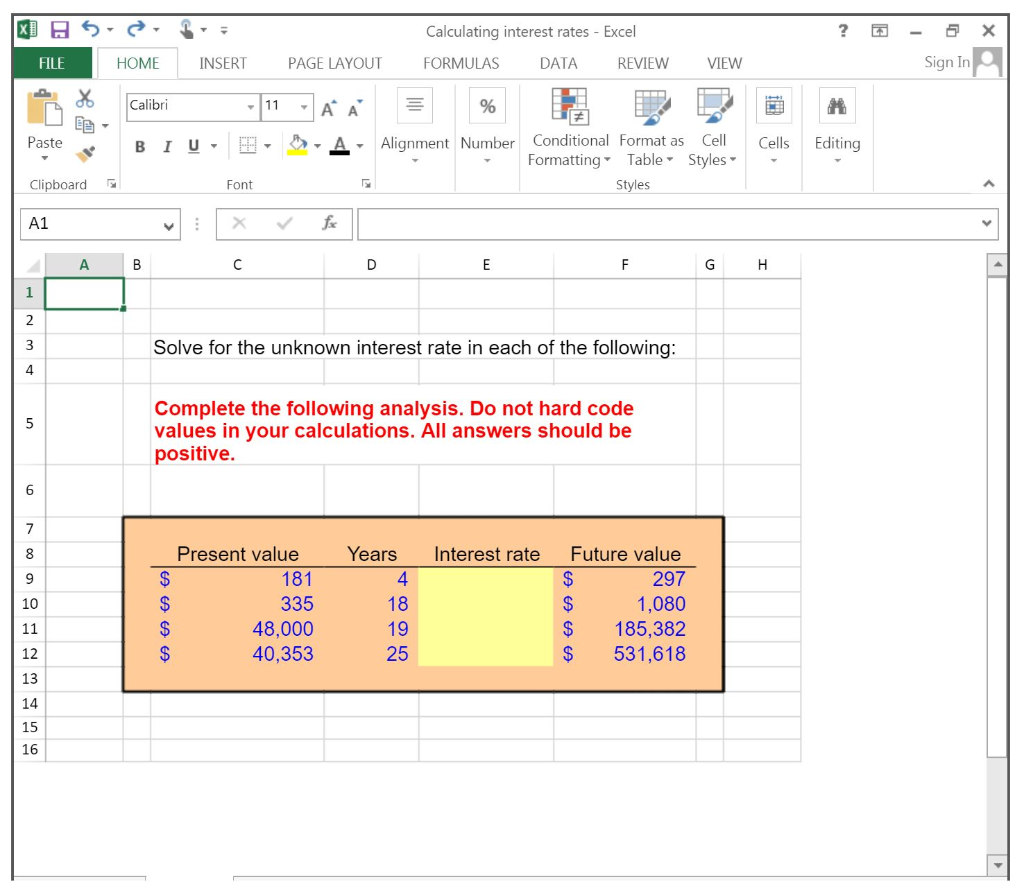

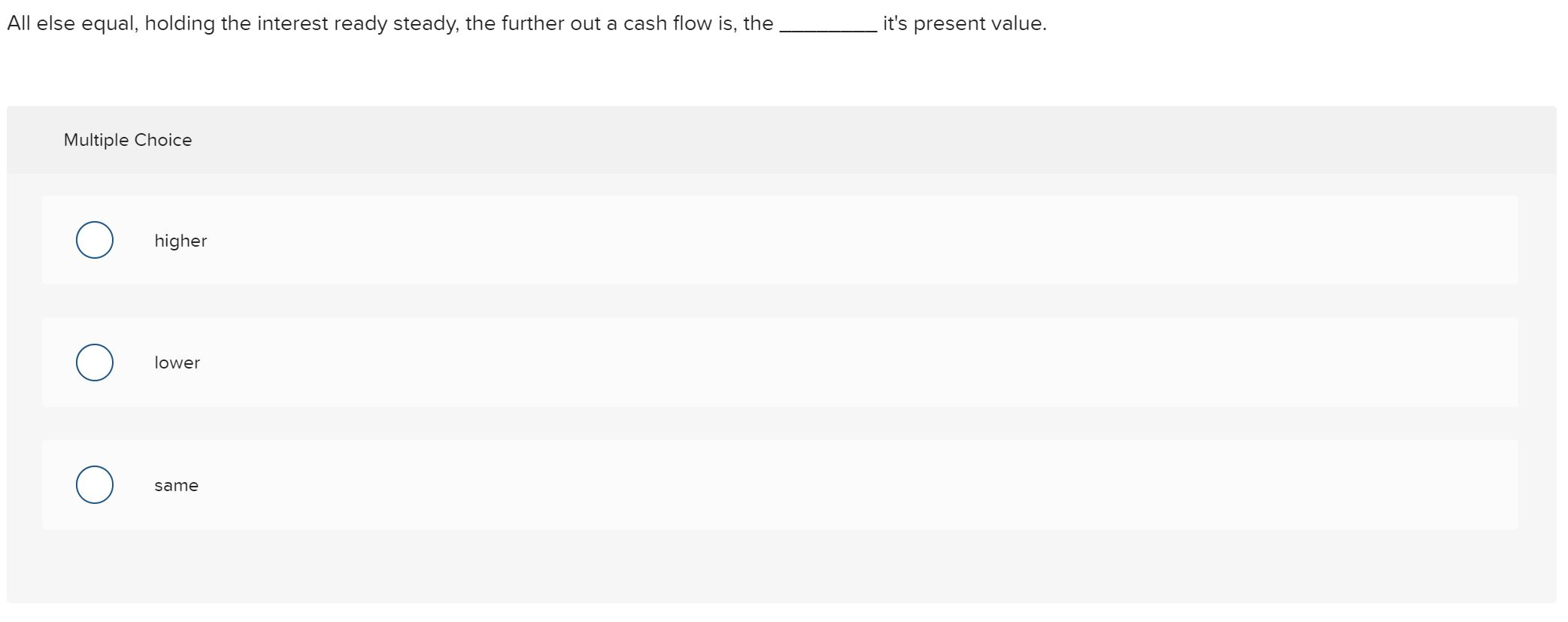

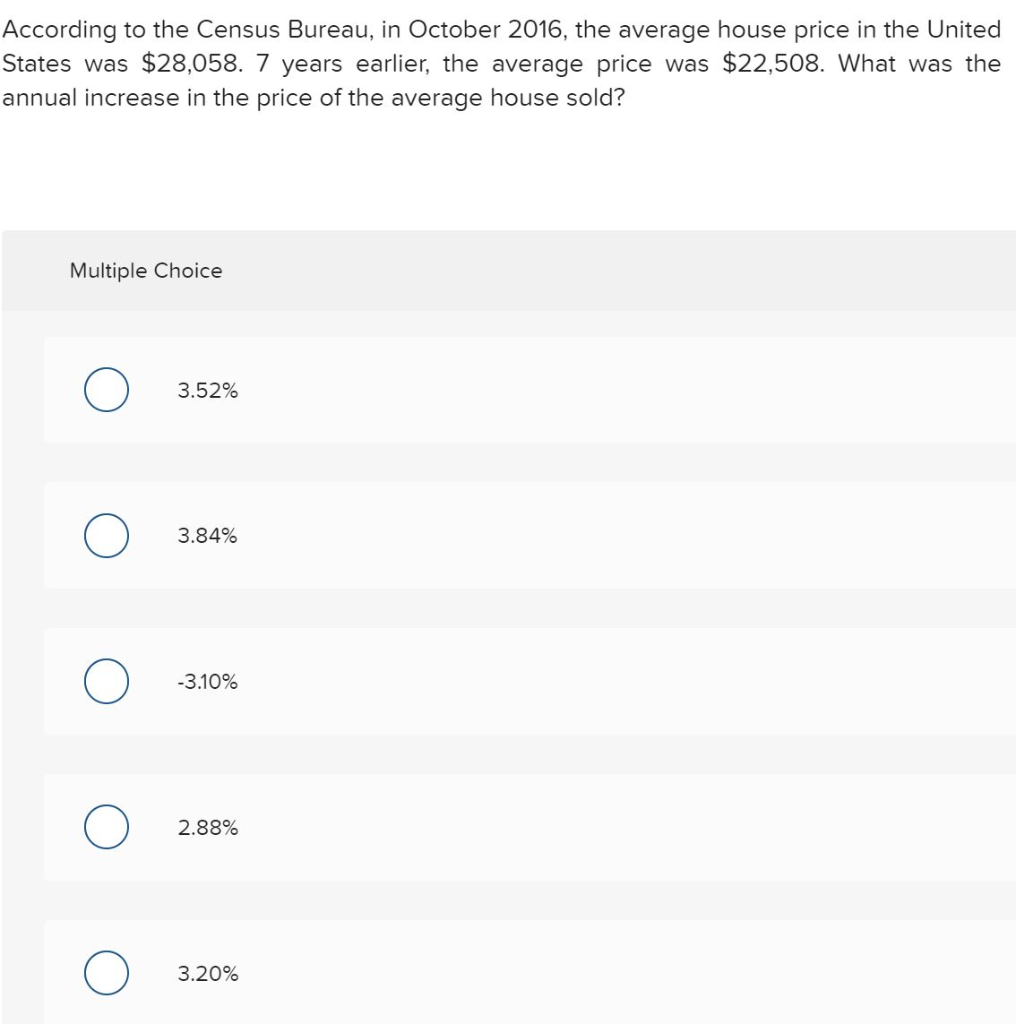

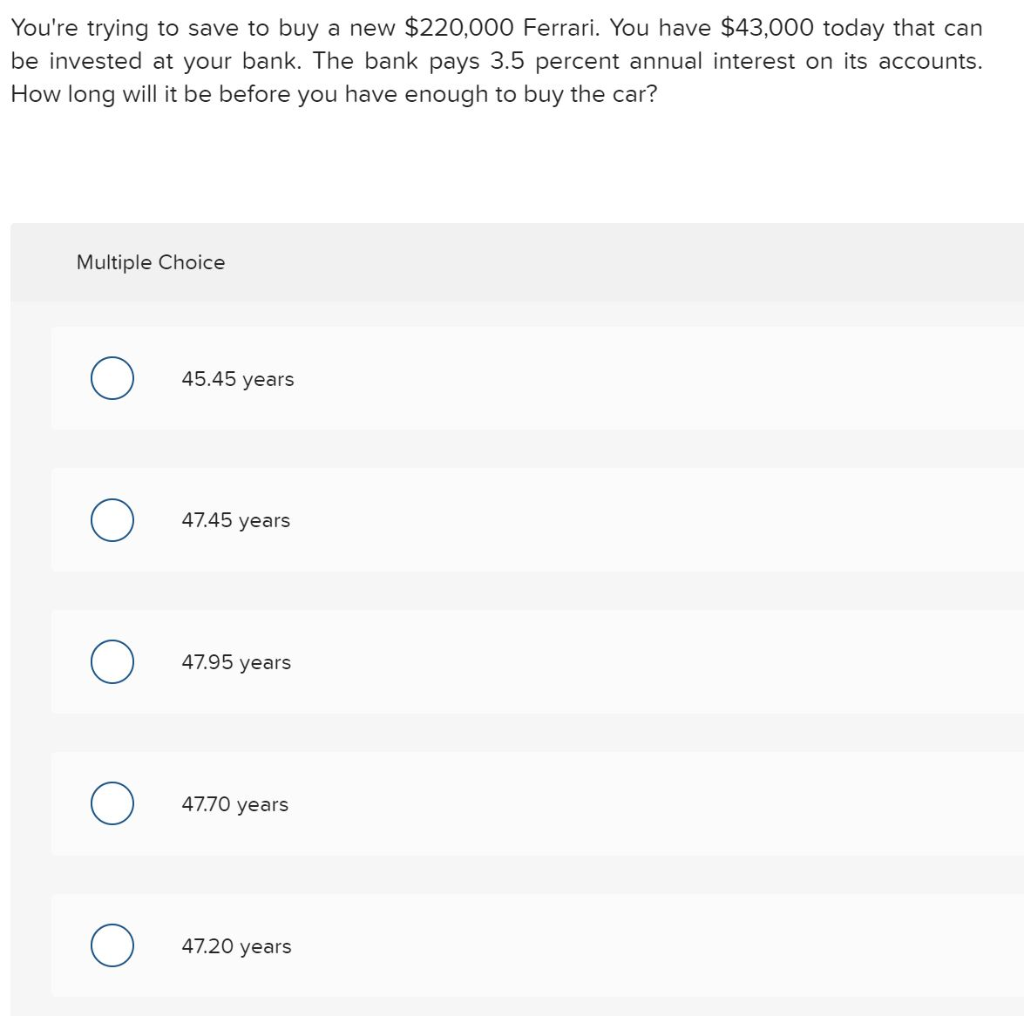

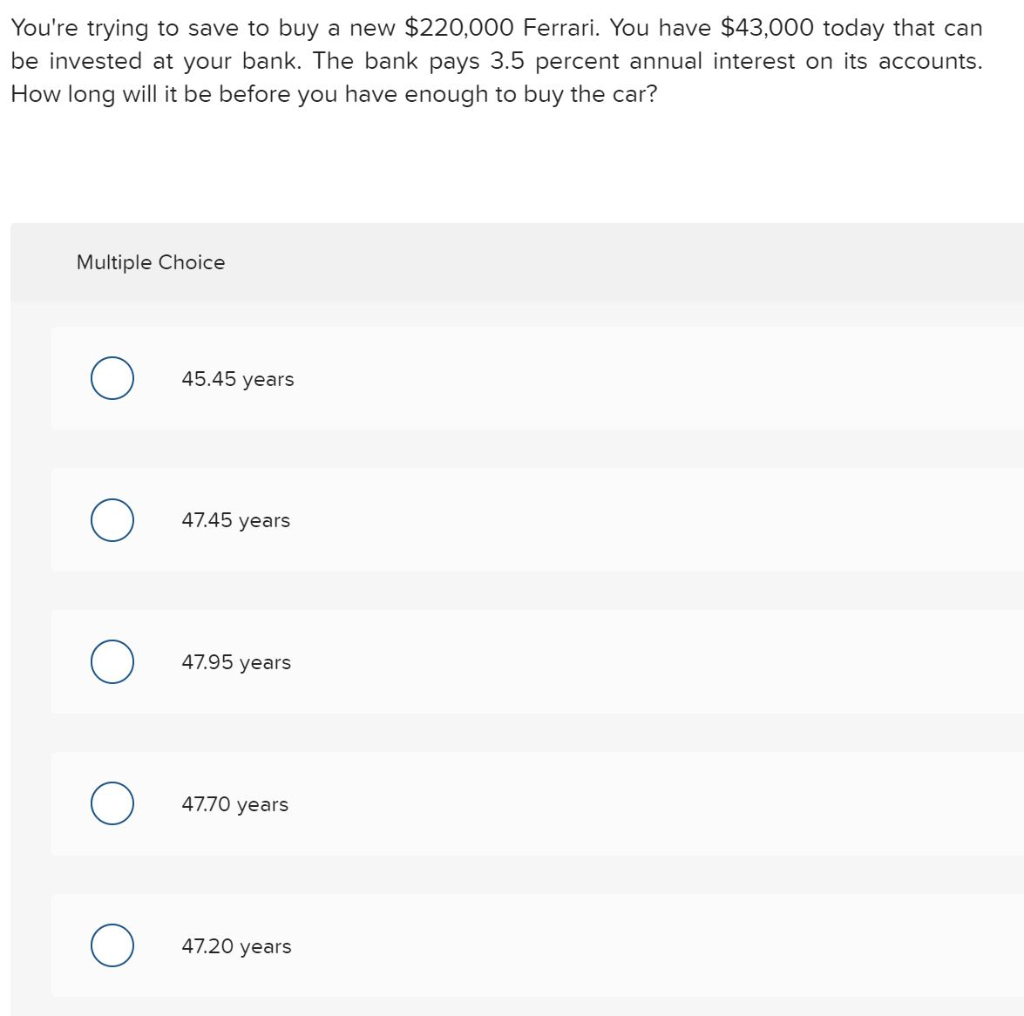

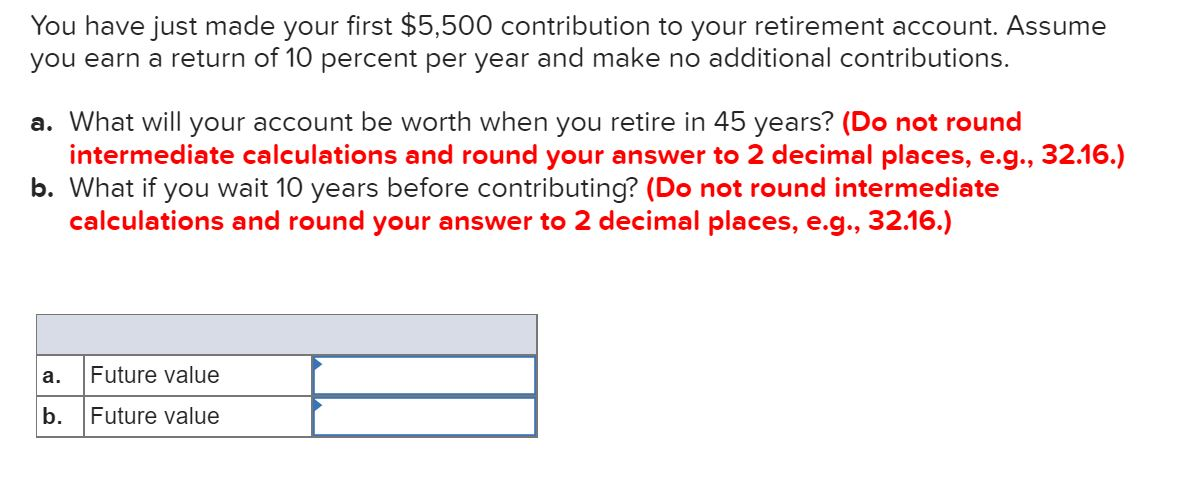

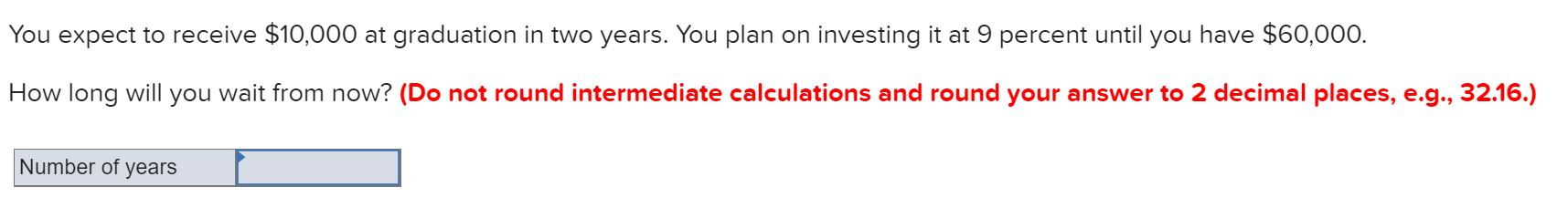

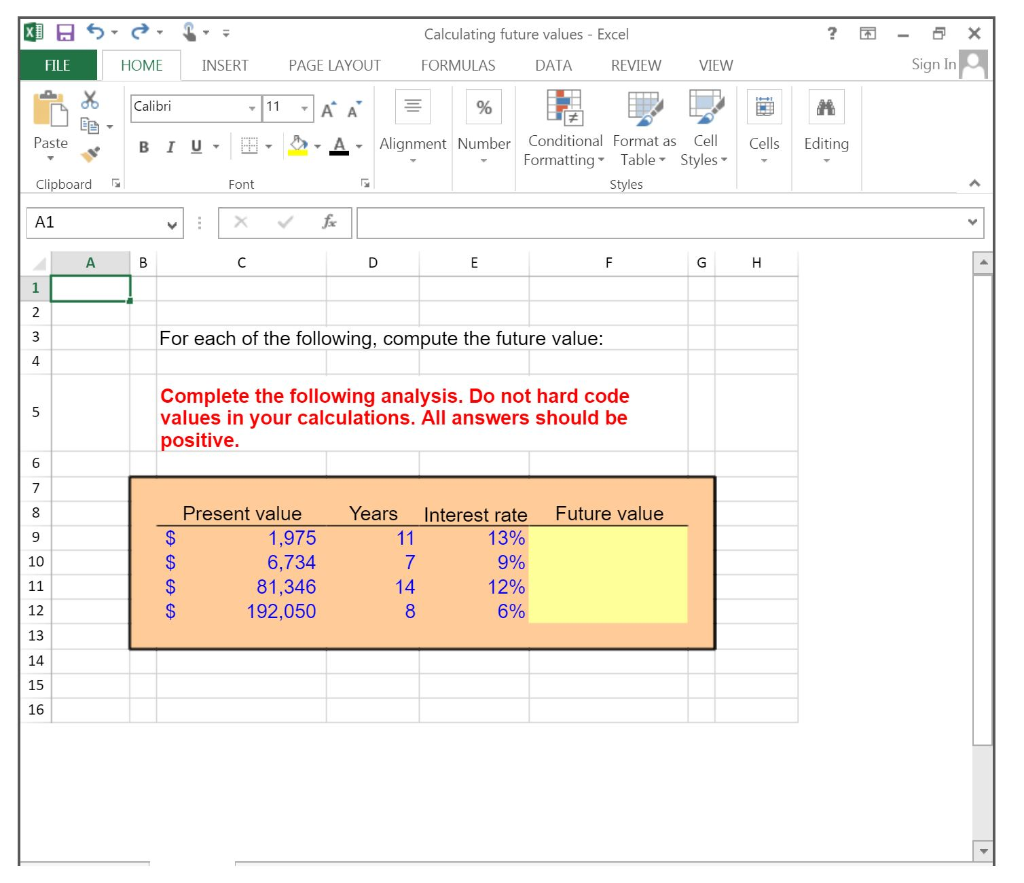

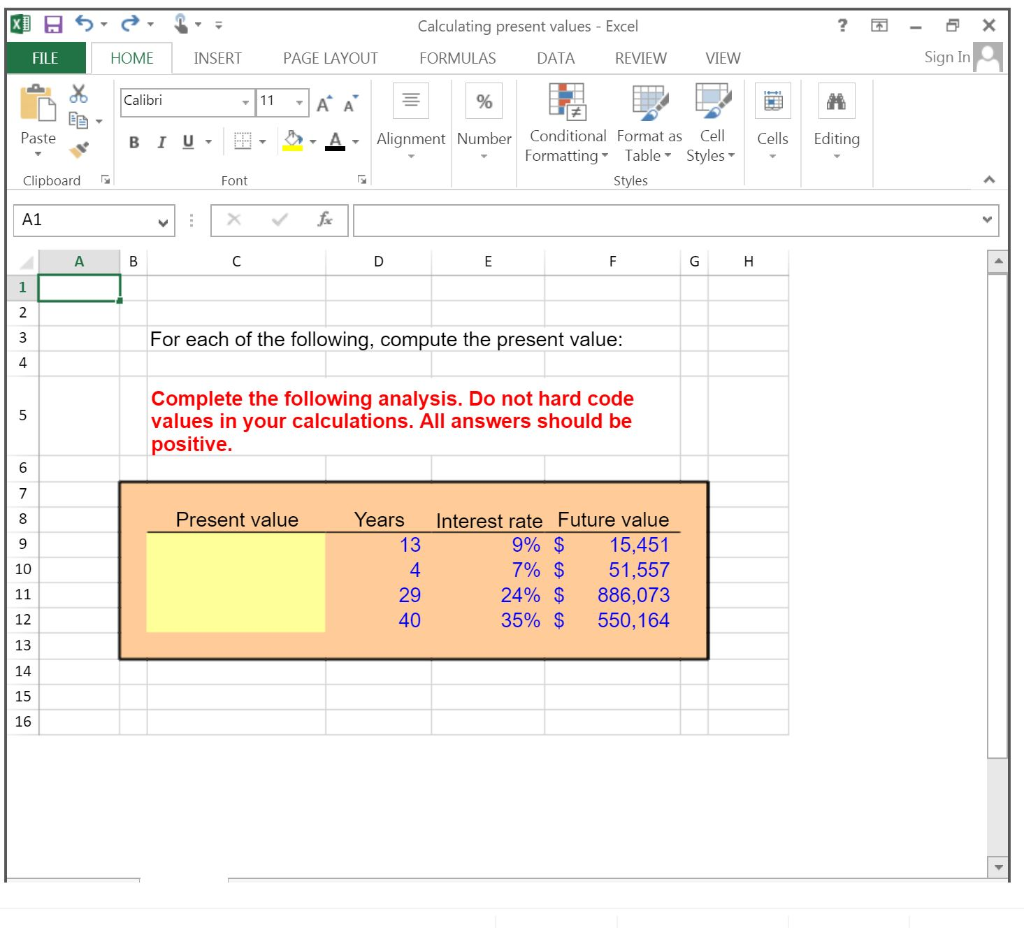

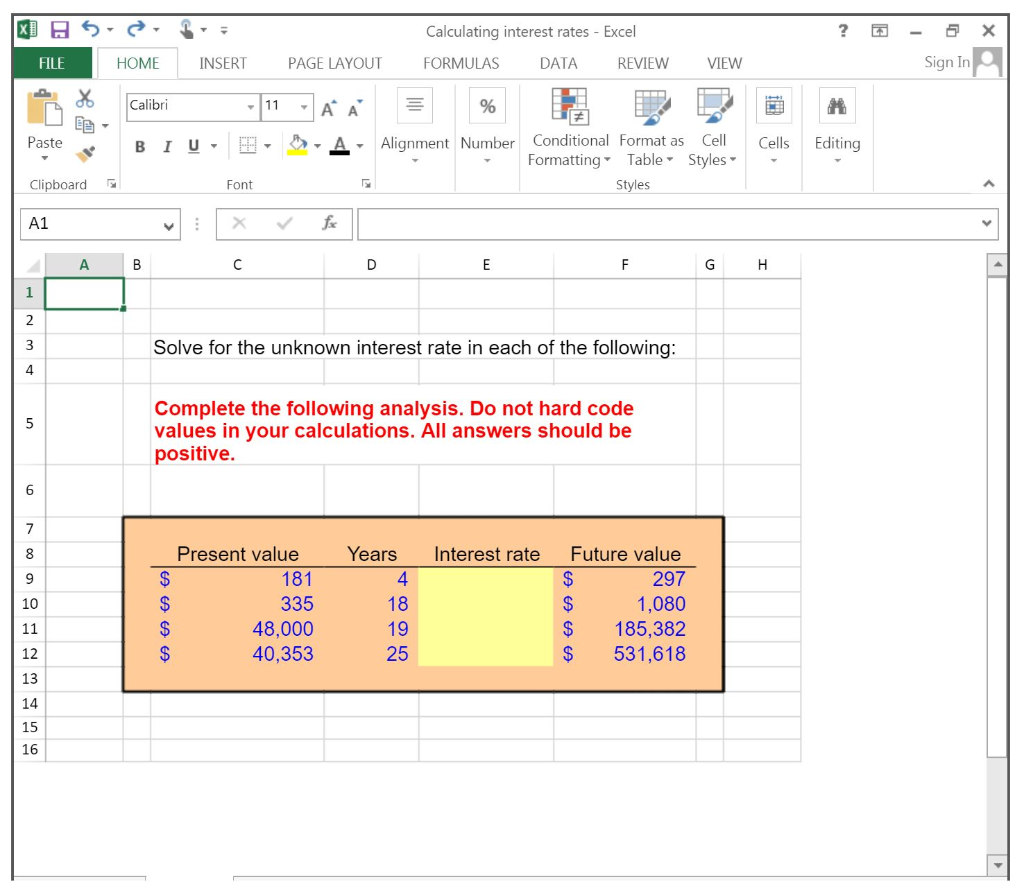

According to the Census Bureau, in October 2016, the average house price in the United States was $28,058. 7 years earlier, the average price was $22,508. What was the annual increase in the price of the average house sold? Multiple Choice 3.52% 3.84% -3.10% 2.88% 3.20% You're trying to save to buy a new $220,000 Ferrari. You have $43,000 today that can be invested at your bank. The bank pays 3.5 percent annual interest on its accounts. How long will it be before you have enough to buy the car? Multiple Choice 45.45 years 47.45 years 47.95 years 47.70 years 47.20 years You're trying to save to buy a new $220,000 Ferrari. You have $43,000 today that can be invested at your bank. The bank pays 3.5 percent annual interest on its accounts. How long will it be before you have enough to buy the car? Multiple Choice 45.45 years 47.45 years 47.95 years 47.70 years 47.20 years You have just made your first $5,500 contribution to your retirement account. Assume you earn a return of 10 percent per year and make no additional contributions. a. What will your account be worth when you retire in 45 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What if you wait 10 years before contributing? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Future value b. Future value You expect to receive $10,000 at graduation in two years. You plan on investing it at 9 percent until you have $60,000. How long will you wait from now? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Number of years Number of years ? X Calculating future values - Excel FORMULAS DATA REVIEW - Sign In PAGE LAYOUT VIEW Saf: FILE HOME INSERT * Calibri Paste B I U - 06 11 - Cells Editing A A = - A - Alignment Number Conditional Format as Cell Formatting Table Styles Styles fix Clipboard Font A1 x AB For each of the following, compute the future value: Complete the following analysis. Do not hard code values in your calculations. All answers should be positive. Future value Present value 1,975 6,734 81,346 192,050 Years Interest rate 11 13% 7 9% S 14 12 % 8 6% ? X - Sign In X SP Calculating present values - Excel FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Calibri - 11 AA = % Paste B IU 3. A Alignment Number Conditional Format as Cell Formatting Table Styles Clipboard Font Styles Cells Editing A1 :x v fx A B C D E F G H For each of the following, compute the present value: Complete the following analysis. Do not hard code values in your calculations. All answers should be positive. Present value Years Interest rate Future value 9% $ 15,451 7% $ 51,557 24% $ 886,073 35% $ 550,164 ? X XD FILE - Sign In * . HOME Calibri B I Pos Calculating interest rates - Excel INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW -111 A A U - - - A - Alignment Number Conditional Format as Cell Formatting Table Styles Font Styles Paste Cells Editing Clipboard A1 A B C D E F G H Solve for the unknown interest rate in each of the following: Complete the following analysis. Do not hard code values in your calculations. All answers should be positive. Years Interest rate Future value 297 Present value 181 335 48,000 40,353 19 25 1,080 185,382 531,618 - You have decided that you when you retire 40 years from now, you want to buy a lodge in Northern Manitoba that you believe will cost $100,000 at that time. You have found an investment opportunity that will yield an interest rate of 7.5% annually, compounded annually. How much will you need to invest now to reach your goal? Multiple Choice O $5,541.94 $6,426.89 $4,091.67 $8,832.02 All else equal, holding the interest ready steady, the further out a cash flow is, the __ _ it's present value. Multiple Choice higher lower same True or false: the higher the interest rate, the higher present value will be relative to future value. Multiple Choice True False