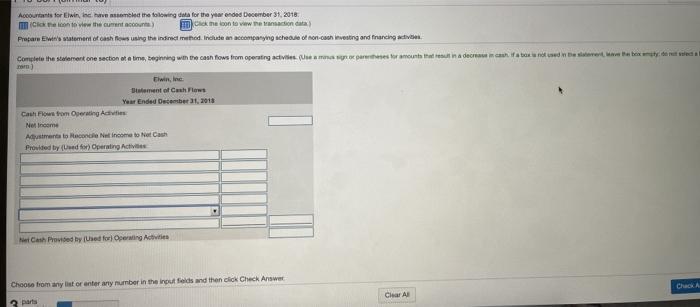

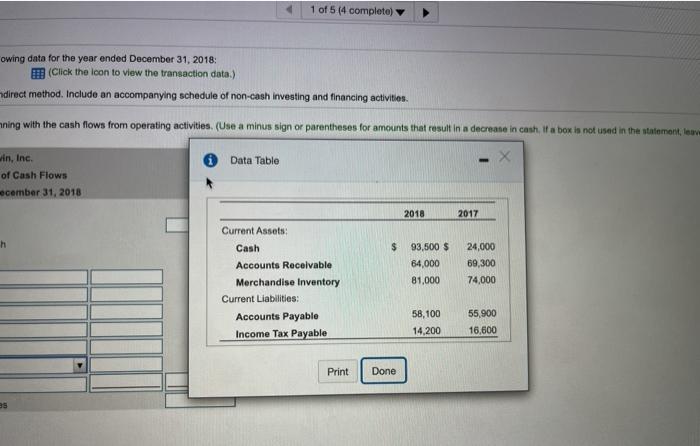

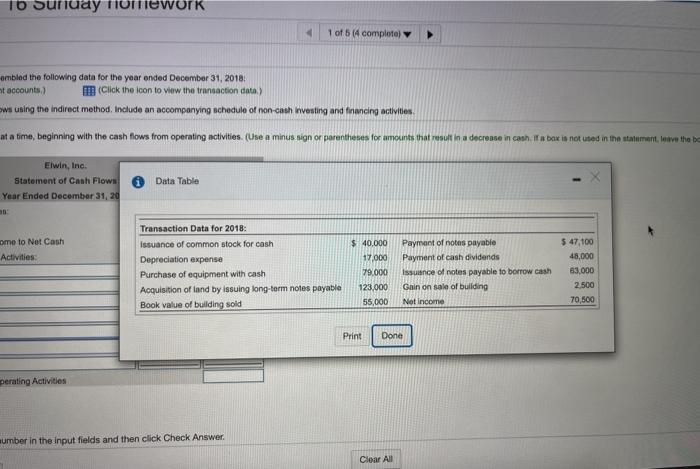

Accountants for Elwin, Inc., een the following data for the year ended December 31, 2018 Click to view the current account Dok me loon to view the main tata Prepare Ewin's watement of cash flows using the indirected. Includes accompanying schedule of nonch Westing and financing Complete the start one section at a time, beginning with the cash flows from operating advies (we cares for mother in a decreased between dered om) twin, Inc Statement of Cash Flow Year Ended December 31, 2018 Cash Flows from Operating Activities Net Income Atsiment to concet income to Net Cash Provided by feed for Operating Active Cash Provided by used for Operating Activities Chuck Choose from any list or enter any number in the input fields and then click Check Answe parts Clear 1 of 5 (4 completo) owing data for the year ended December 31, 2018: (Click the icon to view the transaction data) direct method. Include an accompanying schedule of non-cash investing and financing activities. mning with the cash flows from operating activities. (Use a minus sign or parentheses for amounts that result in a decrease in cash. If a box in not used in the statement, les Data Table win, Inc. of Cash Flows ecember 31, 2018 2018 2017 Current Assets Cash Accounts Receivable Merchandise Inventory Current Liabilities: Accounts Payable Income Tax Payable $ 93,500 $ 64,000 81,000 24,000 69,300 74,000 58,100 14,200 55,900 16,600 Print Done 1b Sunday normework 1 of 5 (4 completo ambled the following data for the year ended December 31, 2018 It accounts) Click the icon to view the transaction data) wa using the Indirect method, include an accompanying schedule of non-cth Investing and financing activities at a time, beginning with the cash flows from operating activities. (Use a minus sign or parentheses for amounts that result in a decreme in cash. It a baix is not used in the statement into the be Elwin, Inc. Statement of Cash Flows Data Table Year Ended December 31, 20 $ 40,000 ome to Net Cash Activities: Transaction Data for 2018: issuance of common stock for cash Depreciation expense Purchase of equipment with cash Acquisition of land by issuing long-term notes payable Book value of building sold 17.000 79.000 123,000 55,000 Payment of notes payable Payment of cash dividends Issuance of notes payable to borrow cash Gain on sale of building Not income $ 47,100 45,000 63.000 2500 70,500 Print Done perating Activities umber in the input fields and then click Check Answer Clover AB Clear All