Answered step by step

Verified Expert Solution

Question

1 Approved Answer

According to the efficient market hypothesis (EMH), which of the following statements are I. Security prices can be expected to be fair measures of value

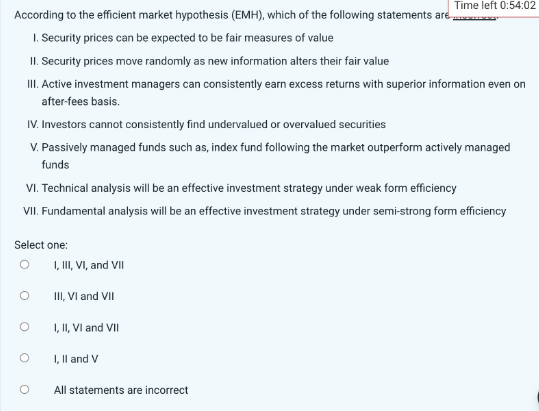

According to the efficient market hypothesis (EMH), which of the following statements are I. Security prices can be expected to be fair measures of value II. Security prices move randomly as new information alters their fair value III. Active investment managers can consistently earn excess returns with superior information even on after-fees basis. IV. Investors cannot consistently find undervalued or overvalued securities V. Passively managed funds such as, index fund following the market outperform actively managed funds VI. Technical analysis will be an effective investment strategy under weak form efficiency VII. Fundamental analysis will be an effective investment strategy under semi-strong form efficiency Select one: I,III,VI, and VII III, VI and VII I,II,VI and VII I, II and V All statements are incorrect

According to the efficient market hypothesis (EMH), which of the following statements are I. Security prices can be expected to be fair measures of value II. Security prices move randomly as new information alters their fair value III. Active investment managers can consistently earn excess returns with superior information even on after-fees basis. IV. Investors cannot consistently find undervalued or overvalued securities V. Passively managed funds such as, index fund following the market outperform actively managed funds VI. Technical analysis will be an effective investment strategy under weak form efficiency VII. Fundamental analysis will be an effective investment strategy under semi-strong form efficiency Select one: I,III,VI, and VII III, VI and VII I,II,VI and VII I, II and V All statements are incorrect Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started