Question

Cats and Kitty are identical firms except for their capital structure. Cats has debt that carries a 10% interest rate and whose market value is

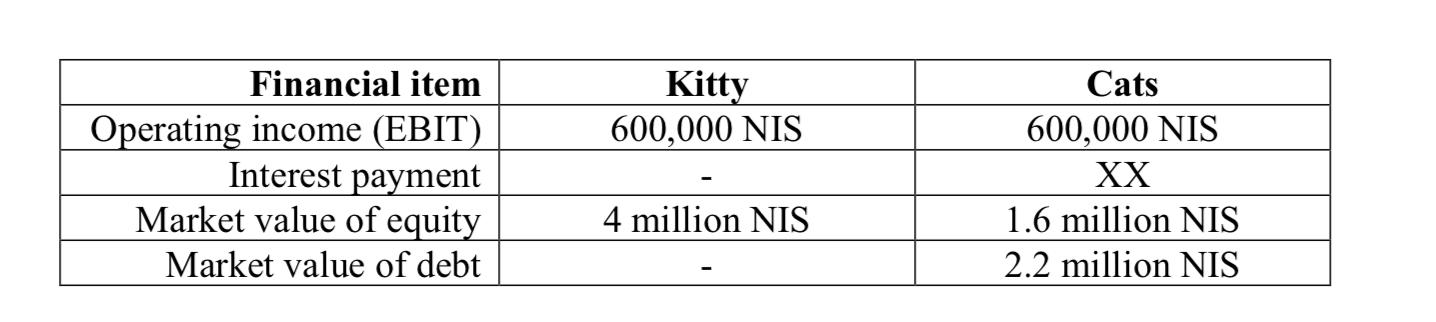

Cats and Kitty are identical firms except for their capital structure. Cats has debt that carries a 10% interest rate and whose market value is 2.2 million NIS. The forecasted financial data of the companies are presented below: All cash flows are forever and there are no taxes.

A. An investor wants to buy 10% of one of the companies. What is the annual cash flow and return on equity under each option?

B. Explain and show complete numerical solution of how an investor can generate arbitrage profits from buying 10% of one of the firms and shorting the other. Assume that the investor can borrow at the 10% interest rate. Also explain how you know that this is really an arbitrage profit, and not a positive return due to increased risk.

C. Assume that following the trading activity of sophisticated investors, the market reached an equilibrium when the value of a Kitty company is 3.9 million NIS. What is the market value of Cat’s equity?

Kitty 600,000 NIS Financial item Cats Operating income (EBIT) Interest payment Market value of equity 600,000 NIS XX 4 million NIS 1.6 million NIS Market value of debt 2.2 million NIS

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Solution Part A in NIS Kitty Cats EBIT 60000000 60000000 Annual Cash Flow ACF 60000000 60000000 Mark...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started