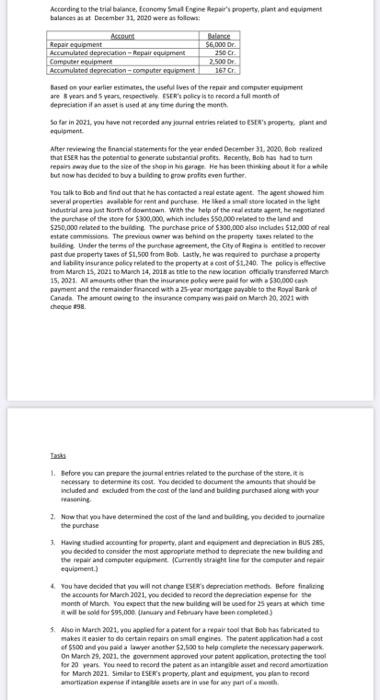

According to the trial bence. Economy Small Engine Repair's property, plant and equipment balances as at December 11, 2020 were as follows: Messe Repair equipment SE DODO Accumulated deprecation - Repair equipment 250C Computer equipment 2.500 DY Accumulated depreciation - Computer equipment 167C1 Based on your earlier estimates, the useful lives of the rear and computer equipment are years and years, respectively. ESER's policy is to record a ful month of depreciation il nasiet is used to time during the month So far in 2021. you have not recorded any umaltres reitted to property plant ind quiment Alter reviewing the financial statements for the year ended December 31, 2020. ob realized that ESER has the potential to generate substantial protes. Recently, Bob has had to turn repair way due to the side of the shop in a garage. He has been thinking about for a while but now has decided to buy a building to grow profits even further You talk to list and find out that he has contacted a real estate agent. The agent showed him several properties wailable for rent and purchase Helhedamalt tore located in the light industrial areast North of downtown. With the help of the real estate agent, he negotiated the purchase of the store for $300,000, which includes $50.000 related to the land and $250,000 related to the building. The purchase price of $300,000 also includes $12,000 ot real estate commissions. The previous owner was behind the property taxes related to the builoing Under the terms of the purchase agreement, the City of Bagno sentitled to recover past due property taxes of $1,500 from Bob Lastly, he was required to purchase a property and ability insurance policy related to the property cost of 1.240. The policy is effective from March 15, 2021 to March 14, 2015 astele to the new location officially transferred Marc 15.2021 Al amounts other than the insurance policy were paid for with a $30,000 cash payment and the remainder Financed with a 25-yeat mortgage payable to the Royal Bank of Canada The amount owing to the insurance company was paid on March 20.2001 with cheque 15 Taska 1. Before you can prepare the journal entries related to the purchase of the store.it necessary to determine its cost. You decided to document the amounts that should be included and excluded from the cost of the land and building purchased along with you 2. Now that you have determined the cost of the land and building you decided to jumalie the purchase Having studied accounting for property, plant and equipment and depreciation in BUS 28. you decided to consider the most appropriate method to depreciate the new building and the repair and computer equipment Currently straight line for the computer and repair equipment You have decided that you will not change Ser's depreciation methods. Before finalizing the accounts for March 2021you decided to record the depreciation pense for the month of March you expect that the new building will be used for 25 years at which time will be sold for $95.000 canary and February have en completed 5. Also in March 2001, you applied for a patent for repair tool that ob has fabricated to makes it easier to do certain repairs on small engines. The patent application had a cost of $500 and you paid a lawyer another $2,500 to help complete the necessary perwork On March 29, 2021, the government approved your patent pplication, protecting the tool for 20 wars. You need to record the potent as an intangible asset and record amortization for March 2021. Similar to ESER's property, plant and equipment you plan to record wortization experiengewerein we forway of According to the trial bence. Economy Small Engine Repair's property, plant and equipment balances as at December 11, 2020 were as follows: Messe Repair equipment SE DODO Accumulated deprecation - Repair equipment 250C Computer equipment 2.500 DY Accumulated depreciation - Computer equipment 167C1 Based on your earlier estimates, the useful lives of the rear and computer equipment are years and years, respectively. ESER's policy is to record a ful month of depreciation il nasiet is used to time during the month So far in 2021. you have not recorded any umaltres reitted to property plant ind quiment Alter reviewing the financial statements for the year ended December 31, 2020. ob realized that ESER has the potential to generate substantial protes. Recently, Bob has had to turn repair way due to the side of the shop in a garage. He has been thinking about for a while but now has decided to buy a building to grow profits even further You talk to list and find out that he has contacted a real estate agent. The agent showed him several properties wailable for rent and purchase Helhedamalt tore located in the light industrial areast North of downtown. With the help of the real estate agent, he negotiated the purchase of the store for $300,000, which includes $50.000 related to the land and $250,000 related to the building. The purchase price of $300,000 also includes $12,000 ot real estate commissions. The previous owner was behind the property taxes related to the builoing Under the terms of the purchase agreement, the City of Bagno sentitled to recover past due property taxes of $1,500 from Bob Lastly, he was required to purchase a property and ability insurance policy related to the property cost of 1.240. The policy is effective from March 15, 2021 to March 14, 2015 astele to the new location officially transferred Marc 15.2021 Al amounts other than the insurance policy were paid for with a $30,000 cash payment and the remainder Financed with a 25-yeat mortgage payable to the Royal Bank of Canada The amount owing to the insurance company was paid on March 20.2001 with cheque 15 Taska 1. Before you can prepare the journal entries related to the purchase of the store.it necessary to determine its cost. You decided to document the amounts that should be included and excluded from the cost of the land and building purchased along with you 2. Now that you have determined the cost of the land and building you decided to jumalie the purchase Having studied accounting for property, plant and equipment and depreciation in BUS 28. you decided to consider the most appropriate method to depreciate the new building and the repair and computer equipment Currently straight line for the computer and repair equipment You have decided that you will not change Ser's depreciation methods. Before finalizing the accounts for March 2021you decided to record the depreciation pense for the month of March you expect that the new building will be used for 25 years at which time will be sold for $95.000 canary and February have en completed 5. Also in March 2001, you applied for a patent for repair tool that ob has fabricated to makes it easier to do certain repairs on small engines. The patent application had a cost of $500 and you paid a lawyer another $2,500 to help complete the necessary perwork On March 29, 2021, the government approved your patent pplication, protecting the tool for 20 wars. You need to record the potent as an intangible asset and record amortization for March 2021. Similar to ESER's property, plant and equipment you plan to record wortization experiengewerein we forway of