Account II need help on assignmet, thank u

#3

#4 pt1

#4 pt2

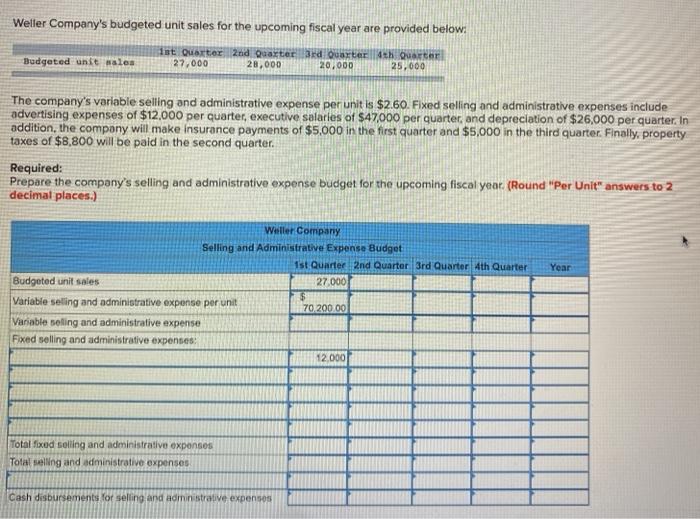

#5

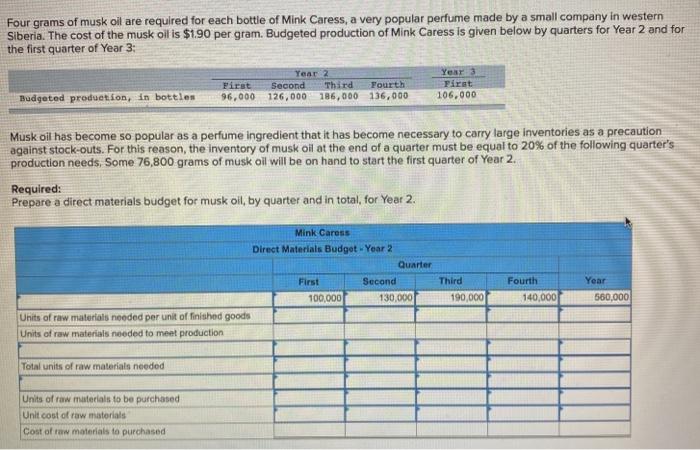

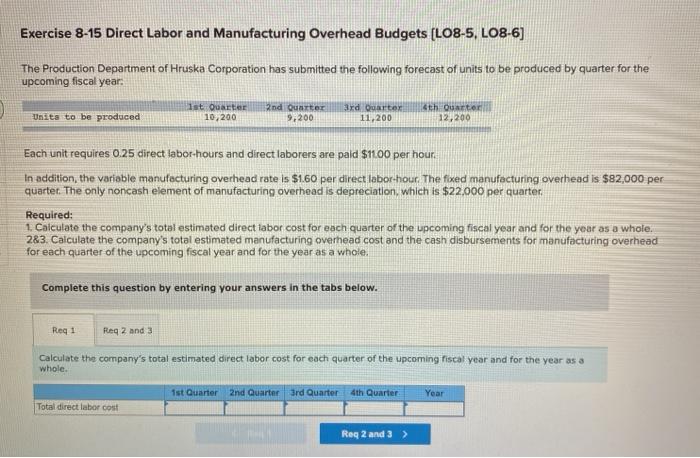

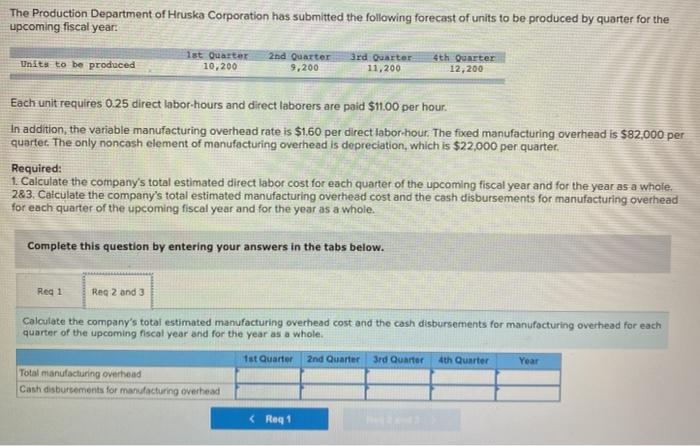

Four grams of musk oil are required for each bottle of Mink Caress, a very popular perfume made by a small company in western Siberia. The cost of the musk oil is $1.90 per gram. Budgeted production of Mink Caress is given below by quarters for Year 2 and for the first quarter of Year 3: Year 2 First Second Third Fourth 96,000 126,000 186,000 136,000 First 106.000 Budgeted production, in bottles Musk oil has become so popular as a perfume ingredient that it has become necessary to carry large inventories as a precaution against stock-outs. For this reason, the inventory of musk oil at the end of a quarter must be equal to 20% of the following quarter's production needs. Some 76,800 grams of musk oil will be on hand to start the first quarter of Year 2. Required: Prepare a direct materials budget for musk oil, by quarter and in total, for Year 2. Mink Caress Direct Materials Budget - Year 2 Quarter First Second 100,000 130,000 Units of raw materials needed per unit of finished goods Units of raw materials needed to meet production Third 190,000 Fourth 140,000 Year 560,000 Total units of raw materials needed Units of raw materials to be purchased Unit cost of raw materials Cost of raw materials to purchased Exercise 8-15 Direct Labor and Manufacturing Overhead Budgets (LO8-5. LO8-6] The Production Department of Hruska Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: 1st Quarter 10,200 Units to be produced 2nd Quarter 9,200 3rd Quartex 11,200 4th Quarter 12,200 Each unit requires 0.25 direct labor-hours and direct laborers are paid $11.00 per hour. In addition, the variable manufacturing overhead rate is $1.60 per direct labor-hour. The fixed manufacturing overhead is $82,000 per quarter. The only noncash element of manufacturing overhead is depreciation, which is $22.000 per quarter, Required: 1. Calculate the company's total estimated direct labor cost for each quarter of the upcoming fiscal year and for the year as a whole. 283. Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole, Complete this question by entering your answers in the tabs below. Req1 Reg 2 and 3 Calculate the company's total estimated direct labor cost for each quarter of the upcoming riscal year and for the year as a whole. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Total direct labor cost Reg 2 and 3 > The Production Department of Hruska Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Units to be produced 10,200 9,200 11,200 12,200 Each unit requires 0.25 direct labor-hours and direct laborers are paid $11.00 per hour. In addition, the variable manufacturing overhead rate is $1.60 per direct labor-hour. The fixed manufacturing overhead is $82,000 per quarter . The only noncash element of manufacturing overhead is depreciation, which is $22,000 per quarter. Required: 1. Calculate the company's total estimated direct labor cost for each quarter of the upcoming fiscal year and for the year as a whole. 283. Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 3 Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Total manufacturing overhead Cash disbursements for manufacturing overhead