Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To analyze nonoperating investments in marketable debt and equity securities, consider the following questions that will help us understand both companies' level of excess cash

To analyze nonoperating investments in marketable debt and equity securities, consider the following questions that will help us understand both companies' level of excess cash and how they invest it:

- • What is the magnitude of the investments in common-size terms? Has this changed over time? What proportion is short-term versus long-term?

- • What types of investments does the company hold debt, equity, private company equity?

- • What explanation do the companies provide for their level of investments? Does the MD&A section of the Form 10-K discuss plans for expansion or other strategic initiatives that would require cash?

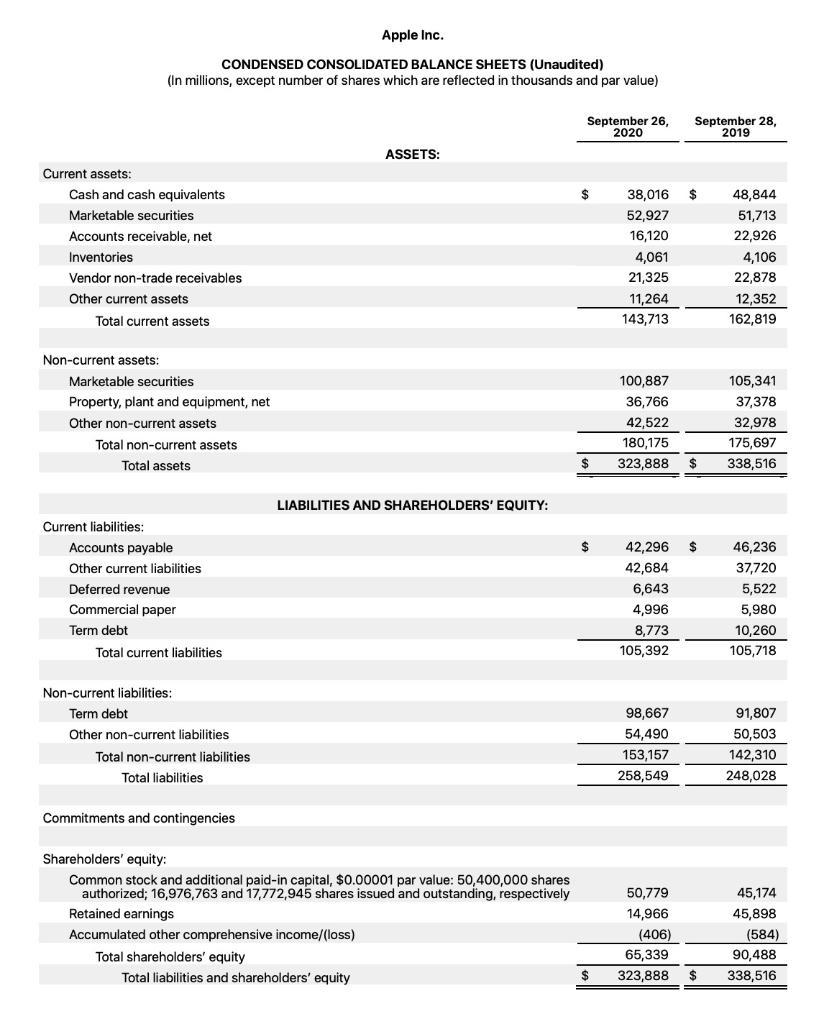

Calculate the quick ratio, current ratio, stockholders' equity ratio, debt-to-equity ratio, operating cost ratio, operating profit margin, price-earnings ratio, and asset multiple based on Apple's financial statements.

Calculate the quick ratio, current ratio, stockholders' equity ratio, debt-to-equity ratio, operating cost ratio, operating profit margin, price-earnings ratio, and asset multiple based on Apple's financial statements.

Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Apple Inc. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) (In millions, except number of shares which are reflected in thousands and par value) Vendor non-trade receivables Other current assets. Total current assets Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities Non-current liabilities: Term debt Other non-current liabilities Total non-current liabilities Total liabilities Commitments and contingencies LIABILITIES AND SHAREHOLDERS' EQUITY: ASSETS: Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 50,400,000 shares authorized; 16,976,763 and 17,772,945 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity September 26, 2020 $ $ $ $ 38,016 52,927 16,120 4,061 21,325 11,264 143,713 100,887 36,766 42,522 180,175 323,888 42,296 42,684 6,643 4,996 8,773 105,392 98,667 54,490 153,157 258,549 50,779 14,966 (406) 65,339 323,888 September 28, 2019 $ 48,844 51,713 22,926 4,106 22,878 12,352 162,819 105,341 37,378 32,978 175,697 $ 338,516 46,236 37,720 5,522 5,980 10,260 105,718 91,807 50,503 142,310 248,028 45,174 45,898 (584) 90,488 338,516

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

thus question cannot be answered ib ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started