Answered step by step

Verified Expert Solution

Question

1 Approved Answer

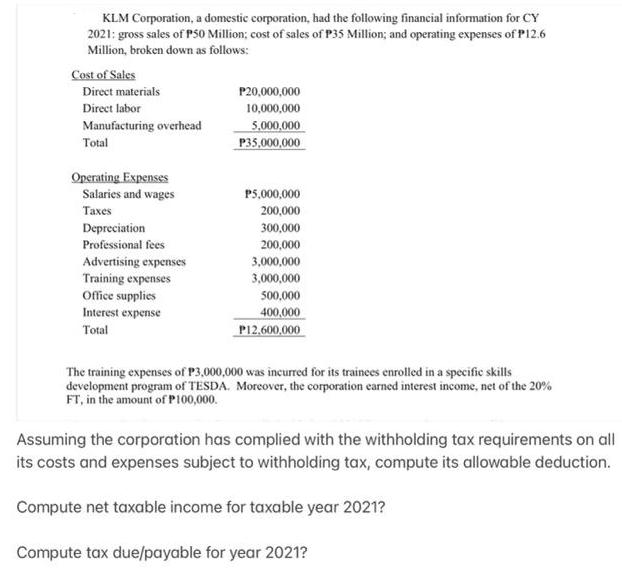

KLM Corporation, a domestic corporation, had the following financial information for CY 2021: gross sales of P50 Million; cost of sales of P35 Million;

KLM Corporation, a domestic corporation, had the following financial information for CY 2021: gross sales of P50 Million; cost of sales of P35 Million; and operating expenses of P12.6 Million, broken down as follows: Cost of Sales Direct materials Direct labor Manufacturing overhead Total Operating Expenses Salaries and wages Taxes Depreciation Professional fees Advertising expenses Training expenses Office supplies Interest expense Total P20,000,000 10,000,000 5,000,000 P35,000,000 P5,000,000 200,000 300,000 200,000 3,000,000 3,000,000 500,000 400,000 P12,600,000 The training expenses of P3,000,000 was incurred for its trainees enrolled in a specific skills development program of TESDA. Moreover, the corporation earned interest income, net of the 20% FT, in the amount of P100,000. Assuming the corporation has complied with the withholding tax requirements on all its costs and expenses subject to withholding tax, compute its allowable deduction. Compute net taxable income for taxable year 2021? Compute tax due/payable for year 2021?

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Comp ute net taxable income for taxable year 2021 ANS WER Allow able ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started