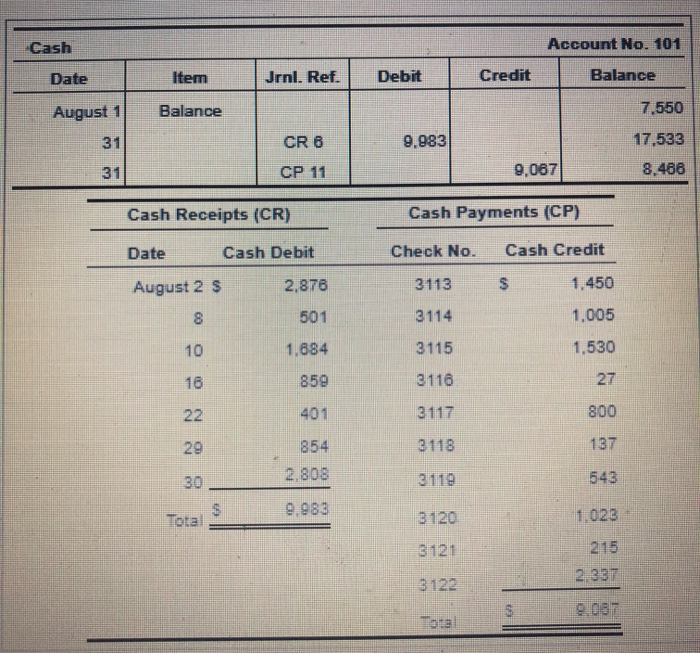

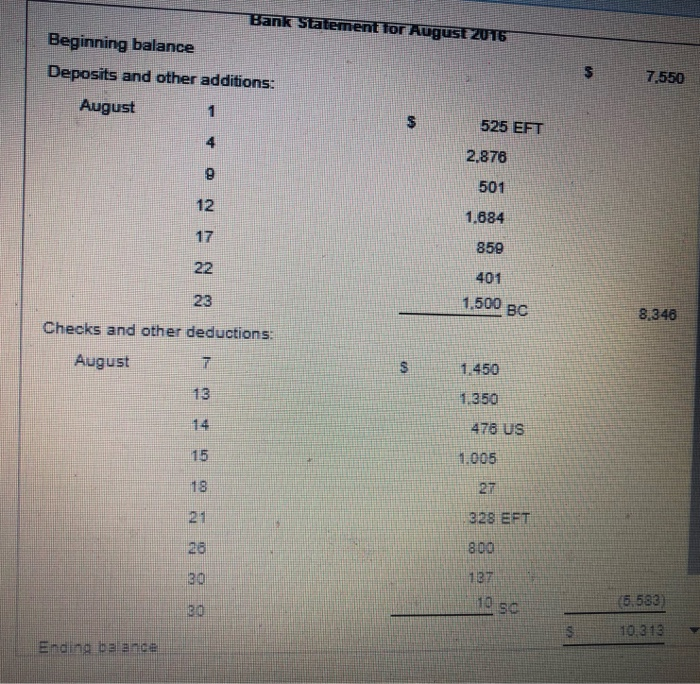

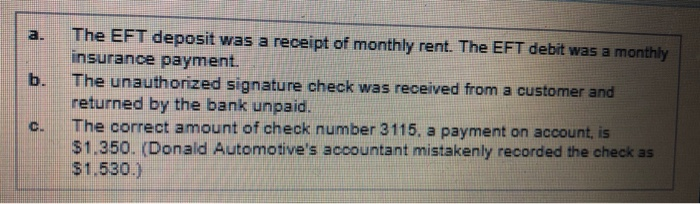

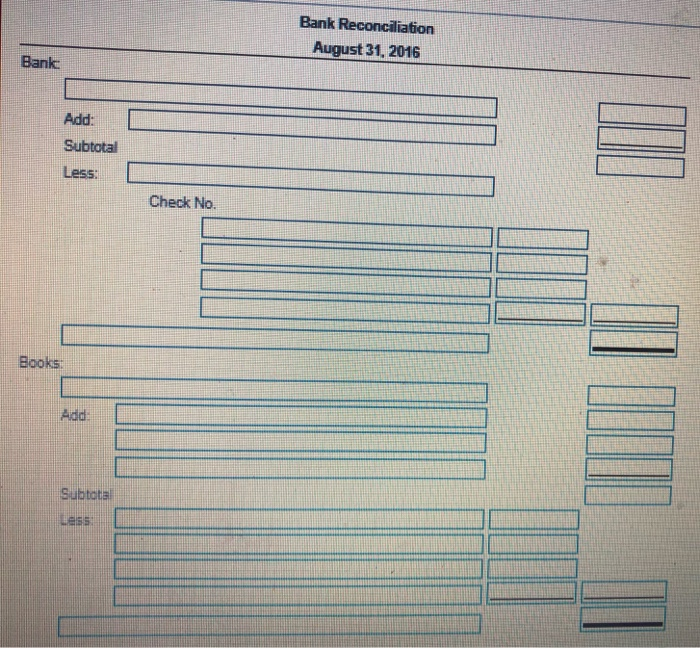

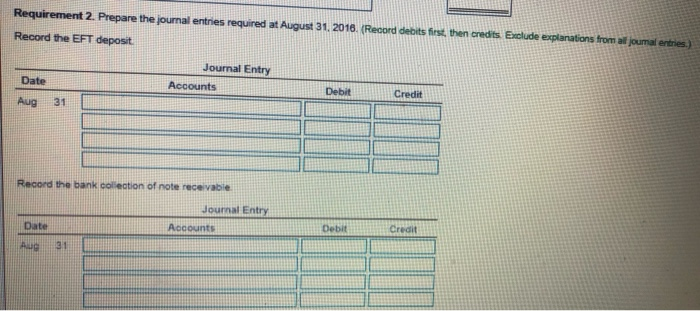

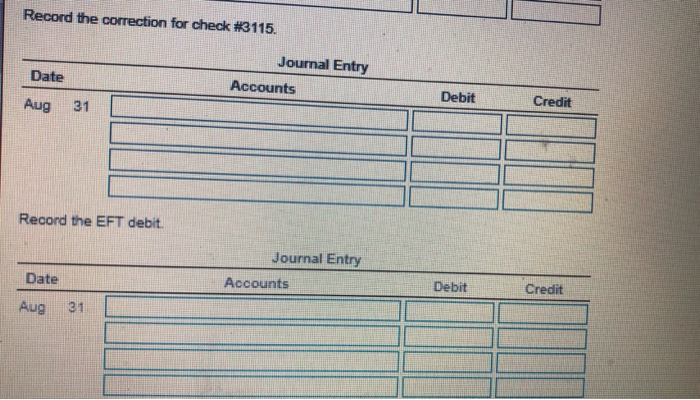

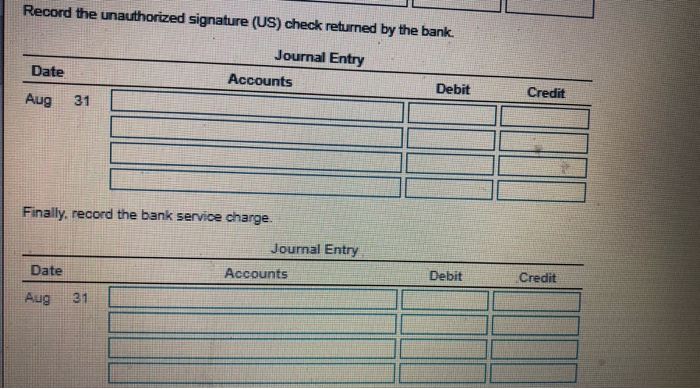

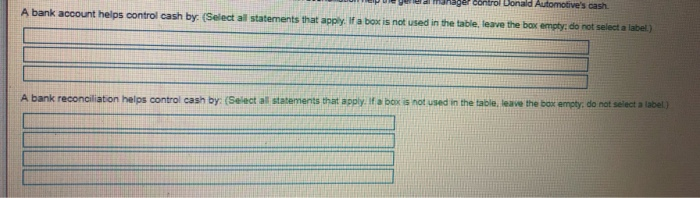

Account No. 101 Cash Credit Balance Debit Item Jrnl. Ref. Date 7,550 Balance August 1 17,533 0,083 CR 6 31 9,067 8,466 CP 11 31 Cash Payments (CP) Cash Receipts (CR) Cash Credit Check No. Cash Debit Date 1,450 3113 2,876 August 2 $ 1,005 501 3114 8 1,530 3115 1,684 10 27 3116 859 16 800 3117 401 22 137 3118 854 29 2.808 543 3119 30 9.983 1,023 3120 Total 215 3121 2.337 3122 9.067 Total Bank Statement for August 2016 Beginning balance 7,550 Deposits and other additions: August 1 525 EFT 4 2.876 501 12 1,684 17 859 22 401 1.500 BC 23 8,346 Checks and other deductions: August 1.450 1,350 13 14 476 US 1.005 15 27 18 328 EFT 21 800 26 30 (5.583) 10 sc 30 10.313 Ending bal ance The EFT deposit insurance payment The unauthorized signature check was received from a customer and returned by the bank unpaid. The correct amount of check number 3115, a payment on account, is $1.350. (Donald Automotive's accountant mistakenly recorded the check as $1.530.) was a receipt of monthly rent. The EFT debit was a monthly b. C. Bank Reconciliation August 31, 2016 Bank Add: Subtotal Less: Check No. Books Add Subtotal Requirement 2. Prepare the journal entries required at August 31, 2016. (Record debits first, then credits Exclude explanations from all joumal entries.) Record the EFT deposit Journal Entry Date Accounts Debit Credit Aug 31 Record the bank collection of note receivabie Journal Entry Credit Debit Accounts Date Aug 31 Record the correction for check # 3115 Journal Entry Date Accounts Debit Credit Aug 31 Record the EFT debit Journal Entry Credit Debit Accounts Date 31 Aug Record the unauthorized signature (US) check returned by the bank. Journal Entry Date Accounts Debit Credit Aug 31 Finally, record the bank service charge. Journal Entry Credit Debit Accounts Date 31 Aug nage control Donald Automotive's cash A bank account helps control cash by: (Select all statements that apply If a box is not used in the table, leave the box empty: do not select a label.) A bank reconciliaton helps control cash by: (Select all statements that apply If a box is not used in the table, leae the box empty: do not select a label) oru e table, leave the box empty: dd detecting all instances of theft. detecting errors in posting collections to accounts receivable ensuring that the bank and book records of cash are correct ensuring that the company accounts for all its cash transactions providing a place for safekeeping providing a detailed list of cash transactions that managers can compare to the books to detect errors. detecting all instances of theft detecting erors in posting collections to accounts receivable. ensuring that the bank and book records of cash are correct ensuring that the oompany aocounts for all its cash transactions correctly to the ne establ shing the balance of cash to report on the balanoe sheet providing a pace for safekeeping