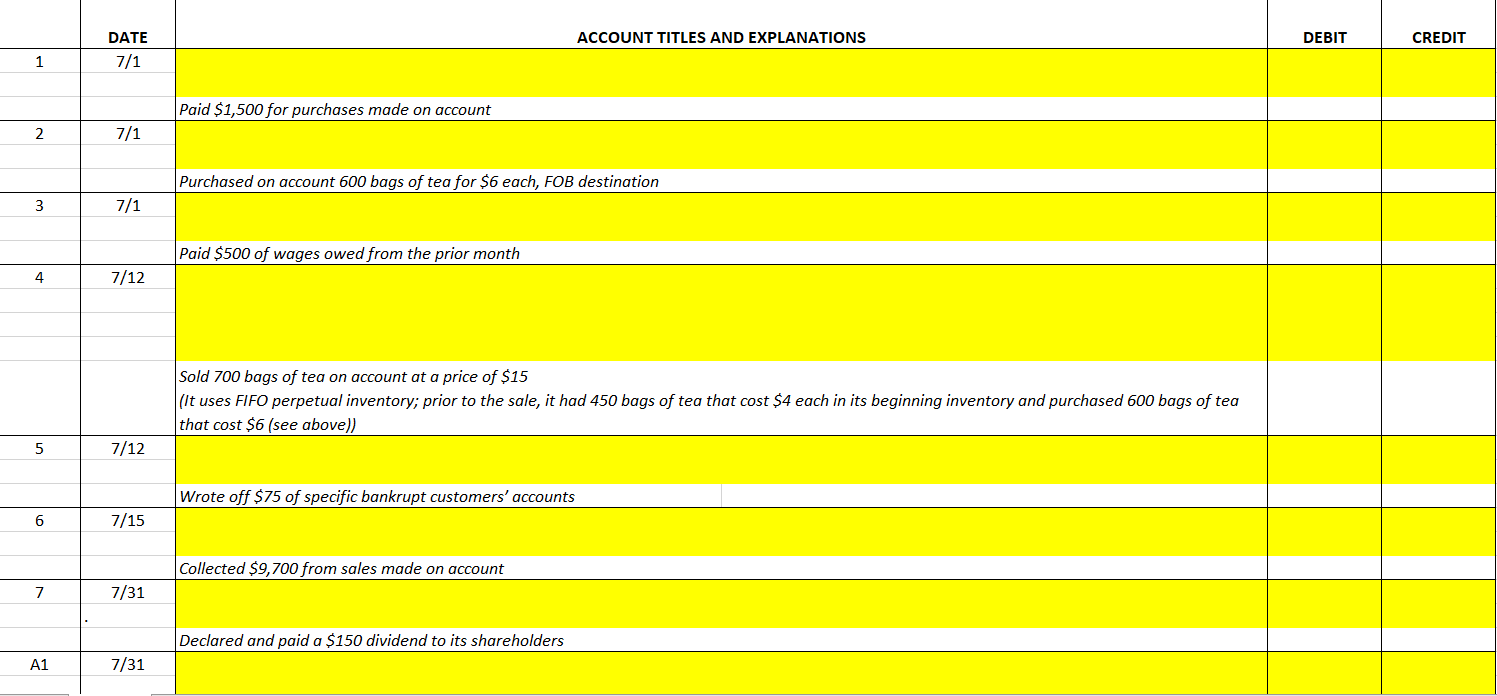

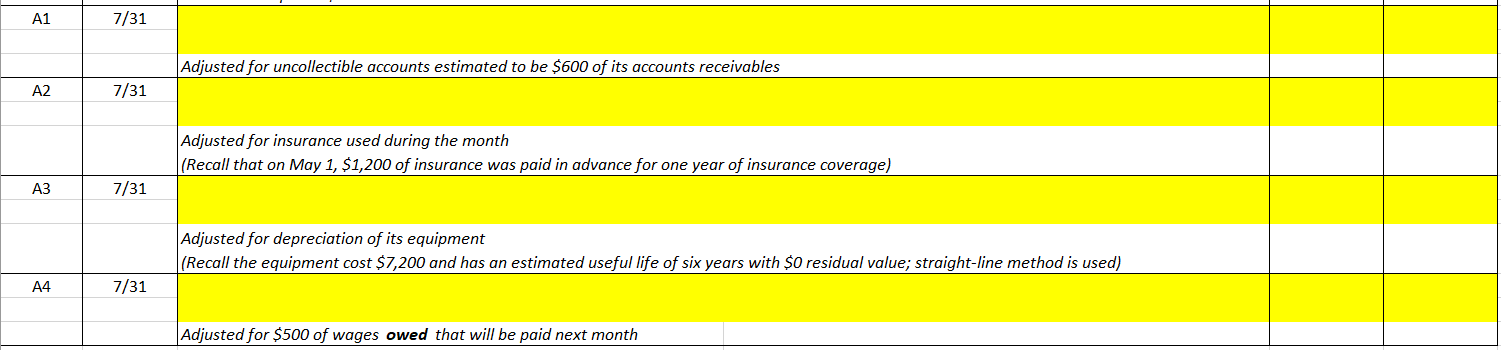

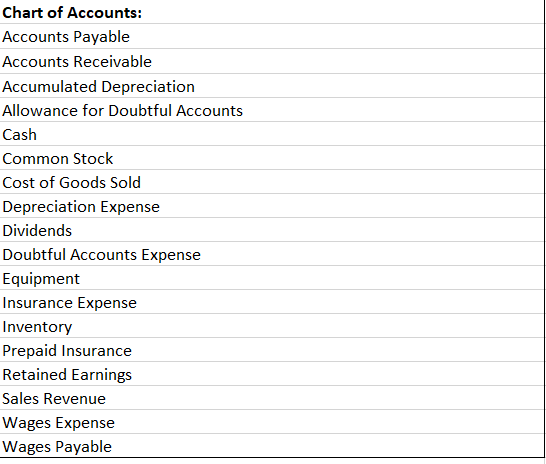

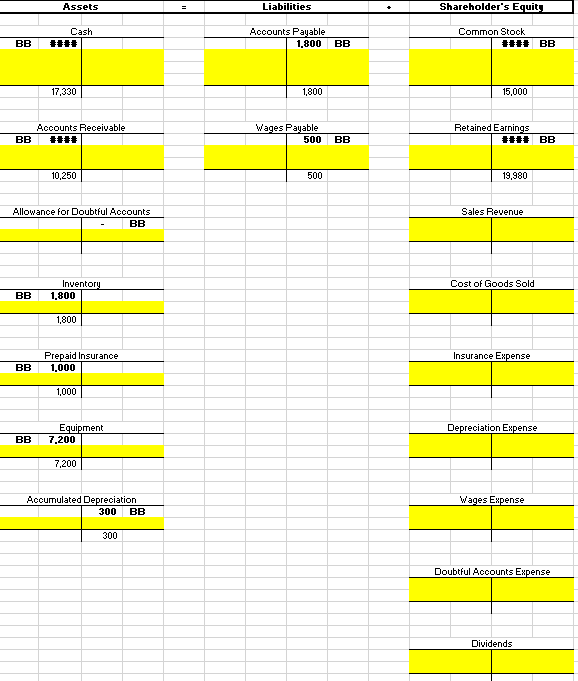

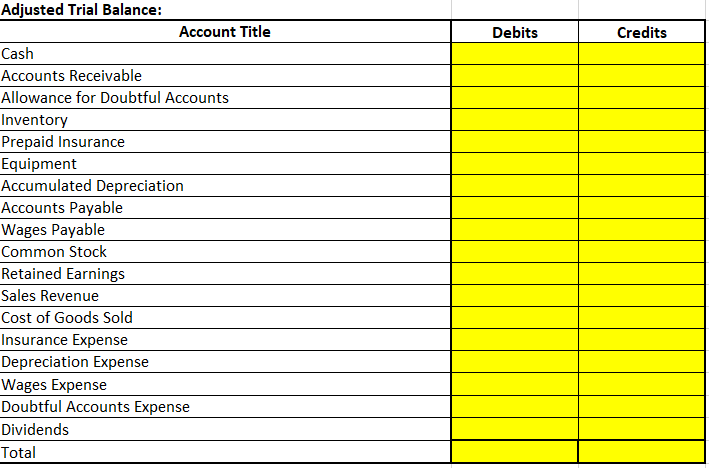

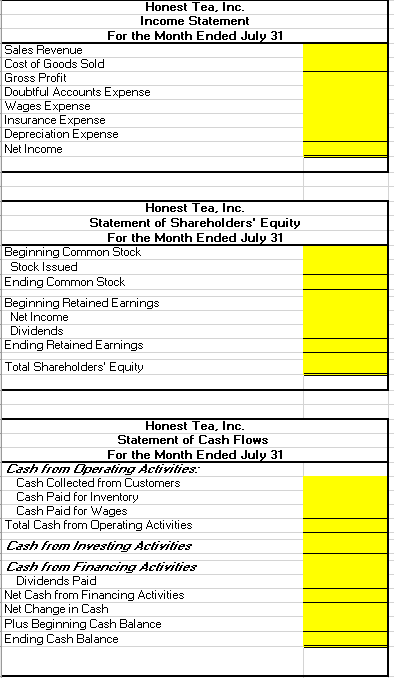

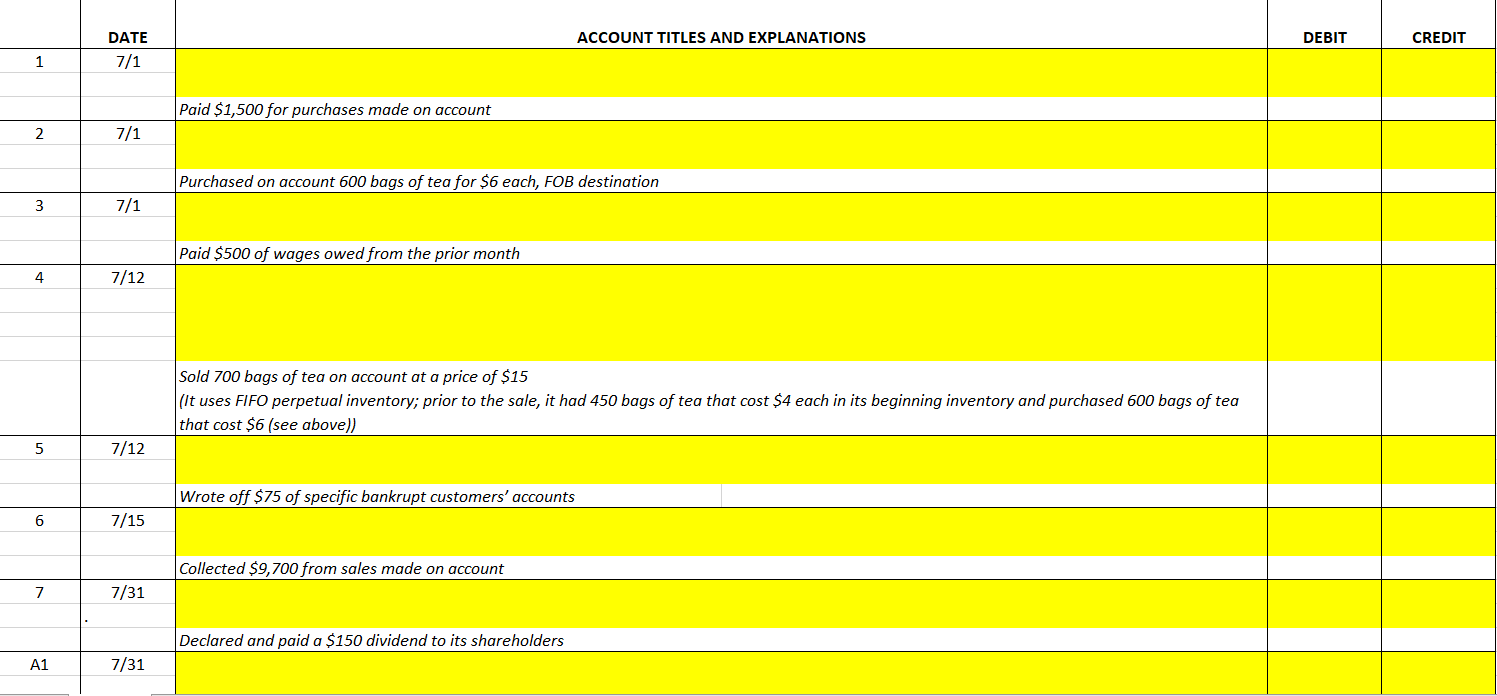

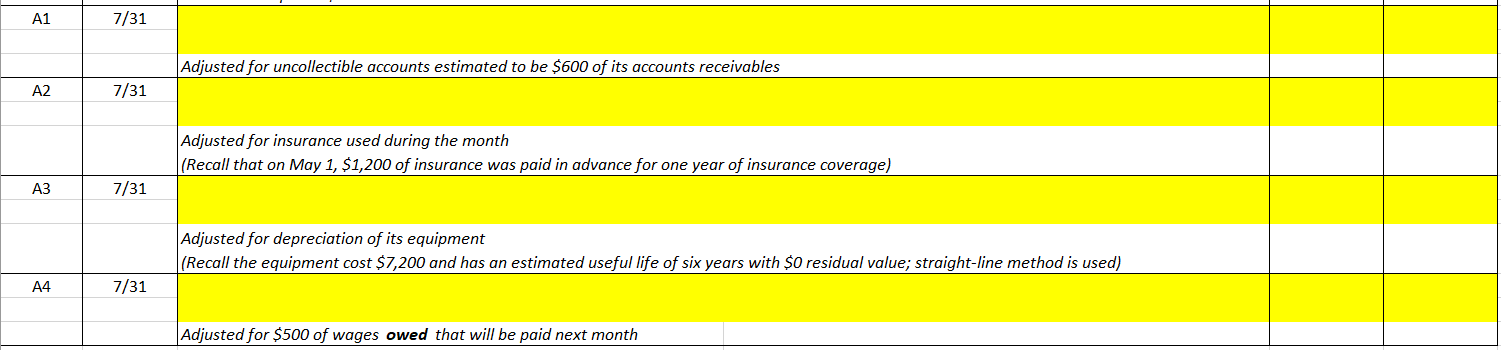

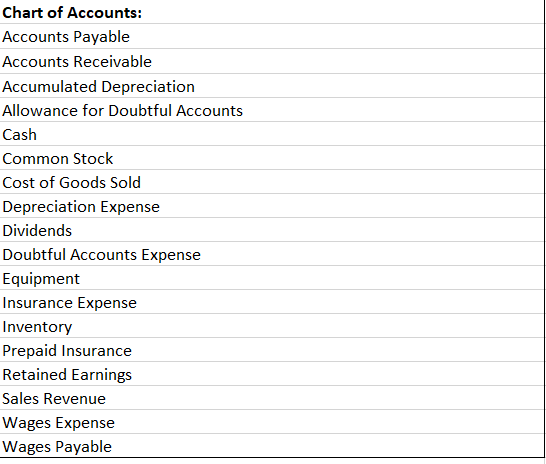

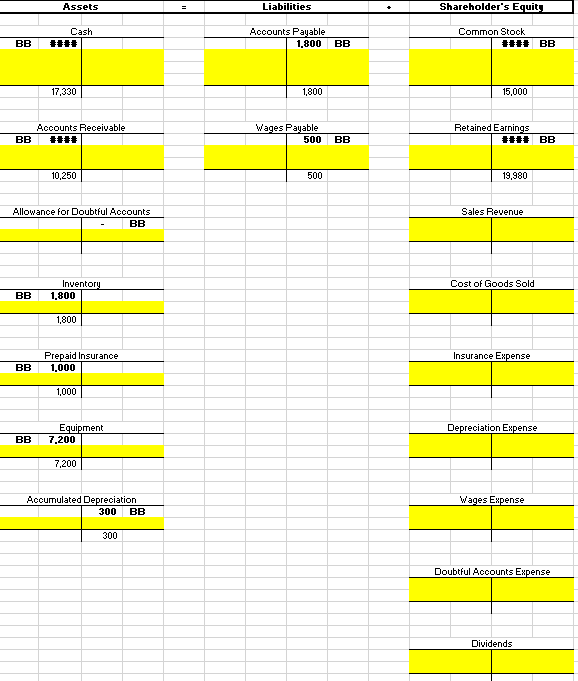

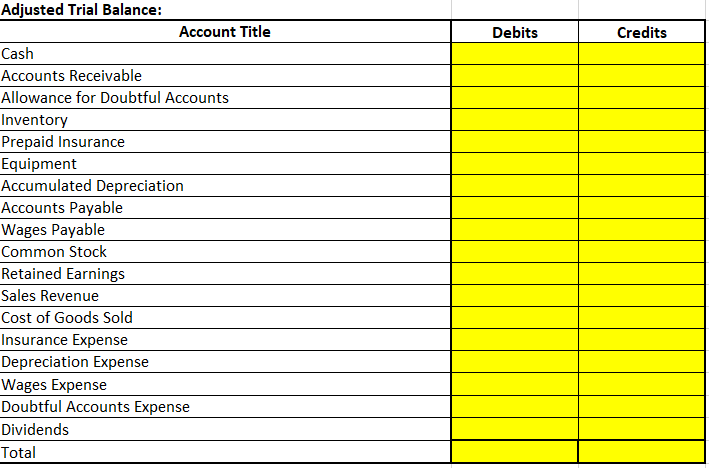

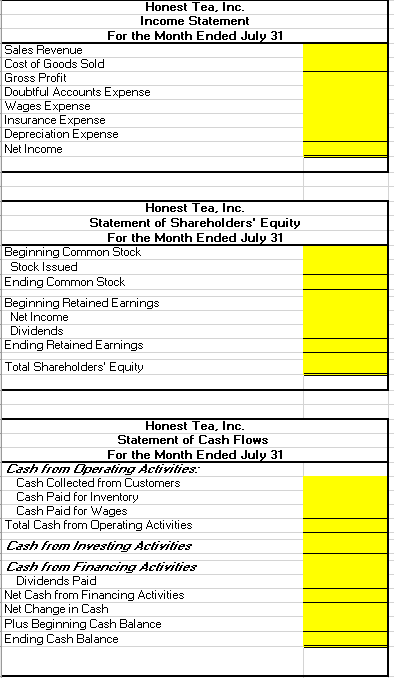

ACCOUNT TITLES AND EXPLANATIONS DEBIT CREDIT DATE 7/1 1 Paid $1,500 for purchases made on account 2 7/1 Purchased on account 600 bags of tea for $6 each, FOB destination 3 7/1 Paid $500 of wages owed from the prior month 4. 7/12 Sold 700 bags of tea on account at a price of $15 (It uses FIFO perpetual inventory; prior to the sale, it had 450 bags of tea that cost $4 each in its beginning inventory and purchased 600 bags of tea that cost $6 (see above)) 5 7/12 Wrote off $75 of specific bankrupt customers' accounts 6 7/15 Collected $9,700 from sales made on account 7 7/31 Declared and paid a $150 dividend to its shareholders A1 7/31 A1 7/31 Adjusted for uncollectible accounts estimated to be $600 of its accounts receivables A2 7/31 Adjusted for insurance used during the month (Recall that on May 1, $1,200 of insurance was paid in advance for one year of insurance coverage) A3 7/31 Adjusted for depreciation of its equipment (Recall the equipment cost $ 7,200 and has an estimated useful life of six years with $0 residual value; straight-line method is used) 44 7/31 Adjusted for $500 of wages owed that will be paid next month Chart of Accounts: Accounts Payable Accounts Receivable Accumulated Depreciation Allowance for Doubtful Accounts Cash Common Stock Cost of Goods Sold Depreciation Expense Dividends Doubtful Accounts Expense Equipment Insurance Expense Inventory Prepaid Insurance Retained Earnings Sales Revenue Wages Expense Wages Payable Assets Liabilities Shareholder's Equity Cash #### Accounts Payable 1,800 Common Stock #### BB BB BB 17,330 1.800 15,000 Accounts Receivable #### Wages Payable 500 Retained Earnings #### BB BB BB 10,250 500 19,980 Sales Revenue Allowance for Doubtful Accounts BB Cost of Goods Sold Inventory 1.800 BB 1,800 Prepaid Insurance 1.000 Insurance Expense BB 1,000 Equipment 7,200 Depreciation Expense 7,200 Accumulated Depreciation 300 BB Wages Expense 300 Doubtful Accounts Expense Dividends Debits Credits Adjusted Trial Balance: Account Title Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Wages Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Insurance Expense Depreciation Expense Wages Expense Doubtful Accounts Expense Dividends Total Honest Tea, Inc. Income Statement For the Month Ended July 31 Sales Revenue Cost of Goods Sold Gross Profit Doubtful Accounts Expense Wages Expense Insurance Expense Depreciation Expense Net Income Honest Tea, Inc. Statement of Shareholders' Equity For the Month Ended July 31 Beginning Common Stock Stock Issued Ending Common Stock Beginning Retained Earnings Net Income Dividends Ending Retained Earnings Total Shareholders' Equity Honest Tea, Inc. Statement of Cash Flows For the Month Ended July 31 Cash from Operating Activities: Cash Collected from Customers Cash Paid for Inventory Cash Paid for Wages Total Cash from Operating Activities Cash from Investing Activities Cash from Financing Activities Dividends Paid Net Cash from Financing Activities Net Change in Cash Plus Beginning Cash Balance Ending Cash Balance ACCOUNT TITLES AND EXPLANATIONS DEBIT CREDIT DATE 7/1 1 Paid $1,500 for purchases made on account 2 7/1 Purchased on account 600 bags of tea for $6 each, FOB destination 3 7/1 Paid $500 of wages owed from the prior month 4. 7/12 Sold 700 bags of tea on account at a price of $15 (It uses FIFO perpetual inventory; prior to the sale, it had 450 bags of tea that cost $4 each in its beginning inventory and purchased 600 bags of tea that cost $6 (see above)) 5 7/12 Wrote off $75 of specific bankrupt customers' accounts 6 7/15 Collected $9,700 from sales made on account 7 7/31 Declared and paid a $150 dividend to its shareholders A1 7/31 A1 7/31 Adjusted for uncollectible accounts estimated to be $600 of its accounts receivables A2 7/31 Adjusted for insurance used during the month (Recall that on May 1, $1,200 of insurance was paid in advance for one year of insurance coverage) A3 7/31 Adjusted for depreciation of its equipment (Recall the equipment cost $ 7,200 and has an estimated useful life of six years with $0 residual value; straight-line method is used) 44 7/31 Adjusted for $500 of wages owed that will be paid next month Chart of Accounts: Accounts Payable Accounts Receivable Accumulated Depreciation Allowance for Doubtful Accounts Cash Common Stock Cost of Goods Sold Depreciation Expense Dividends Doubtful Accounts Expense Equipment Insurance Expense Inventory Prepaid Insurance Retained Earnings Sales Revenue Wages Expense Wages Payable Assets Liabilities Shareholder's Equity Cash #### Accounts Payable 1,800 Common Stock #### BB BB BB 17,330 1.800 15,000 Accounts Receivable #### Wages Payable 500 Retained Earnings #### BB BB BB 10,250 500 19,980 Sales Revenue Allowance for Doubtful Accounts BB Cost of Goods Sold Inventory 1.800 BB 1,800 Prepaid Insurance 1.000 Insurance Expense BB 1,000 Equipment 7,200 Depreciation Expense 7,200 Accumulated Depreciation 300 BB Wages Expense 300 Doubtful Accounts Expense Dividends Debits Credits Adjusted Trial Balance: Account Title Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Wages Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Insurance Expense Depreciation Expense Wages Expense Doubtful Accounts Expense Dividends Total Honest Tea, Inc. Income Statement For the Month Ended July 31 Sales Revenue Cost of Goods Sold Gross Profit Doubtful Accounts Expense Wages Expense Insurance Expense Depreciation Expense Net Income Honest Tea, Inc. Statement of Shareholders' Equity For the Month Ended July 31 Beginning Common Stock Stock Issued Ending Common Stock Beginning Retained Earnings Net Income Dividends Ending Retained Earnings Total Shareholders' Equity Honest Tea, Inc. Statement of Cash Flows For the Month Ended July 31 Cash from Operating Activities: Cash Collected from Customers Cash Paid for Inventory Cash Paid for Wages Total Cash from Operating Activities Cash from Investing Activities Cash from Financing Activities Dividends Paid Net Cash from Financing Activities Net Change in Cash Plus Beginning Cash Balance Ending Cash Balance