Answered step by step

Verified Expert Solution

Question

1 Approved Answer

According to the financial data of Air Canada company, find the following for each year. *Profitability Ratios (Net Profit Margin, Return on Equity, Return on

According to the financial data of Air Canada company, find the following for each year.

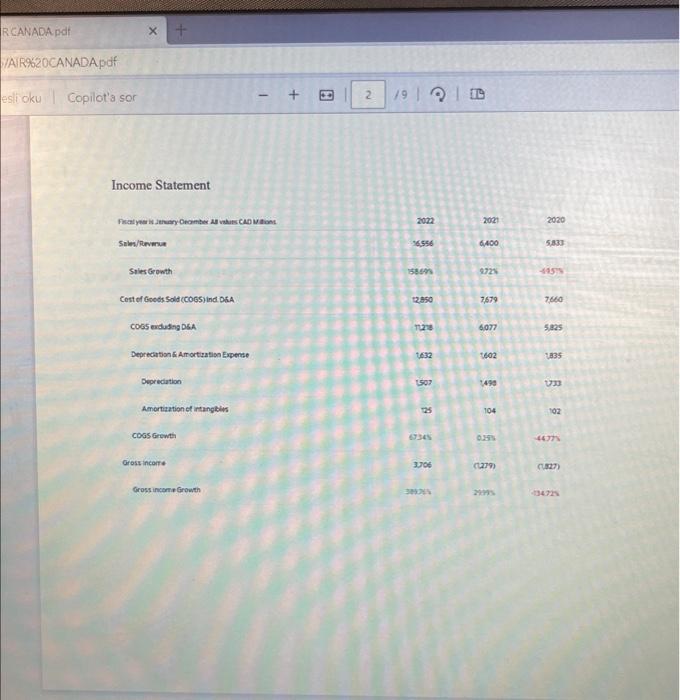

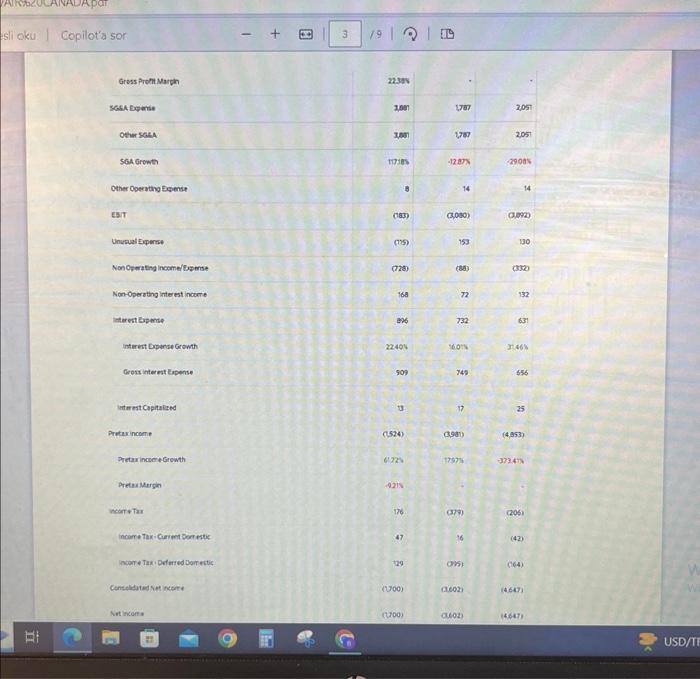

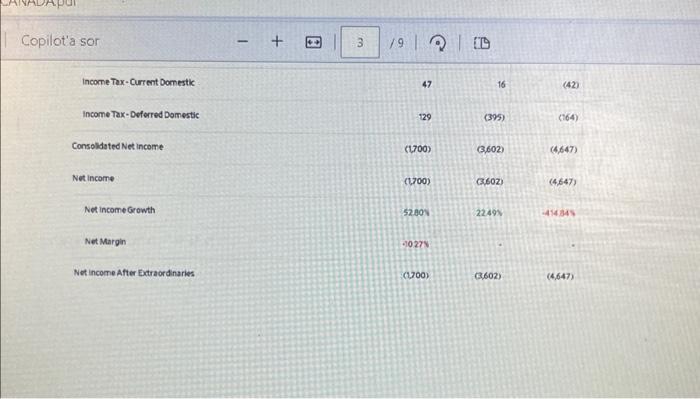

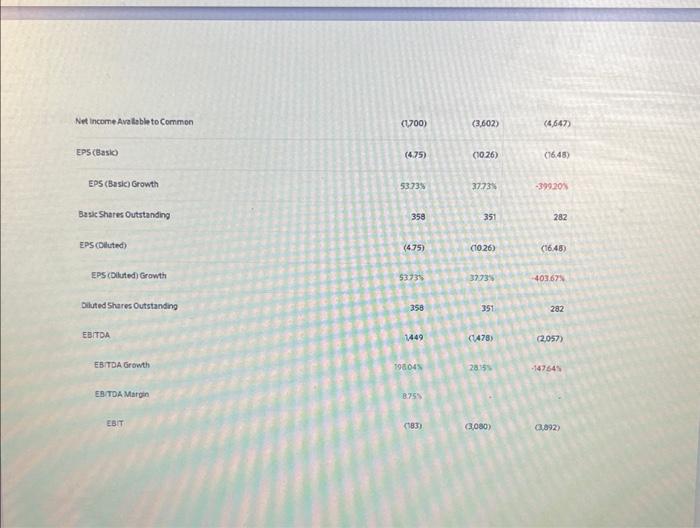

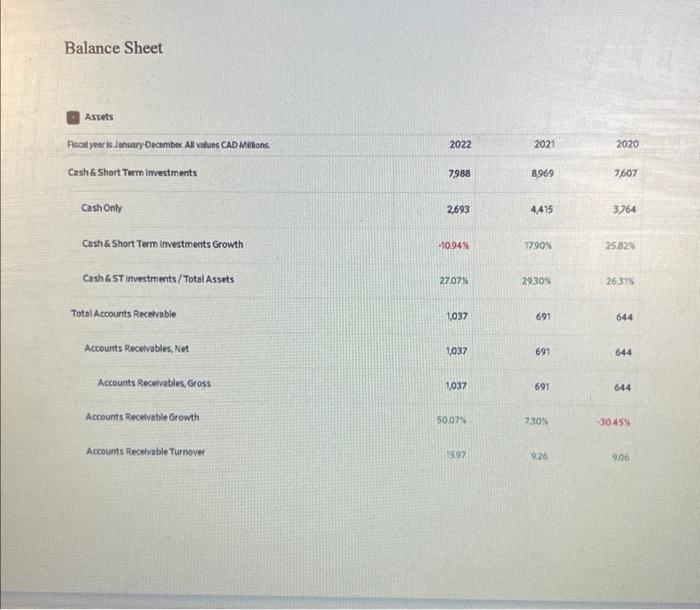

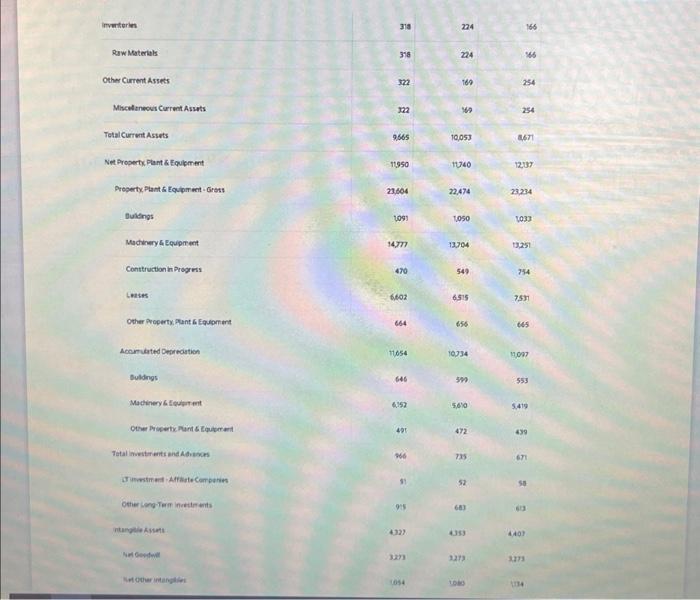

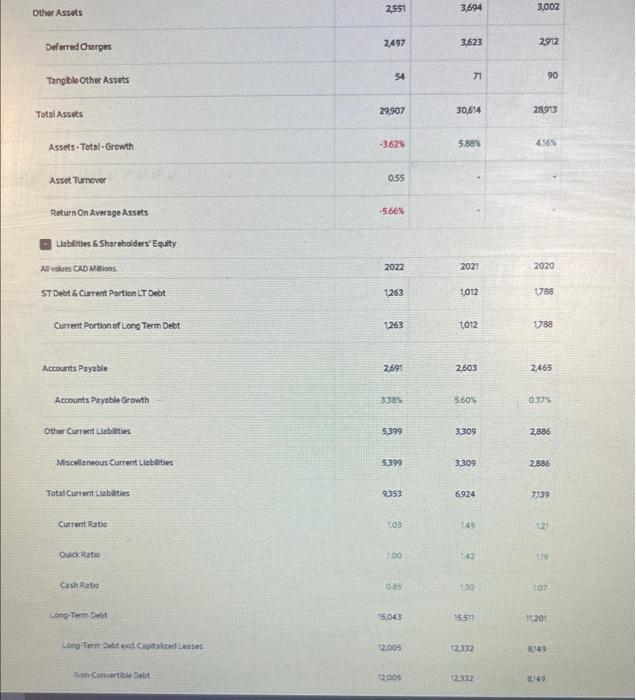

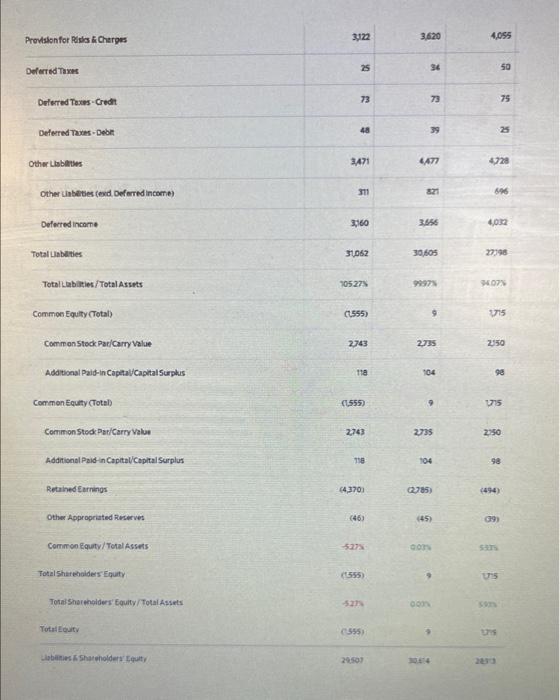

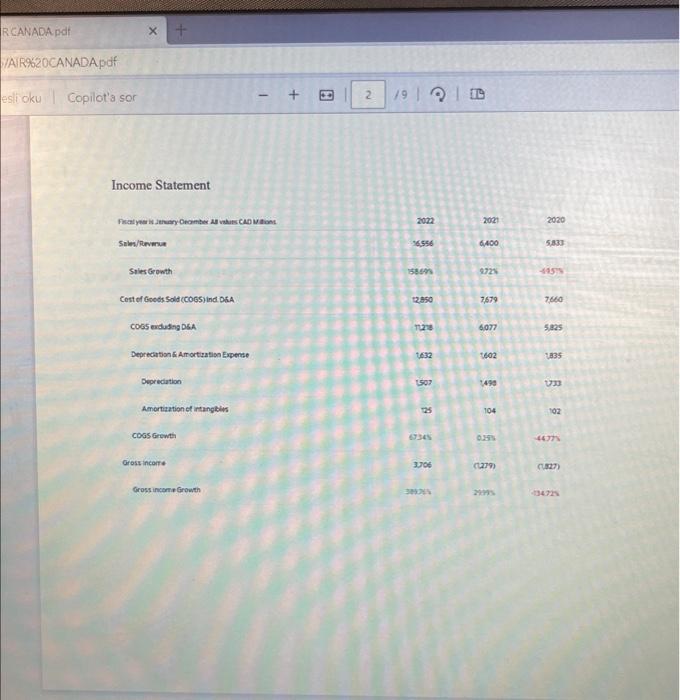

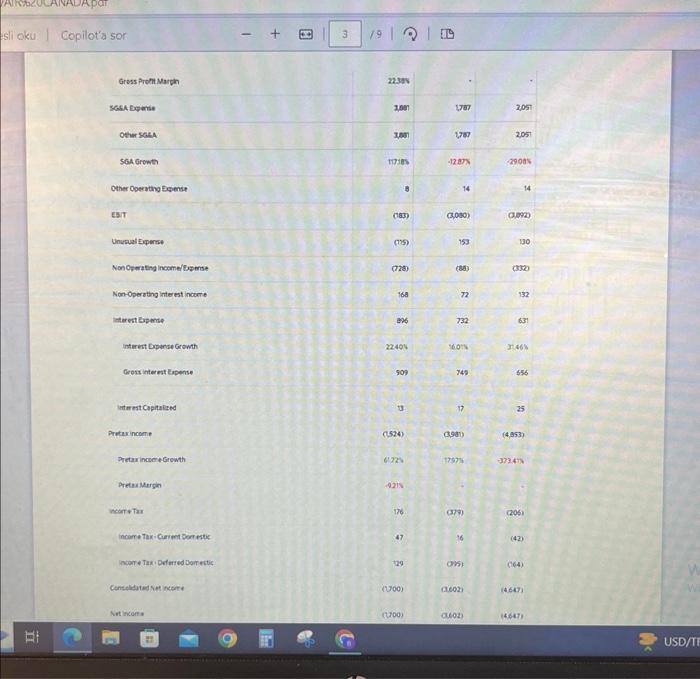

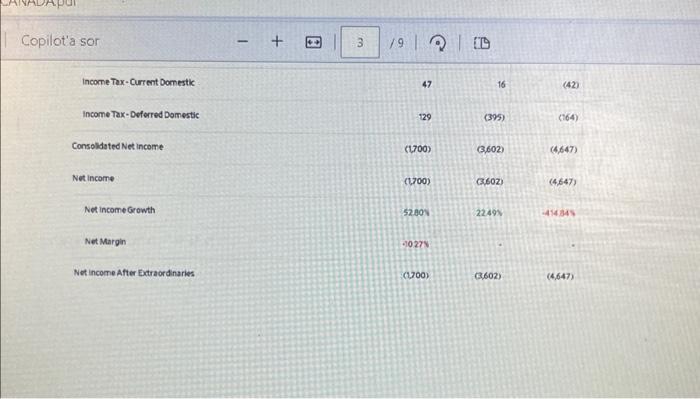

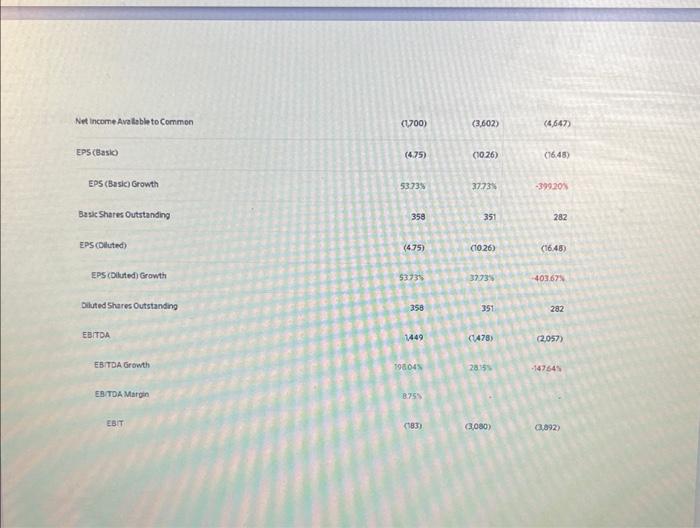

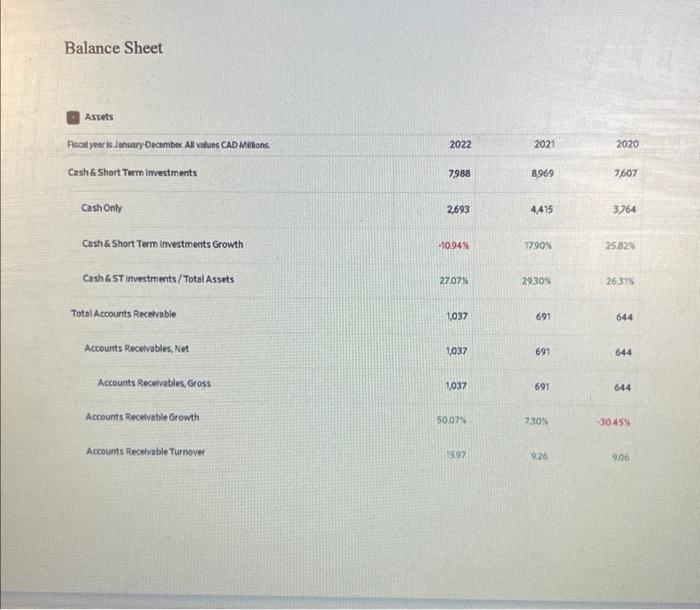

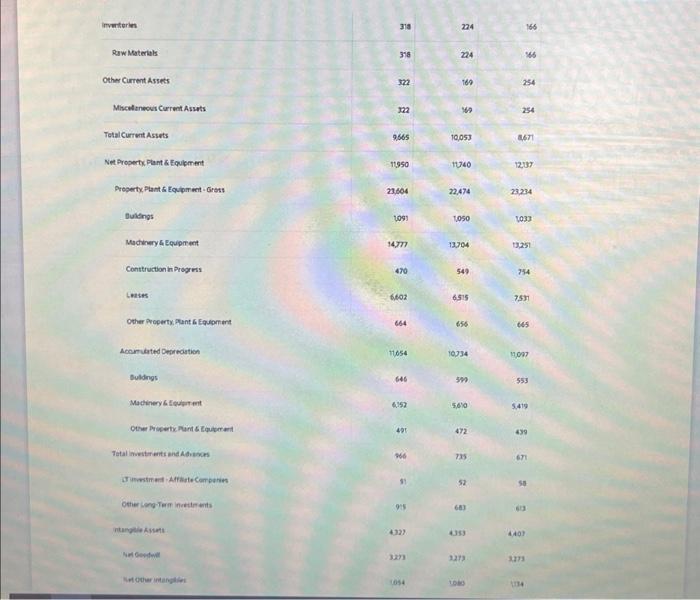

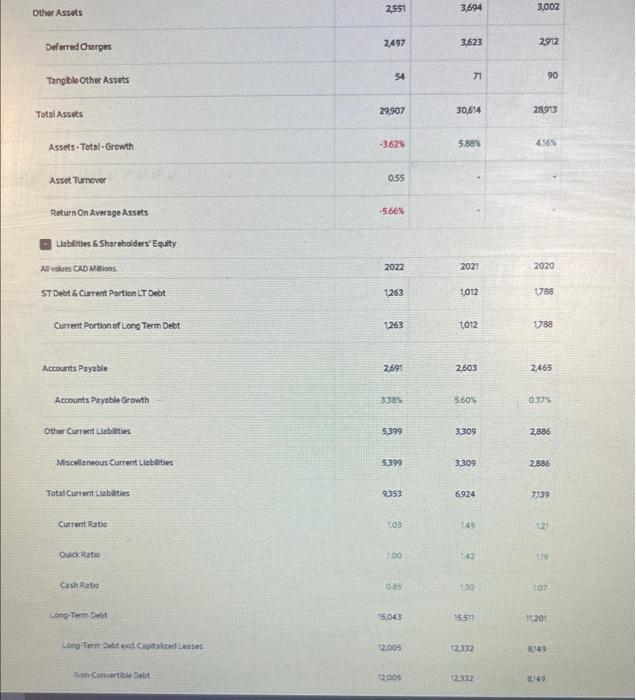

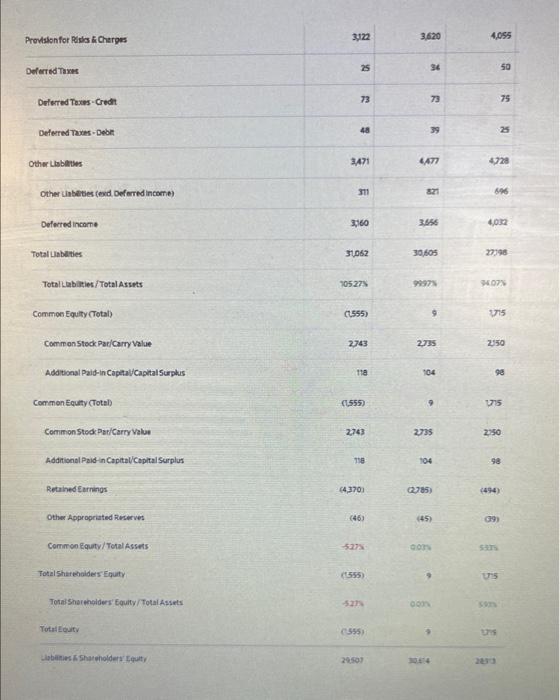

RCANADA pdf /AIR\%620CANADAp df Copilot's sor 2 19 2 1] Income Statement \begin{tabular}{|c|c|c|c|} \hline & & 202 & 2020 \\ \hline Selen/Revmat & & 6400 & \\ \hline Snles Growth & isesen & & 415% \\ \hline Cest of Goeds Sold (COGS) ind DSA & 12350 & 7679 & 7600 \\ \hline COCS erdusing DSA & rus & 6077 & 5.225 \\ \hline Depredition K: Amortiratise Expente & tos2 & 3602 & 1335 \\ \hline Deprectution & 1507 & 495 & Ux \\ \hline Amertization of irtanglivis & Ws & 104 & 102 \\ \hline cogs arewth & gies & ous & 44m \\ \hline Gross incorte & woe & cosn & (c)m) \\ \hline Gross income Growth & & mans & 4347N \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Gress Pront Marph & & & ; \\ \hline Sast Expants & 1901 & & 2051 \\ \hline other SasA & yat & & 2051 \\ \hline S64 Growt & mates & & 29005 \\ \hline Oener Coervang Esemse & B & 14 & 14 \\ \hline EST & () & (cose) & casa \\ \hline Unutazal Expersu & (1) & 153 & 100 \\ \hline Non Opmating income/'topmse & (7)s) & (t)ds) & cos \\ \hline Non-Operating interest income & 164 & n & 132 \\ \hline leterent Bxemte & ans & 732 & 631 \\ \hline intarest Dporde Growth & 22404 & & 346s \\ \hline Geosx interest Experse & 900 & 745 & S5S \\ \hline interest Capitalised & 13 & 17 & 25 \\ \hline Pretarincomp & & Qsa) & (4,353) \\ \hline Pretarinceeterewth & & 17974 & 3724 \\ \hline PretuMergin & 0215 & & \\ \hline vedrt + Tar & 176 & & \\ \hline incarre Tax-Cuermet Doce estix & 47 & 16 & (42) \\ \hline Incor + Tax, Deferred Domertic: & 60 & ons & (6e4) \\ \hline Conseliditad set netet & (roo) & acors & (4,64) \\ \hline Ant incerts & (xoo) & acos & (4,647) \\ \hline \end{tabular} Copilot'a sor +/3/9 Q Income Tax-Current Domestic 47 16 (42) Income Tax-Deferred Domestic 129 (39) (164) Consoldated Net income (1700) (3,602) (4,647) Net incorne (1,700) (3602) (4,647) Net incomeGrowth 52001 22495 41434 Net Margin 1027x Not income After Extraordinaries (1) (3,602) (4,647) \begin{tabular}{|c|c|c|c|} \hline Net income Avalable to Common & (1700) & (3,602) & (4,647) \\ \hline EPS (Basio) & (4.75) & (0026) & (16,48) \\ \hline EPS (Basic) Growth & 5373% & & -399201 \\ \hline Bask Shates Outstanding & 358 & 351 & 282 \\ \hline EPS (Dlluted) & (475) & (1026) & (16.48) \\ \hline EPS (Dluted) Grawth & 53735 & & 40367 \\ \hline Diluted Shares Outstanding & 356 & 351: & 282 \\ \hline EBTROA & 1449 & (478) & (2057) \\ \hline EBTDA Grownth & raso4s & 28155 & 147645 \\ \hline EATDAMaron & 875: & & \\ \hline EBT & (183) & (3080) & abon: \\ \hline \end{tabular} Balance Sheet invorterin Raw Meterals Oeher Cirrent Assets Mhadeneovi Current Assuts TetalCurrent Assets Net Propertx Ptant \& Equlement Propertic. Plant s Equprent - Grsts Dulengs Madinary G Equipreant Conttruction in Progress contes Other Property. Fant is Equpriunt Acombated Deprocition Buldngs Madinery 6 Efoustemt Othe Miseric Runt 6 Equternt Getier iong toin invitents nurgitivint Ner Gentwit 11054 10.34 now 6602 664 147 1304 1025 470 549 Modinery G Eevipremt 11950 robs 10,053 467 23604 1140 1237 \begin{tabular}{|c|c|c|c|} \hline Other Assets & 2551 & 3,694 & 3,002 \\ \hline Deferted Cuargen & 2497 & 3,623 & 2912 \\ \hline Tanglble Other Assets & 54 & n & 90 \\ \hline Total Assots & 29,507 & 30,614 & 2sin3 \\ \hline Assets-Total-Growh & -3624 & 5828 & \\ \hline Asset Tumover & 0.55 & - & - \\ \hline Return On Average Assets & 5.66s & . & \\ \hline \multicolumn{4}{|l|}{ E Leblities E Shareholders' Equity } \\ \hline Alv vadues CAD wations. & 2022 & 2021 & 2020 \\ \hline ST Debt B Current Portion LT Debt & 1263 & 1012 & vas \\ \hline Current Portion of Long Term Debt & 1263 & 1,012 & 1,788 \\ \hline Accourits Payable & 2691 & 2,603 & 2,465 \\ \hline Accounts Payable Growth & 3364 & 560% & 0374 \\ \hline Other Curtent Leblities & 5399 & 3,309 & 2,886 \\ \hline Miscedaneous Current Llabblities & 5399 & 3309 & 2886 \\ \hline Total Curtent Liablities & 9353 & 6,924 & 7,339 \\ \hline Curtert ratio & tos & 45 & 21 \\ \hline Ouckratio & 200 & 42 & 109 \\ \hline Cashratio & Q.45 & 130 & tor \\ \hline Cong-Tem Debt & 5,043 & 15,511 & nz201 \\ \hline Long-Term bebe exd Copitulized Leuses & 12005 & 1233 & 8/49 \\ \hline Non-Caniertbie Detit & & 12332 & a42 \\ \hline \end{tabular} Provisionfor Risla therges 3,22 3,620 4,055 Defered Taxes 25 34 50 Delerted Toxes-Credint 73 n 75 Defered Tous-Debr 48 39 25 Other Libbinies 4 4) 473 Other unbetses (exd oeferred incorte) mi a21 ins Deferted incorne 300 4,02 Total Labuties 31062 30,605 Total Labartiet/ Total Assuts 705275 sons wons Common Equity (Total) (455) 9 Commanstedk.Par/Carry value 2743 2735 250 Additional Paid-in Capetal/Capital Surphis na 104 ge Commen Equaty (Totel) Common Stodk PeriCarry Value Addrional Paid-in Captal/Capital Surplus Retained Earnings Other Appropriated Rinterves Common Equty/Total Assets Total Sharrenaider Equaty TotalSharmpiders' Equity/Total Assets Total Equty (1555) 2743 15 (4)370) (2)5) u5 273 250 9a (494) (46) (45) (99) 104 9 250 \begin{tabular}{|c|c|c|c|} \hline CommonStedk Par/Carry Value & 2743 & 2735 & 250 \\ \hline Additional Paid-in Captal/Caphtal Surphis & & 104 & se \\ \hline Common Equity (Totel) & (1555) & 9 & is. \\ \hline Common Stodk Pat/Carry Value & 2743 & 235 & 2350 \\ \hline Addrional Paid-in Capital/Capital Surplus & 78 & 104 & 98 \\ \hline Retrined Eerrinos & (4,370) & (2)85) & (494) \\ \hline Other Appropriated Ruserves & (46) & (45) & (a9) \\ \hline Common Equaty/Total Assens & & aon & s*rs \\ \hline Total Sharebalders Equaty & (555) & 9 & vis \\ \hline Totasharehaiders' Equity/Total Assets & sin & oon & sen \\ \hline \begin{tabular}{l} Totaitouty \\ = \\ \end{tabular} & (sss) & ? & uns \\ \hline & & 10:5:4 & 263 \\ \hline \end{tabular} *Profitability Ratios (Net Profit Margin, Return on Equity, Return on Assets)

*Efficiency Ratios (Inventory Turnover and Inventory holding period, Receivables Turnover and

*Average collection period, Account payable turnover ratio and Payable deferral period)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started