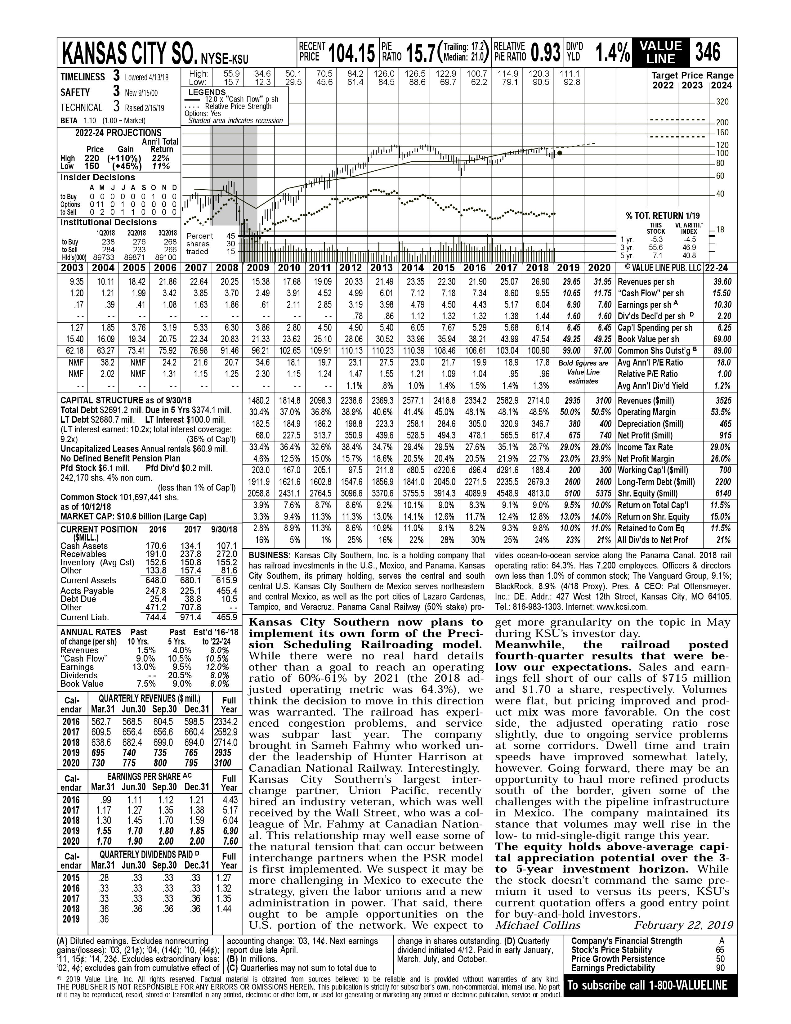

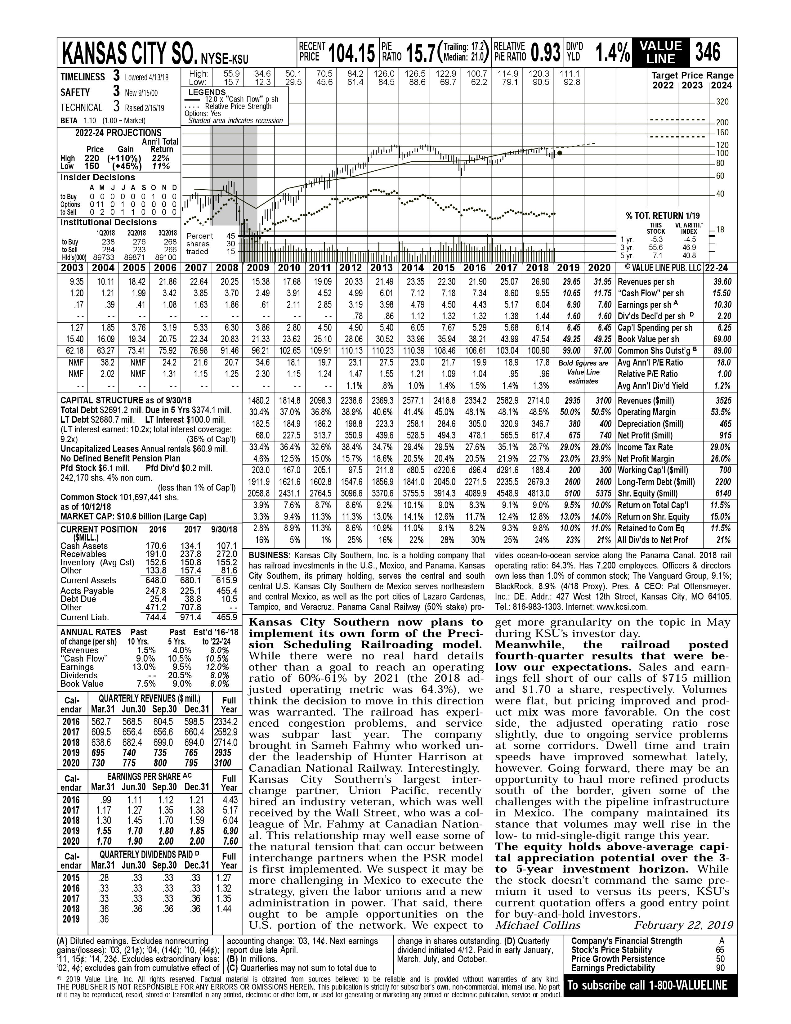

According to the CFO of Kansas City Southern (KSU), the railroad spent $175 million by to rebuild 83 miles of an abandoned rail line previously owned by the Union Pacific abandoned rail line in order to provide the railroad with ready access to growing markets in Mexico. The railroad predicts a free cash flow of $26 million per year from the project. From the standpoint of net present value, do you think this is a good investment? To begin, the companys WACC was 8.73% from 2009 through 2016. You will need its WACC for 2017, 2018, and 2019. To guide your analysis, please see the railroads Value Line summary page on Blackboard under KSU 2019, which includes KSUs (financial) capital structure and estimated beta. The companys bond rating is BBB, as assessed by the Standard & Poors Corporation, with an interest rate of 4.8%. For ease of estimation, assume a corporate tax rate of 28%. Please show all your work. (Hint: To estimate the WACC, you will need the cost of equity from the estimates of the capital asset pricing model in problem 7. Because the KSU data are annual but the CAPM data are monthly, you will have to annualize the CAPM estimates before estimating KSUs cost of equity.)

b. (5 points) In what year does the internal rate of return exceed the WACC? What do you conclude by comparing the internal rate of return to a less formal means of estimating the cost of capital, such as the current interest rate on the bonds plus three percentage points? What do you conclude about the profitability of the project now? Please show your work.

KANSAS CITY SO. Trailing: 17.2 RELATIVE VALUE RECENT PRICE 104.15 RATIO 15.7(Hedian: 21.P RAI.93 YLD 1.4% INE346 NYSE-KSU F . 12 120. 120 122.9 1007 LEGENDS TIMELINESS 3 1 3Naw 120 Target Price Range 2022 2023 2024 S2 8 SAFETY 320 3 Pased 21S19 IECHNICAL aa cats nossr BEIA 11 1-Mark: 2022-24 PROJECTIONS 200 150 Tata Retur Price4102% High Low 150 (.45 % ) Inslder Decia N D 11 011 10 etitutionalL necisions %TOT, RETURN 1/19 MDEX STOCK 18 03018 22018 FHcer 66 2003 2004 T 2005 2006 2007 2008 2009 2010 2011 20 VALUE LNE PUB. LLC 22-24 2014 2015 2016 2017 2018 2019 2020 190 2033 21.49 31.95 Revenues per sh 11.75 "Cash Flow per sht 935 10 1 42 .86 264 20,25 538 1768 23.35 22.30 21.90 25.07 26,90 28.65 39.60 120 4e 15.50 1.2 6.01 10.65 4E .24 2.al 2E5 21 4 133 7 67 5295.60 6.14 38 1,60 Diyds Decrd per shD 6.45 Capl Spending per sh 1.12 144 1,60 2 20 553 8S0 366 2F 450 490 540605 127 185 378 0,25 0 3 103 04 185 C62 102 65 $46 181 ree 106 61 R2 18 1CC 50 .00 3700 Common Shs Outst a 17.8 Bald fws a Avg Ann'l PIE Ratic 21.7 199 207 23.1 27.5 23.0 NMI 242 1.6 NMI Relative PE Ratio 2.02 3 5 25 30 1.47 1.55 1.21 1.09 95 1.00 rimntex 10% Avg Ann'l D 1587 8 4802 8148 2068 3 CAPITAL STRUCTURE as of 30'18 Total Debt $2691.2 mil. Due in 5 Yrs $374.1 mil. 3100 F 418 714 2935 50.5% Operating Margin 400 Depreciation (Smill 370% | 368% |38 9% | 40e% 41.4% 45.0 % 4.1% 5% 30.4% 48.1% 500% 53.5%2 82.5 1849186.2 198.8 223.3 258.1 284.6 305.0 320.9 346.7 380 LT inlerest eane: 10.2x: Ipal inleresl cweran apitalized Leases Annual sendl of Cap No Defined Benefit Pension Plan Pfd Stock $6.1 mil Pfd Div'd $0.2 mil. 242.170 shs 4% mon c r then 1 % of CapT 92x 33.434%32 6% 38 4% 34.7% 125% 150%| 57 %| 8.6% 29.0% Inceme Tax Rate 23.9 % | Net Profit Margin 300 Working Cap'l(Smill) 2600 Long-Term Debt (Smill) 2 7% 230 % 203.0 167,0 205.1 75 211.8 c8C.5c220.6 d96.4 d281.6 189.4 200 29.5% 27.8% 35 1% $60.9 mil 29.0% 29 0% 20.4 % 4.3% 20.5% 20.5% 219% 2.7% 26.0% 700 811. 621.6 602.8 1547.6 1856.9 1841.0 2045.0 2271.5 2235.5 2679.3 2600 2200 E Df 10439Ck 101.697,441 shs 76% 8 6% 25 10.1 9.5% 100% Retum on Total Cap'l 14.0 % | Retun on Shr. Equity .0% .3% 11.7 9.1% 90 % 39% 11.5% 11.3%| 1.3 %| 3.0 %14.1% 128% 130 % TAARKET CAP: $10.6 billion Large Cap) 3.3%% 9% 12.6% 12.4% 15.0% 11 85 11.5% T POSITION 2016 2017 9/3018 21%All Didde M 23% 107.1 BUSINESS: Karsas Cly Sauthern, Inc. is a holding company that has raiad invesimenls in the US, Mcxico, and Panama, Kansas operating ratio: 64.3 %. Has 7200 cmakyecs Ollicers & dircctors vides anean-lo-ocean servie alang the Panaira Canal, 2018 ail 152.6 CEEit(Av Cul) 648.0 680.1 515.9 Culenl Assels Fenlal US KarsCly Suen de Mevic srves nbrlack (4/18 PoP and ocnlral Mcxico, as wel as he port cics of Lazaro Cardenas, nc DE. Addr 427 Wcst 12th Strect, Kansas City, MO 64105. Tampico, and Veracruz. Panama Canal Raitay (50% staka) pro Tel: 818-983-1303. Internet www.kcsi.com CEO B p, .1%; cs Payable 4 Cuuenl Lin ANNUAL RATES gpersh 455.9 Past Est'd 16-18 implement its own form of th Preciii K ople in My posted aa t rach an onrating os oexpectations Sales andarn Past 5 Yrs to 22-24 1o rs sion Scheduling Railroading model. ther han ratio of 60 %-61 % by 2021 (the 2018 ad justed uperatig netric was 64.3%), we and 1.70 a sare, respectively Vulues Meanwhile, railroad the 20.3 . ings fell short of our calls of $715 million 75% Jue Cal endar Mar.31 Jun.30 Sep.30 Dec.31 Yea QUARTERLY REVENUES IS milli Full uct mix was more favorable, On the cost side, the adjusted operating ratio rose was warranted, The railroad has experi enced congestion problems, and service 2018 638.6 82.4 699.0 694.0 27140 rouht in Samueh Fahuy who worked un- der the ladership of Hunter Harrison at 2017 603 F at some coidurs. Dwell time and train speeds have improved somewhat ately, however. Coing Torward. nere ay Full i eway Interestingly. Year chang pariner Unio Pacific. recently 443 hired an industry veteran, which was wel challenges with the pipeline infrastructure 159 FARNINGS PER SHARE AC endar Mar.31 Jun.30 Sep.30 Dec.31 Cal south of the order given some uf the 70 6.04 league of Mr. Fahmv at Canadian Nation 2018 1.30 45 stance that volumes may well rise n the Tmid-single-digit range this year al. This rlatioship may wel ease some of low 760 200 200 CUARTERLY DIVIDENDS PAIDD endar Mar31 Jun.30 Sep.30 Dec.31 47 interchange nartners when the PSR model tal annreriation notential overthe 3- Cal- Ful Year is first implemented. We suspect it may be to 5-year investment horizon. While more challenging in Mexico to execute the diiation in nower That said there 1.2 the stock doesn't command the same pre- 2015 2 current quotation offers a gond entry noir 2017 33 33 3 36 3 1 3 int ought to be ample opportunities on the for buy and hold investors euary 22, 2019 36 1 44 U.S. portion of the network. We expect to Michael Collins e 21s04 14r 10 4 or dus at 14. Next earnings 1542a. Excluces exUrdhay bss ... 019 Ve Ure e N bts reseeed rEcusl maleri ctrared tem s0,rces televe te relsbte and is crosded whhou waEdes ay To euheeribe call1-800-VALUELINE SayFinancial Strength Price Growth Persistence dividand initiatedi 412 Padin ea Janar March. July, and October sum to total due to THE FUBLSFERIS rUT RESorslBLE FUk HY ERks R UNISSs HEREI. TNSP. nis s o srbar s o.ron-cam mm . e pE KANSAS CITY SO. Trailing: 17.2 RELATIVE VALUE RECENT PRICE 104.15 RATIO 15.7(Hedian: 21.P RAI.93 YLD 1.4% INE346 NYSE-KSU F . 12 120. 120 122.9 1007 LEGENDS TIMELINESS 3 1 3Naw 120 Target Price Range 2022 2023 2024 S2 8 SAFETY 320 3 Pased 21S19 IECHNICAL aa cats nossr BEIA 11 1-Mark: 2022-24 PROJECTIONS 200 150 Tata Retur Price4102% High Low 150 (.45 % ) Inslder Decia N D 11 011 10 etitutionalL necisions %TOT, RETURN 1/19 MDEX STOCK 18 03018 22018 FHcer 66 2003 2004 T 2005 2006 2007 2008 2009 2010 2011 20 VALUE LNE PUB. LLC 22-24 2014 2015 2016 2017 2018 2019 2020 190 2033 21.49 31.95 Revenues per sh 11.75 "Cash Flow per sht 935 10 1 42 .86 264 20,25 538 1768 23.35 22.30 21.90 25.07 26,90 28.65 39.60 120 4e 15.50 1.2 6.01 10.65 4E .24 2.al 2E5 21 4 133 7 67 5295.60 6.14 38 1,60 Diyds Decrd per shD 6.45 Capl Spending per sh 1.12 144 1,60 2 20 553 8S0 366 2F 450 490 540605 127 185 378 0,25 0 3 103 04 185 C62 102 65 $46 181 ree 106 61 R2 18 1CC 50 .00 3700 Common Shs Outst a 17.8 Bald fws a Avg Ann'l PIE Ratic 21.7 199 207 23.1 27.5 23.0 NMI 242 1.6 NMI Relative PE Ratio 2.02 3 5 25 30 1.47 1.55 1.21 1.09 95 1.00 rimntex 10% Avg Ann'l D 1587 8 4802 8148 2068 3 CAPITAL STRUCTURE as of 30'18 Total Debt $2691.2 mil. Due in 5 Yrs $374.1 mil. 3100 F 418 714 2935 50.5% Operating Margin 400 Depreciation (Smill 370% | 368% |38 9% | 40e% 41.4% 45.0 % 4.1% 5% 30.4% 48.1% 500% 53.5%2 82.5 1849186.2 198.8 223.3 258.1 284.6 305.0 320.9 346.7 380 LT inlerest eane: 10.2x: Ipal inleresl cweran apitalized Leases Annual sendl of Cap No Defined Benefit Pension Plan Pfd Stock $6.1 mil Pfd Div'd $0.2 mil. 242.170 shs 4% mon c r then 1 % of CapT 92x 33.434%32 6% 38 4% 34.7% 125% 150%| 57 %| 8.6% 29.0% Inceme Tax Rate 23.9 % | Net Profit Margin 300 Working Cap'l(Smill) 2600 Long-Term Debt (Smill) 2 7% 230 % 203.0 167,0 205.1 75 211.8 c8C.5c220.6 d96.4 d281.6 189.4 200 29.5% 27.8% 35 1% $60.9 mil 29.0% 29 0% 20.4 % 4.3% 20.5% 20.5% 219% 2.7% 26.0% 700 811. 621.6 602.8 1547.6 1856.9 1841.0 2045.0 2271.5 2235.5 2679.3 2600 2200 E Df 10439Ck 101.697,441 shs 76% 8 6% 25 10.1 9.5% 100% Retum on Total Cap'l 14.0 % | Retun on Shr. Equity .0% .3% 11.7 9.1% 90 % 39% 11.5% 11.3%| 1.3 %| 3.0 %14.1% 128% 130 % TAARKET CAP: $10.6 billion Large Cap) 3.3%% 9% 12.6% 12.4% 15.0% 11 85 11.5% T POSITION 2016 2017 9/3018 21%All Didde M 23% 107.1 BUSINESS: Karsas Cly Sauthern, Inc. is a holding company that has raiad invesimenls in the US, Mcxico, and Panama, Kansas operating ratio: 64.3 %. Has 7200 cmakyecs Ollicers & dircctors vides anean-lo-ocean servie alang the Panaira Canal, 2018 ail 152.6 CEEit(Av Cul) 648.0 680.1 515.9 Culenl Assels Fenlal US KarsCly Suen de Mevic srves nbrlack (4/18 PoP and ocnlral Mcxico, as wel as he port cics of Lazaro Cardenas, nc DE. Addr 427 Wcst 12th Strect, Kansas City, MO 64105. Tampico, and Veracruz. Panama Canal Raitay (50% staka) pro Tel: 818-983-1303. Internet www.kcsi.com CEO B p, .1%; cs Payable 4 Cuuenl Lin ANNUAL RATES gpersh 455.9 Past Est'd 16-18 implement its own form of th Preciii K ople in My posted aa t rach an onrating os oexpectations Sales andarn Past 5 Yrs to 22-24 1o rs sion Scheduling Railroading model. ther han ratio of 60 %-61 % by 2021 (the 2018 ad justed uperatig netric was 64.3%), we and 1.70 a sare, respectively Vulues Meanwhile, railroad the 20.3 . ings fell short of our calls of $715 million 75% Jue Cal endar Mar.31 Jun.30 Sep.30 Dec.31 Yea QUARTERLY REVENUES IS milli Full uct mix was more favorable, On the cost side, the adjusted operating ratio rose was warranted, The railroad has experi enced congestion problems, and service 2018 638.6 82.4 699.0 694.0 27140 rouht in Samueh Fahuy who worked un- der the ladership of Hunter Harrison at 2017 603 F at some coidurs. Dwell time and train speeds have improved somewhat ately, however. Coing Torward. nere ay Full i eway Interestingly. Year chang pariner Unio Pacific. recently 443 hired an industry veteran, which was wel challenges with the pipeline infrastructure 159 FARNINGS PER SHARE AC endar Mar.31 Jun.30 Sep.30 Dec.31 Cal south of the order given some uf the 70 6.04 league of Mr. Fahmv at Canadian Nation 2018 1.30 45 stance that volumes may well rise n the Tmid-single-digit range this year al. This rlatioship may wel ease some of low 760 200 200 CUARTERLY DIVIDENDS PAIDD endar Mar31 Jun.30 Sep.30 Dec.31 47 interchange nartners when the PSR model tal annreriation notential overthe 3- Cal- Ful Year is first implemented. We suspect it may be to 5-year investment horizon. While more challenging in Mexico to execute the diiation in nower That said there 1.2 the stock doesn't command the same pre- 2015 2 current quotation offers a gond entry noir 2017 33 33 3 36 3 1 3 int ought to be ample opportunities on the for buy and hold investors euary 22, 2019 36 1 44 U.S. portion of the network. We expect to Michael Collins e 21s04 14r 10 4 or dus at 14. Next earnings 1542a. Excluces exUrdhay bss ... 019 Ve Ure e N bts reseeed rEcusl maleri ctrared tem s0,rces televe te relsbte and is crosded whhou waEdes ay To euheeribe call1-800-VALUELINE SayFinancial Strength Price Growth Persistence dividand initiatedi 412 Padin ea Janar March. July, and October sum to total due to THE FUBLSFERIS rUT RESorslBLE FUk HY ERks R UNISSs HEREI. TNSP. nis s o srbar s o.ron-cam mm . e pE