Question

1) If the Fed makes an open market purchase of $0.01 billions of government securities from a member bank, it pays for the securities by

1) If the Fed makes an open market purchase of $0.01 billions of government securities from a member bank, it pays for the securities by crediting the member bank’s deposit with the Federal Reserve. How would this transaction affect the balance sheet of the Fed?

2) When the U.S. was on the gold standard, the Fed held substantial gold reserves, and transactions in gold were common. Suppose gold coin of $0.01 billion was deposited by a customer of a member bank. The bank could send the coin to its Federal Reserve Bank and receive an increase in its reserve deposit of that amount. How would this gold inflow affect the Fed’s balance sheet?

3) Suppose instead that, triggered by large gold outflow, a member bank was experiencing large cash withdrawals of $0.1 billion and needed extra currency. The member bank requested currency in the form of Federal Reserve notes. How would this gold outflow affect the Fed’s balance sheet?

4) The Fed could offset, or "sterilize," the impact of one transaction on bank reserves with a second transaction having the opposite impact on reserves. If there was a gold outflow of $0.1 billion, what would the Fed do to sterilize money supply? What would happen to the Fed’s balance sheet?

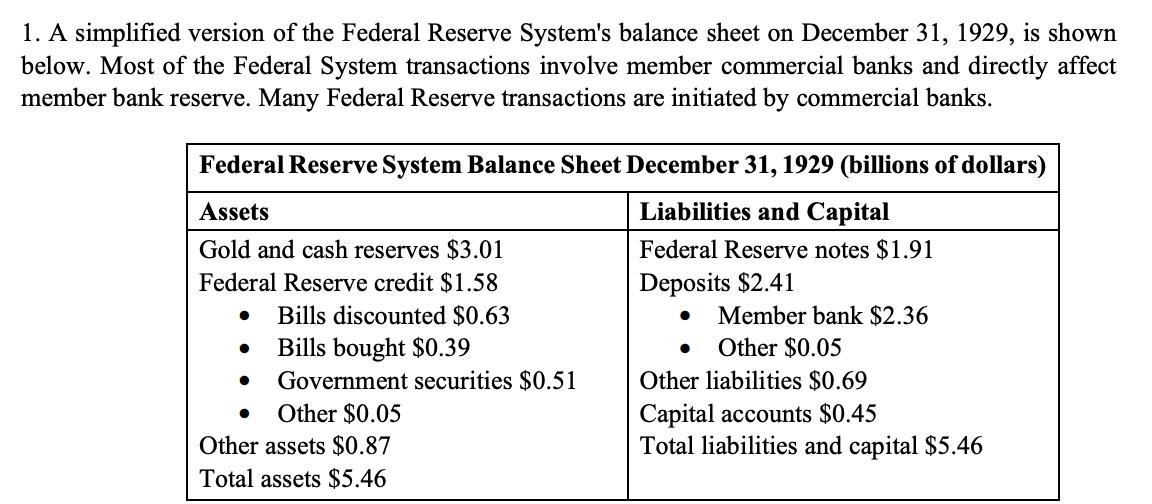

1. A simplified version of the Federal Reserve System's balance sheet on December 31, 1929, is shown below. Most of the Federal System transactions involve member commercial banks and directly affect member bank reserve. Many Federal Reserve transactions are initiated by commercial banks. Federal Reserve System Balance Sheet December 31, 1929 (billions of dollars) Assets Liabilities and Capital Gold and cash reserves $3.01 Federal Reserve notes $1.91 Federal Reserve credit $1.58 Deposits $2.41 Bills discounted $0.63 Member bank $2.36 Bills bought $0.39 Government securities $0.51 Other $0.05 Other liabilities $0.69 Capital accounts $0.45 Total liabilities and capital $5.46 Other $0.05 Other assets $0.87 Total assets $5.46

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 FED buys securities in order to increase the flow of money and credit in the economy On buying sec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started