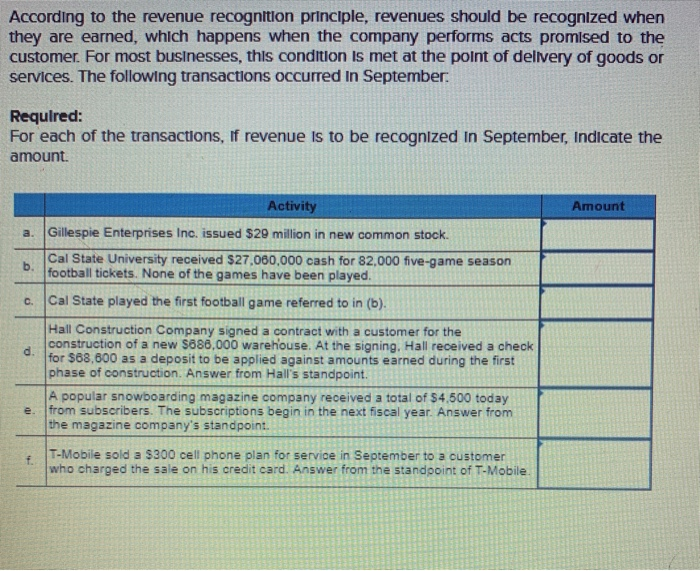

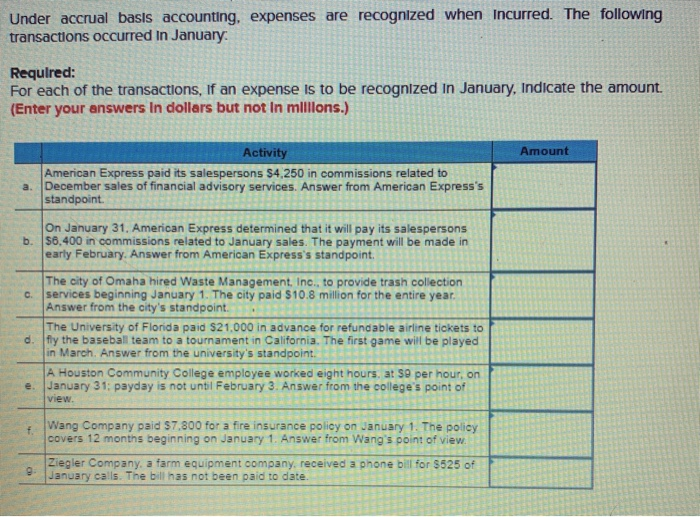

According to the revenue recognition principle, revenues should be recognized when they are earned, which happens when the company performs acts promlsed to the customer. For most businesses, this condition is met at the point of delivery of goods or services. The following transactions occurred in September Required: For each of the transactions, If revenue is to be recognized In September, Indicate the amount Activity Amount a. Gillespie Enterprises Inc. issued $29 million in new common stock. Cal State University received $27,060,000 cash for 82,000 five-game season b. football tickets. None of the games have been played. c. Cal State played the first football game referred to in (b). Hall Construction Company signed a contract with a customer for the construction of a new $886,000 warehouse. At the signing, Hall received a check for $68,600 as a deposit to be applied against amounts earned during the first phase of construction. Answer from Hall's standpoint. A popular snowboarding magazine company received a total of $4,500 today e. from subscribers. The subscriptions begin in the next iscal year. Answer from the magazine company's standpoint T-Mobile sold a $300 cell phone plan for service in September to a customer who charged the sale on his credit card. Answer from the standpoint of T-Mobile Under accrual basis accounting, expenses are recognized when Incurred. The following transactions occurred In January Required: For each of the transactions, If an expense is to be recognized in January, Indicate the amount (Enter your answers In dollars but not In millions.) Amount Activity American Express paid its salespersons S4,250 in commissions related to a. December sales of financial advisory services. Answer from American Express's standpoint On January 31. American Express determined that it will pay its salespersons $6,400 in commissions related to January sales. The payment will be made itn early February. Answer from American Express's standpoint. b. The city of Omaha hired Waste Management, Inc., to provide trash collection c services beginning January 1. The city paid $10.8 million for the entire year d. fy the baseball team to a tournament in California. The first game wil be played e. January 31: payday is not unbl February 3. Answer from the college's point of f Wang Company paid $7,800 for a fire insurance policy on January 1. The policy Answer from the city's standpoint The University of Florida paid $21,000 in advance for refundable airline tickets to in March. Answer from the university's standpoint A Houston Community College employee worked eight hours. at S9 per hour, on view covers 12 months beginning on January 1. Answer from Wang's point of view Ziegler Company. a farm equipment company, received a phone bill for $525 of January calls. The bill has not been paid to date