Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Employee ID First name Last name Job classification Jan Sales 1001 Mary Stevens Senior Sales Rep $ 85,000 1002 Larry Anderson Senior Sales Rep $

| Employee ID | First name | Last name | Job classification | Jan Sales |

| 1001 | Mary | Stevens | Senior Sales Rep | $ 85,000 |

| 1002 | Larry | Anderson | Senior Sales Rep | $ 72,000 |

| 1003 | Sunil | Gupta | Junior Sales Rep | $ 35,000 |

| 1004 | Sarah | Ellis | Junior Sales Rep | $ 61,500 |

| 1005 | Timothy | Chau | Junior Sales Rep | $ 48,000 |

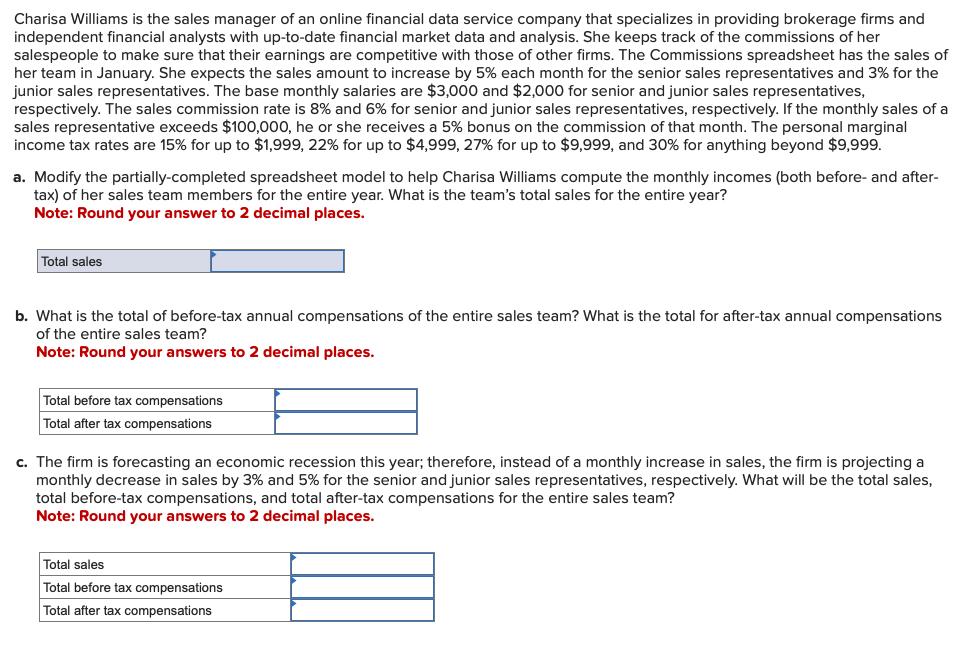

Charisa Williams is the sales manager of an online financial data service company that specializes in providing brokerage firms and independent financial analysts with up-to-date financial market data and analysis. She keeps track of the commissions of her salespeople to make sure that their earnings are competitive with those of other firms. The Commissions spreadsheet has the sales of her team in January. She expects the sales amount to increase by 5% each month for the senior sales representatives and 3% for the junior sales representatives. The base monthly salaries are $3,000 and $2,000 for senior and junior sales representatives, respectively. The sales commission rate is 8% and 6% for senior and junior sales representatives, respectively. If the monthly sales of a sales representative exceeds $100,000, he or she receives a 5% bonus on the commission of that month. The personal marginal income tax rates are 15% for up to $1,999, 22% for up to $4,999, 27% for up to $9,999, and 30% for anything beyond $9,999. a. Modify the partially-completed spreadsheet model to help Charisa Williams compute the monthly incomes (both before- and after- tax) of her sales team members for the entire year. What is the team's total sales for the entire year? Note: Round your answer to 2 decimal places. Total sales b. What is the total of before-tax annual compensations of the entire sales team? What is the total for after-tax annual compensations of the entire sales team? Note: Round your answers to 2 decimal places. Total before tax compensations Total after tax compensations c. The firm is forecasting an economic recession this year; therefore, instead of a monthly increase in sales, the firm is projecting a monthly decrease in sales by 3% and 5% for the senior and junior sales representatives, respectively. What will be the total sales, total before-tax compensations, and total after-tax compensations for the entire sales team? Note: Round your answers to 2 decimal places. Total sales Total before tax compensations Total after tax compensations

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To compute the monthly incomes both before and aftertax of the sales team members for the entire year we need to first compute the monthly ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started