Answered step by step

Verified Expert Solution

Question

1 Approved Answer

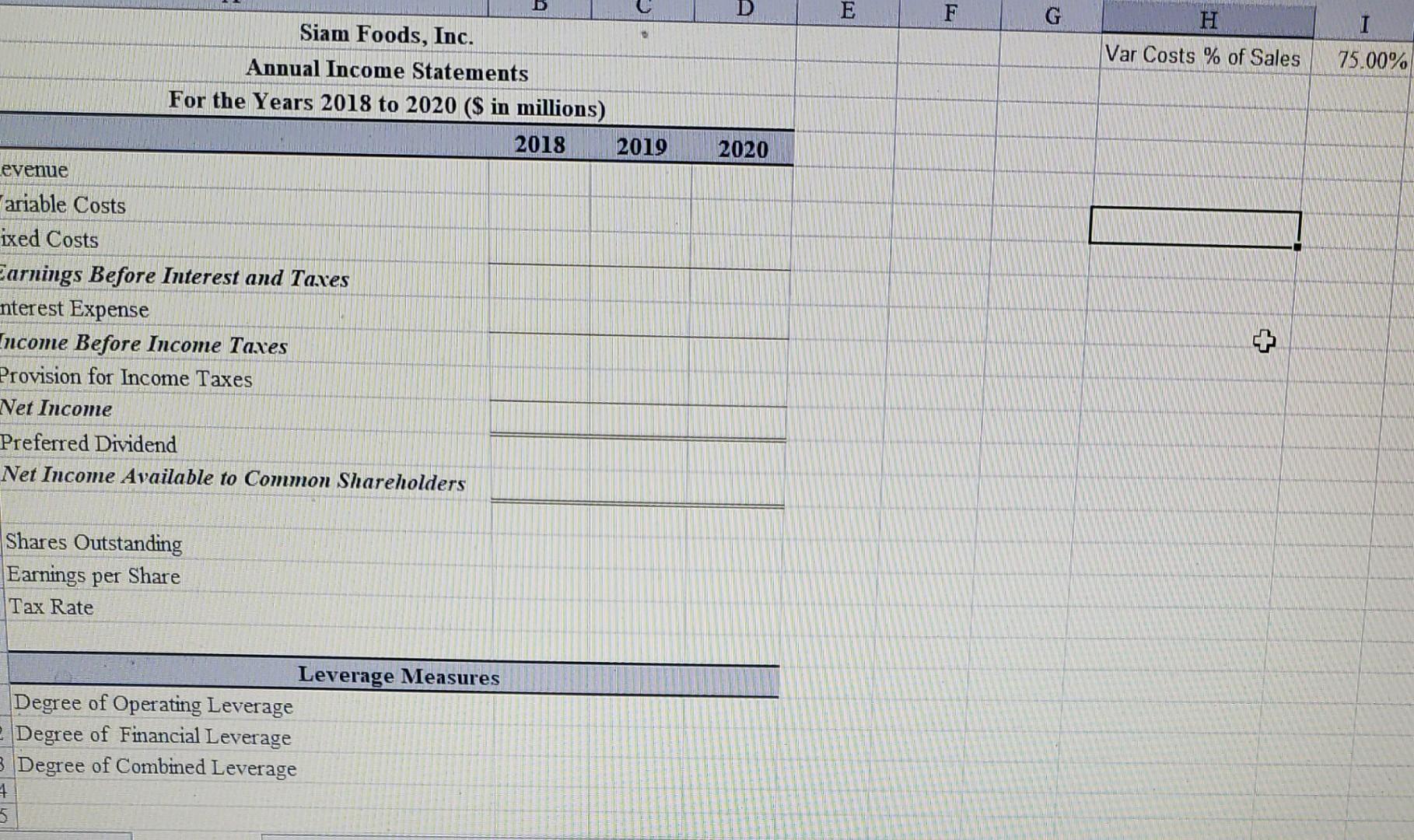

account decision for business decisions ncome statements for Siam Foods, Inc. from 2018 to 2020 appear below. Enter the data into your worksheet and calculate

account decision for business decisions

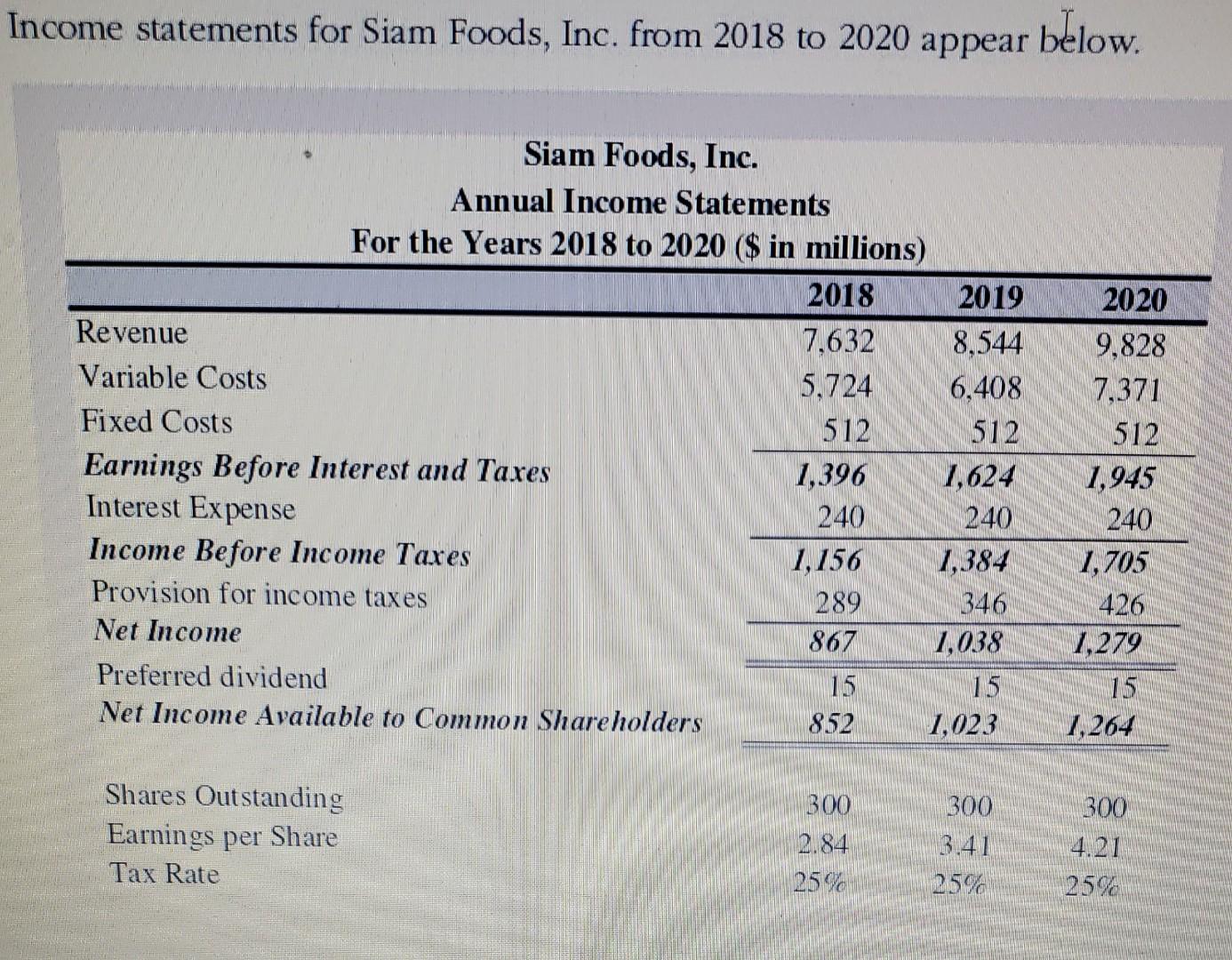

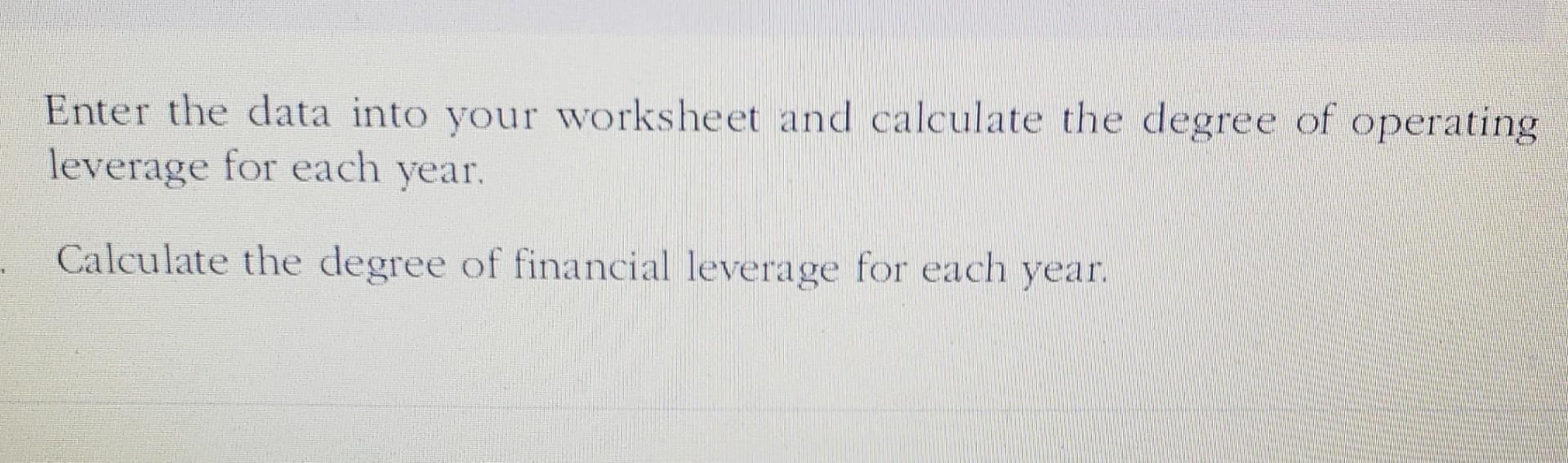

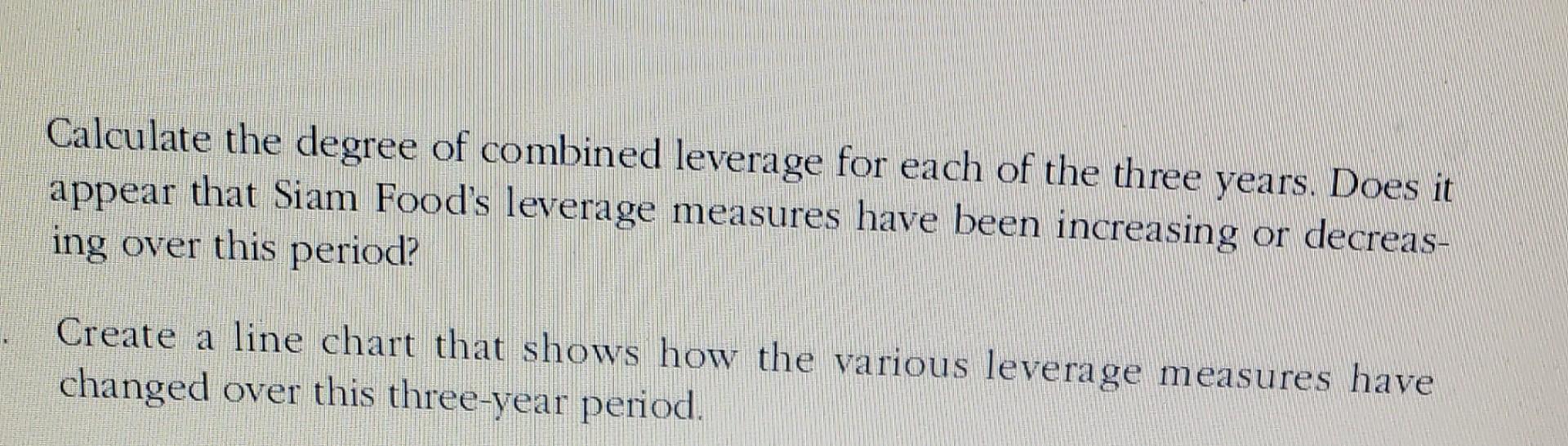

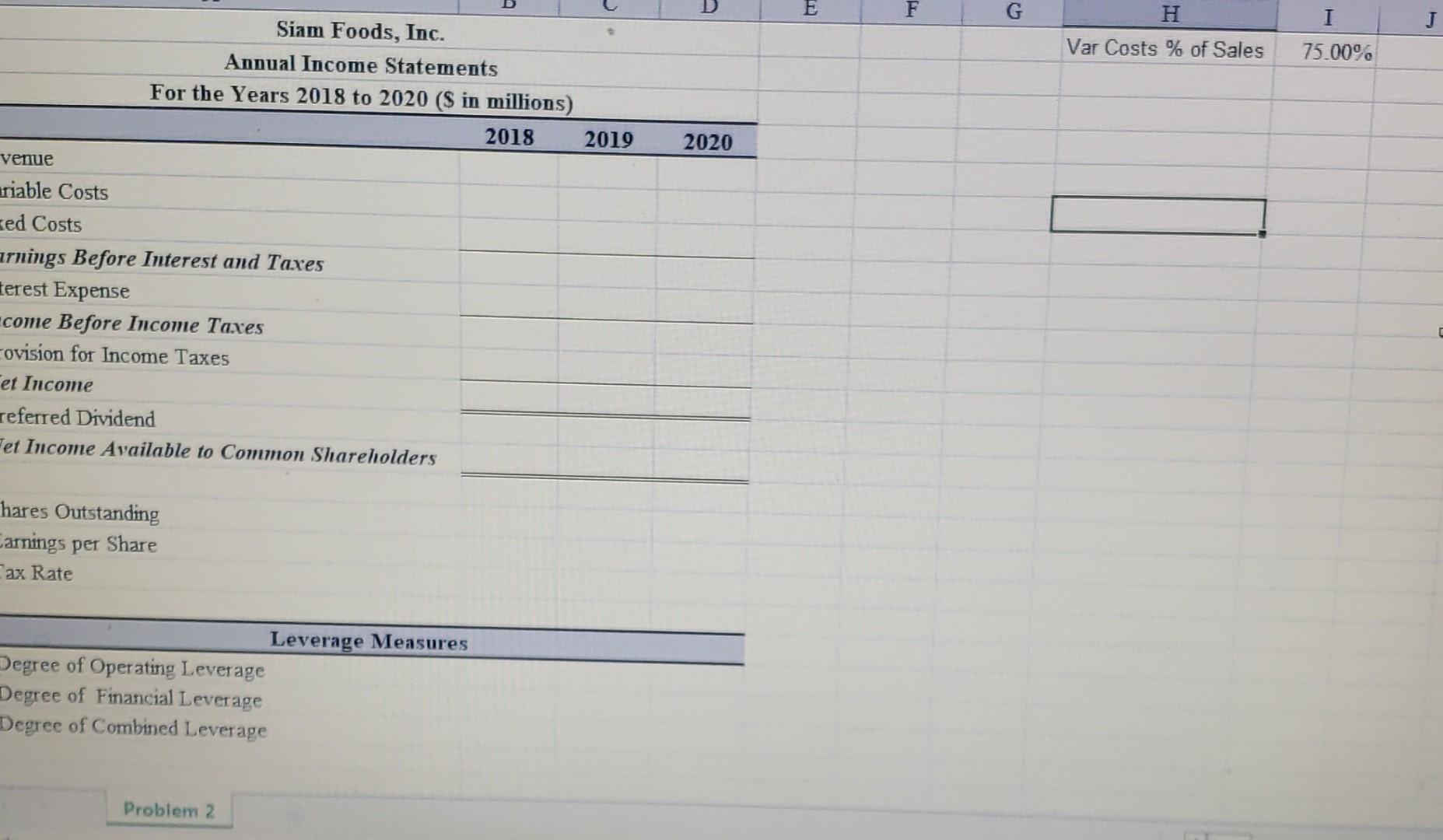

ncome statements for Siam Foods, Inc. from 2018 to 2020 appear below. Enter the data into your worksheet and calculate the degree of operating leverage for each year. Calculate the degree of financial leverage for each year. Calculate the degree of combined leverage for each of the three years. Does it appear that Siam Food's leverage measures have been increasing or decreasing over this period? Create a line chart that shows how the various leverage measures have changed over this three-year period. Siam Foods, Inc. Annual Income Statements For the Years 2018 to 2020 ( S in millions) riable Costs Costs irnings Before Interest and Taxes terest Expense come Before Income Taxes ovision for Income Taxes et Income referred Dividend et Income Available to Common Sharelolders hares Outstanding arnings per Share ax Rate Leverage Measures Degree of Operating Leverage Degree of Financial Leverage Degree of Combined Leverage Problem 2 Siam Foods, Inc. Annual Income Statements For the Years 2018 to 2020 ( $ in millions) evenue ariable Costs ixed Costs Earnings Before Interest and Taxes nterest Expense Income Before Income Taxes Provision for Income Taxes Net Income Preferred Dividend Net Income Available to Common Shareholders Shares Outstanding Earnings per Share Tax Rate Leverage Measures Degree of Operating Leverage Degree of Financial Leverage Degree of Combined Leverage ncome statements for Siam Foods, Inc. from 2018 to 2020 appear below. Enter the data into your worksheet and calculate the degree of operating leverage for each year. Calculate the degree of financial leverage for each year. Calculate the degree of combined leverage for each of the three years. Does it appear that Siam Food's leverage measures have been increasing or decreasing over this period? Create a line chart that shows how the various leverage measures have changed over this three-year period. Siam Foods, Inc. Annual Income Statements For the Years 2018 to 2020 ( S in millions) riable Costs Costs irnings Before Interest and Taxes terest Expense come Before Income Taxes ovision for Income Taxes et Income referred Dividend et Income Available to Common Sharelolders hares Outstanding arnings per Share ax Rate Leverage Measures Degree of Operating Leverage Degree of Financial Leverage Degree of Combined Leverage Problem 2 Siam Foods, Inc. Annual Income Statements For the Years 2018 to 2020 ( $ in millions) evenue ariable Costs ixed Costs Earnings Before Interest and Taxes nterest Expense Income Before Income Taxes Provision for Income Taxes Net Income Preferred Dividend Net Income Available to Common Shareholders Shares Outstanding Earnings per Share Tax Rate Leverage Measures Degree of Operating Leverage Degree of Financial Leverage Degree of Combined LeverageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started