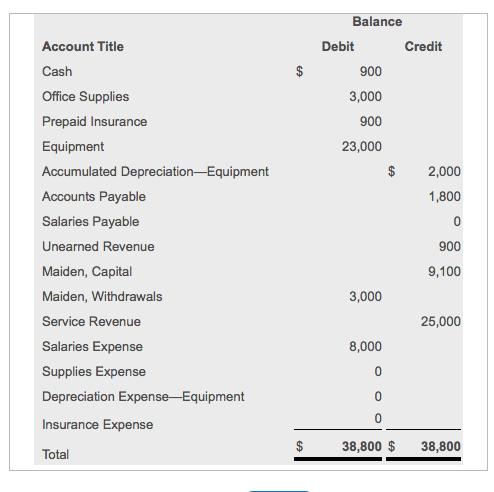

Account Title Cash Office Supplies Prepaid Insurance Equipment Accumulated Depreciation Equipment Accounts Payable Salaries Payable Unearned Revenue Maiden, Capital Maiden, Withdrawals Service Revenue Salaries

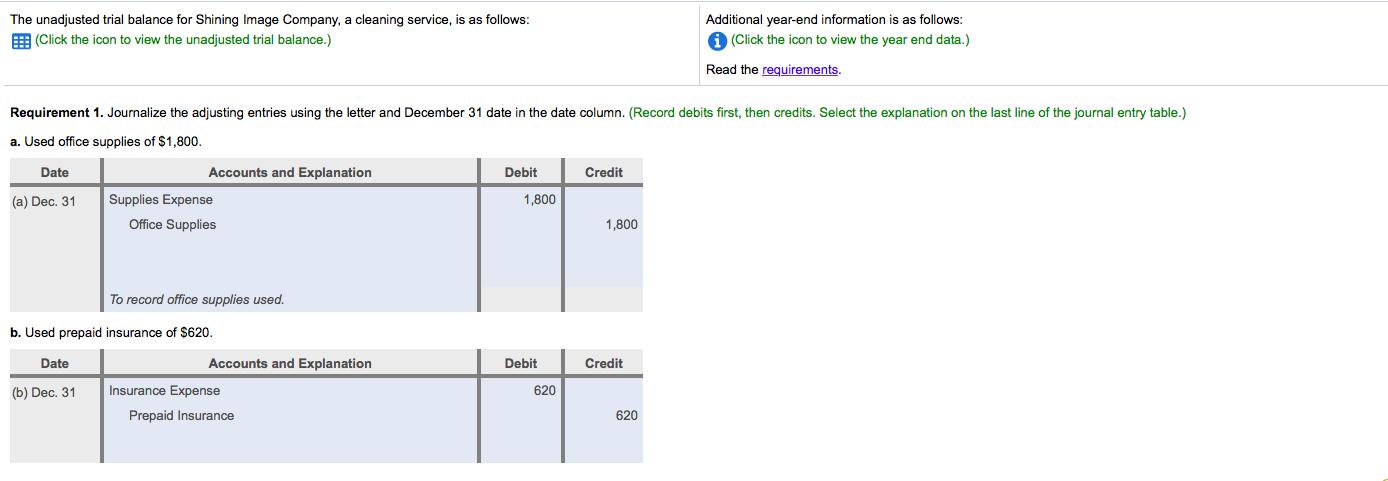

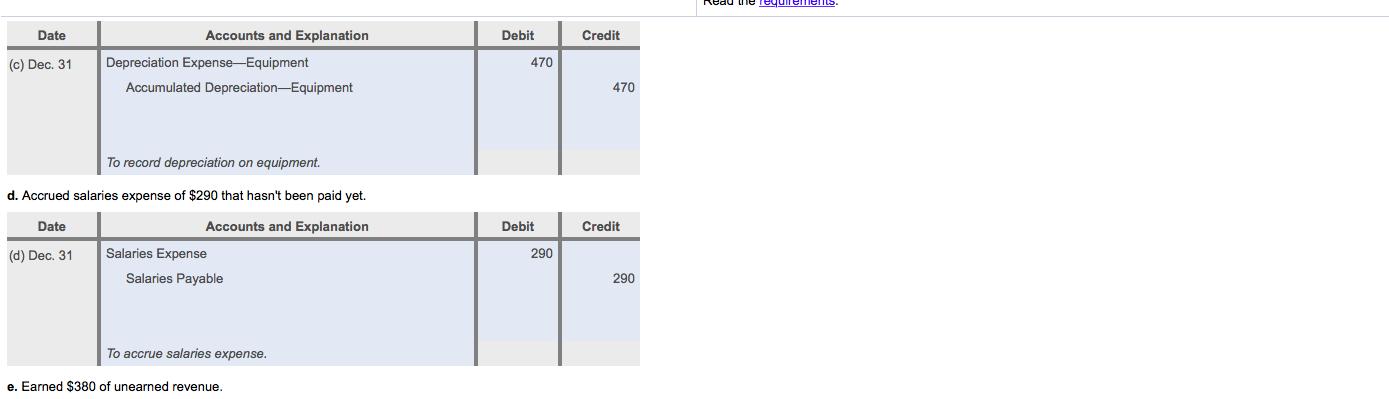

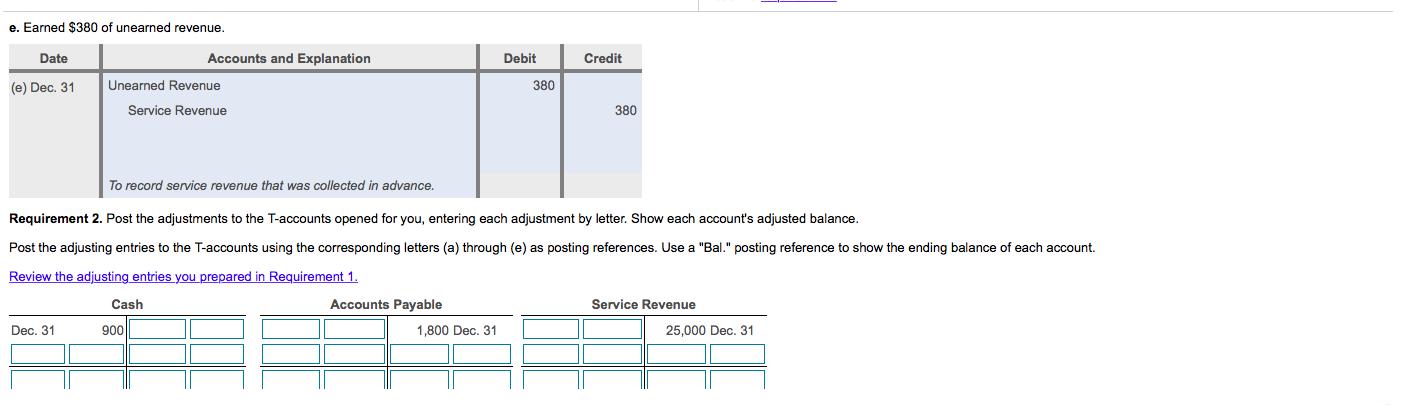

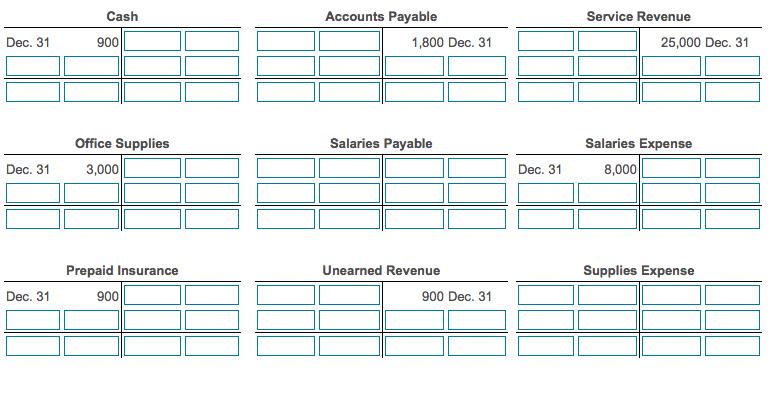

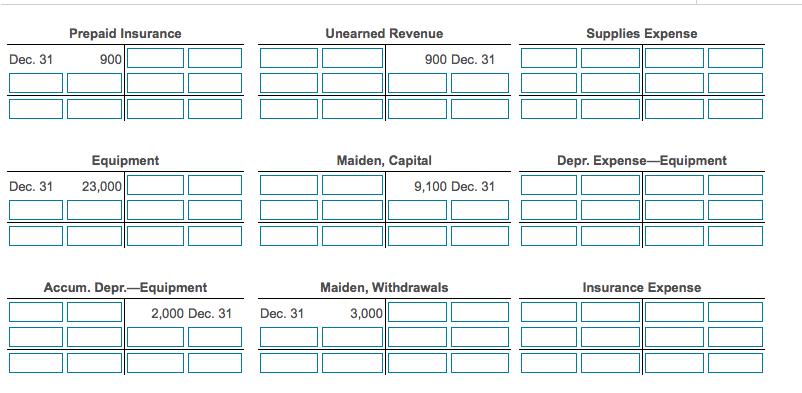

Account Title Cash Office Supplies Prepaid Insurance Equipment Accumulated Depreciation Equipment Accounts Payable Salaries Payable Unearned Revenue Maiden, Capital Maiden, Withdrawals Service Revenue Salaries Expense Supplies Expense Depreciation Expense Equipment Insurance Expense Total $ $ Balance Debit 900 3,000 900 23,000 3,000 8,000 0 0 0 38,800 $ Credit 2,000 1,800 0 900 9,100 25,000 38,800 The unadjusted trial balance for Shining Image Company, a cleaning service, is as follows: (Click the icon to view the unadjusted trial balance.) Requirement 1. Journalize the adjusting entries using the letter and December 31 date in the date column. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) a. Used office supplies of $1,800. Date (a) Dec. 31 Accounts and Explanation Date (b) Dec. 31 Supplies Expense Office Supplies To record office supplies used. b. Used prepaid insurance of $620. Accounts and Explanation Insurance Expense Prepaid Insurance Debit 1,800 Debit 620 Credit 1,800 Credit Additional year-end information is as follows: (Click the icon to view the year end data.) Read the requirements. 620 Date (c) Dec. 31 Accounts and Explanation Depreciation Expense-Equipment Accumulated Depreciation-Equipment To record depreciation on equipment. d. Accrued salaries expense of $290 that hasn't been paid yet. Date Accounts and Explanation (d) Dec. 31 Salaries Expense Salaries Payable To accrue salaries expense. e. Earned $380 of unearned revenue. Debit 470 Debit 290 Credit 470 Credit 290 e. Earned $380 of unearned revenue. Date (e) Dec. 31 Dec. 31 Accounts and Explanation Unearned Revenue Service Revenue To record service revenue that was collected in advance. Cash 900 Debit 1,800 Dec. 31 380 Requirement 2. Post the adjustments to the T-accounts opened for you, entering each adjustment by letter. Show each account's adjusted balance. Post the adjusting entries to the T-accounts using the corresponding letters (a) through (e) as posting references. Use a "Bal." posting reference to show the ending balance of each account. Review the adjusting entries you prepared in Requirement 1. Accounts Payable Credit 380 Service Revenue 25,000 Dec. 31 Dec. 31 Dec. 31 Dec. 31 Cash 900 Office Supplies 3,000 Prepaid Insurance 900 Accounts Payable 1,800 Dec. 31 Salaries Payable Unearned Revenue 900 Dec. 31 Dec. 31 Service Revenue 25,000 Dec. 31. Salaries Expense 8,000 Supplies Expense Dec. 31. Prepaid Insurance 900 Equipment Dec. 31. 23,000 Accum. Depr.-Equipment 2,000 Dec. 31 Dec. 31 Unearned Revenue 900 Dec. 31 Maiden, Capital 9,100 Dec. 31 Maiden, Withdrawals 3,000 Supplies Expense Depr. Expense-Equipment Insurance Expense

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entry Journal Entry Date Particulars Debit Credit Dec31 Supplies Expenses 1800 To Office Supplies 1800 Being use office supplies expenses Dec3...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started